- According to the CEO of Swan Bitcoin, BTC could reach $100,000 in early 2025, and then $1 million by 2030.

- The Bitcoin Power Law model reflected the April 2025 BTC price prediction.

Bitcoin [BTC] has been stuck in a boring price consolidation since March. However, most analysts and industry leaders remain optimistic, especially between the fourth quarter of 2024 and 2025.

Leading institutions like Standard Chartered predicted that the world’s largest digital asset could reach $150,000 by the end of 2024.

Cory Klippsten, CEO of Swan Bitcoin, is the latest to set a BTC price target. During a recent interview with Kitco News, he said said,

“I think the BTC price will be stable at 100,000 euros in April 2025… By the end of 2025 we will probably have a round trip and be back at $125,000.”

However, the executive claimed that the largest digital asset could reach $1 million per coin by 2030, citing likely more education about the asset.

“We will ensure that Bitcoin equals the dollar by 2030, which amounts to $1 million per coin.”

Klippsten’s purpose was somewhat different from that of Standard Chartered. The bank predicted that BTC could reach $200,000 by the end of 2025, as opposed to Klippsten’s conservative target of $125,000.

However, do the usual BTC forecasting models agree with this outlook?

What does the Bitcoin power law model project?

Source: BitBo

The Bitcoin power law is one of the forecasting models widely used by analysts. It attempts to measure future price targets based on historical price action. It has three price ranges: support, resistance and median level.

The model will be released in early 2024 projected a high of $300,000, a low of $20,000 and a conservative target of $74,000. In March, BTC reached a high of $73,000, slightly below the average target of $74,000.

The model targets for early 2025 are $420,000, $40,000 and $115,000. So Klippsten’s goal was almost equal to the average goal of the model. By the end of 2025, the average target was $150,000, well below executives’ projections of $125,000.

It is worth noting that the power law model is dependent on past price patterns and could potentially be debunked by Blackswan events.

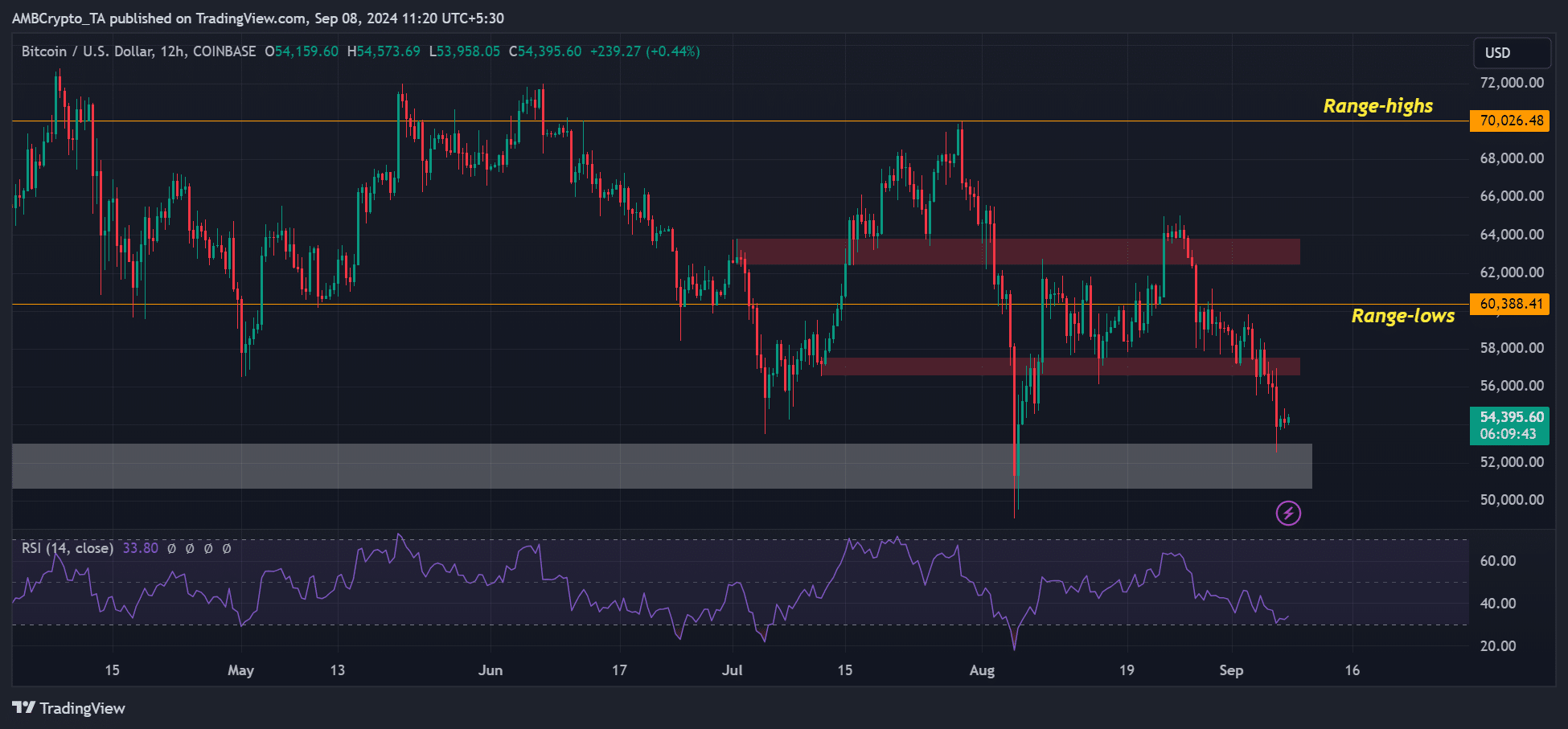

In the meantime, BTC’s recent dump fell above $52,000, the same support that halted the massive decline in early August. According to BitMEX founder Arthur Hayes, a recovery could likely be based on a positive outlook on the macro front. He said,

“With Janet Yellen eyeing the market and releasing a weekend statement, BTC *MAY* rise if things continue to vomit next week, pending more liquidity in the dollar.”

Source: BTC/USD, TradingView

However, the recovery should clear overhead resistances above $57,000, the previous low at $60,000, and another supply area at $65,000. At the time of writing, BTC was trading at $54.3K, down about 26% from its all-time high of $73.8K in March.