- Expirations of Bitcoin options can be significant, as expirations of large numbers of contracts can lead to sharp price movements

- At the time of writing, call options were dominant, with $7.9 billion in Open Interest indicating bullish sentiment.

Bitcoins [BTC] The options market is currently in a state of tension due to the high stakes expiration date approaching on December 27th. With bulls eyeing the $100,000 target following a post-election surge in capital flows, Open Interest has skyrocketed to a new high of $50 billion.

However, reaching $100,000 and maintaining it are two different challenges. While current bullish sentiment, driven by a mix of micro and macroeconomic factors, suggests a potential new all-time high, the options market should be closely monitored.

The $11.8 billion in year-end call and put orders set to expire could significantly impact Bitcoin’s price action in the coming days.

Bitcoin options exhibit call order dominance bias

Bitcoin was trading below $90,000 at the time of writing, while its market dominance was over 60%. Some price correction also seemed to be taking shape over the past 24 hours.

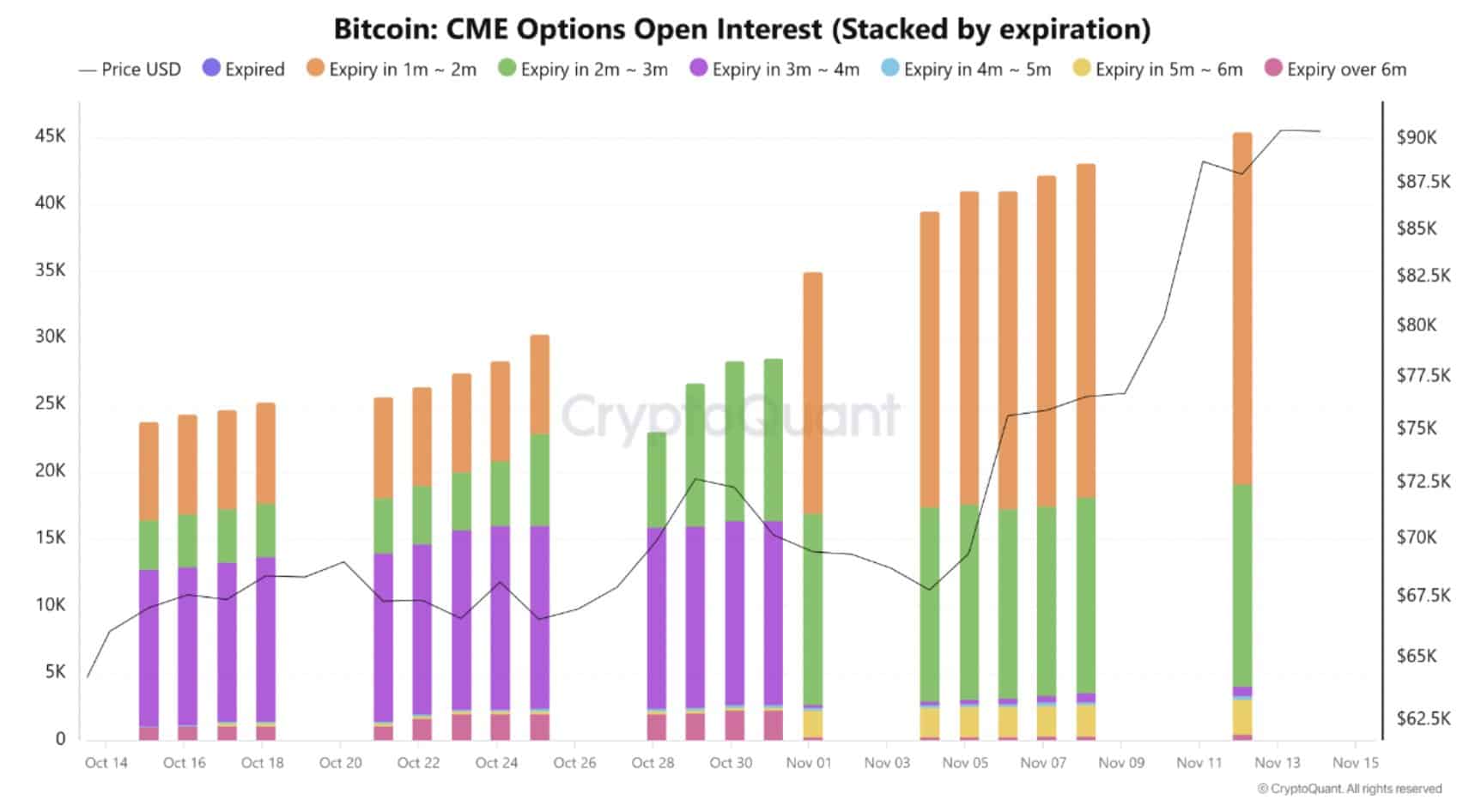

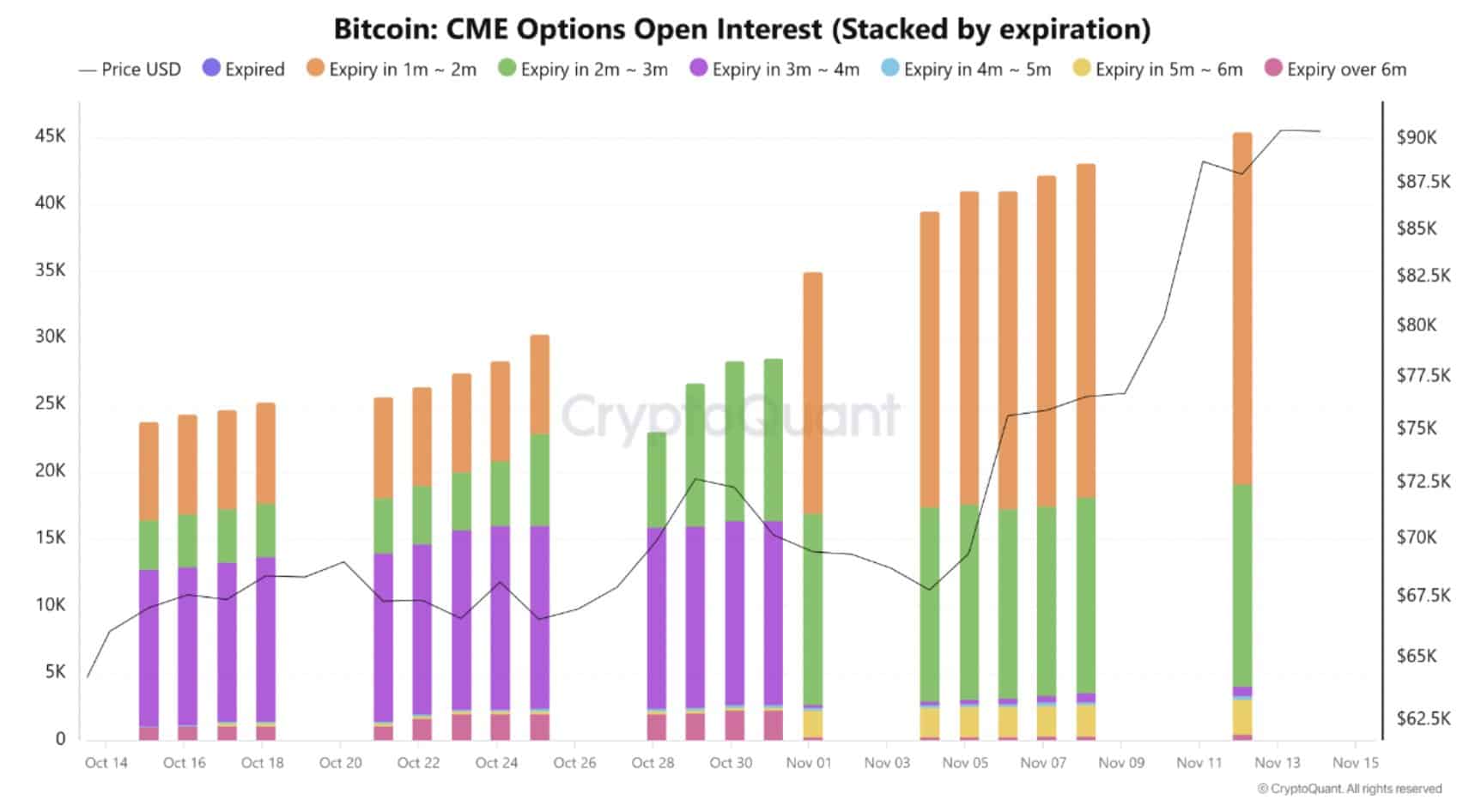

In the options market, Deribit led with a 74% market share, while CME and Binance each held about 10.3%. This concentration of activity on Deribit highlighted where the majority of betting on Bitcoin’s price movement takes place.

According to Coinglass factsCalls (bets on a rising price) make up almost 70% of the order book, indicating strong bullish sentiment. In fact, many investors seem to be betting that Bitcoin will reach a value of $100,000, expecting the price to rise even further.

However, if Bitcoin reaches the $100,000 target, a significant number of options contracts (worth $11.8 billion) will expire, the majority of which will be call options (bets on a rising price).

