- American retail investors saw a sharp decrease in BTC purchase activity after the market was opened, reflected institutional trends.

- The wider market remains bullish, with billions of dollars bought from BTC.

Bitcoin’s [BTC] Price promotion remains uncertain. The active has fallen 12.42% in the past month and had trouble maintaining a bullish attitude, an increase of 0.26% in the last 24 hours to time.

The current sentiment suggests that BTC could see a big price study, because remarkable purchase activity is observed by investors and whales. However, low liquidity levels threaten this rally.

American investors and institutions Panic-Sell BTC

According to data, there is a remarkable decrease in the interest of the American retail and institutional investors in the last 24 hours.

The Coinbase Premium Index (CPI), which follows the activities of the American retail investors on Coinbase in relation to other trade fairs, shows that the sales pressure is intensified as the CPI has fallen below zero.

Source: Cryptuquant

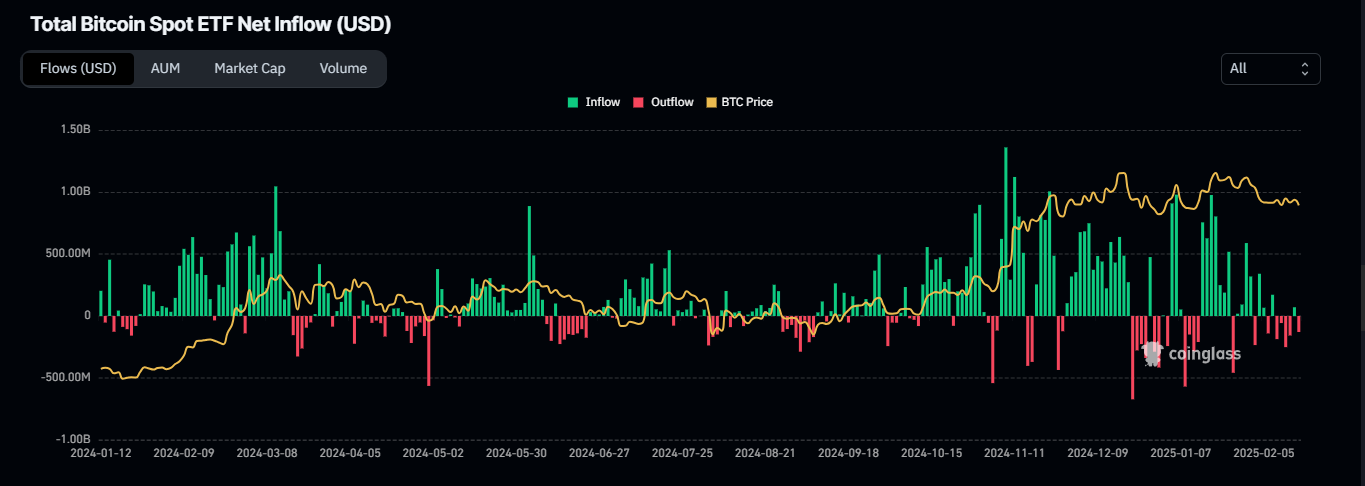

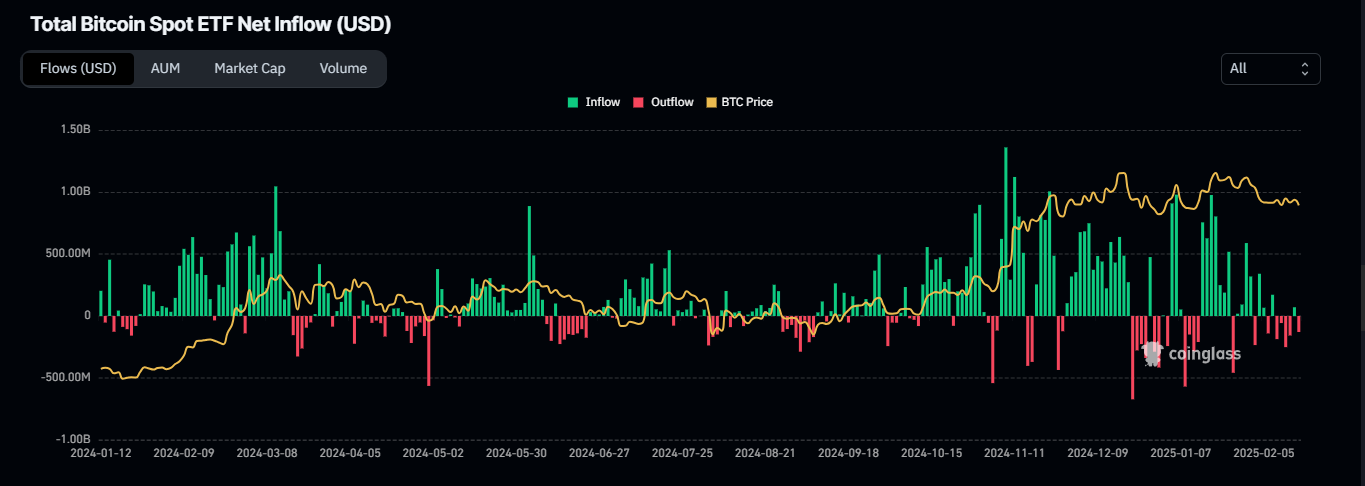

This shift will follow on 17 February Bullish Sentiment, when the cryptomarkt saw a strong price increase. However, ETF activity suggests a more bearish look.

In February Spot BTC ETFs saw an inflow of $ 70.60 million, suggesting that buying activities. On the 18th, however, an important outflow of $ 129.10 million was registered, which means that more BTC was withdrawn from these institutions.

Source: Coinglass

This was a continuation of the market outflows that took place from 10 to 13 February, because institutional investors continued to sell their BTC companies.

Bullish sentiment remains strong

Despite recent sales pressure, there is still a bullish sentiment. According to Cryptoquant, an address has linked a considerable amount of BTC collected to freely available (OTC) transactions for long -term retention.

At the time of analysis, more than 28,000 BTC – more than $ 2.6 billion – was purchased by these addresses. This can lead to a supply, which reduces the circulating BTC.

