- Multiple flash crashes for BTC occurred on centralized exchanges.

- Sentiment around BTC dropped, but the price remained stable.

Bitcoin [BTC] has raised hopes among traders in recent days thanks to the recent rally.

However, the tide could soon turn in BTC’s favor, mainly due to the mishaps happening on Centralized Exchanges (CEXs).

Some sudden crashes

More specifically, sentiment around BTC could be negatively affected due to flash crashes on CEXs.

For context, flash crashes refer to sudden and extreme drops in the price of an asset or security, typically occurring within a very short period of time, often just minutes or even seconds.

During a sudden crash, prices can drop dramatically before quickly recovering.

These events are typically caused by rapid and large sell-offs, sometimes exacerbated by automated trading algorithms or market liquidity shortages.

In recent weeks, the number of BTC flash crashes on various exchanges has increased.

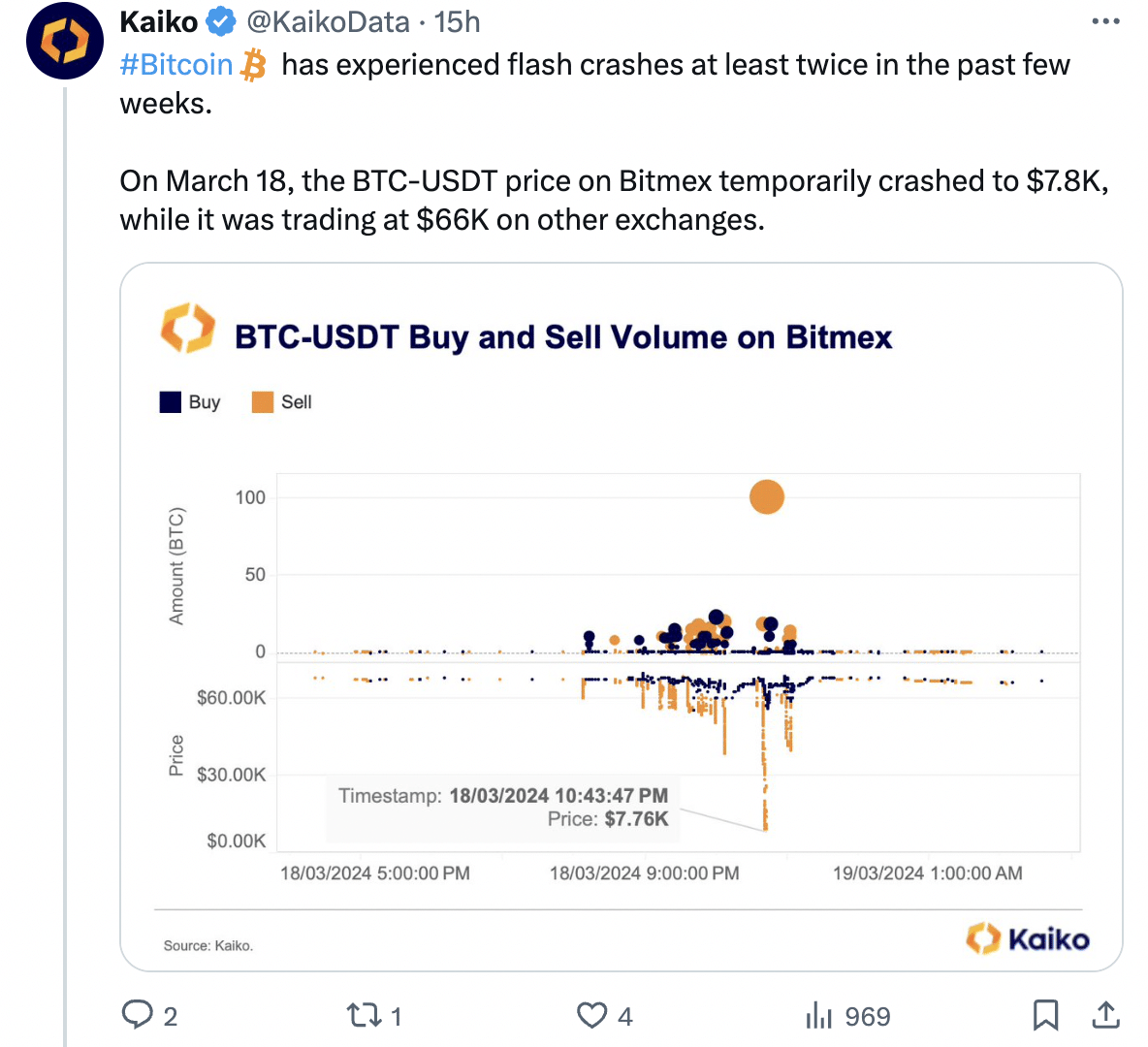

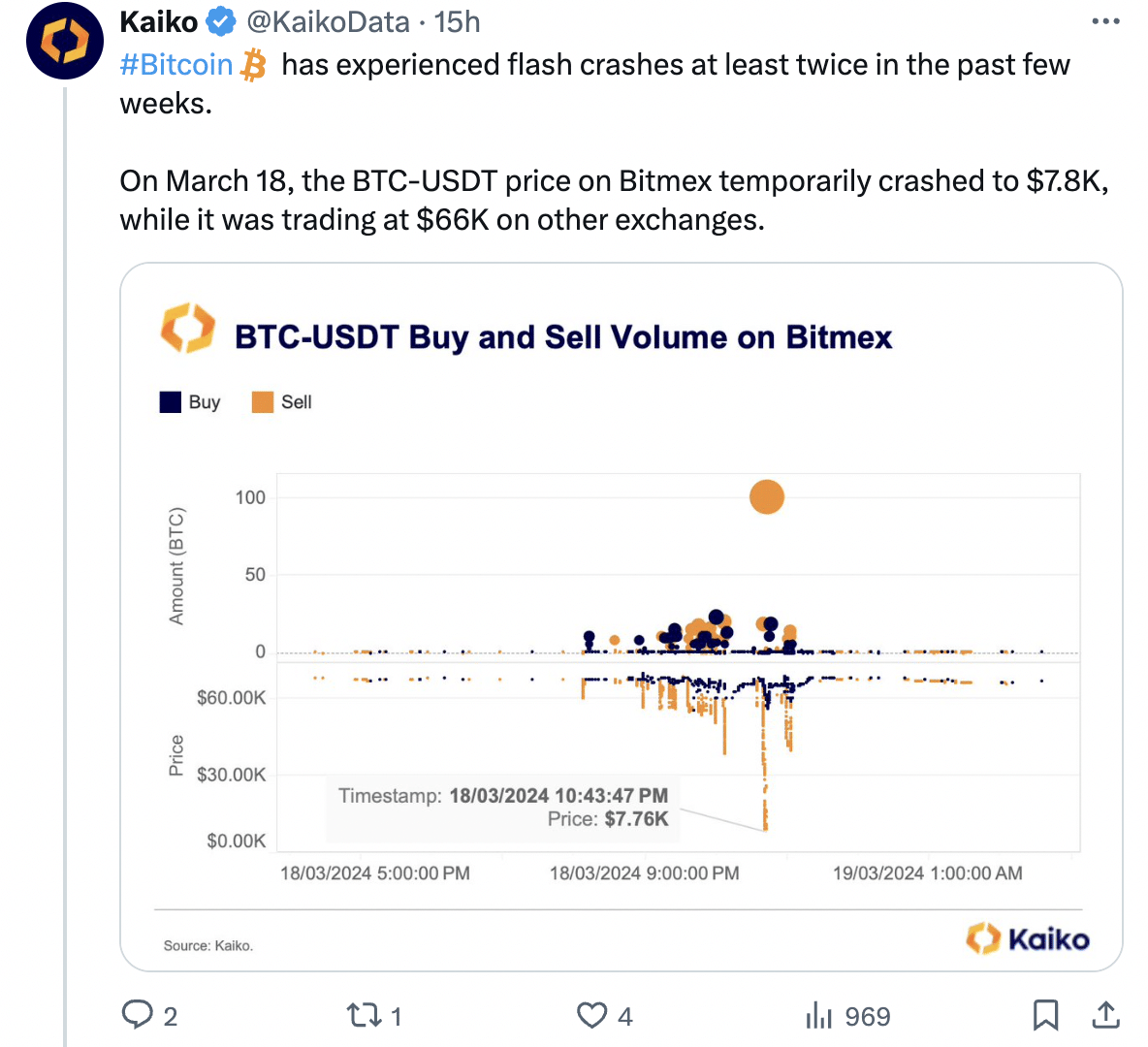

One of the instances of the flash crash occurred on March 18, when the BTC-USDT price on Bitmex experienced a temporary crash to $7,800.

At this time, it was still trading at $66,000 on other exchanges.

In a recent post on X (formerly Twitter), the exchange attributed the sudden price drop to aggressive selling from a few accounts.

Numerous large sell orders ranging from 10 to 20 BTC were executed, including one exceptionally large order of 100 BTC, worth approximately $6.6 million.

Another example of this occurred in the European market, where BTC-EUR prices on Coinbase fell from €63,000 to €48,000.

Source:

Bad optics

These mishaps that have occurred on CEXs may contribute to a negative outlook around Bitcoin, especially among new market participants and retail investors.

Anyone new to the crypto sector can initially start their journey by purchasing a few blue chip coins such as BTC and ETH in their account.

If price crashes occur for these coins, it could erode the confidence of new users and deter users from venturing further into crypto. This negative outlook was further emphasized by the weighted sentiment indicator.

