Bitcoin whales are witnessing a historic exodus. @CryptoVizArt, a senior researcher at Glassnode has shed light on the significant shifts within the whale cohort in a new analysis.

The Impact of Bitcoin Whales: Revealing the Numbers

In a remarkable revelation, the research highlights the substantial impact of whales on recent market activity. According to the data, “34% of the selling pressure in the past 30 days came from Binance whales.” These influential entities have been instrumental in shaping recent market dynamics.

In addition, the research also points to a trend in whale behavior: a notable decrease in the total balance of whale entities on exchanges. Over the past 30 days, the report states, “Whale Flow to Exchanges witnessed the largest monthly balance decline in history, with -148,000 BTC/month.” This dramatic decline marks a major shift within the whale cohort, raising intriguing questions about their motives and strategies.

As the market witnessed the rally above $31,000, the influx of whale funds into exchanges increased markedly. Glassnode data shows that whale inflows reached an impressive +16,300 BTC/day, indicating their active involvement in recent market movements. Notably, this whale dominance accounted for 41% of all inbound exchanges, which is comparable to both the LUNA crash (39%) and the failure of FTX (33%).

Throughout June and July, whale inflows have maintained an increased inflow of between 4,000 and 6,500 BTC/day. Of all the exchanges, Binance emerged as the top destination for whale influx. The report reveals that about 82% of whale-to-exchange flows went to Binance. In contrast, Coinbase accounted for 6.8% and all other exchanges for 11.2%.

While the overall balance of whales may have declined, @CryptoVizArt’s analysis points to intriguing internal dynamics within the whale cohort. While some whales increased their balance, others experienced decreases. This phenomenon led the researcher to introduce the concept of “Whale Reshuffling,” suggesting that not all whales follow the same strategy.

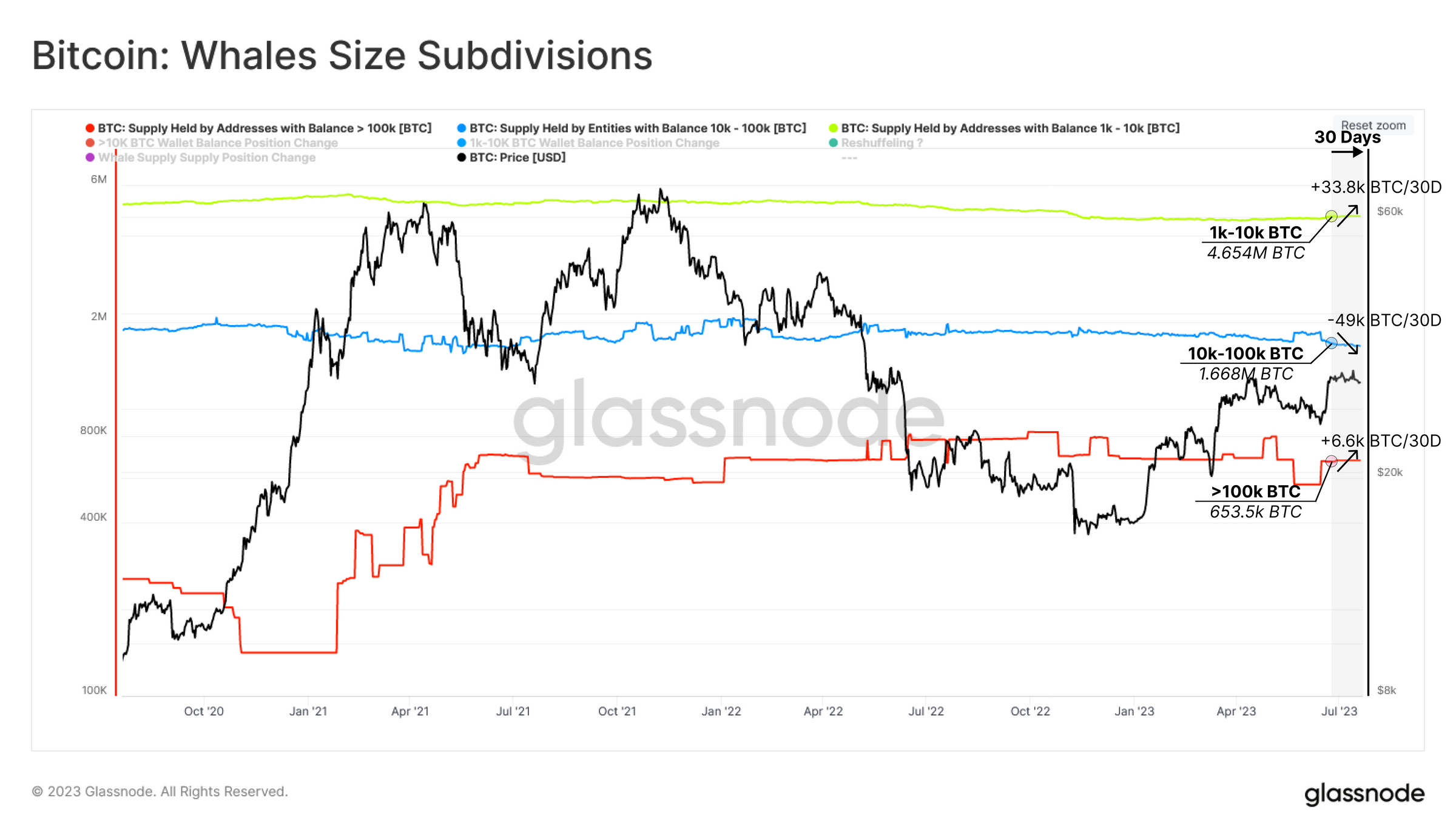

The investigation of the Walviscohort in the past 30 days shows that whales with more than 100,000 BTC have registered an increase of +6,000 BTC, whales with 10,000-100,000 BTC have reduced their calculation balance with -49.0k BTC and whales with 1,000-10,000 BTC. However, in total, the whale group has only seen -8.7k BTC in net outflows.

