- According to Kiyosaki, BTC will explode after the Fed rate cut.

- The author believed that money would flee bonds and other assets into BTC, gold and silver.

The highly anticipated Fed pivot event will take place this week, and market experts have been bullish lately. The US FOMC (Federal Open Money Committee) is expected to start its easing cycle on September 18.

According to Robert Kiyosaki, the author of “Rich Dad Poor Dad,” the Fed will benefit Bitcoin [BTC] and gold. He said,

“Bitcoin, Gold and Silver Prices Are About to Explode… When the Fed PIVOTS and Real Assets Surge in Price While Fake Money Leaves Fake Assets Like US Bonds and Flees to Real Assets Like Real Estate, Gold, Silver and Bitcoin.”

Inflation to make BTC rise?

Kiyosaki further urged his followers to buy more BTC before the Fed begins its easing cycle.

“Buy some (more) gold, silver or Bitcoin… before the Fed cuts rates.”

This will be the first rate cut in four years, and market observers will have primed risky assets for potential gains. However, Kiyosaki has previously stated that BTC and other real assets will benefit even more from unsustainable US debt.

On On September 13, Kiyosaki warned that unsustainable US debt cannot be solved no matter who wins the US election. He declared that the dollar was garbage and that people were better off with Bitcoin and gold than the dollar.

“The dollar is trash. Stop saving dollars, fake money… and start saving gold, silver and Bitcoin… real money.”

Galaxy’s Mike Novogratz echoed a similar sentiment in March. According to Novogratz, BTC would increase in value as US debt continues to grow by $1 trillion every 100 days.

In short, monetary inflation will erode the value of the dollar, forcing users to look for alternatives such as gold, BTC or silver. This massive inflation could quickly push BTC to $10 million per coin, noted the author in a July price projection.

In the meantime, BTC was back to $60,000 after two weeks of struggling below the psychological level.

