- Bitcoin is up 4% on the ‘Christmas Rally’, with Secret Santas driving the momentum.

- However, psychological risks remain, keeping the bull rally just out of reach.

Ten days ago, Bitcoin [BTC] reached a new ATH of $108,000, a level it has been looking at since the “Trump pump.”

But even with no signs of an overheated market and greed well below 90, investor caution increased as the FOMC warned of a “cautious” 2025 ahead.

The result? BTC saw a sharp decline, wiping out much of the gains made during the latter stages of the election cycle.

With a potential correction looming, many opted to cash out at the $94,000 price, leading to a profit of more than $7.17 billion.

While it may seem like a setback, the exit of weak hands is often seen as a ‘healthy’ retracement, paving the way for new players to come in and grab the available supply.

Now that BTC is creeping towards $100,000 again, is new capital flowing into the market again, or is the aftermath of that ‘unexpected’ drop still fresh, keeping investors on edge?

Risk-averse investors are moving out of caution

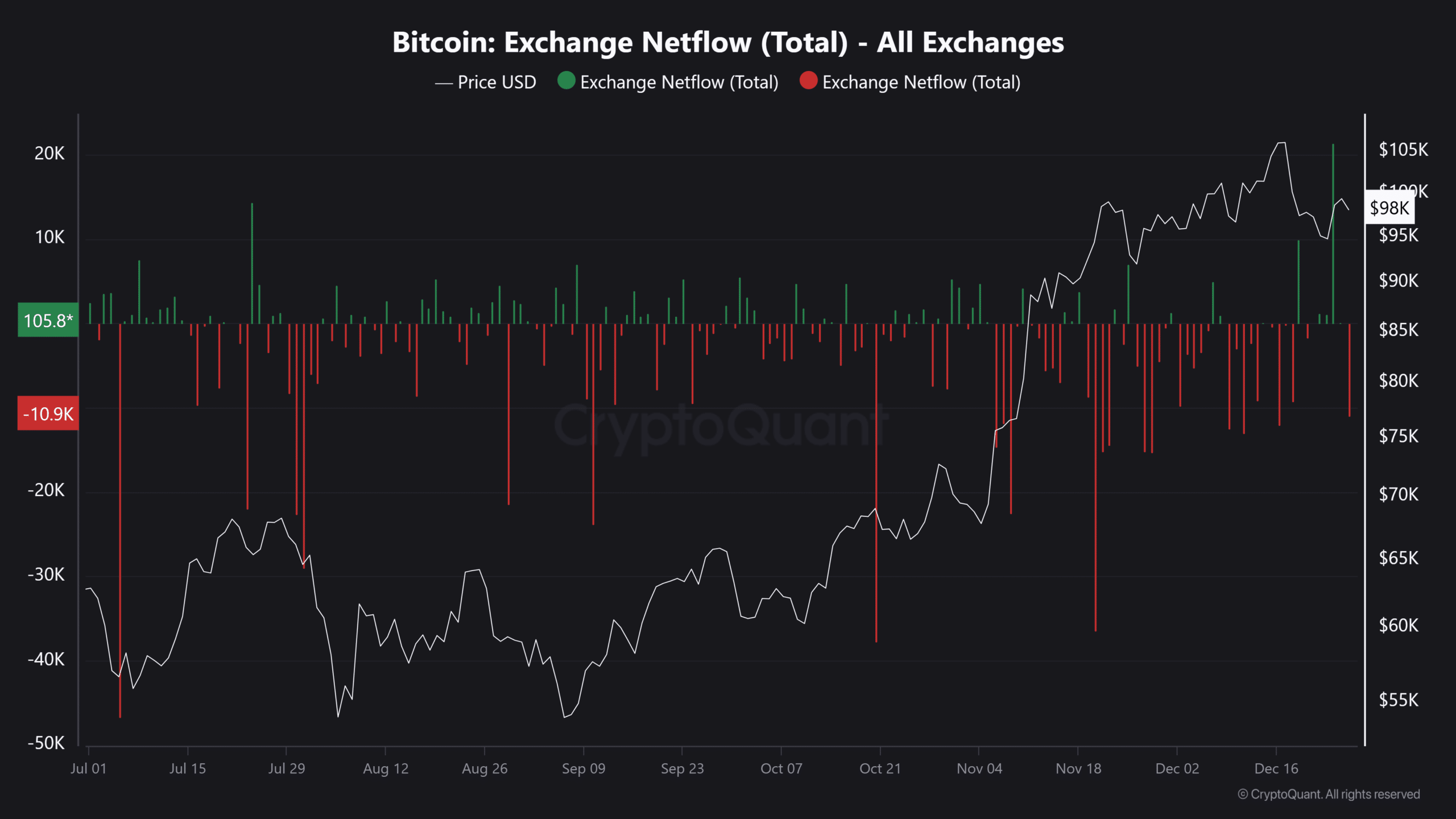

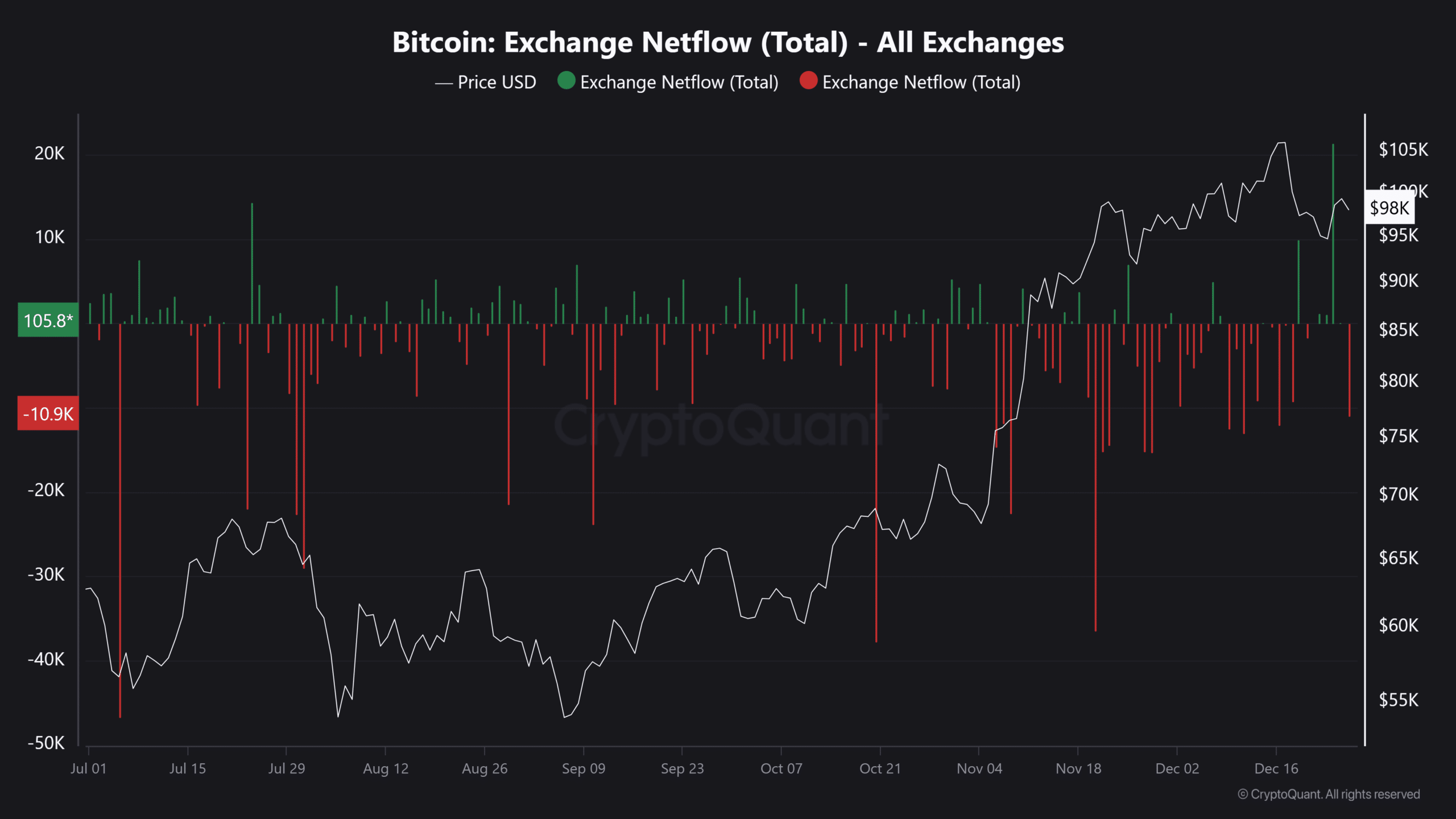

After the huge payout, Bitcoin exchange reserves rose to 2.427 million – the highest peak since November.

The SOPR of short-term holders also reached 1.04, indicating that those with less than five months of exposure were cashing out and holding on to their gains.

Furthermore, BTC inflows on the exchanges reached a five-month high, with 21,000 BTC deposited at an average price of $98,000.

This sent BTC to $92K, its lowest level in over two weeks, with $94K clearly proving to be a strong profit-taking zone.

Source: CryptoQuant

But just when everything seemed to be going south, the holidays started cheer kicked in.