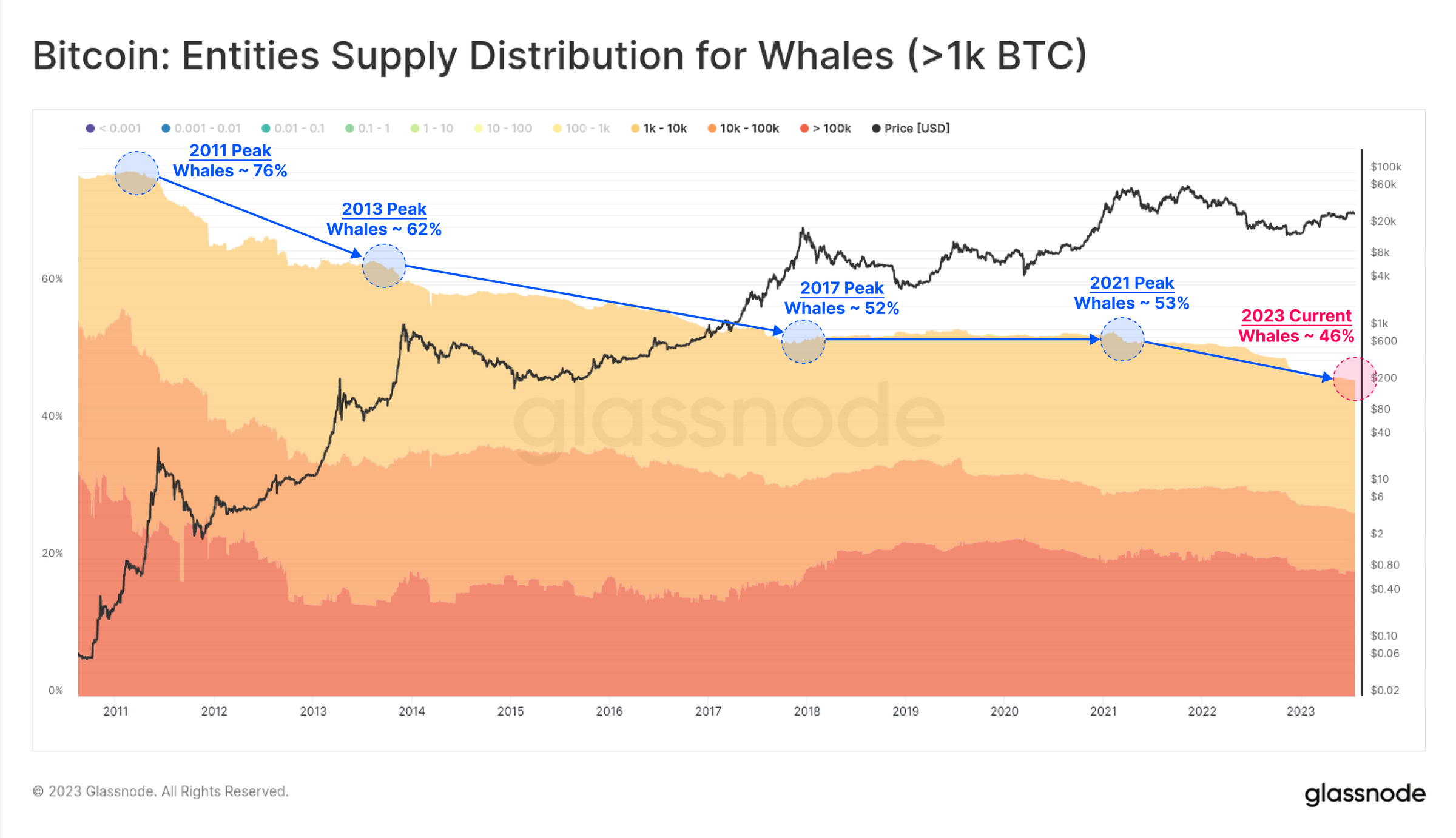

Remarkably, whale entities now make up only 46% of the total supply, up from 63% at the beginning of 2021. Since the early days of Bitcoin, a steady downward trend has been observed.

Short-term holders: the driving force

The research also sheds light on the dominance of short-term holders (STHs) among the whale entities. The data indicates that STHs represent a significant portion of recent trading activity and are actively trading in the market. This behavior is evident as market rallies and corrections lead to notable gains or losses in this group.

Short-Term Holder (STH) Dominance in Exchange Inflows has exploded to 82%. This is drastically above the long-term range of the past five years (typically 55% to 65%). “From this, we can conclude that much of the recent trading activity is driven by whales that are active in the 2023 market and are thus classified as STHs,” the analyst said. With each rally in 2023 more profit was taken.

BTC whale trades can therefore be a good indicator at the moment. However, special attention should also be paid to the STHs, which will run out of bullets at some point.

At the time of writing, the BTC price was at $29,203.