- Major BTC addresses showed uncertainty during the market correction.

- Retail interest declined as whales made significant movements.

Like Bitcoin’s [BTC] the price rose to new heights and positive sentiment around the king coin grew significantly.

However, in recent days, bullish sentiment around Bitcoin dipped slightly as the price of BTC fell below the $70,000 mark.

Whale makes big movements

However, a major Bitcoin address showed signs of uncertainty in response to a recent market correction.

Data showed that a significant amount of Bitcoin, totaling 16,003 BTC, with an age ranging between 5 and 7 years, had been moved up the chain by a significant whale.

The movement of long-dormant Bitcoin signals increased activity from large holders.

This could indicate a variety of actions, including profit-taking, portfolio rebalancing, or strategic positioning in response to market dynamics.

Source:

Looking at the bigger picture

Given the significant size of these BTC holdings, the behavior of the addresses holding these Bitcoins will have a significant impact on price dynamics and traders’ sentiment.

Despite the behavior of this one key whale, the broader sentiment for BTC on large addresses holding anywhere from 100 to 100,000 BTCs was relatively positive.

An increase in accumulation was observed in these cohorts, with no signs of slowing down.

Source: Santiment

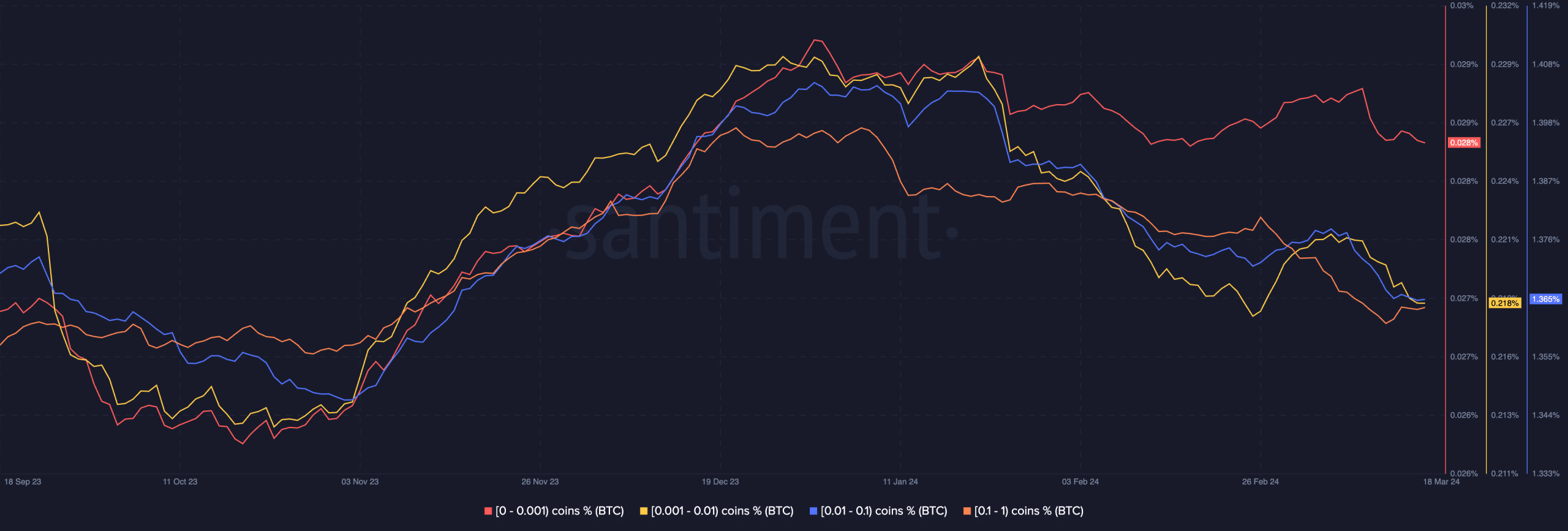

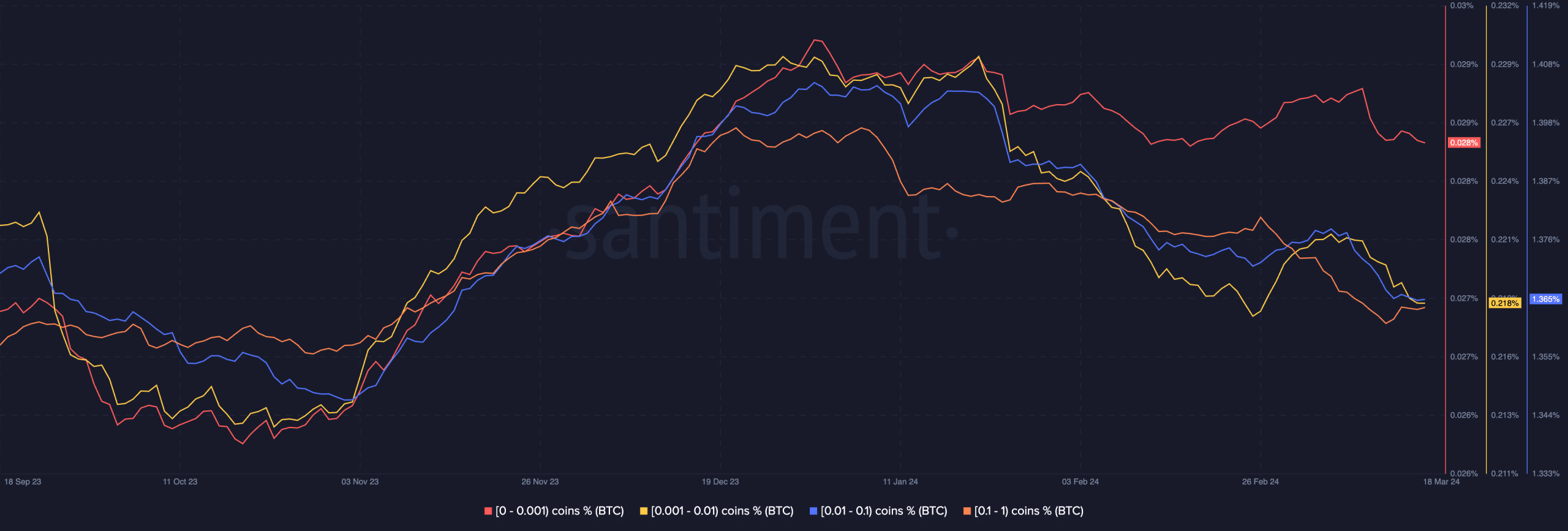

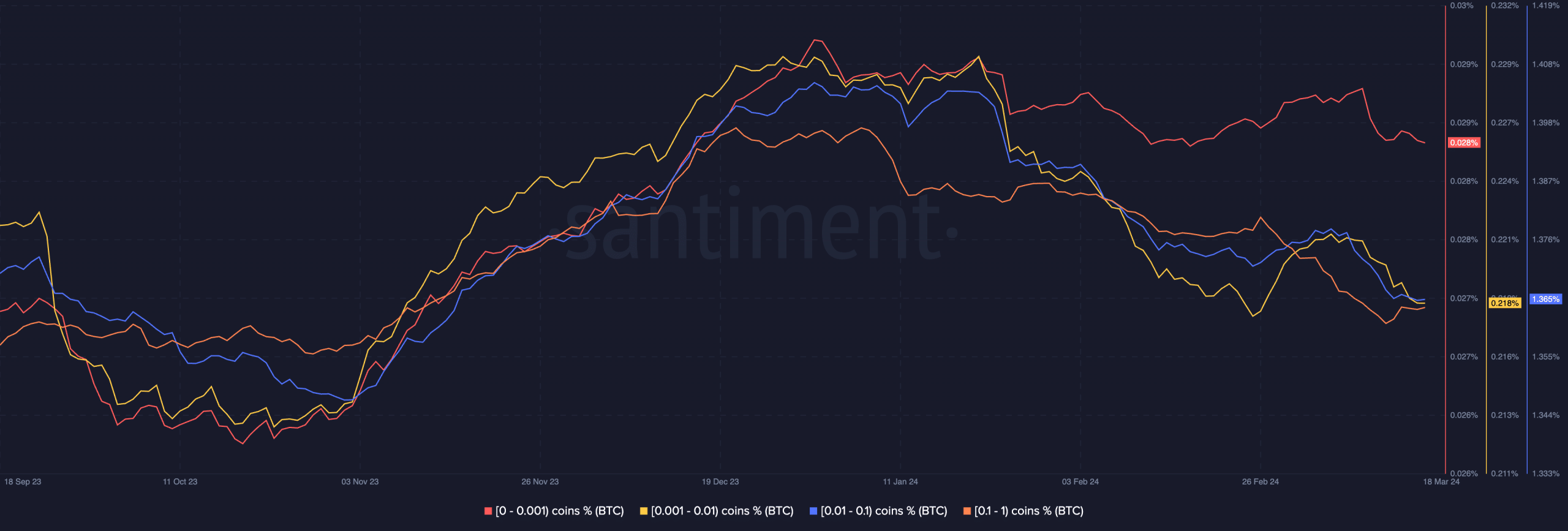

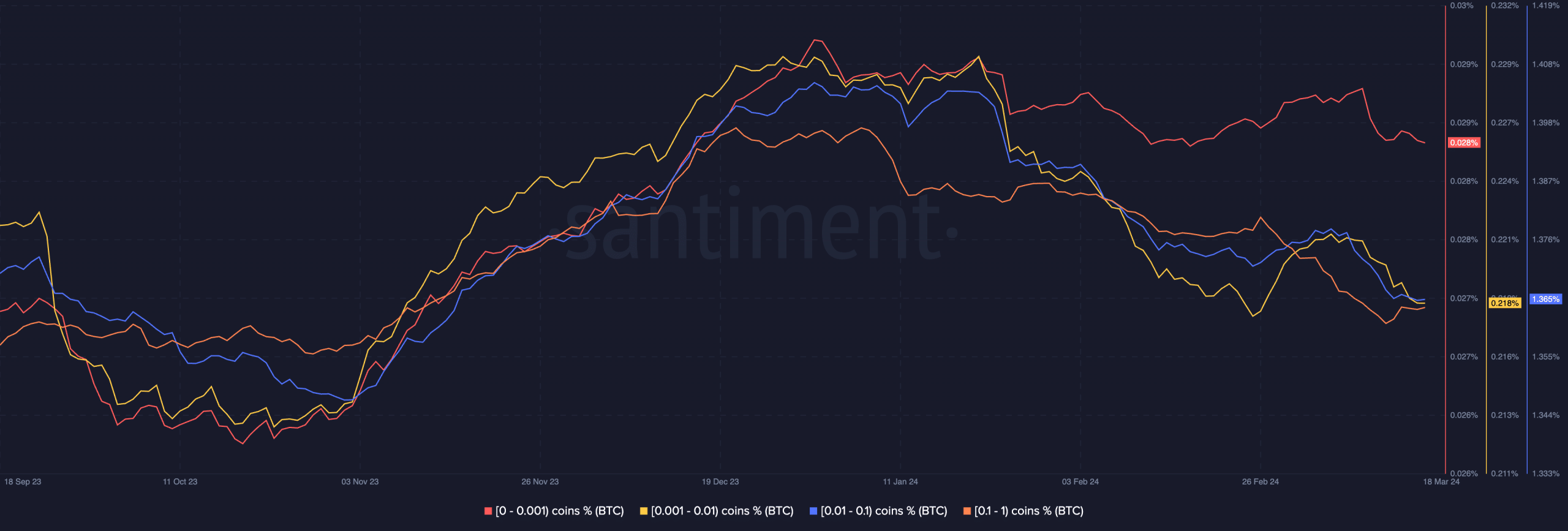

On the other hand, private individuals’ interest in BTC dropped significantly. Most addresses with coins between 0.001 and 0.1 had slowly started selling their holdings.

The behavior of retail investors could be one of the reasons for BTC’s recent price correction.

However, the whale enthusiasm could help support the price movement and help BTC reach the $70,000 mark again.

Source: Santiment

At the time of writing, BTC was trading at $67,687.92 and the price was up 2.44% over the past 24 hours.

