According to data from CoinMarketCap, Bitcoin has experienced a turbulent end to August, losing 7.75% of its market value over the past week. This price drop underlines the crypto market leader’s overall negative performance over the past month, with a monthly price drop of 10.64% recorded. Interestingly, amid this downtrend, the asset’s historical price data indicates that the bears could maintain control of the market in the coming weeks.

September popular due to negative returns, says analyst

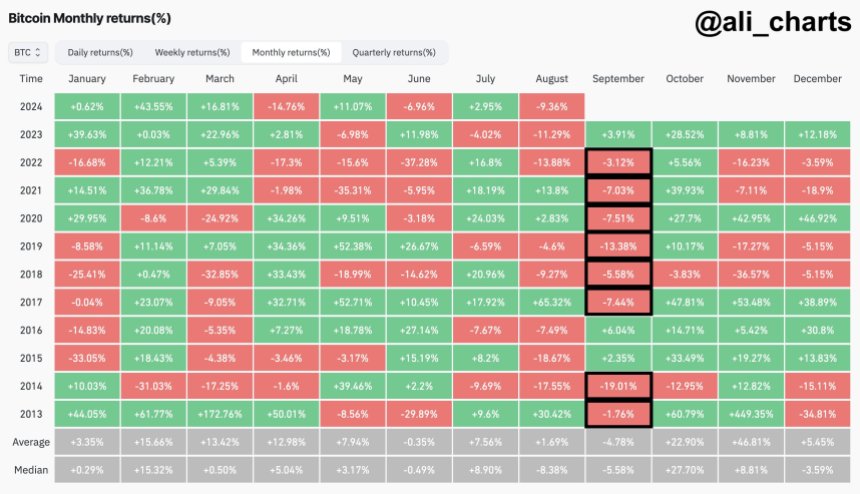

In an X post On Friday, renowned crypto analyst Ali Martinez gave Bitcoin investors a boost to brace for what could be a “tough” period in September. Based on historical price data, Martinez notes that Bitcoin usually records a cumulative negative performance in September, as seen in eight of the past eleven years.

During this period, Bitcoin has experienced an average and mean price loss of 4.78% and 5.58% respectively in September. Therefore, investors can expect the major cryptocurrency to trade as low as $55,618 to $56,105 over the next four weeks.

Interestingly, this period of potential price loss could serve as an opportunity for massive BTC accumulation. According to Bitcoin’s monthly returns, the crypto market leader has previously posted significant price gains in the fourth quarter, with a cumulative positive performance on October 9 out of the last 11 years.

Meanwhile, the month of November could be a favorite among investors, with net gains of 42.95% (2020) and 53.48% (2017) in the past two bull cycles. Overall, November offers a lot of potential for significant price appreciation, with an average price gain of 46.81% since 2013.

However, investors can be cautious in December. While Bitcoin has previously posted gains of as much as 46.92% (2020) in December, it has also suffered significant losses of 34.81% (2013). It is striking that the main cryptocurrency has shown double-digit performance in this last month of the year to almost the same extent, with an average price gain of 5.45% and an average price loss of 3.59%.

Bitcoin Price Outlook

At the time of writing, Bitcoin is trading at $59,218, down 0.84% on the last day. Meanwhile, the asset’s daily trading volume has posted a gain of 3.05% and is currently valued at $33.38 billion.

According to BTC’s daily chart, the crypto market leader is undergoing a price consolidation, a breakout of which could result in a rise to the $65,400 price zone. However, data from the relative strength index shows that Bitcoin is far from its oversold zone and may suffer further losses. In such a case, investors could prepare for a possible drop to around $53,800.

BTC is trading at $59,230 on the daily chart | Source: BTCUSDT chart on Tradingview.com