- The Bitcoin Sell-Side Ratio and advancing averages hint on a possible market trally.

- The adjusted issued output Winstratio (ASopr) shows that long -term traders sell with a loss.

Bitcoin [BTC] Has maintained relatively stable performance in the last 24 hours and fell somewhat by 0.84%, which shows clear signs of exhaustion in the market.

Different indicators now suggest that a rally is close by and in motion, with Bitcoin that may be expanded further.

Does Bitcoin already have Bottomed?

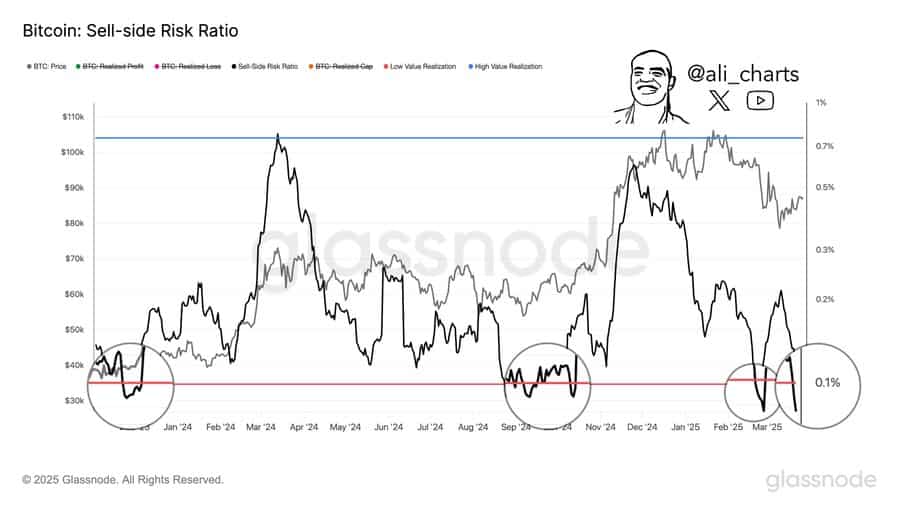

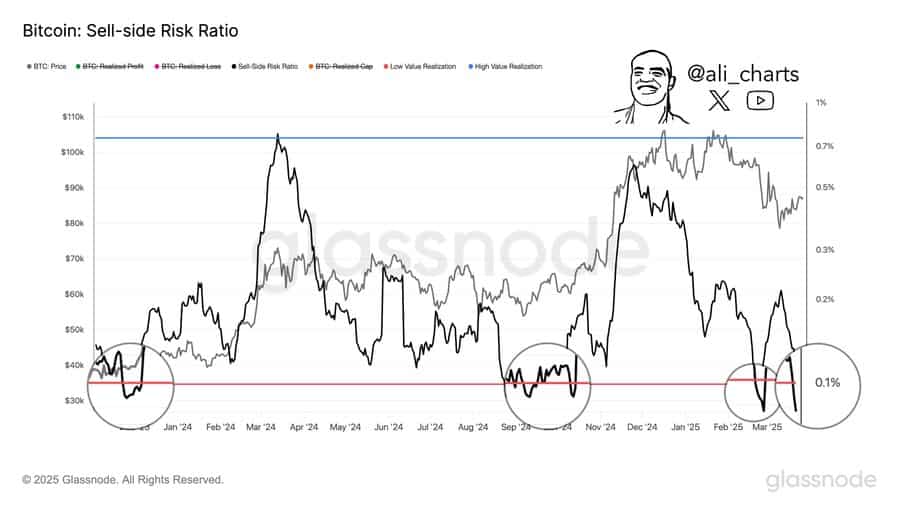

A critical metric that is in accordance with the bullish story is the Sell-Side Ratio. This ratio compares investor’s expenditure within a specific period with the realized market capitalization.

Historically, when this level drops to the region of 0.1% or lower, it often indicates at the start of a Grand Price Rally. The Sell-Side ratio is currently 0.086%, which implies that Bitcoin could resume his meeting soon.

Source: Glassnode

Adding these bullish prospects is the adapted output profit ratio (ASopr), which is recently lower than 1, with a lecture of 0.99 – which indicates that traders sell with losses.

Selling in the event of loss often forces the market as Bitcoin is collected at a discount.

Although these indicators remain bullish and suggest that a rally can be close by, the analysis of Ambcrypto shows that traders may wait for the optimum buying.

The Bitcoin market value for the Momentum (70-day) indicator for realized value (MVRV) helps to determine this excellent chance. A big price run usually starts when the MVRV crosses its 70-day advancing average.