Read Bitcoin’s [BTC] Price forecast 2024-25

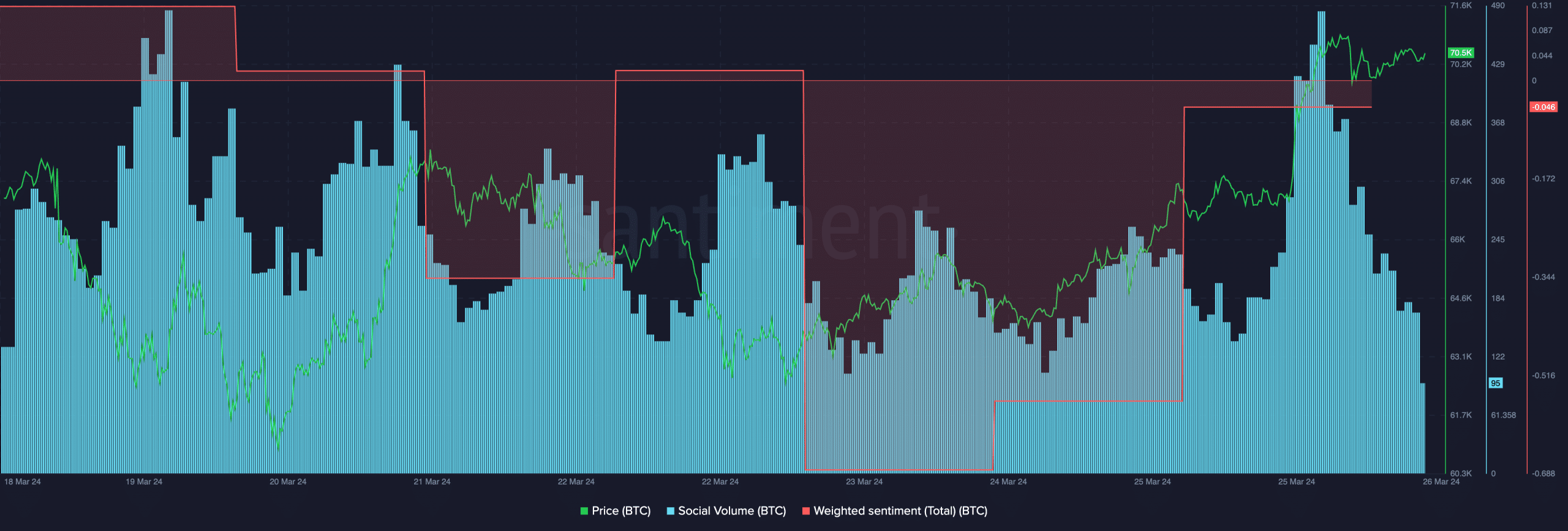

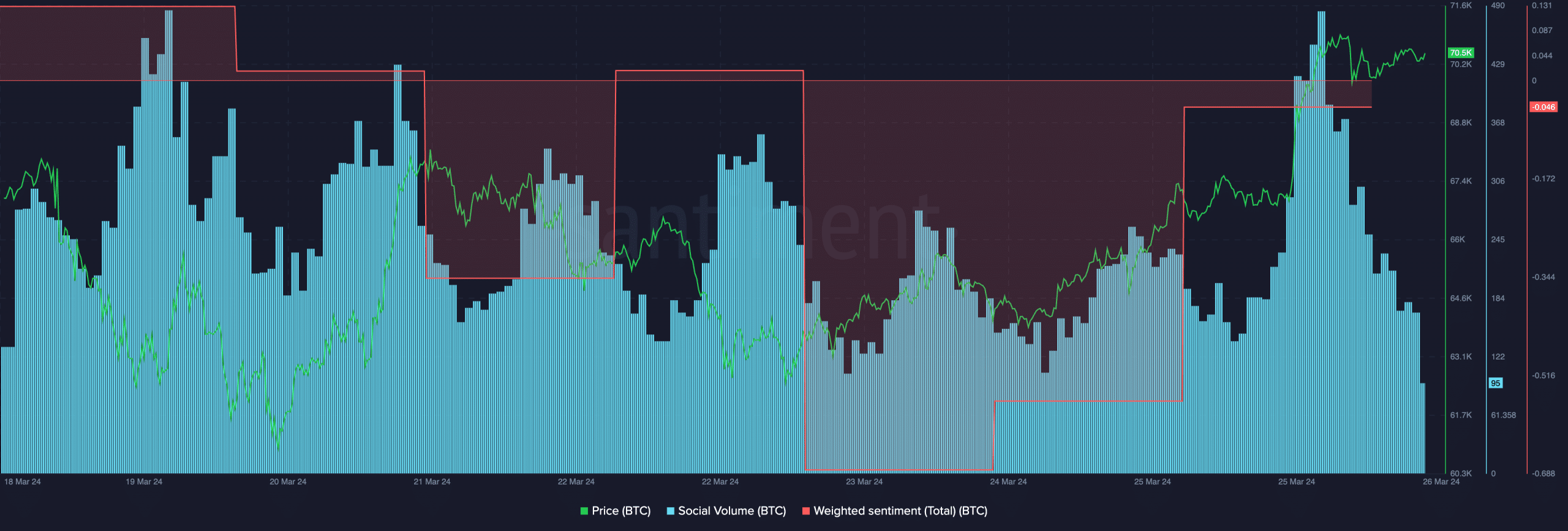

AMBCrypto’s analysis of Santiment’s sentiment data indicated that negative comments surrounding BTC outnumbered positive ones.

These factors could prove to be a hurdle for BTC’s rally in the future.

Source: Santiment