- Cryptuquant CEO Ki Young Ju believes that Bitcoin’s bull’s cycle has ended, which predicts for 6-12 months of Bearish movement

- Historical trends suggest that Bitcoin could surpass his all time in mid -2025

Bitcoin [BTC]The newest decline has fueled a significant shift in market sentiment, with experts again evaluating his process on the charts. According to Coinmarketcap factsBTC traded at $ 81,896.71 at the time of the press, after a decrease of 0.46% in the last 24 hours.

Ki Young Ju’s Bitcoin -Warning

In response, cryptoquant CEO Ki Young Ju warns, who has previously rejected Beerarish, now that the Bitcoin bull’s cycle was possible.

To X, Ju said”

“#Bitcoin Bull Cycle is over and expects 6-12 months of Bearish or lateral price action.”

Source: Ki Young Ju/X

What is Exec’s reasoning?

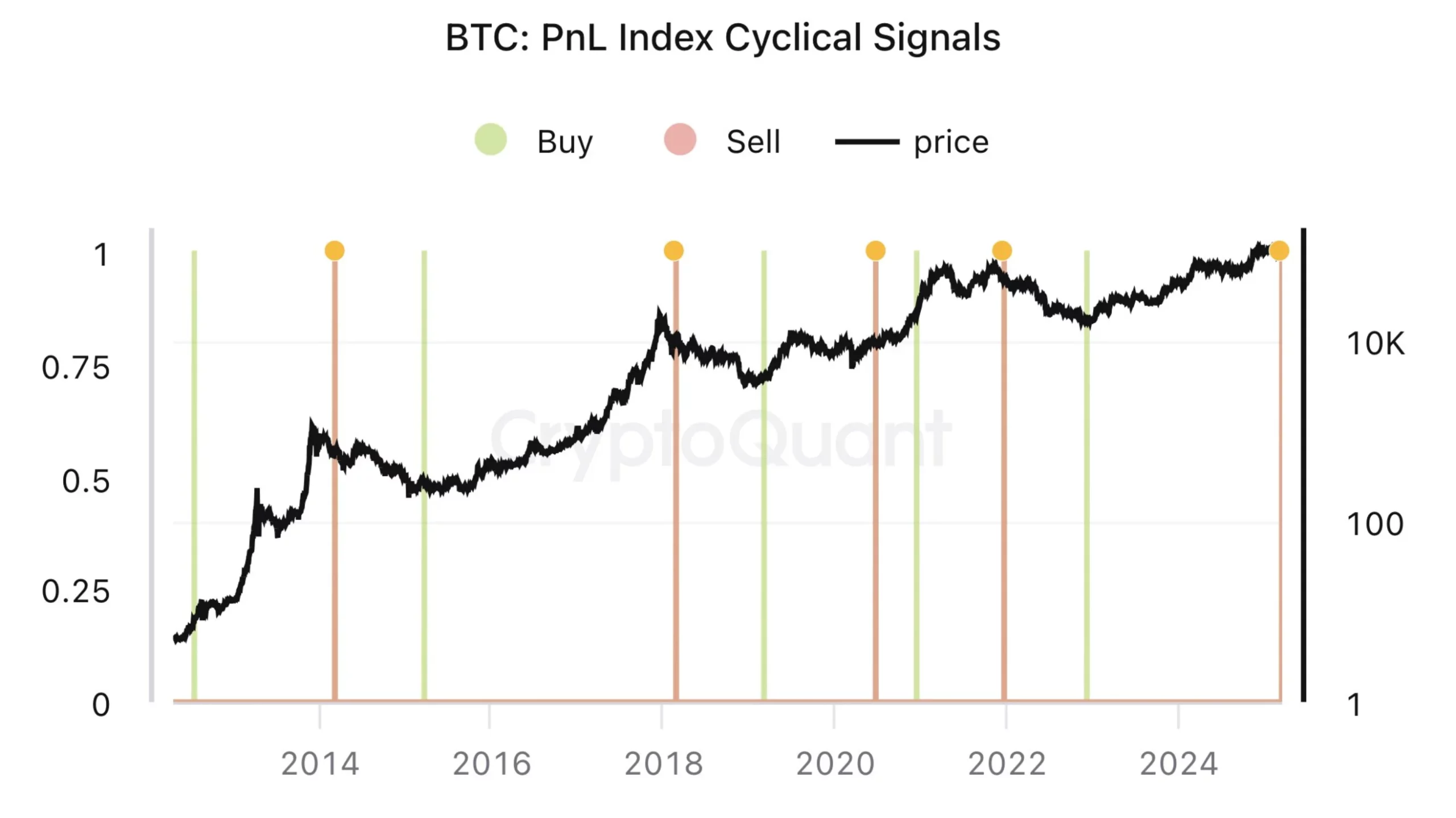

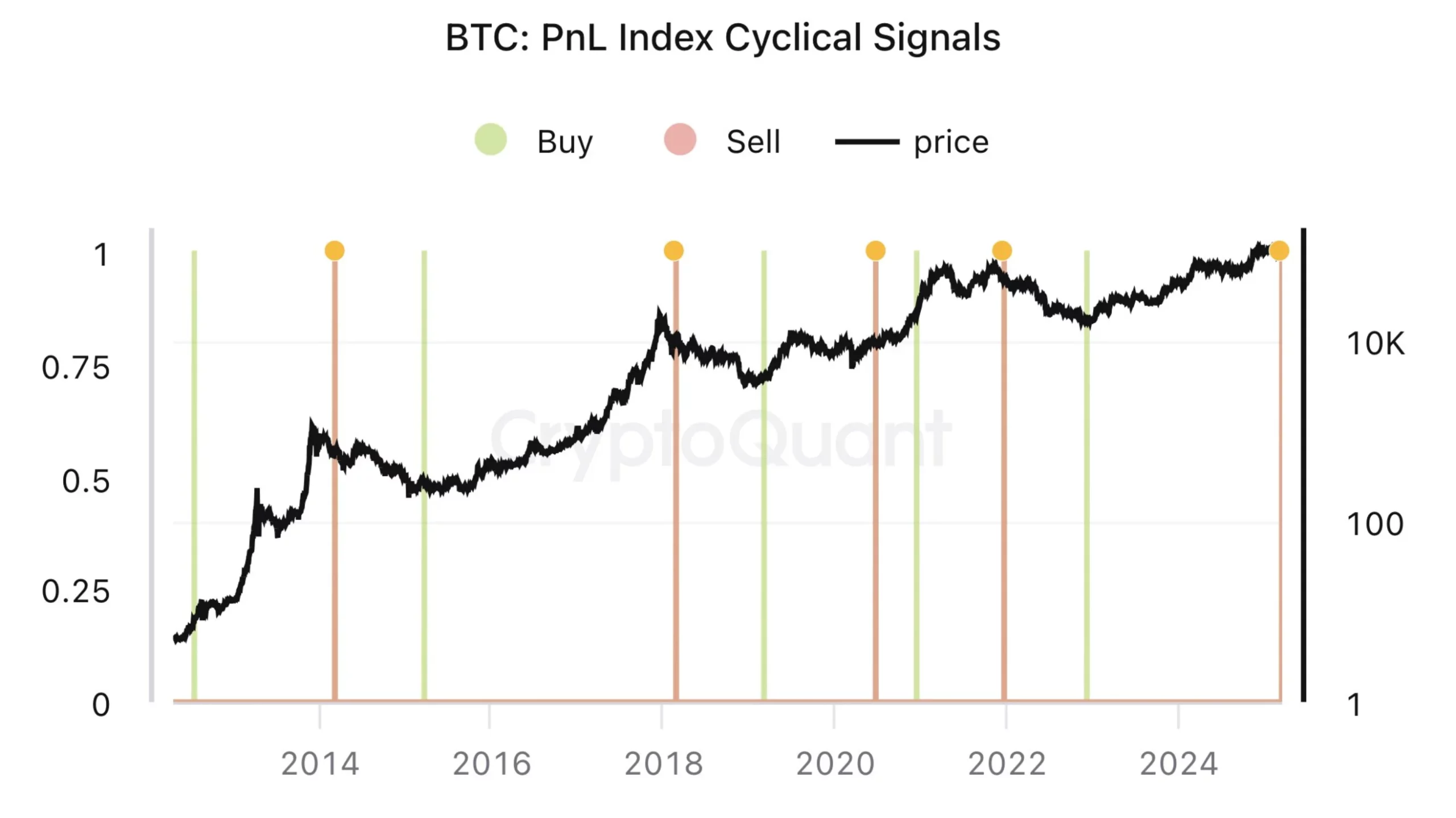

Ju’s latest analysis hinted on a relevant shift in the Bitcoin market cycle, with important statistics on chains that indicate a bearish or lateral trend for the next six to twelve months. He shares a graph about the profit and loss of BTC (PNL), he suggested that bullish expectations for a strong rebound could be misplaced.

According to JU, the liquidity inflow is weakened, while newly drawn up whales discharge their property at lower prices.

