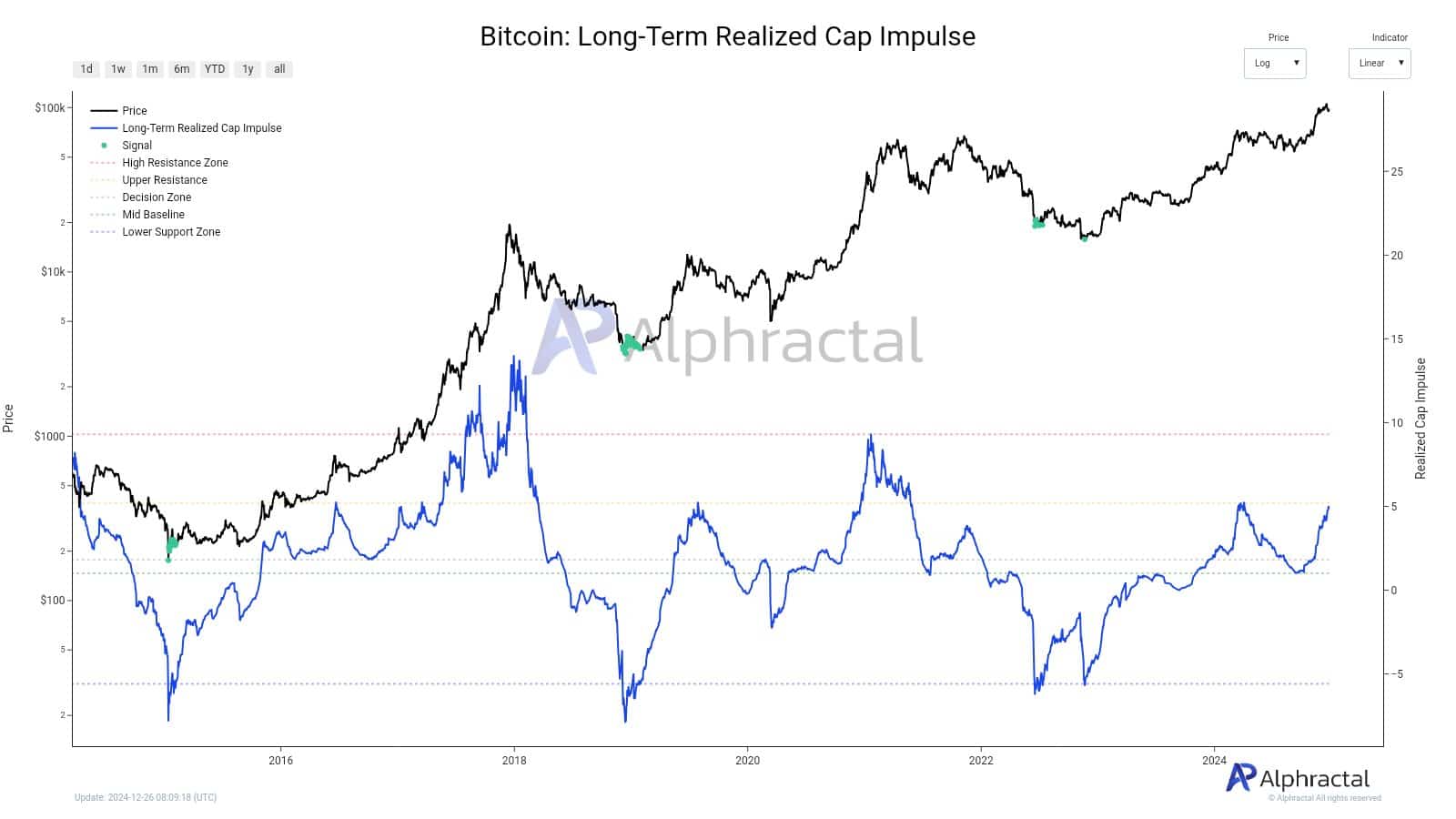

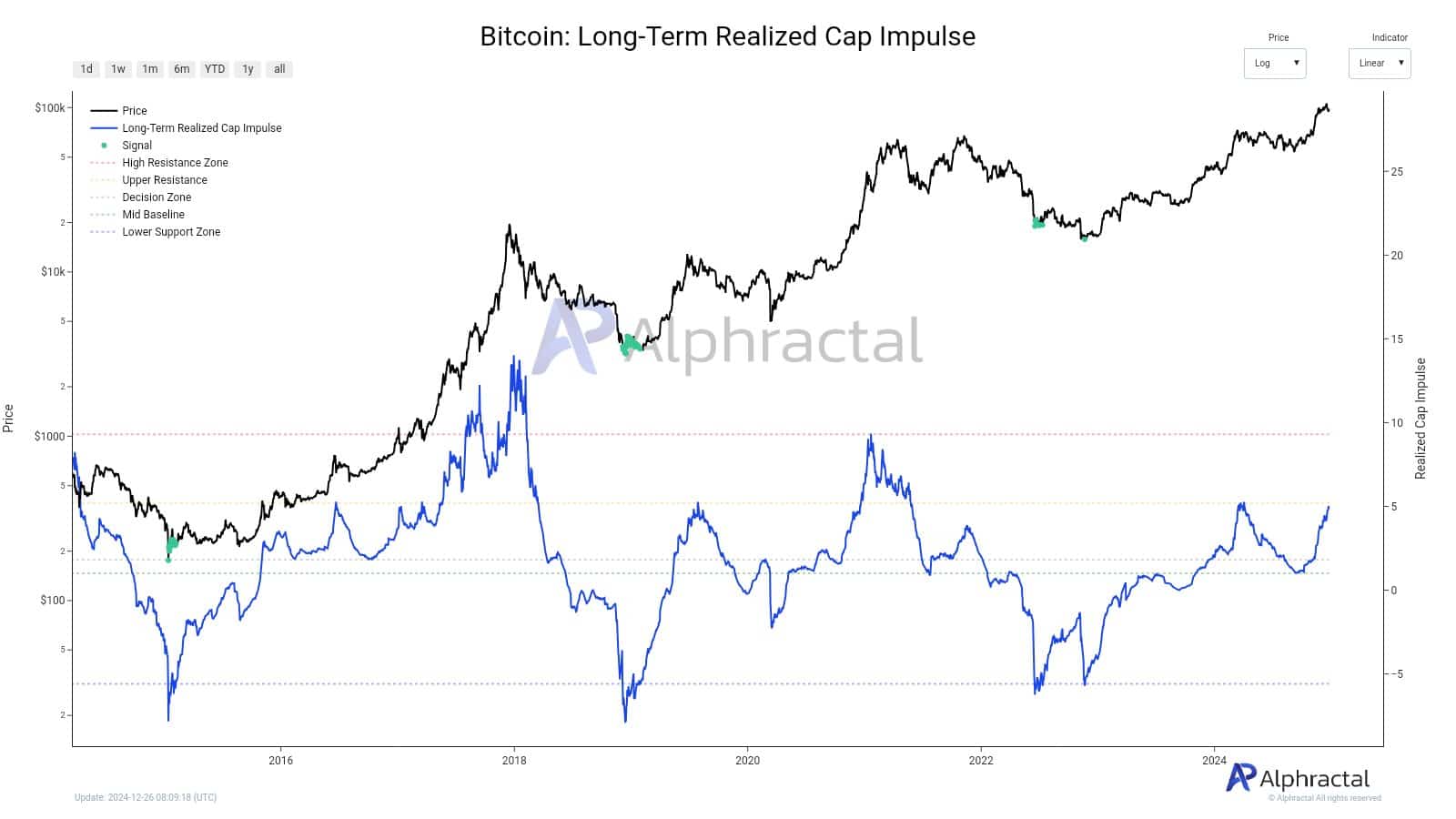

- Bitcoin’s realized limit reached the 2019 and March 2024 resistance levels

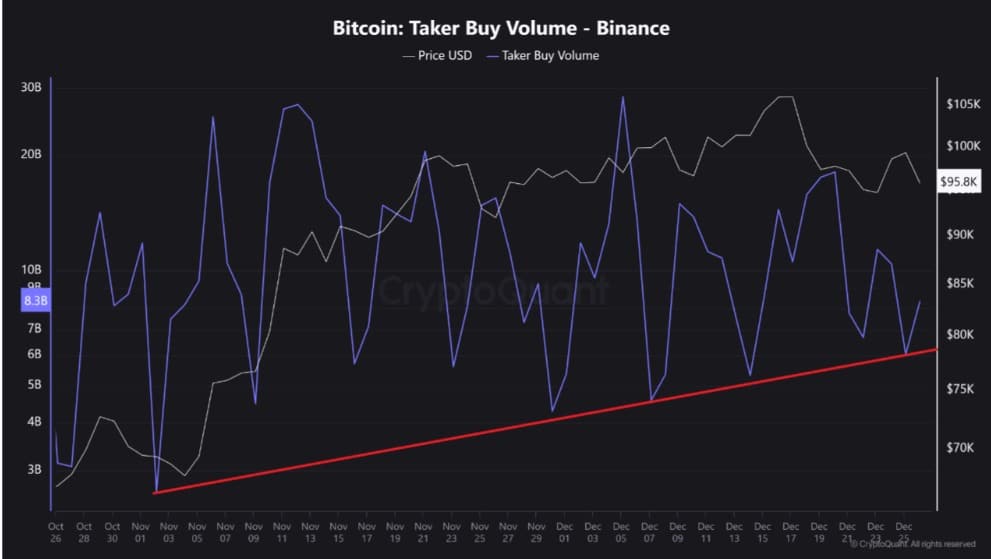

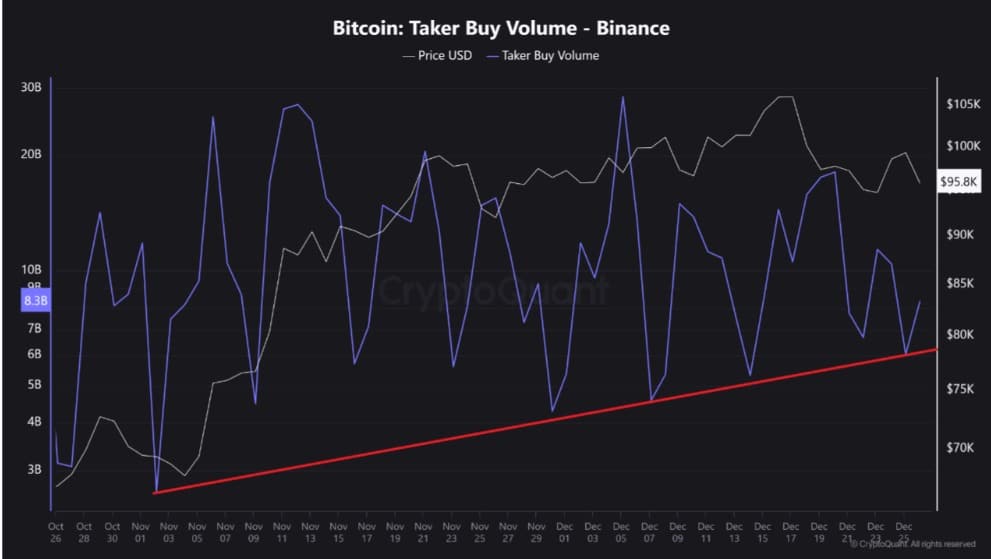

- Binance Taker’s buying volume also rose to $8.3 billion

Since reaching $102,747 a week ago, Bitcoin [BTC] has traded within a consolidation range between $97k and $92k. While market bears have tried to recapture the market and push the price down, bulls have consistently resisted.

This resilience has kept BTC above $90,000 for the past 39 days. This market resilience can be attributed to an increase in purchasing activity across the board.

Bitcoin’s realized limit reaches 2019 and March 2024 levels

According to Alpharactals According to analysis, Bitcoin’s realized capitalization reached the same resistance levels as in 2019 and March 2024. A rise to this level can be interpreted as a sign of continued buying activity, especially as investor demand rises.

