- Bitcoin’s behavior in 2019 is repeating itself, thanks to its investors.

- Analysts were divided on a post-halving rally in 2024 and the likely price trigger.

It’s five months after the halving, and Bitcoin [BTC]‘The historic parabolic rally remains elusive.

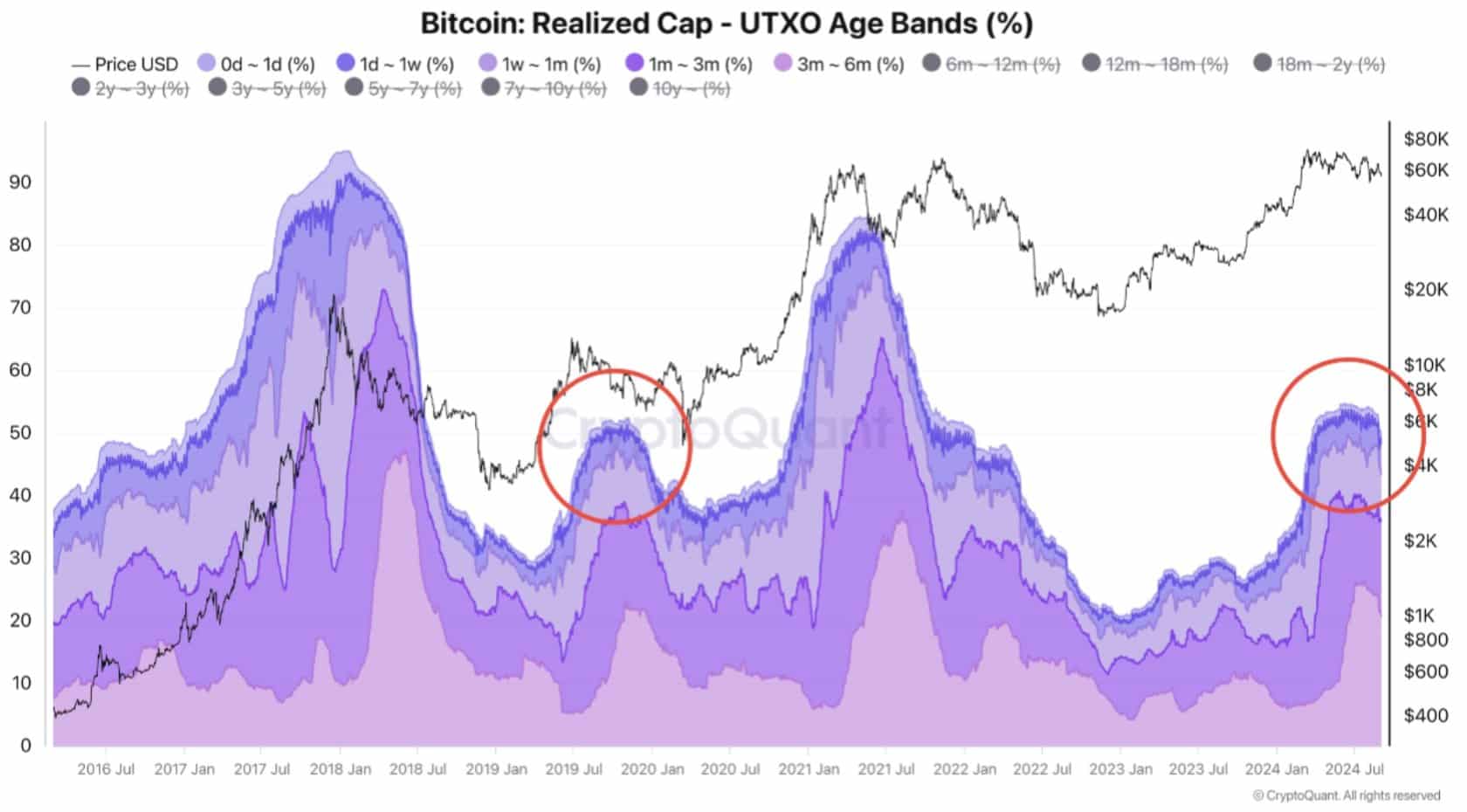

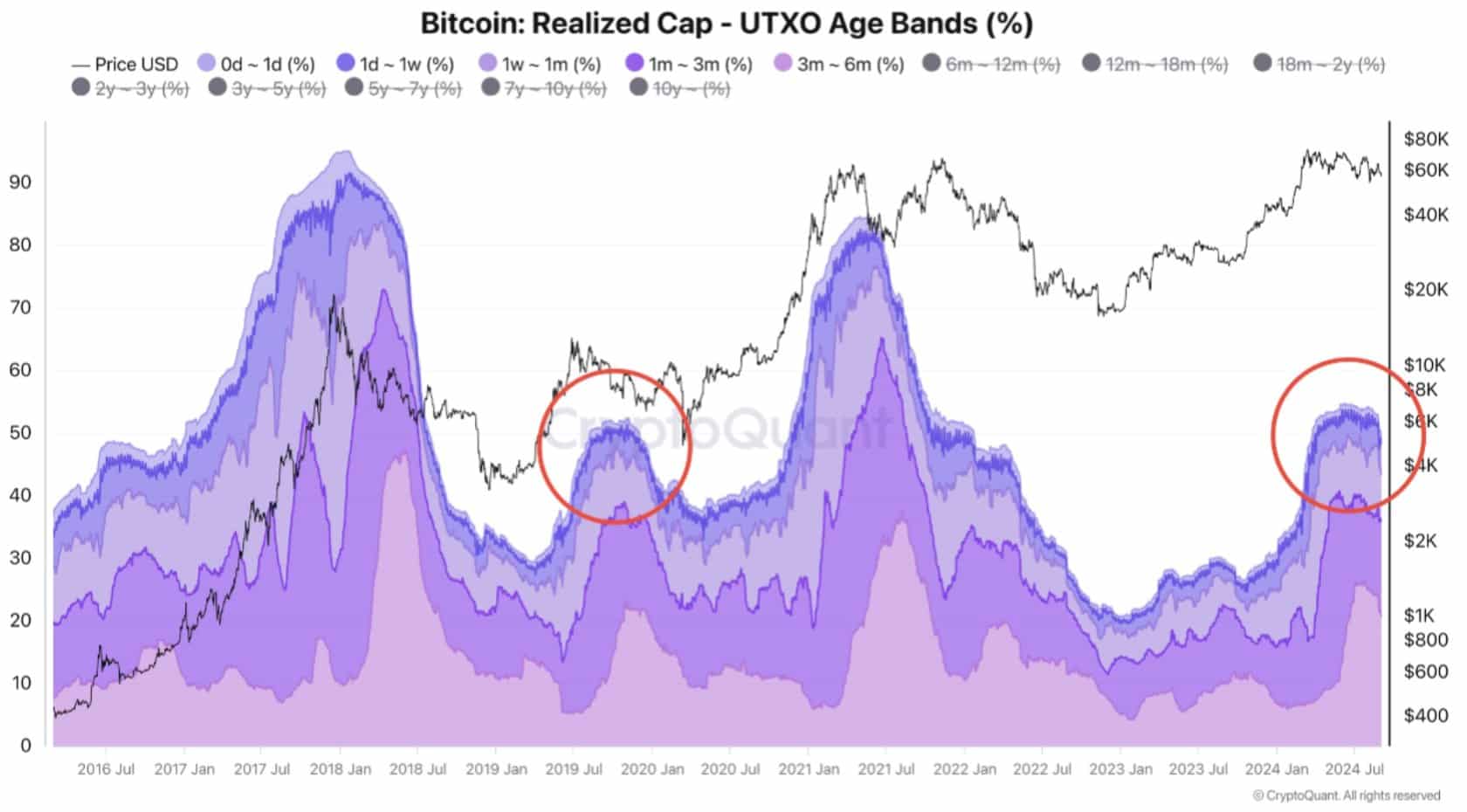

However, according to CryptoQuant, the halving rally could still be in play, especially as current short-term BTC investors mirrored 2019 behavior.

According to the factsBTC rose 490 days after new investors peaked around the 2019 halving, and a similar pattern occurred.

“Currently, we can see a small peak in UTXOs within six months, which looks like a similar structure to 2019 (red circle).”

Source: CryptoQuant

Mixed opinions on BTC’s post-halving rally

For context, UTXO (Unspent Transaction Output) provides insights about BTC holders and, by extension, their behavior based on age categories. The above data tracked those who had held BTC for less than six months (new users).

However, the UTXO fell after BTC peaked in March, which the data attributed to the likely exit of new investors due to losses.

Nevertheless, according to the analysis report, BTC could only see a massive rally if the number of new BTC investors increases.

“Historically, the influx of capital from new investors has been a crucial condition for Bitcoin’s price increases.”