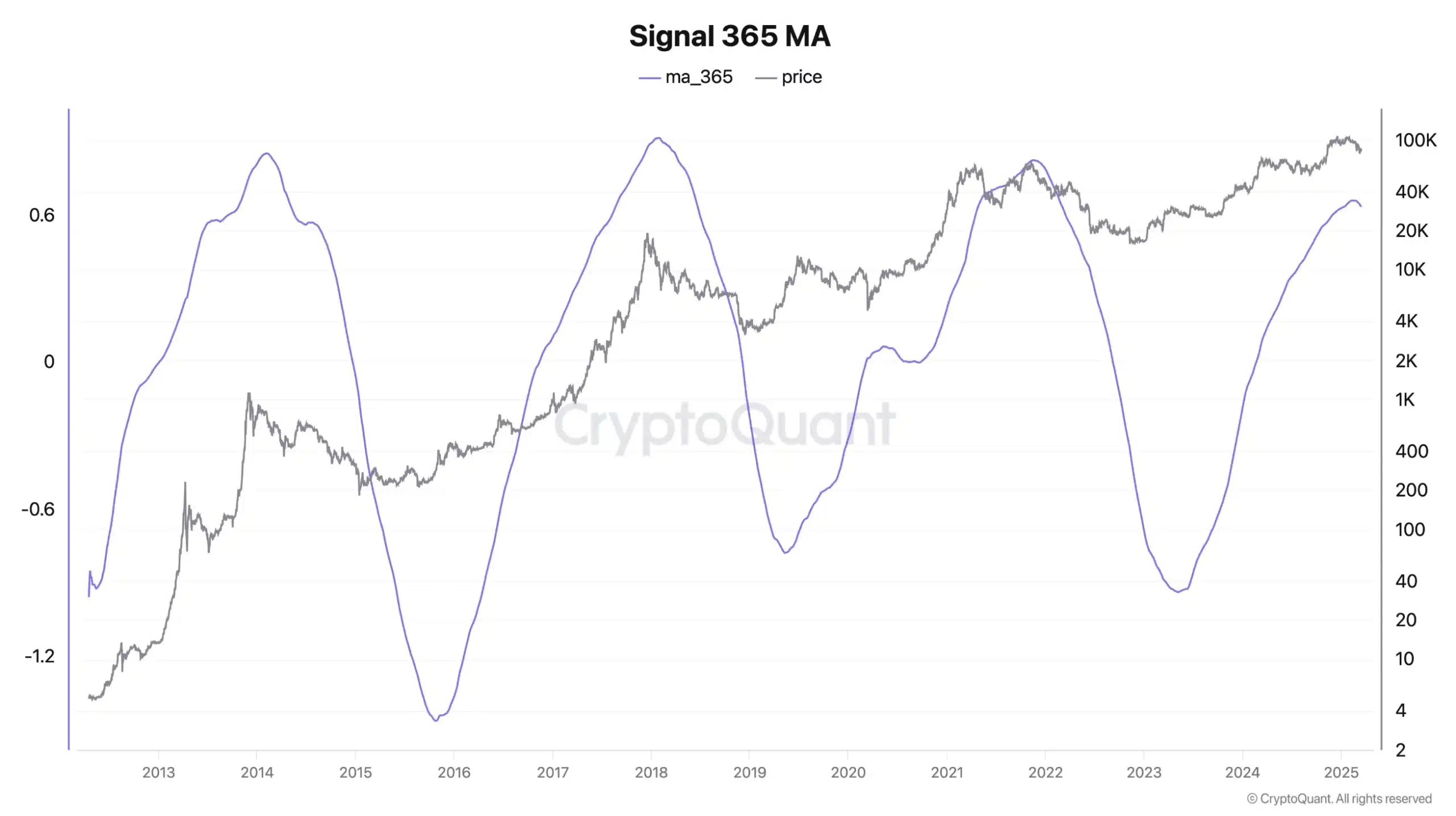

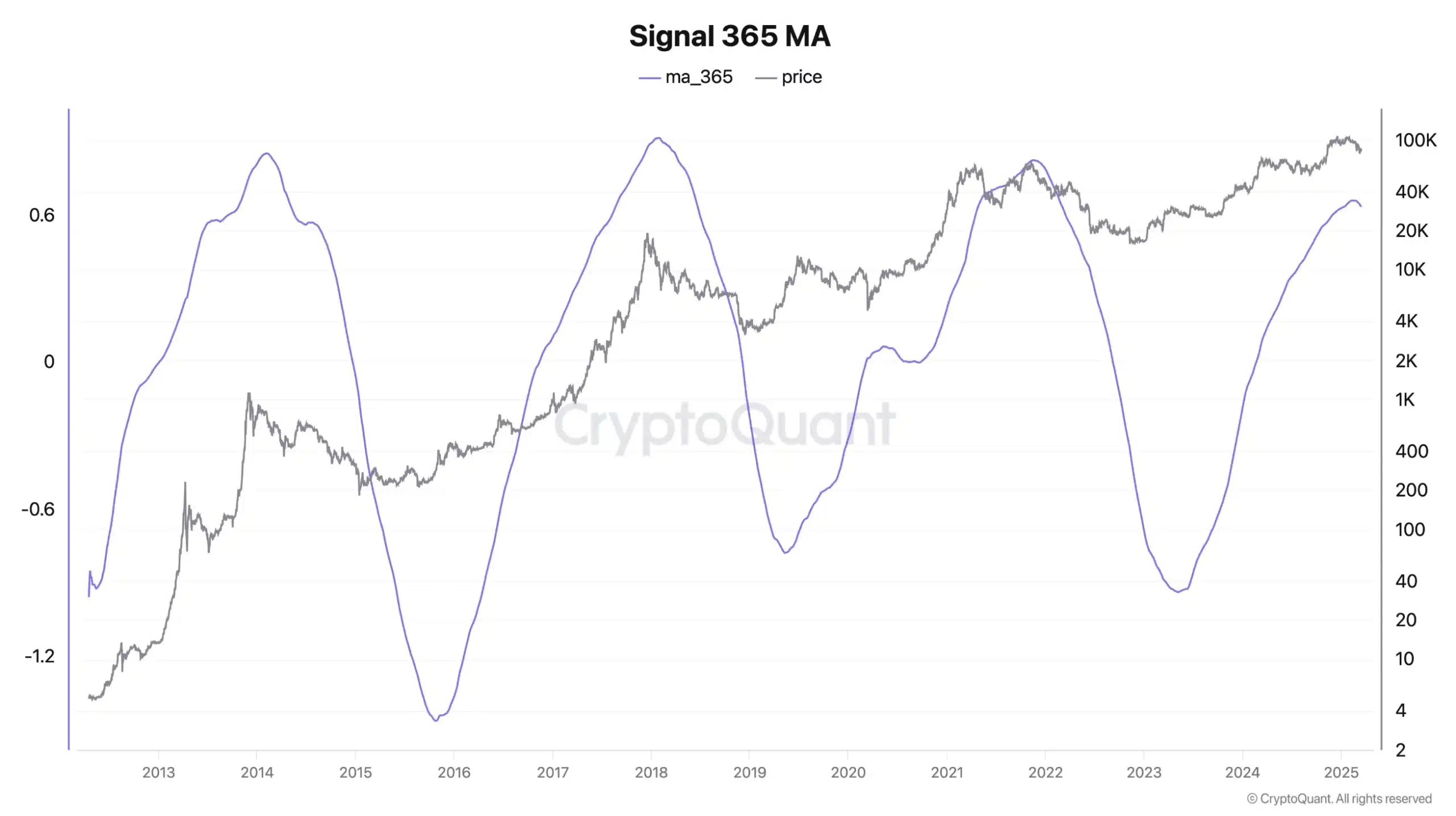

He also applied Principal Component Analysis (PCA) to indicators such as the MVRV, SOPR and NUPL, using a 365-day advancing average, E to identify trend covers.

Source: Ki Young Ju/X

However, some traders remain skeptical and noted that Ju’s sales signal did not play as expected in 2020.

What is more?

Ju also emphasized an important warning sign for the Bitcoin process – the decrease in fresh liquidity, an important engine of price stability and growth. He noted that newly established whale investors discharge their companies at lower price levels, a pattern that has historically indicated the beginning of Beerarish Trends.

As an addition to concern, the institutional question seems to decrease. Especial as ETF intake has remained negative for three consecutive weeks. Episodes of sUstained outflows can often be seen as a sign of weakening the purchasing pressure, so that doubts are made about Bitcoin’s ability to regain bullish momentum in the short term.

Provide further insights, Ju added”

“Sorry that I changed my opinion, but it now looks pretty clear that we are entering a bear market.”

He concluded it best when he said

“I can’t only share my hope when the data continues to signal.

Is there any hope?

Despite the current Bearish signals, historical trends suggest that Bitcoin can be about to be about another large rally. In fact an ANalysis of BTC’s price movements Since 2015, a seasonal growth pattern emphasized, with the strongest profit between April and October.

If this trend applies, Bitcoin can stabilize in the coming months before resuming his upward process. Some PRjecties even indicate that BTC could surpass its previous time against mid -2025.

Although the uncertainty remains in the short term, indicators can indicate a considerably upward potential for the flagship cryptocurrency in the long term.

That is why it is still to be seen whether Ju’s prediction is funds or whether Bitcoin can restore another Bull Run.