- Bitcoin is down 5.41% in the past week.

- Market fundamentals suggest a potential upside if Bitcoin closes above the 21-week EMA.

After defying expectations in September, Bitcoin [BTC] has had a difficult start to October, a month that is usually accompanied by an upturn. As such, BTC has experienced a sharp decline over the past week.

In fact, at the time of writing, Bitcoin was trading at $61980. This marked a decline of 5.41% on the weekly charts, with an extension of the bearish trend by 0.34% on the daily charts.

Before this decline, BTC was on an upward trajectory, rising 9.87% on the monthly charts.

Current market conditions raise questions about whether BTC will continue its uptrend, especially after the recent downtrend.

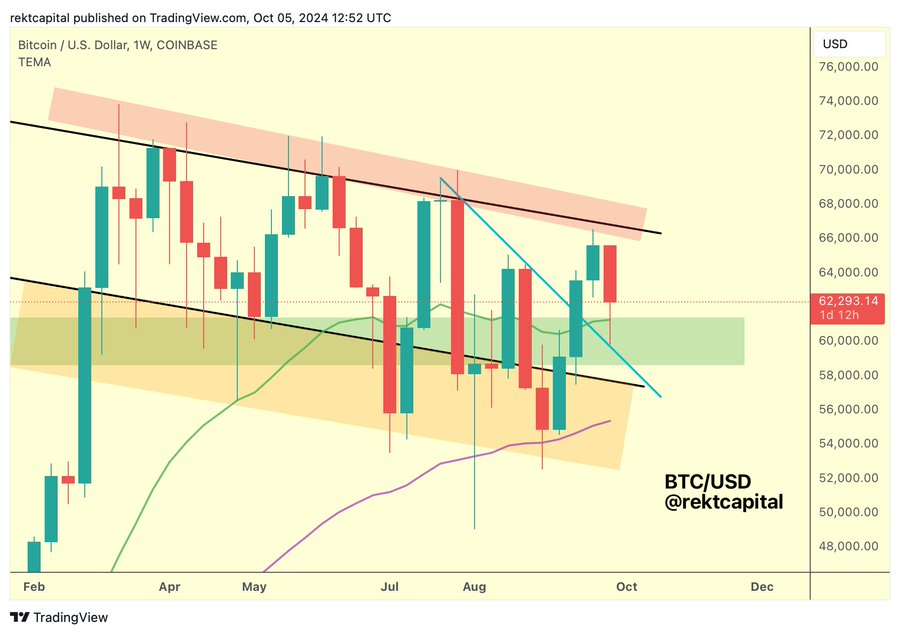

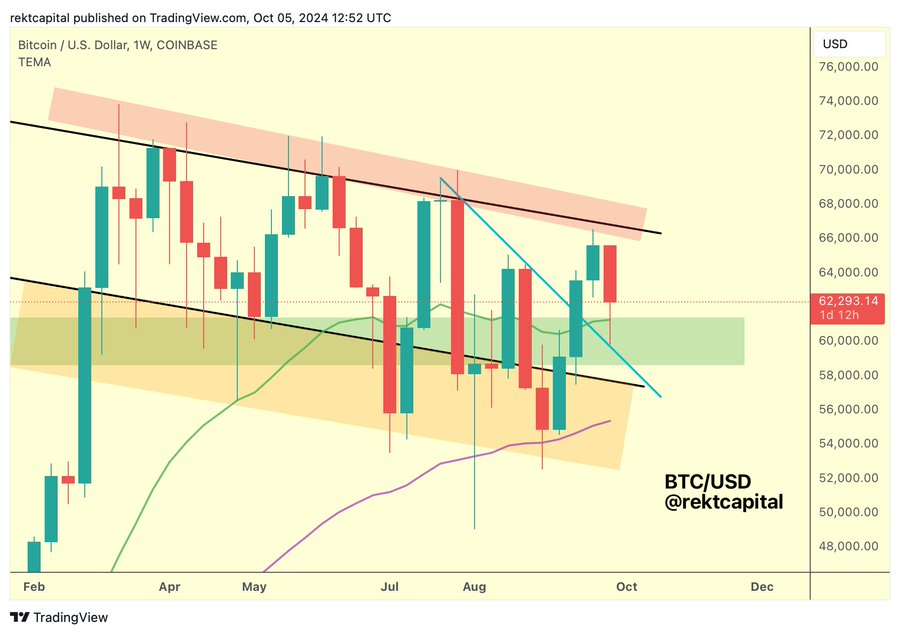

To that extent a popular crypto analyst Rekt Capital has suggested a potential rally, citing a 21-week bull market EMA.

Which is what the market sentiment suggests

In its analysis, RektCapital stated that the 21-week EMA has been successfully retested as support.

