- Both short and long positions fell victim as BTC fluctuated up and down.

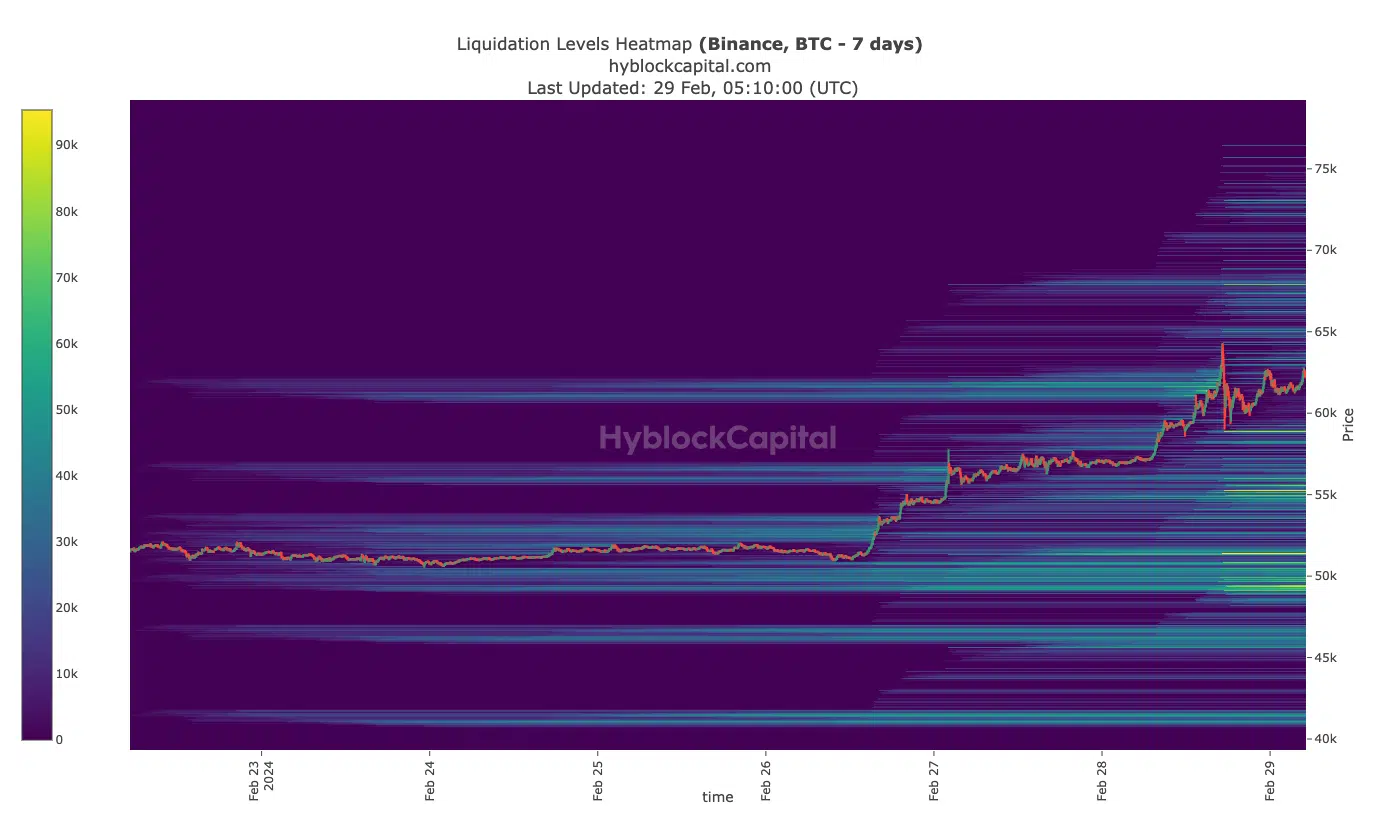

- The Liquidation Heatmap showed that Bitcoin is not hindered in reaching $70,000.

If you were shorting the market, chances are you are part of the 79,700 traders who saw their money disappear in the last 24 hours. This happened because Bitcoin’s [BTC] the price shot past $64,000 on February 28. Moments later, the price of the coin fell below the $60,000 threshold.

From Coinglass data, AMBCrypto noticed that the total amount of the liquidation was more than $790 million. Of this, short positions accounted for $438 million, while long liquidations amounted to approximately $352 million.

The path beyond $69,000 could be here

Furthermore, the derivatives information portal revealed that Bitcoin liquidations were worth $298.98 million. Ethereum [ETH]whose price had risen above $3,300, registered $126.83 million in the wipeout.

For those unfamiliar, liquidation occurs when a trader’s leveraged position is automatically closed. This is often because the trader can no longer meet the margin requirements.

If the price of Bitcoin continues to rise, more positions could be liquidated. AMBCrypto checked the Liquidation Heatmap to determine the likelihood of a rise.

The Liquidation Heatmap could also show the possible prices where positions could face another round of extermination. According to our analysis based on HyblockCapital’s data, Bitcoin’s price could rise to $75,000 in the coming weeks.

Moreover, the indicator did not reveal any major resistance on that path. However, if Bitcoin reaches $70,000, many short positions between $49,000 and $56,000 could be liquidated.

Bears are virtually non-existent

On the daily time frame, bulls held the solid support at $55,450. However, in the run-up to $64,000, Bitcoin encountered minor resistance at $57,395. However, buying pressure helped clear the path.

AMBCrypto noted that BTC registered a 15.01% increase between the solid support and the rise to $61,837.

In terms of price potential, the Directional Movement Index (DMI) predicted further gains for the coin. At the time of writing, the +DMI (green) was 39.34. The -DMI (red), on the other hand, was 2.62.

The difference in indicators was evidence that the bears have scaled back and may not have a chance to pull back BTC.

Furthermore, the average directional index (ADX) was 57.82. The ADX (yellow) indicates whether the directional movement is strong or weak.

If the ADX value is less than 25, it indicates weak directional movement. Therefore, the high ADX alongside Bitcoin’s rising price suggests that the coin could reach a higher value soon.

Read Bitcoin’s [BTC] Price forecast 2024-2025

Should buying pressure continue as it has in recent days, BTC could surpass $69,000.

However, if bearish forces gain some market dominance, Bitcoin’s price could fall to $55,000. But in the current market conditions, indicators point to an upturn.