- BTC has recovered moderately in the past day and has risen by 1.37%.

- The 3-6 million long-term holders of Bitcoin have seen their wealth rise sharply.

In the past two months, Bitcoin [BTC] has experienced extreme volatility. Despite increased fluctuations, Bitcoin’s long -term holders remain steadfastly in the market.

As such, holders have seen their wealth in the long term, despite the prevailing market conditions. According to Glassnode, 3-6 million Bitcoin holders, in particular those transferring to the status of the long term, have seen a sharp increase in the wealth they had.

Source: Glassnode

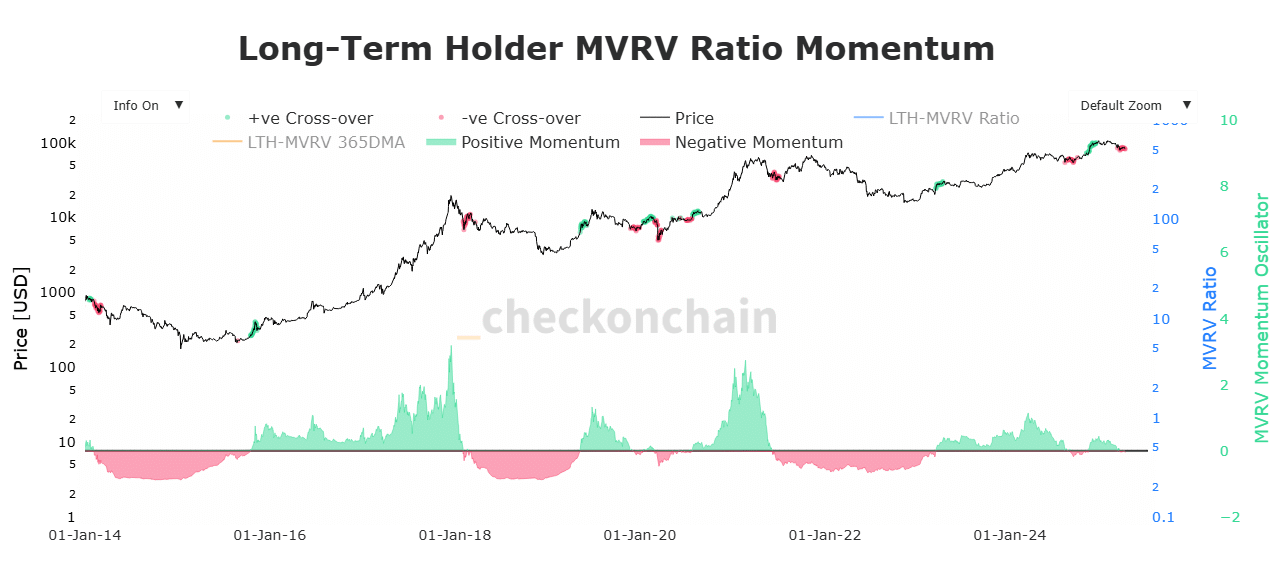

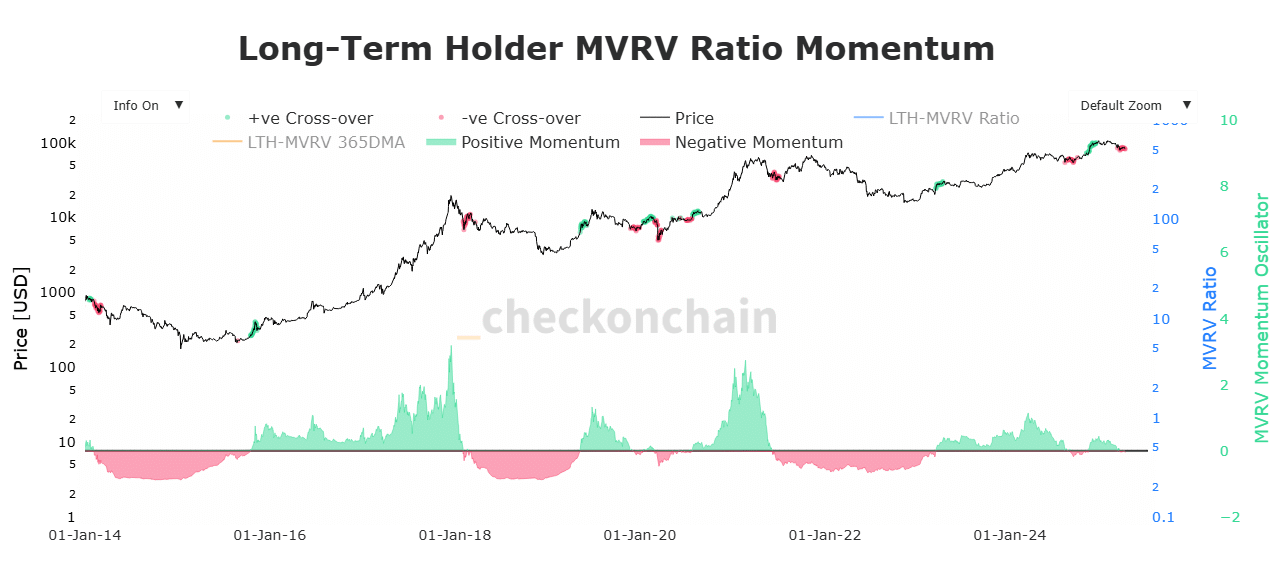

Ambcrypto has identified an increasing wealth with holders in the long term, with the LTH MVRV ratio since December 2024 maintaining a positive momentum.

This indicates that the value of BTC for long -term holders remains relatively high compared to the cost basis. Historically, positive LTH MVRV momentum reflects renewed confidence among these holders.

Although many of these coins were obtained in the vicinity of a high level, their continuous aging shows conviction instead of signs of capitulation.