Source:

As BTC remains above this level, it confirms that market sentiment remains bullish. This indicates that buyers are entering the market and price action is driving the upside.

According to this analysis, BTC has broken above a downtrend line that has acted as resistance for months. Such a move is a bullish signal, as it suggests the end of the downtrend and a possible shift in momentum.

Therefore, a strong close above the 21-week EMA and a confirmed breakout from the multi-month downtrend would signal further upside momentum, especially after a bullish weekly close above $62,000-$63,000.

What Bitcoin’s Charts Suggest

RektCapital’s analysis undoubtedly offered promising prospects for BTC. Therefore, it is essential to determine what other market indicators are saying.

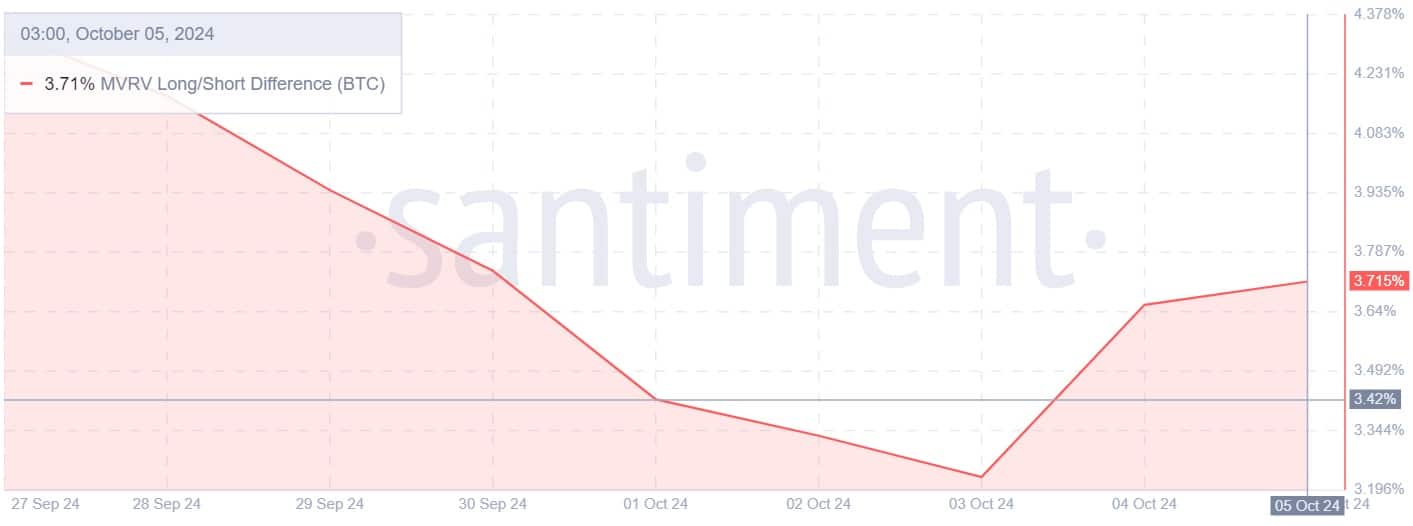

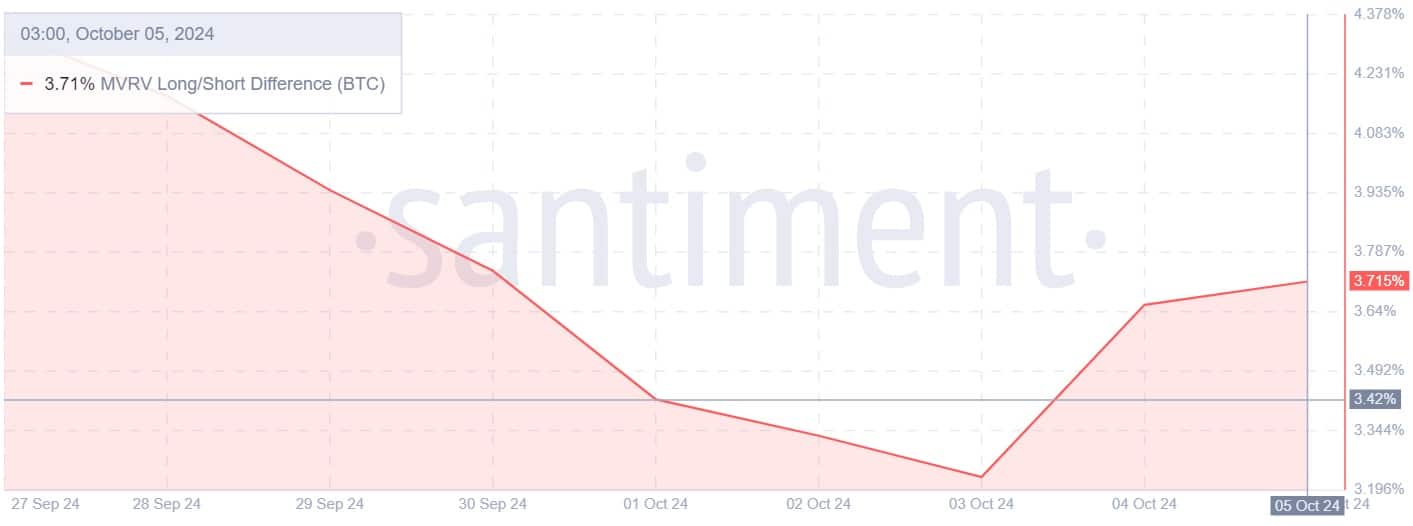

Source: Santiment

The first indicator to take into account is Bitcoin’s long/short MVRV difference, which has shifted from a downtrend to an uptrend.

The MVRV long/short difference has risen since September 4, after falling in previous days.

This suggests that long-term investors are more confident in their positions and are less likely to sell stocks on which they are already making a profit. As the gaps widen, it suggests that long-term investors believe in the upside.

