This article is available in Spanish.

Bitcoin is on a notable upward trajectory, having crossed above the $96,000 mark for several days after consolidating below the psychological $100,000 level. As the leading cryptocurrency, Bitcoin has consistently broken all-time highs over the past three weeks, reaching a milestone yesterday at a weekly close of $98,000 – the highest in its history.

Related reading

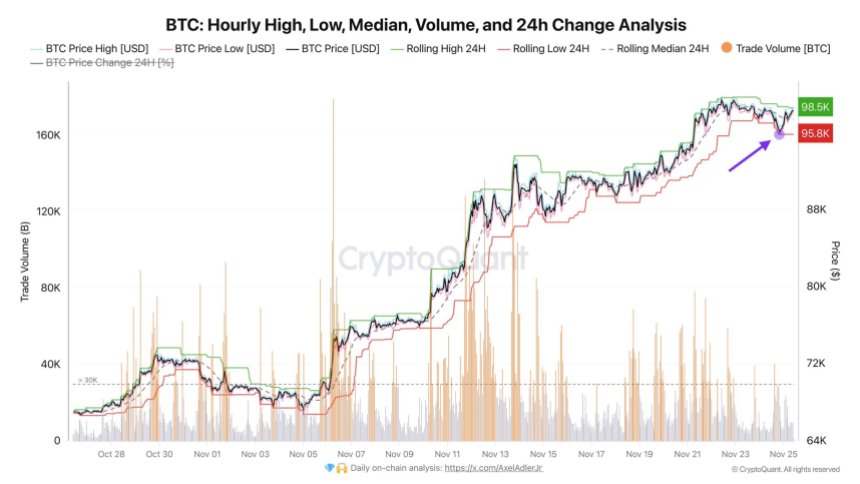

CryptoQuant analyst Axel Adler shared an insightful analysis on According to Adler, the market is now primed for a critical test of the $100,000 barrier, a barrier that could catalyze further bullish momentum or signal a near-term consolidation phase.

With Bitcoin’s bullish trajectory showing no signs of slowing, traders and investors are closely watching for a breakout above $100,000. Such a move could fuel broader market optimism and spur renewed interest in altcoins, potentially shaping the next phase of the crypto market’s growth. However, if we fail to break above this key level, it could trigger a healthy correction, paving the way for a more sustainable recovery.

Bitcoin price action remains strong

Bitcoin’s price action has remained exceptionally bullish despite a recent pullback from $99,800 to $95,800 – a small decline of less than 4%. Investors are widely viewing this pullback as a brief consolidation phase before a potential breakout above the crucial $100,000 mark.

The resilience shown during this setback has boosted confidence among market participants, with many viewing it as a healthy pause in an ongoing uptrend.

Renowned CryptoQuant analyst Axel Adler weighed in on the recent market moves via Xwhich shares a technical analysis that reinforces Bitcoin’s robust bullish structure. Adler emphasized that it was unsuccessful in pushing BTC to lower demand levels, further strengthening current support zones.

According to his insights, the stage is now set for Bitcoin to finally test the critical $100,000 area and gauge the market’s reaction to this psychological threshold. As BTC approaches this milestone, investor sentiment appears divided. Many traders consider the $100,000 level as an ideal price to take profits, citing historical patterns of pullbacks after key milestones in round numbers.

Related reading

However, others remain optimistic about Bitcoin’s continued strength, predicting a potential rise of over $100,000. Predictions for the peak of the rally are between $105,000 and $120,000, reflecting a broader belief in the cryptocurrency’s long-term potential. Whether Bitcoin consolidates or continues to rise, all eyes remain on the next steps.

Bullish Weekly Close Could Send BTC Higher

Bitcoin has reached its highest weekly close in history, hitting an impressive $98,000. This milestone is a technical achievement and a critical psychological boost for market participants. It signals a strong bullish environment that could soon push Bitcoin above the coveted $100,000 mark.

The $98,000 level now serves as a robust support zone, and maintaining this price – or at least staying above $95,000 – in the coming days will be crucial. A breakout above these levels could propel Bitcoin towards $100,000 with significant momentum. Such a move would strengthen Bitcoin’s upward trend and attract further interest from retail and institutional investors.

Related reading

However, further consolidation below $100,000 remains a possibility. Bitcoin may take several weeks to move sideways to gather the strength needed for the next move up. While this phase of consolidation may be frustrating for short-term traders, it would provide a sound foundation for sustainable growth.

Featured image of Dall-E, chart from TradingView