Consequently, traders who hold these call options are likely to exercise or sell them to protect their profits. This can cause selling pressure, especially if many traders decide to exit at once.

Therefore, maintaining the $100,000 price level largely depends on how these contracts unfold. A temporary pullback could occur in two scenarios: when call option holders exercise their contracts and when put options begin to dominate.

Can Bitcoin Reach $100,000 Amid Rising Volatility?

Although Bitcoin hit a temporary dip after five days of consistent uptrend, mainly due to miner selling, long-term holders continue to hold their positions. This, even as the market becomes increasingly overloaded with derivatives.

As more traders enter the Bitcoin options market, with a large number of bets set to expire before the end of this quarter, volatility is reaching new highs every day.

Source: CryptoQuant

Despite this volatility, Bitcoin has continued its upward momentum, indicating that long positions still dominate the market in several areas indicators.

Simply put: the market is not yet overloaded. Despite the RSI being in extremely overbought territory, miners dropping out and weak hands exiting for short-term gains, the impact on Bitcoin’s price has not been drastic – something that is normally expected in such circumstances.

This means the bulls are holding strong and the $100,000 target is within reach. If Bitcoin hits this target before the end of the month, it wouldn’t be surprising.

Read Bitcoin (BTC) price prediction 2023-24

However, a shadow of uncertainty still looms over the options market, where $11.8 billion worth of contracts will ultimately decide whether Bitcoin enters the new year bullish or bearish.

The latter seems more likely given the high stakes associated with the $100,000 price target and the call orders that will expire as volatility increases in the coming days.