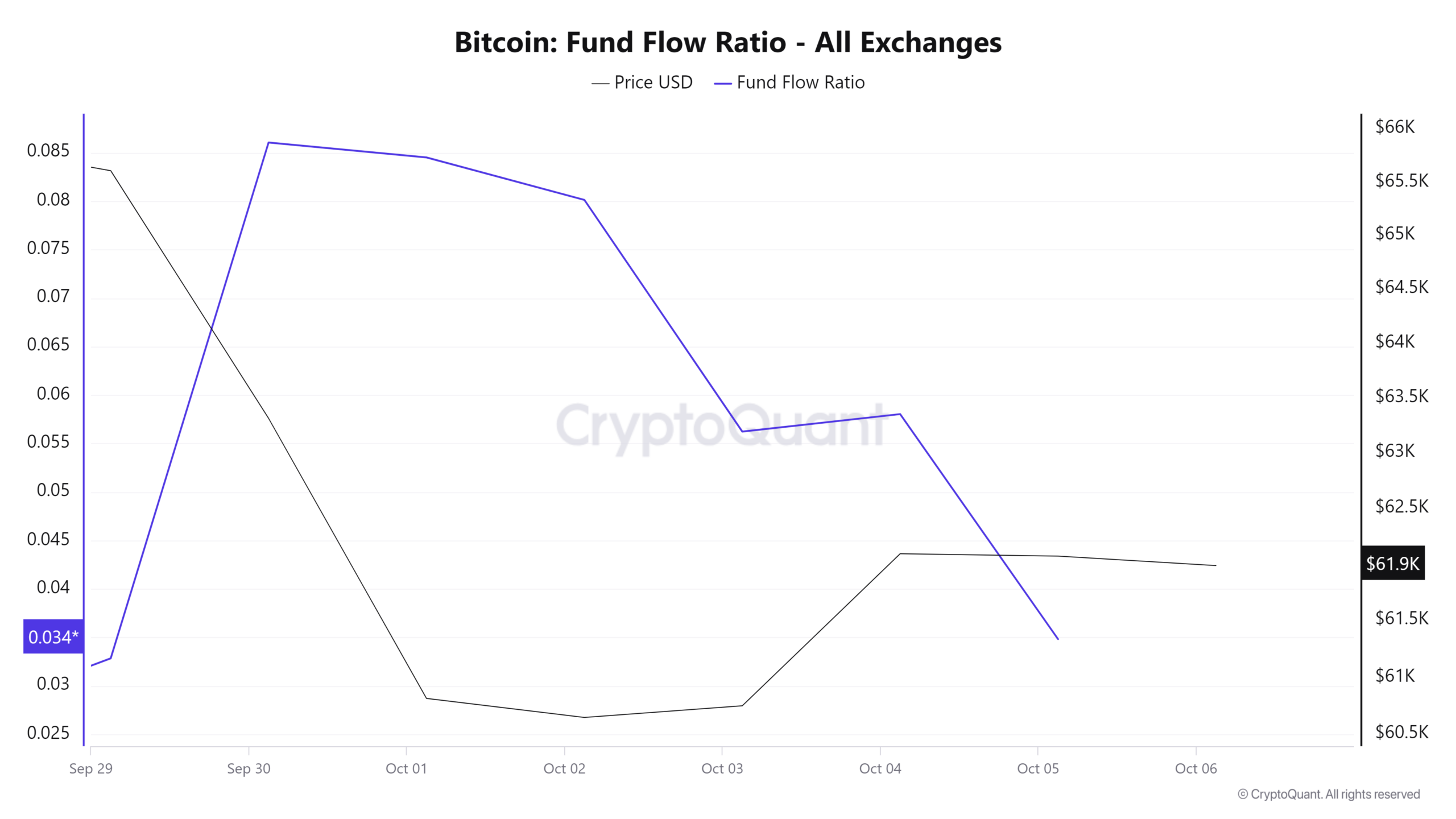

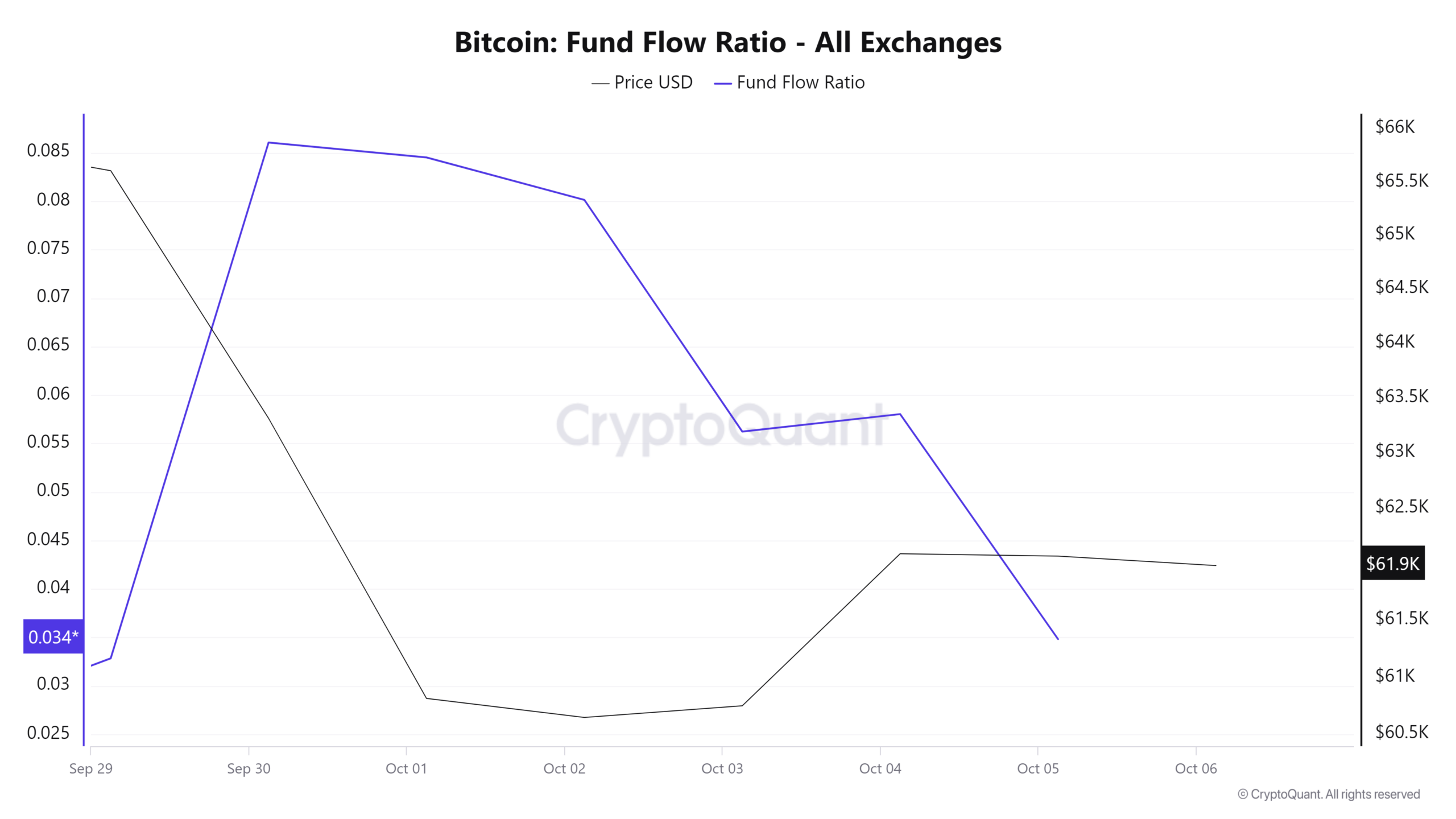

Source: CryptoQuant

Moreover, the fund flow ratio has fallen over the past six days despite market declines. This suggests that investors are depositing less BTC on exchanges to sell, instead storing it in private wallets.

Such market behavior indicates accumulation, as investors expect further gains.

Source: Santiment

Finally, Bitcoin’s Exchange aggregated funding rate has remained largely positive all week. This indicates that investors are taking long positions in anticipation of future price gains.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Simply put, there has been sideways trading in recent days, with investors adding to accumulation while others took long positions. Such a shift indicates that the market is well positioned for further gains.

If market sentiment holds, BTC will attempt resistance at $62,785 in the near term.