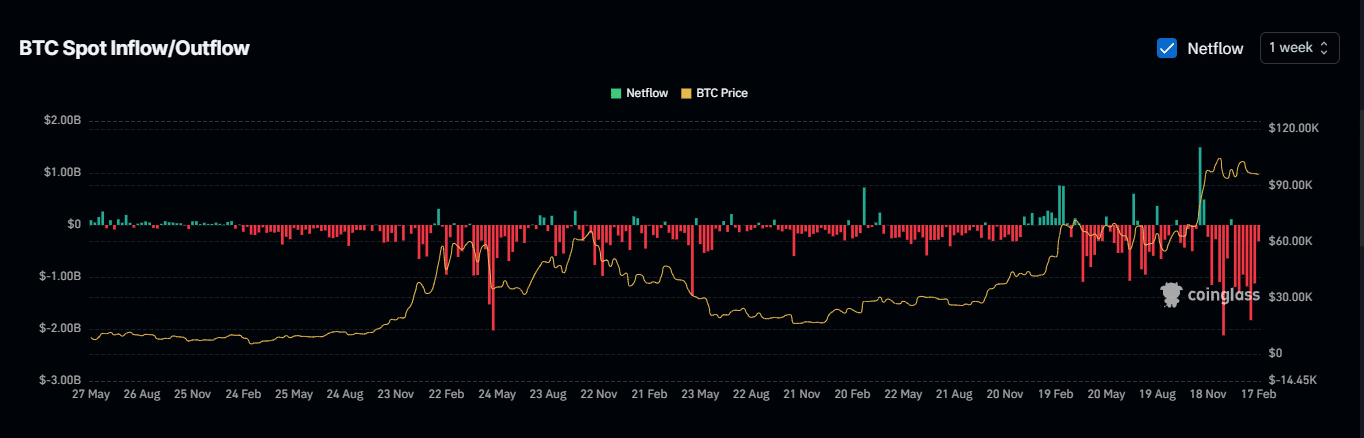

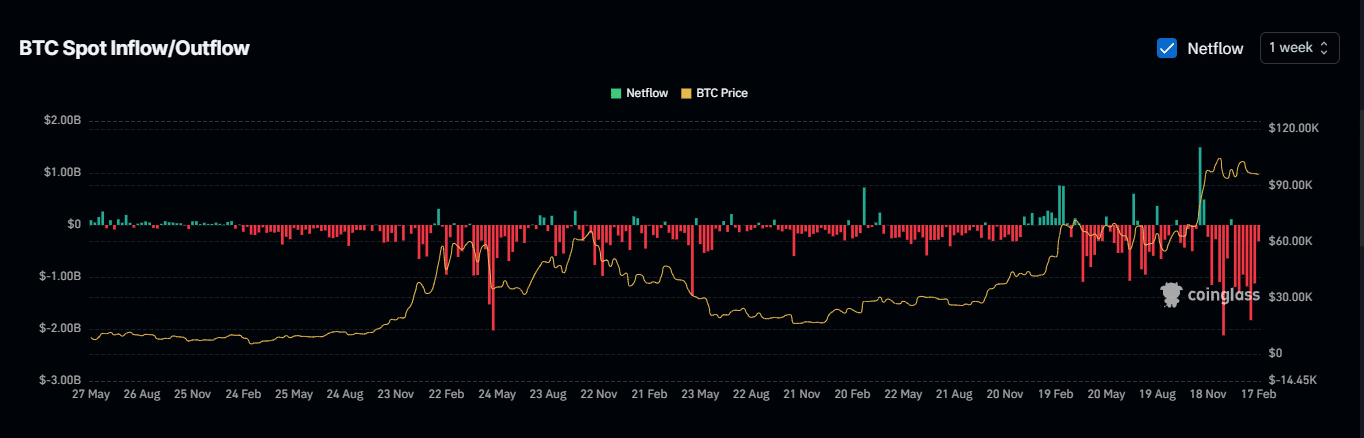

A further consideration of the spot market reflects comparable buying trends. In the past week alone, $ 314.70 million more BTC was bought than sold.

Asset Netflow data Show Consistent BTC accumulation since January 2025, which further supports a bullish prospect.