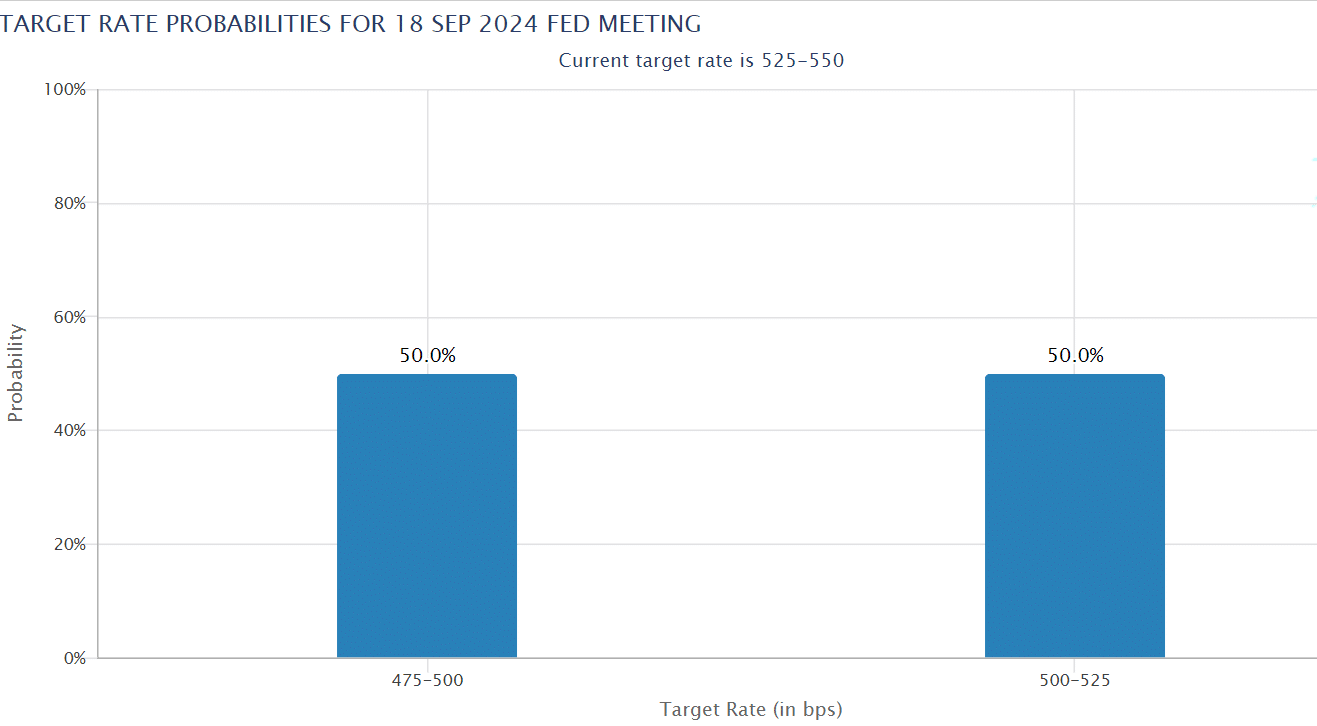

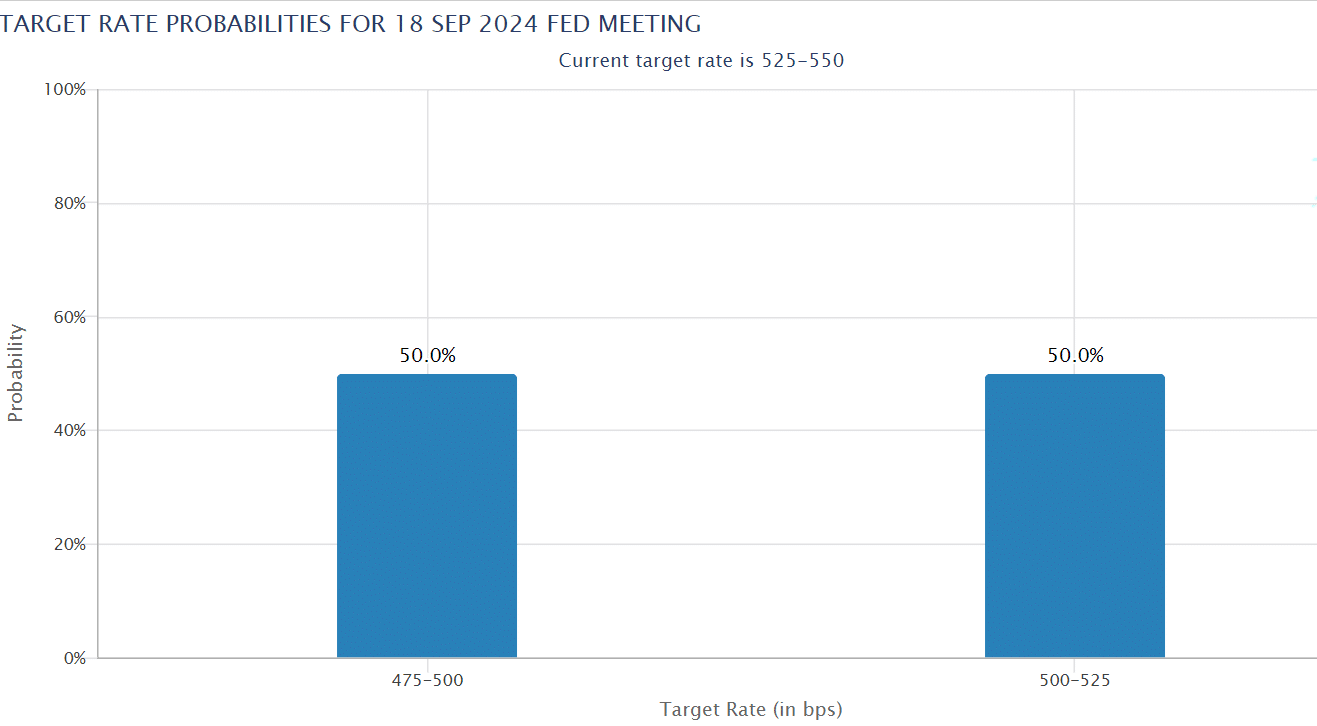

Following last week’s US economic data, markets are estimating a 50/50 chance of a 25/50 Fed rate cut (basis points). It remains to be seen how the market will react to the Fed’s turnaround in the short term.

Source: CME FedWatch