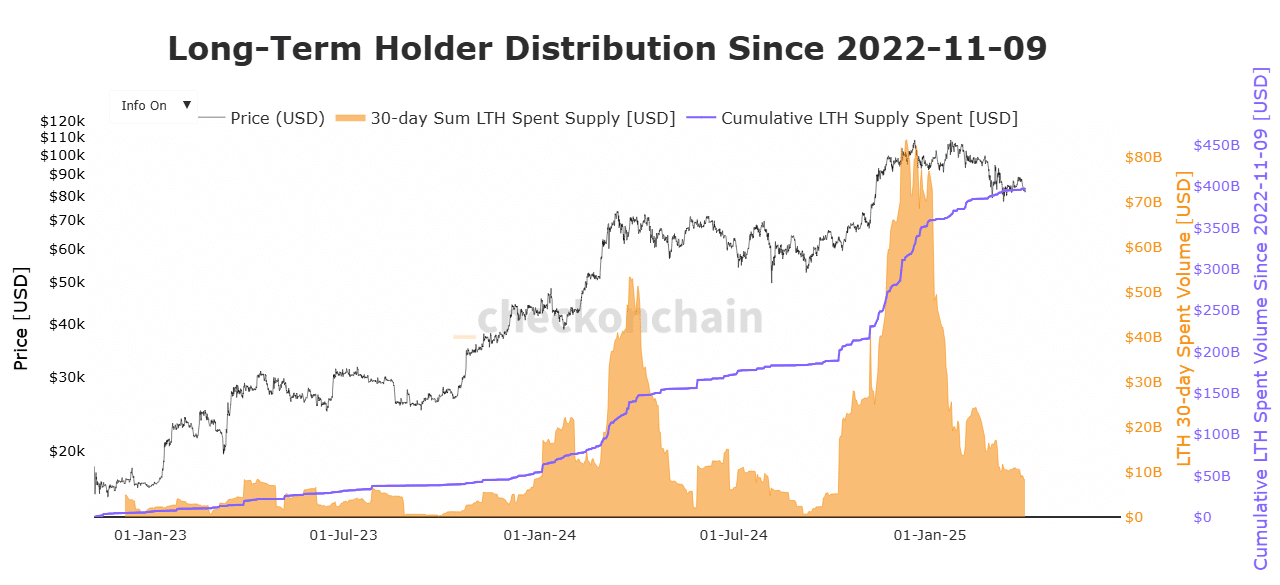

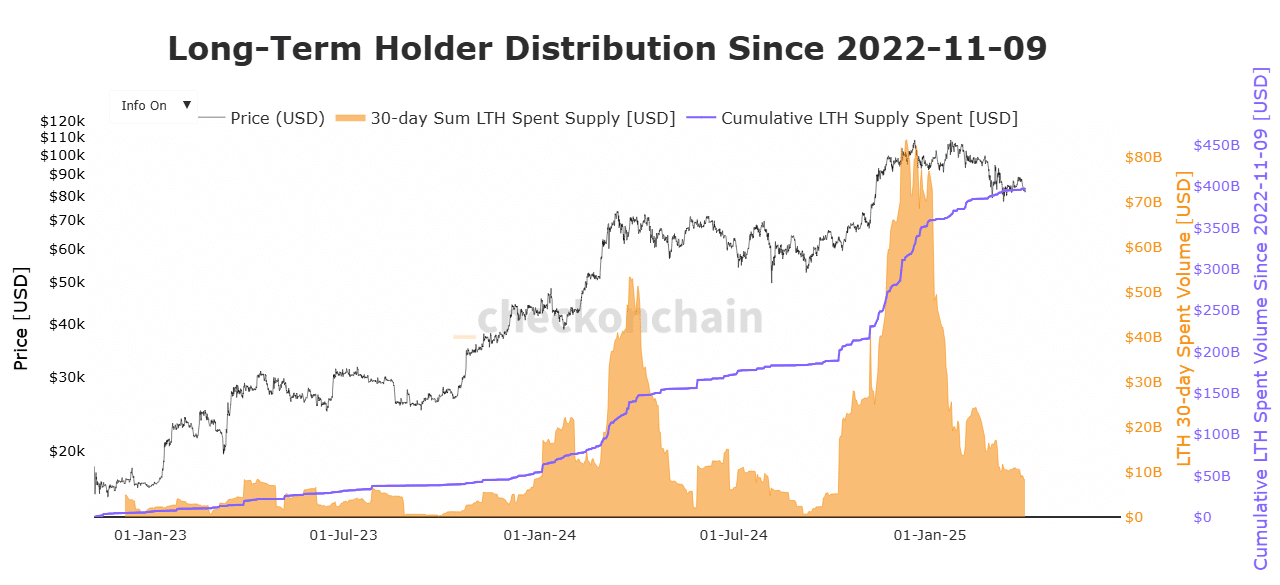

Source: Checkonchain

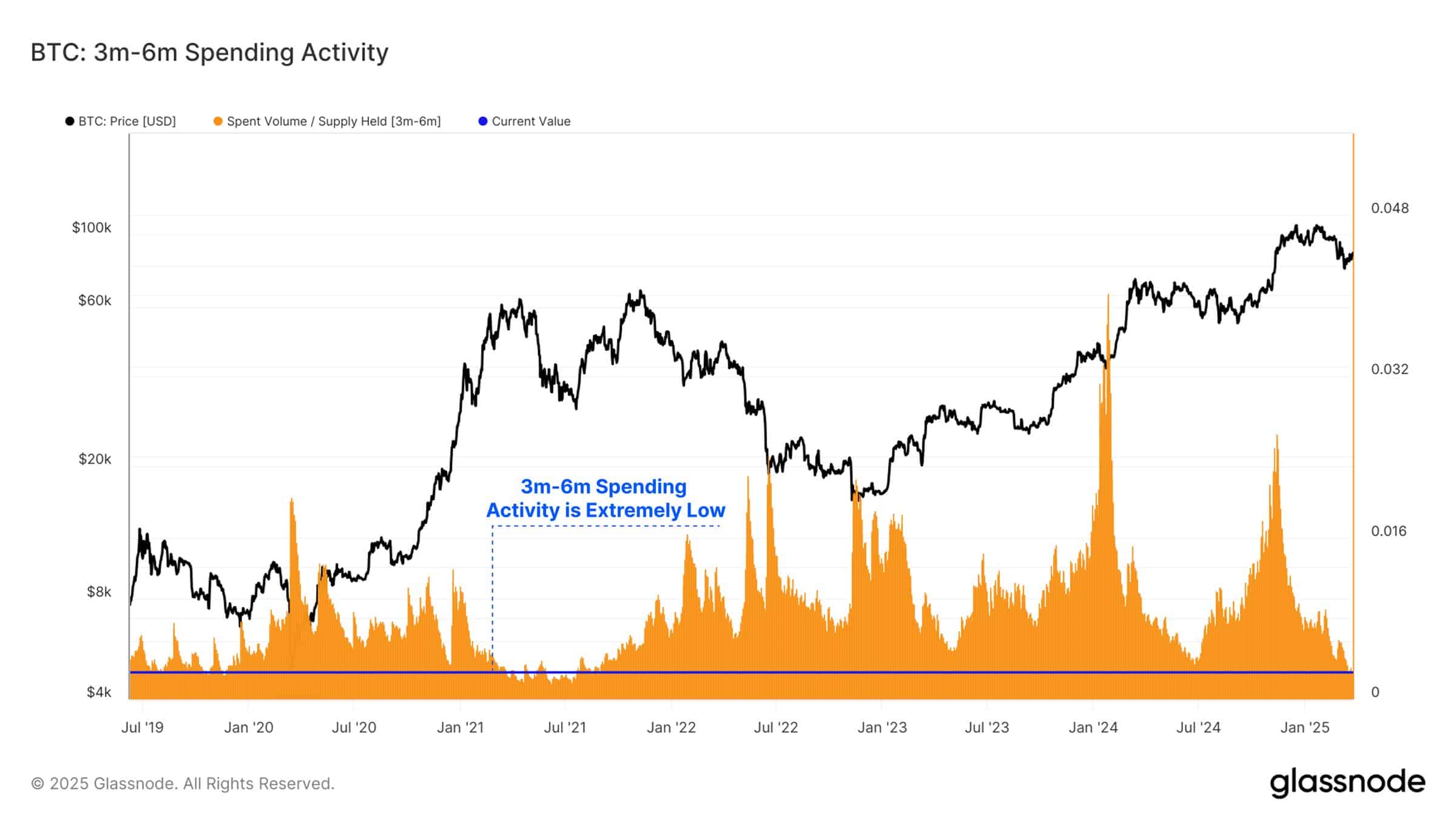

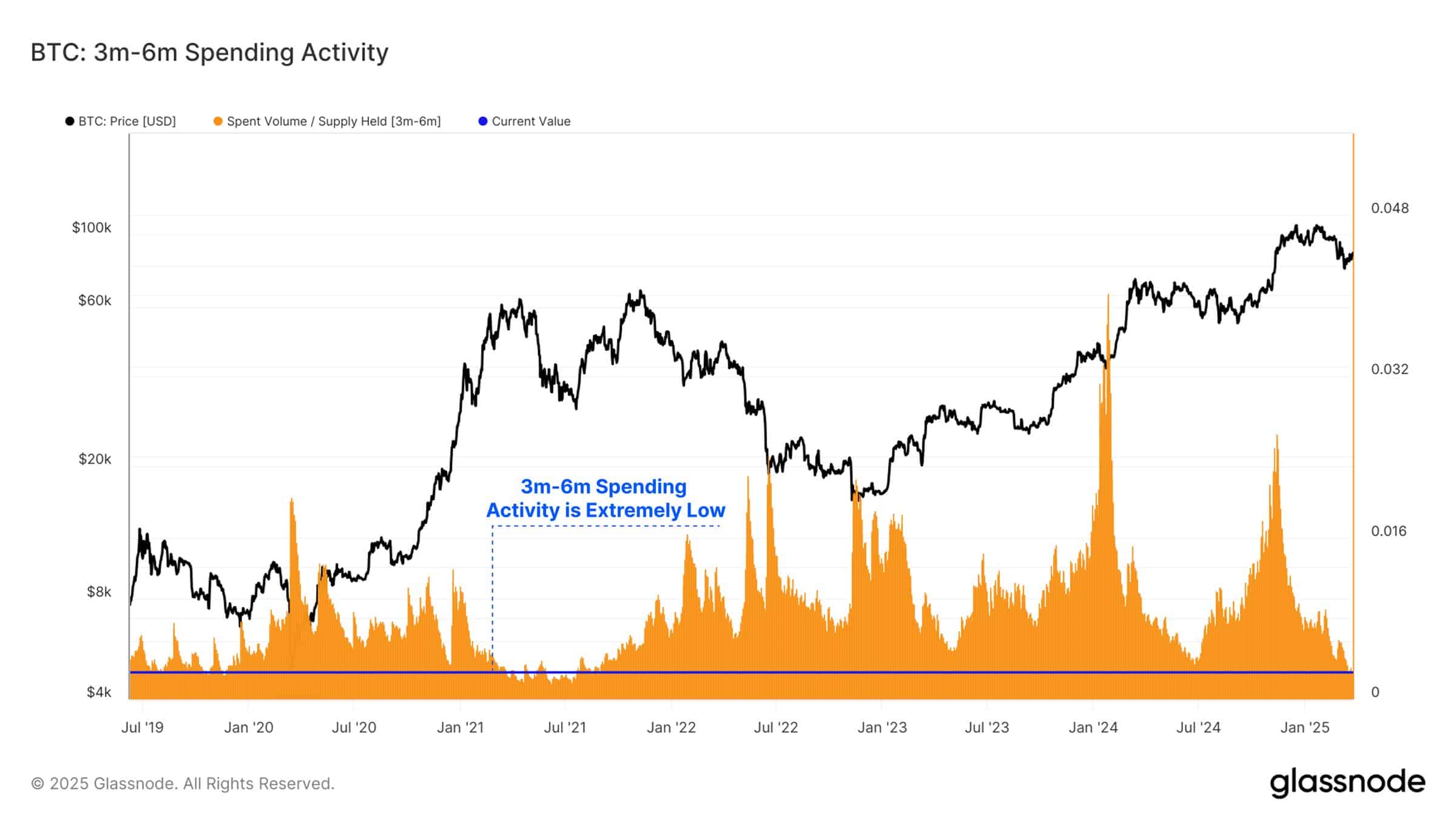

While holders see their profit grow in the long term, they remain steadfast in holding their BTC. The expenditure activity of 3-6 million Bitcoin holders has fallen to the lowest level since mid-2021.

This reduced activity supports the idea that recent top buyers maintain their positions instead of selling, even in the midst of current market volatility.

Source: Glassnode