Source: Coinglass

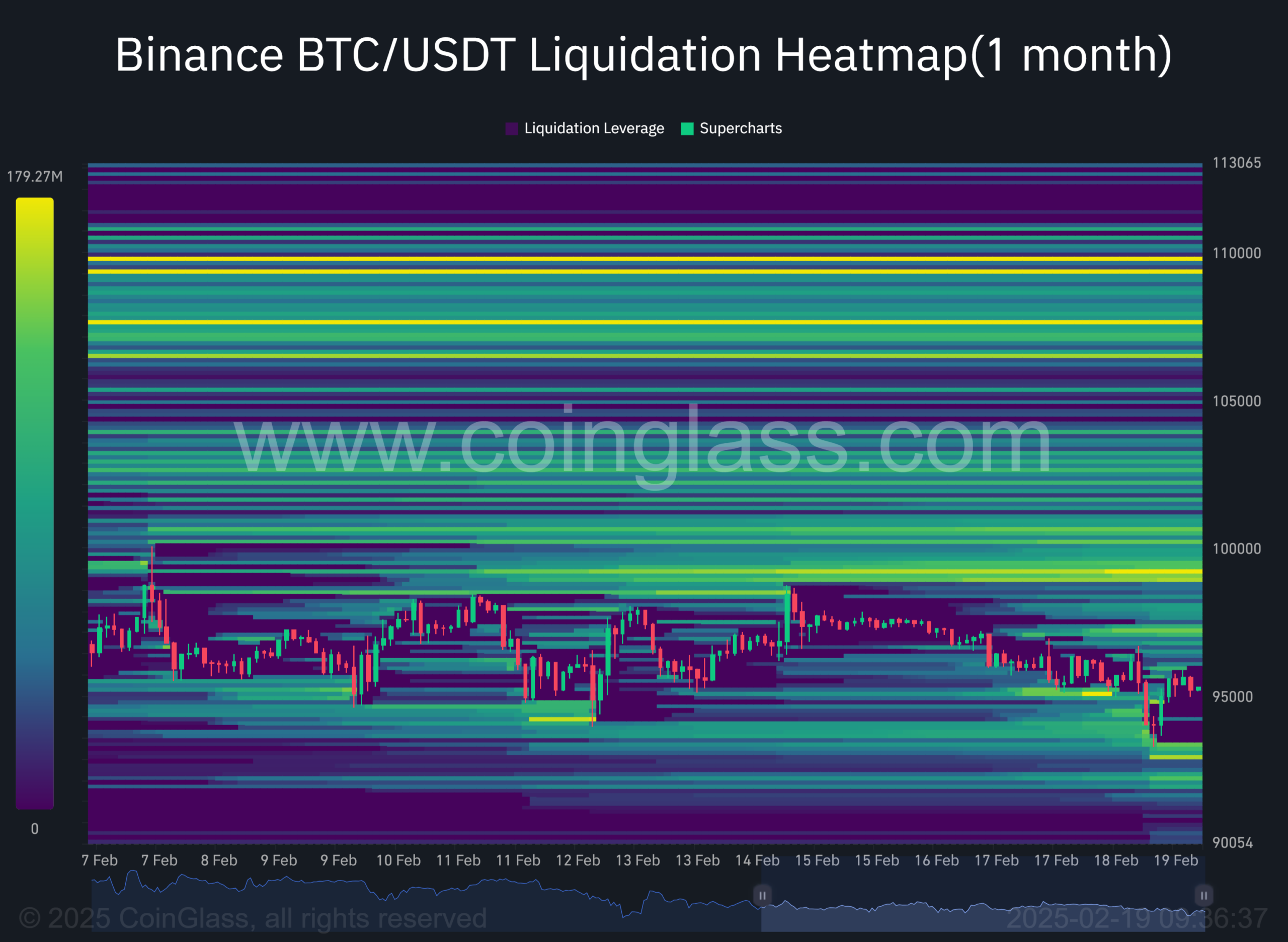

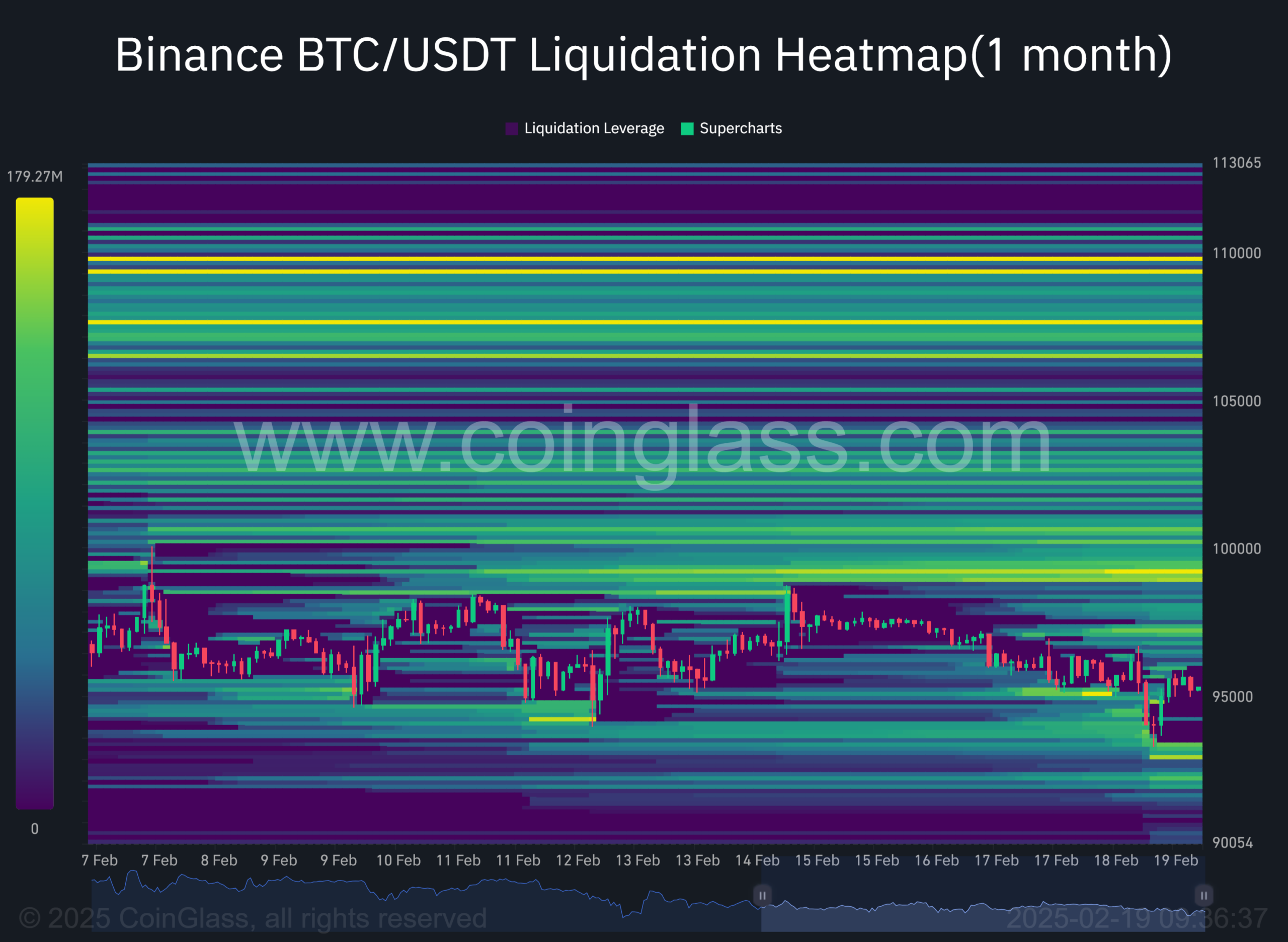

Low liquidity levels threaten an upward movement

According to the liquidation of Binance at the monthly period of time frame, a large liquidity level is positioned at $ 92,930.28, where $ 136.1 million have been placed on BTC buying orders.

Source: Coinglass

Typical work Liquidation levels such as magnets that draw the price towards them. If this applies to BTC, this can fall to this level before it returns quickly.

For the time being, the market sentiment will continue to be mixed and further data and activities on the chain will provide clarity about the next step of BTC.