- Bitcoin saw record inflows, fueled by institutional inflows and regulatory clarity.

- Growing confidence in Bitcoin’s realized limit highlighted the shift from speculation to stability.

Bitcoin [BTC]once known for wild price swings, it now raises $80 billion in capital every month.

Nearly half of all capital ever invested in Bitcoin came in the past year. This increase signals a market shift, indicating that Bitcoin may be evolving from a risky asset to a more stable store of value. Institutional investors view Bitcoin as a more stable investment.

As this transformation unfolds, one key question remains: what does this mean for Bitcoin’s long-term future?

What’s Driving Bitcoin’s Unprecedented Inflow?

The recent surge in Bitcoin inflows, totaling $80 billion per month, reflects a confluence of macroeconomic and market-specific factors.

Institutional investors increasingly view Bitcoin as a hedge against inflation and as a diversification tool amid uncertainty in financial markets.

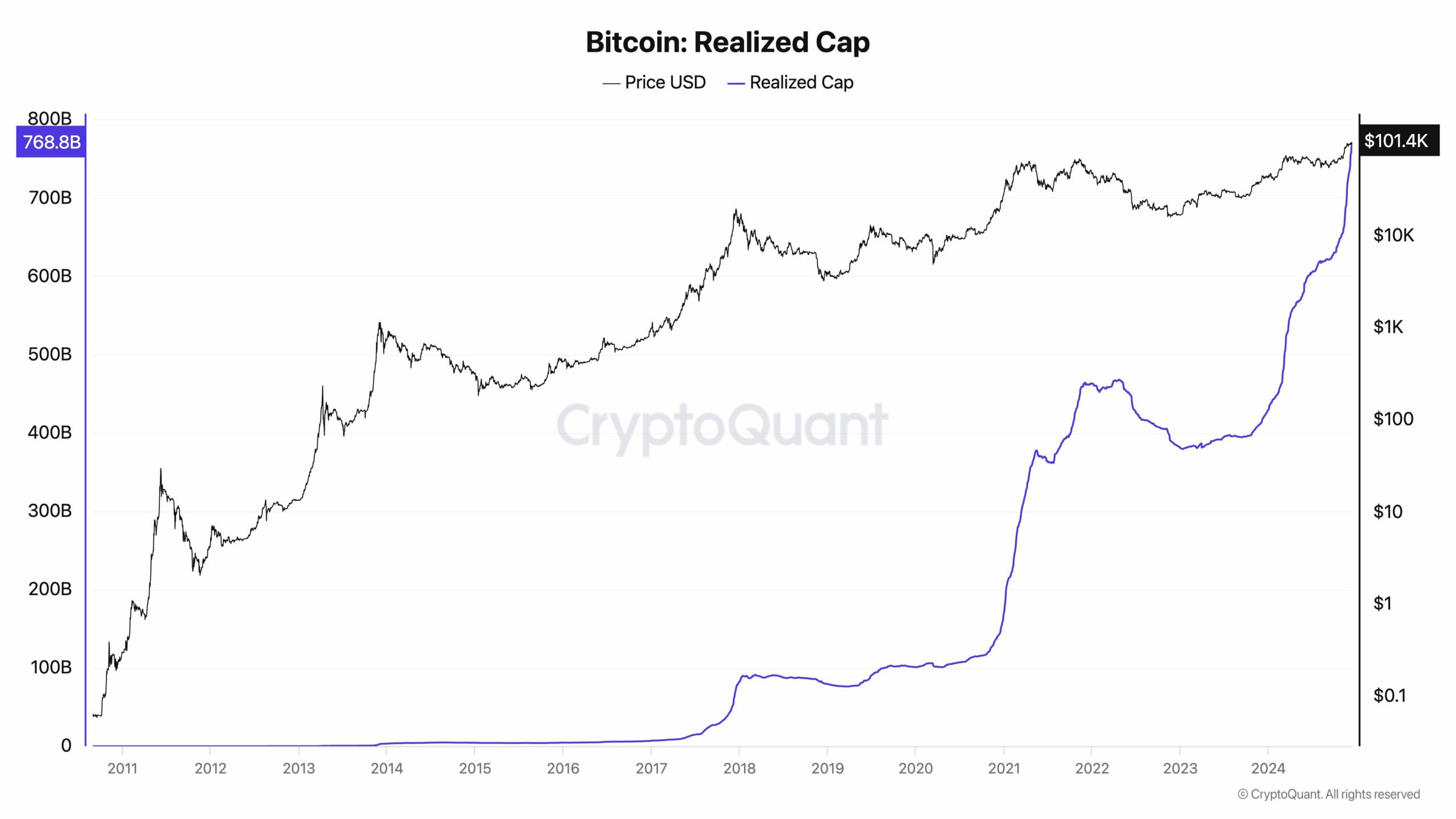

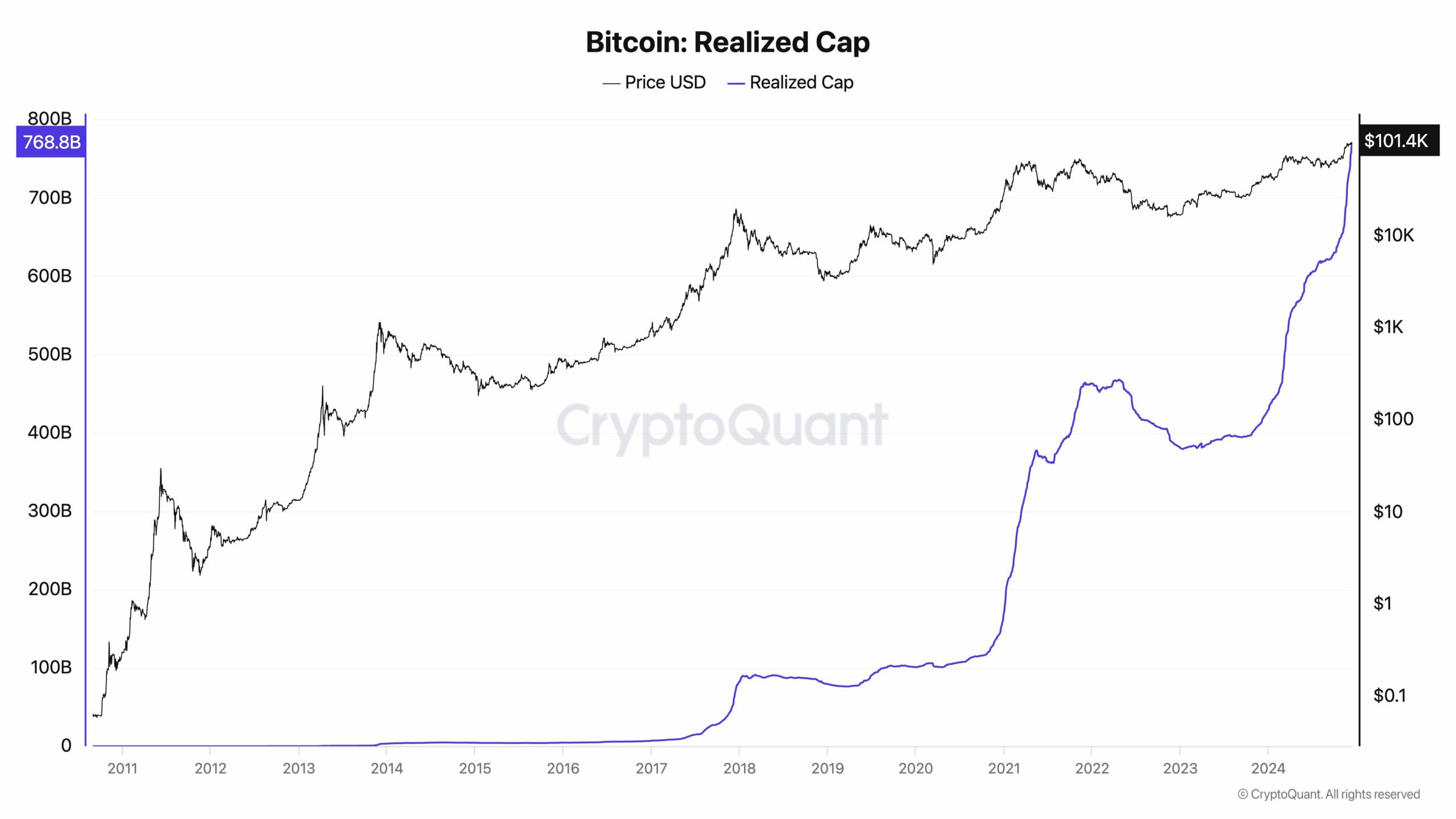

The sharp increase in Bitcoin’s realized cap to $768.8 billion shows growing confidence in its long-term stability. Fresh capital from whales and long-term owners is accumulating at an almost unprecedented high price level.

Source: CryptoQuant

In particular, regulatory clarity in key jurisdictions and the prospect of approval of Bitcoin ETFs have further legitimized its appeal.

Combined with a strengthening dollar and declining returns on risk-free assets, these factors indicate that Bitcoin is no longer the domain of speculation, but a cornerstone in the evolving financial ecosystem.

Impact of the inflows on the market capitalization and how the latter affects the BTC price

The market capitalization of BTCnow approaching $2 trillion, owes much of its recent growth to the influx of institutional capital.

This capital inflow strengthens liquidity, stabilizes price movements and reduces the risk of sharp corrections, a shift from Bitcoin’s previous volatility. Considering the realized cap is $768.8 billion, this represents a robust base of confident long-term holders.

Historically, market capitalization expansion has been directly correlated with higher price potential. More capital creates a positive feedback loop, attracting new investors and increasing demand.

This dynamic is evident in BTC’s ability to sustain record-high prices without significant pullbacks, cementing its reputation as a reliable store of value.

Read Bitcoin’s [BTC] Price forecast 2024–2025