Source: Alpharactal

In March 2024, Bitcoin’s realized limit recorded a sharp increase, while BTC’s price rose to the first ATH of 2024 and BTC ended the month at a high of $71,000. As the market recovered from the 2018 bear market, BTC rose from $3,000 to $13,000 in 2019 between February and April. After reaching this resistance level in 2019, prices fell to $7,000, while in March through April they fell to $56,000.

These two previous cycles showed that an increase in the realized limit directly correlates with BTC’s price trajectory. When the price rises, it means an increase in buying pressure even if the price rises higher.

Source: Cryptoquant

We can see this buying pressure in Binance Taker’s recent increase in Bitcoin purchasing volume, which saw the same increase to $8.3 billion. Usually, high customer volume indicates high demand, which ultimately drives the price up.

For example, over the past 30 days, the stock has made higher lows, indicating increased investor interest and increasing buying pressure.

Based on the increasing interest from buyers, we can see that demand remains high and the cap realized by Bitcoin will most likely break its previous resistance levels.

Therefore, if Bitcoin’s realized limit manages to break the 2019 and 2024 resistance levels, BTC will continue to rise. If this fails, the price will eventually decline – a sign that Bitcoin’s annual growth has already been significant.

What Do BTC’s Charts Suggest?

While the analysis provided seemed to offer a positive outlook, it is essential to research and determine what other market indicators are saying.

According to AMBCrypto’s analysis, Bitcoin is currently seeing strong market demand.