Source: Glassnode

If this happens, Bitcoin could start making higher highlights, increasing the total monthly profit, currently at 4.32%, according to Coinmarketcap.

Market activity remains low

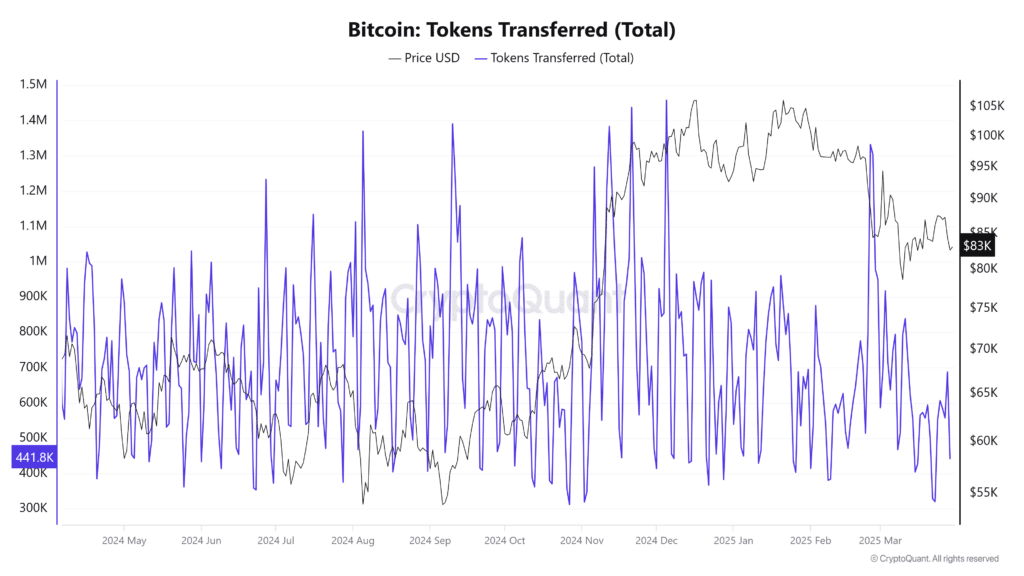

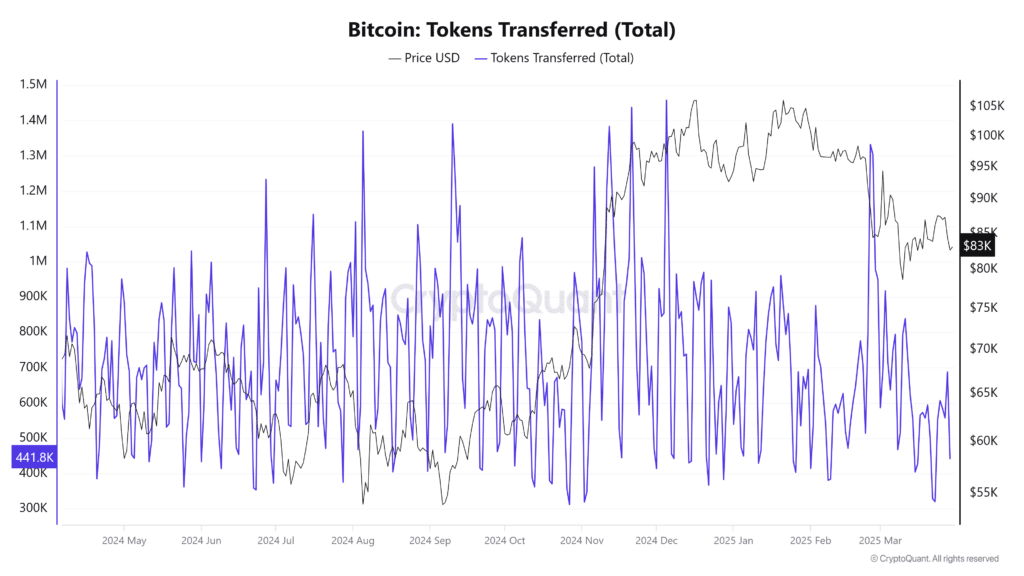

Market activity remains modest, with fewer transactions, which indicates a lack of momentum to push Bitcoin ahead.

At the time of writing, the amount of BTC that is being transferred has fallen considerably, currently at around 441,000 BTC – a sharp decrease in earlier highlights.

Source: Cryptuquant

If the market momentum continues to fall, the chance of a persistent rally slim remains. In order for a rally to take place with full force, both volume and price must rise at the same time.

A divergence between the two would indicate a weak momentum, making a rally unlikely.