Both 2019 and 2024 were BTC’s halving years. However, the historic price rally took place in 2020, after the halving. Will history repeat itself?

Some, like noted analyst Peter Brandt, claimed that BTC may not reach a new all-time high after too long a stagnation compared to previous cycles.

Jasper De Maere of Outlier Ventures, however warned that BTC and digital assets have matured and the halving had no impact on the price in 2024.

“It’s time for founders and investors to try to time the market to focus on more important macroeconomic factors instead of relying on the four-year cycle.”

For his part, James Straten believed that the recent 34% drop to $49,000 was normal during the bull run and that the post-halving rally was still likely.

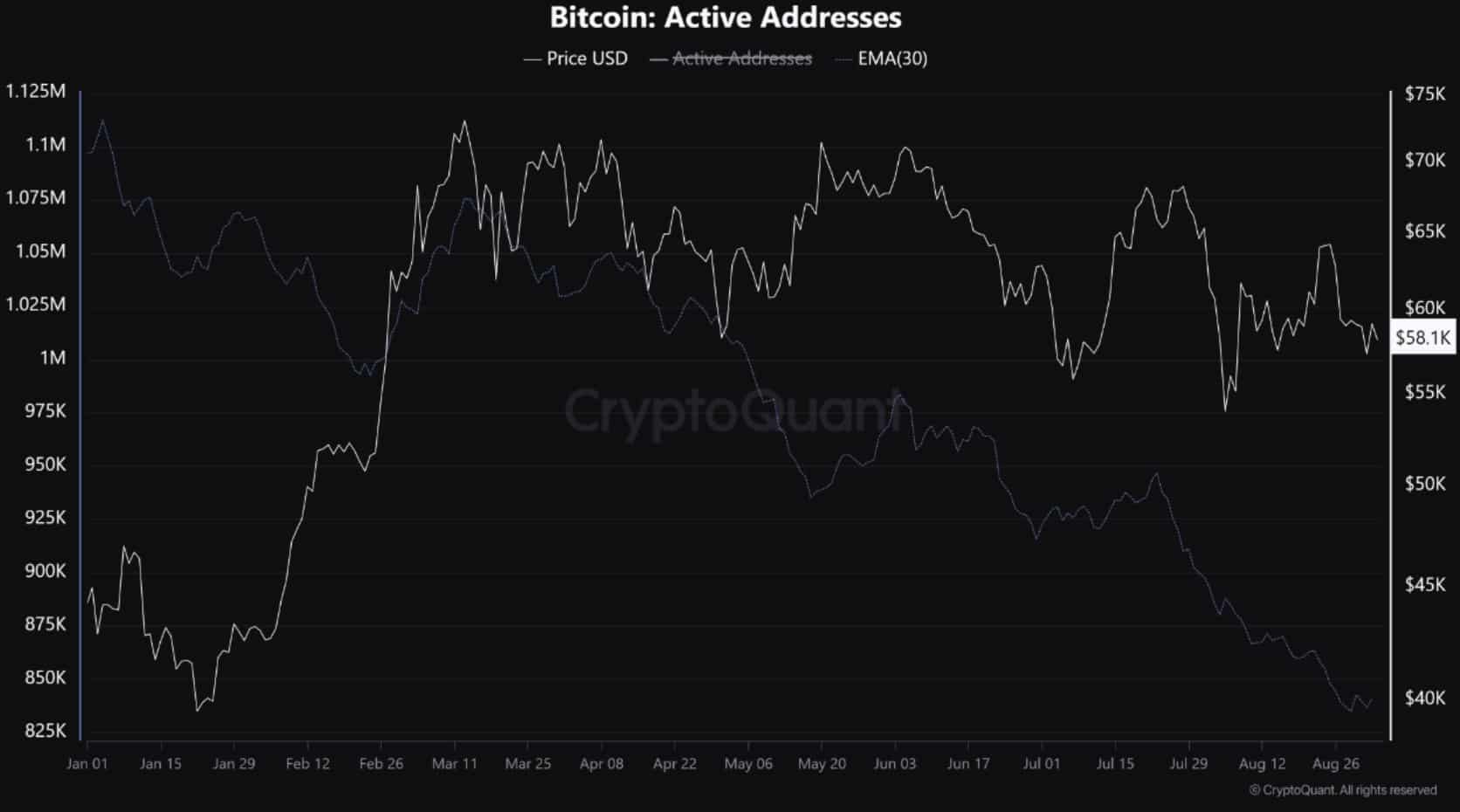

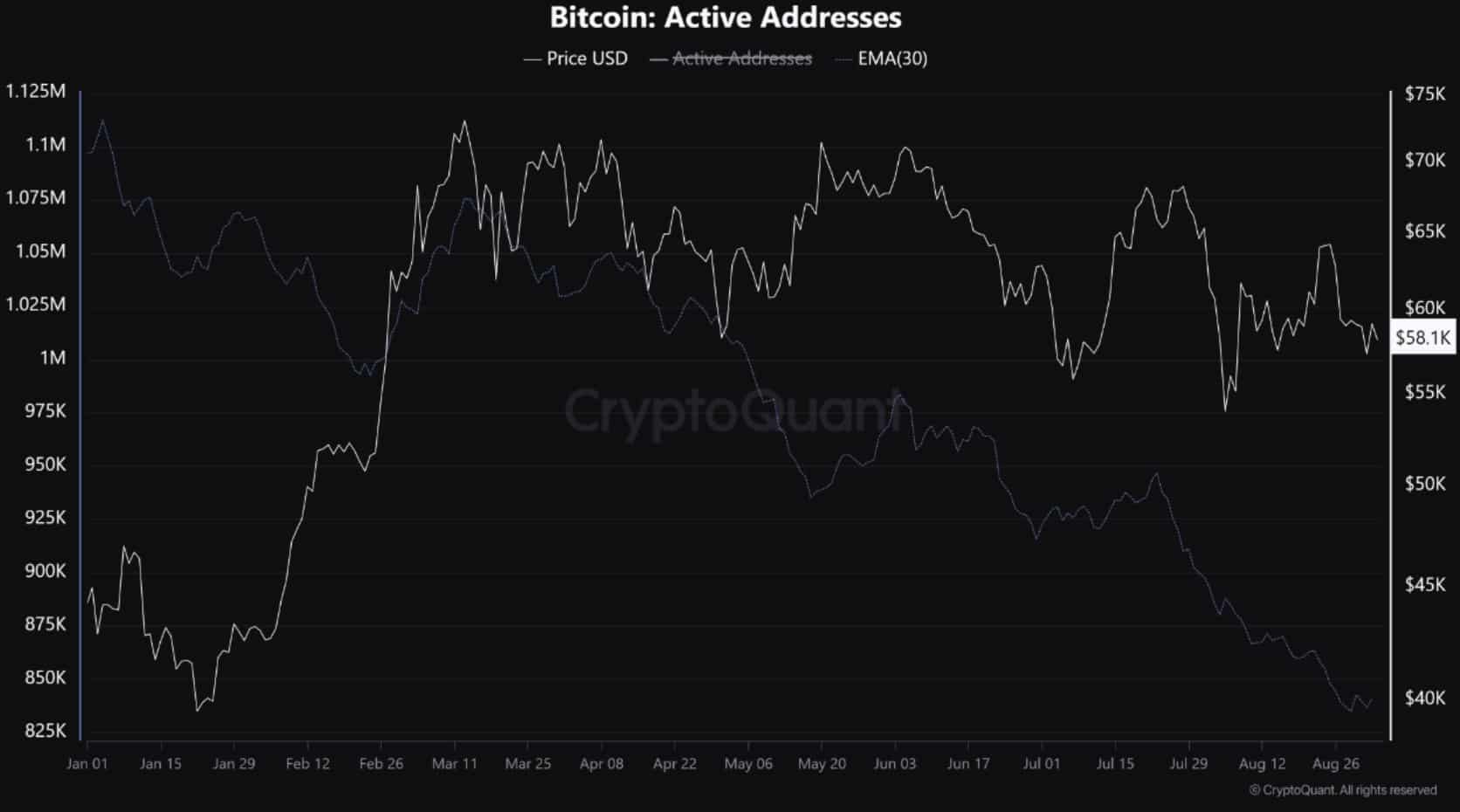

That said, BTC network activity contracted further, as active addresses bottomed out in 2024 and could further depress the price due to muted interest in the digital asset.

“Active addresses on the #Bitcoin network hit new lows in 2024, reaching the same levels as three years ago when the price of BTC was around $45,000.”

Source: CryptoQuant

Whether the expected positive macro front amid a likely Fed rate cut will drive the post-halving rally remains to be seen.

Meanwhile, BTC was valued at $56.7k at the time of writing and has been below $60k since early September.