That is why Bitcoin’s LTH issued a continuing decrease has been seen since February 2025. As such, the amount issued has fallen from a peak of $ 18 billion to $ 8 billion from March 31 of 2025.

This suggests that holders are publishing less and less BTC, which reflects a rising accumulation trend between LTH. With an increased company, it suggests that investors are optimistic about the long -term potential of BTC and anticipate more profit.

Source: Checkonchain

Looking further, during the cycle of 2023-2025, holders have divided more than 2 million BTC in the long term. This distribution is followed by a strong re-accumulation, which includes the sales pressure.

This cyclical balance played a key role in stabilizing the price action of Bitcoin.

What it means for BTC

With long -term holders who maintain their optimism, it is unlikely that Bitcoin will be confronted with considerable sales pressure, because this group remains instead of selling instead of selling.

A reduced expenditure speed at holders in the long term enables BTC to absorb sales pressure from short-term and speculative investors.

This balance between sales and accumulation suggests that Bitcoin will probably act within a consolidation range. Short-term and speculative investors enter the market to take advantage of rebounds and take a profit.

The bullish sentiment among holders in the long -term Bitcoin positions for potential price wines. If their conviction persists, BTC is expected to be retained above $ 81k, so that the road is cleared for a possible rebound to $ 87,500.

As long as holders continue to retain in the long term, there is room for growth. However, if their conviction is shaking, Bitcoin can experience a sharp fall and fall under $ 80k again.