Before a deeper pullback to the $88,000-$90,000 range could occur, BTC bounced back with a 4% jump and found itself back in the $98,000-$100,000 band.

Despite this recovery, institutional demand through Bitcoin ETFs has remained sluggish for four days in a row outflow stripe.

This suggests that the current price has not yet attracted significant institutional capital.

On the retail On the other hand, buying has increased, but not aggressively enough to signal a full ‘accumulation’. As excitement builds in the new year, BTC could fluctuate between $100,000 and $105,000. Yet a new ATH still feels a bit far away.

Ultimately, the ‘risk factor’ looms large. With the recent declines still fresh in investors’ minds, psychological resistance could prevent new capital from flowing in.

So, is Bitcoin heading south?

Historically, the first quarter of each year has been bullish for Bitcoin, characterized by a supply shock where limited supply meets high demand, creating the perfect economic imbalance.

However, with current statistics in mind, it wouldn’t be surprising if Bitcoin deviates from its typical pattern.

External forces are becoming increasingly powerful, and the lack of clear economic signals could pose a significant hurdle in 2025, even with healthy numbers within the chain.

So unless BTC breaks its previous all-time high in mid-January, it may be premature to call a bull rally.

The lack of substantial retail and institutional capital means that even big players like MSTR may not be enough to spark the rally.

Read Bitcoin’s [BTC] Price forecast 2025-26

Instead, a consolidation between $95,000 and $98,000 could be exactly what Bitcoin needs to build momentum for the next big move.

This would keep risk-averse investors in the game by squeezing their profit margins, while reigniting FOMO and setting the stage for the rally that could carry us through the coming weeks.