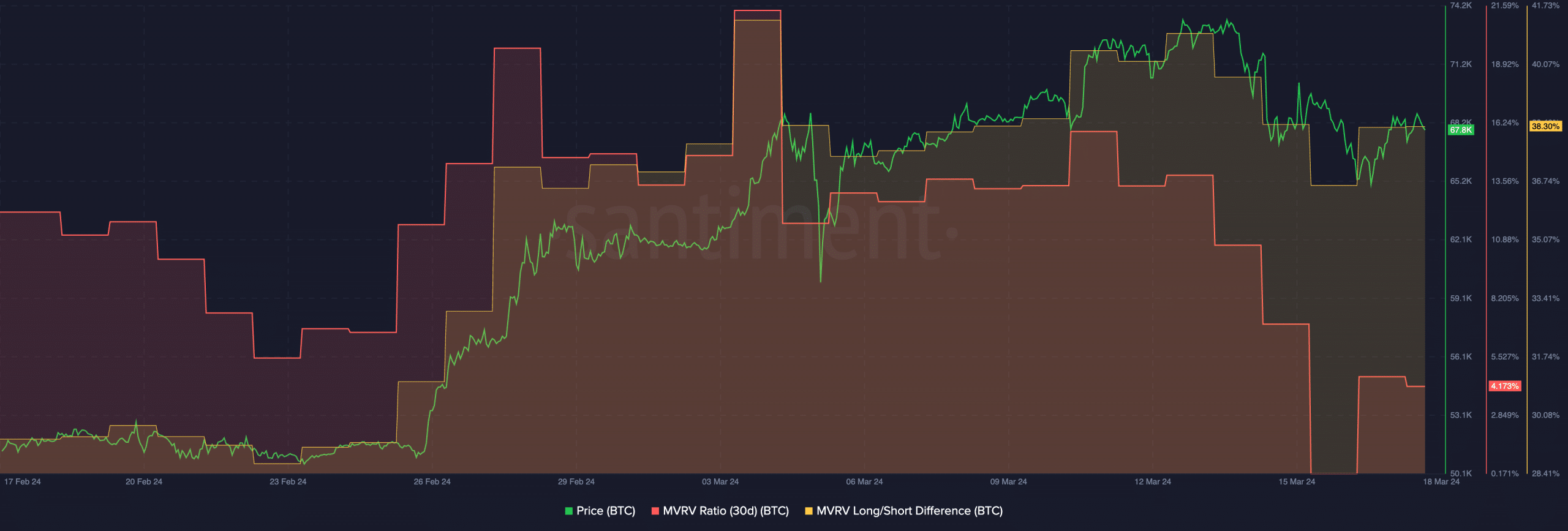

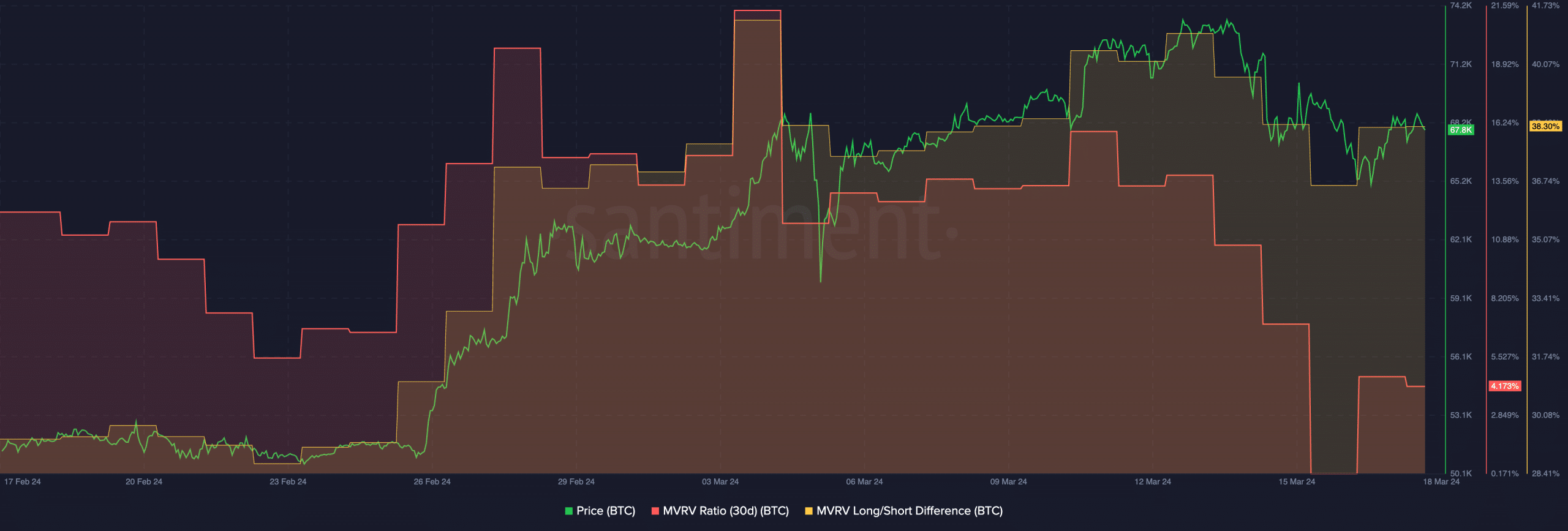

Furthermore, the MVRV ratio for BTC also grew, showing that most addresses were still profitable and had an incentive to sell.

The long/short difference for BTC remained high, implying that the percentage of long-term holders was higher than short-term holders at the time of writing.

How much are 1,10,100 BTCs worth today?

Long-term holders do not respond to small price movements and are much more likely to HODL their BTC during times of market uncertainty.

The presence of long-term holders could benefit the sustainability of BTC’s rally in the long term.

Source: Santiment