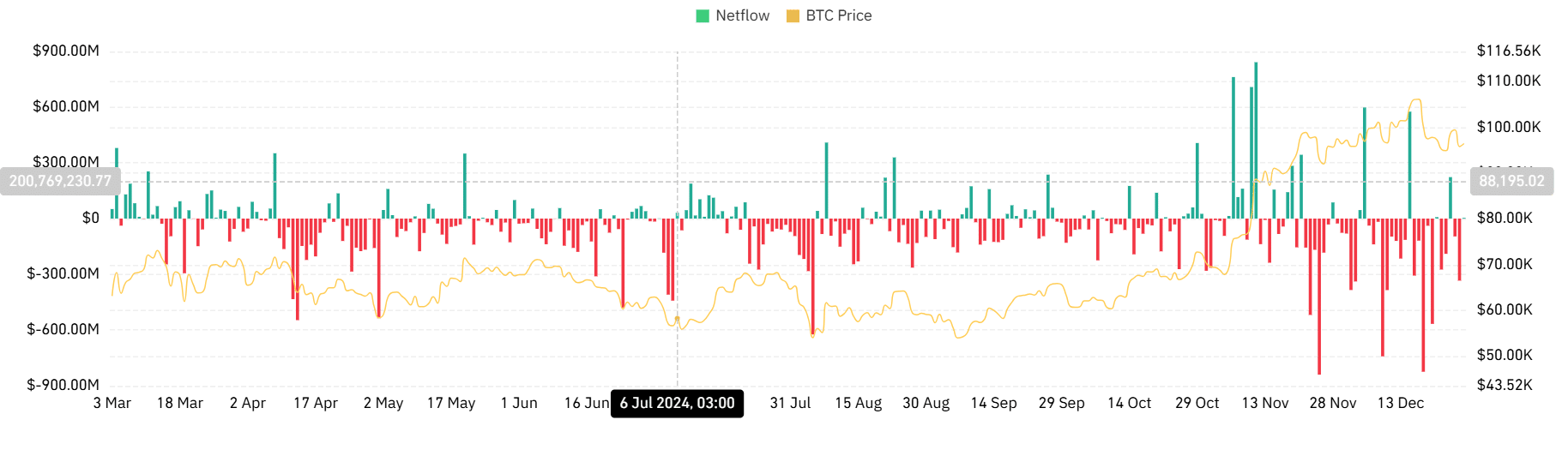

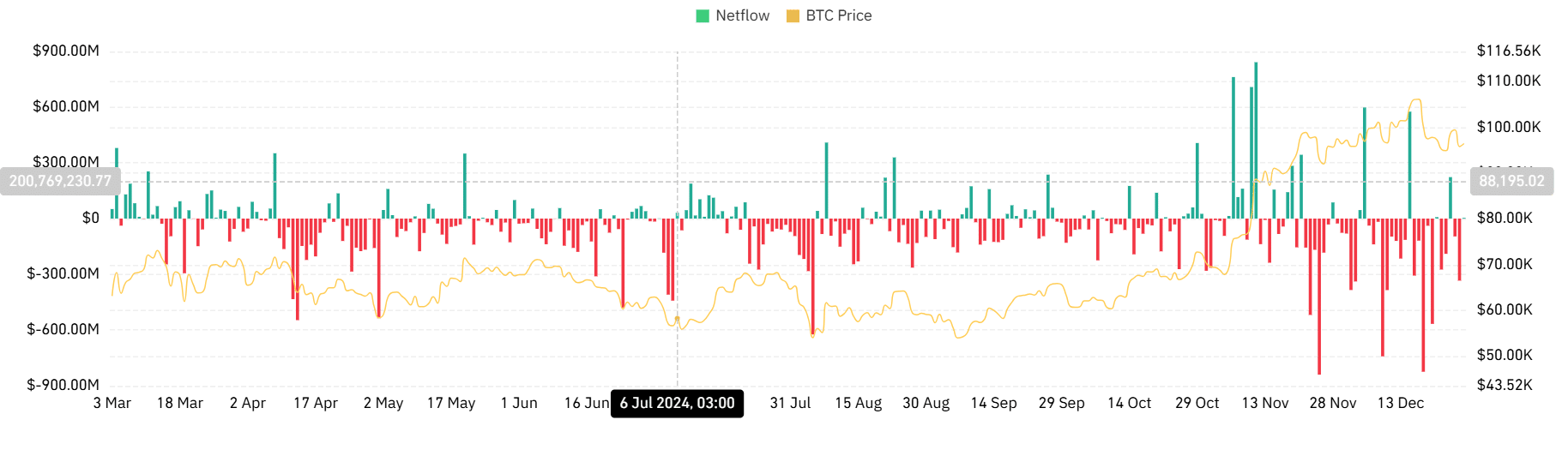

Source: Coinglass

To start with, we can see this demand in the continued decline in spot grid flows. Last month, figures for this fell from $597 million to $-334.1 million. This suggested that demand may be exceeding supply as investors continually accumulate.

Source: TradingView

Moreover, we may see higher buying pressure via positive Chaikin Fund Flow (CMF). This has remained positive as of November – a sign of strong demand for the crypto as investors continue to enter the market.

Simply put, even though Bitcoin’s realized limit has reached the previous resistance level, BTC demand remains significant. This means that Bitcoin has more room for growth. If this demand continues and buying pressure pushes the price higher, BTC will attempt $98,900 in the near term.

However, if the annual growth is already behind us, Bitcoin could fall to $92,200.