- BTC forms a similar technical pattern on the chart to that of 2020, which preceded a market rally.

- At the same time, multiple liquidity clusters above and below the current price level place BTC at a crossroads.

Bitcoin [BTC] has seen a gradual recovery after falling 2.54% in the past week, following a broader market decline. Since then, it has posted a daily gain of 1.48%, drawing renewed attention from investors.

As market conditions improve, uncertainty remains about Bitcoin’s next move. This analysis from AMBCrypto sheds light on possible scenarios.

Does BTC follow the 2020 pattern?

Insight from analyst Mr. Crypto indicates that BTC is currently mirroring the technical pattern it followed in 2020, which led to a significant rally after the asset broke through the $20,000 resistance level.

According to this pattern, BTC first experiences a rally and then falls to form a bottom, followed by another rally that creates a symmetrical triangle pattern before an explosive upward move.

Currently, BTC appears to be in the middle of this range. After a rally, it has now returned and formed a bottom – perfectly in line with the previous cycle.

If this pattern continues, it could be a signal that BTC will eventually break the $100,000 resistance level.

Source:

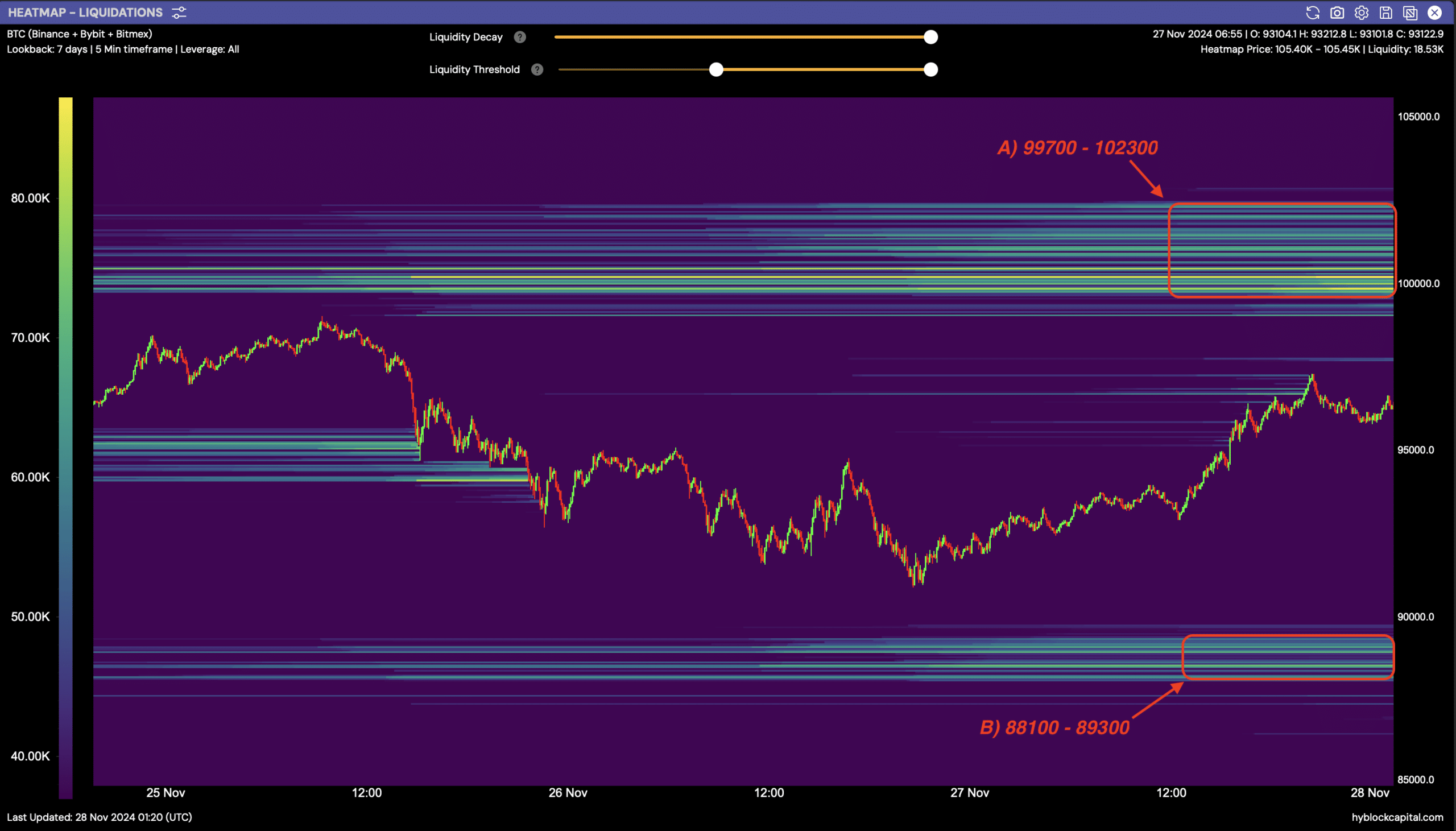

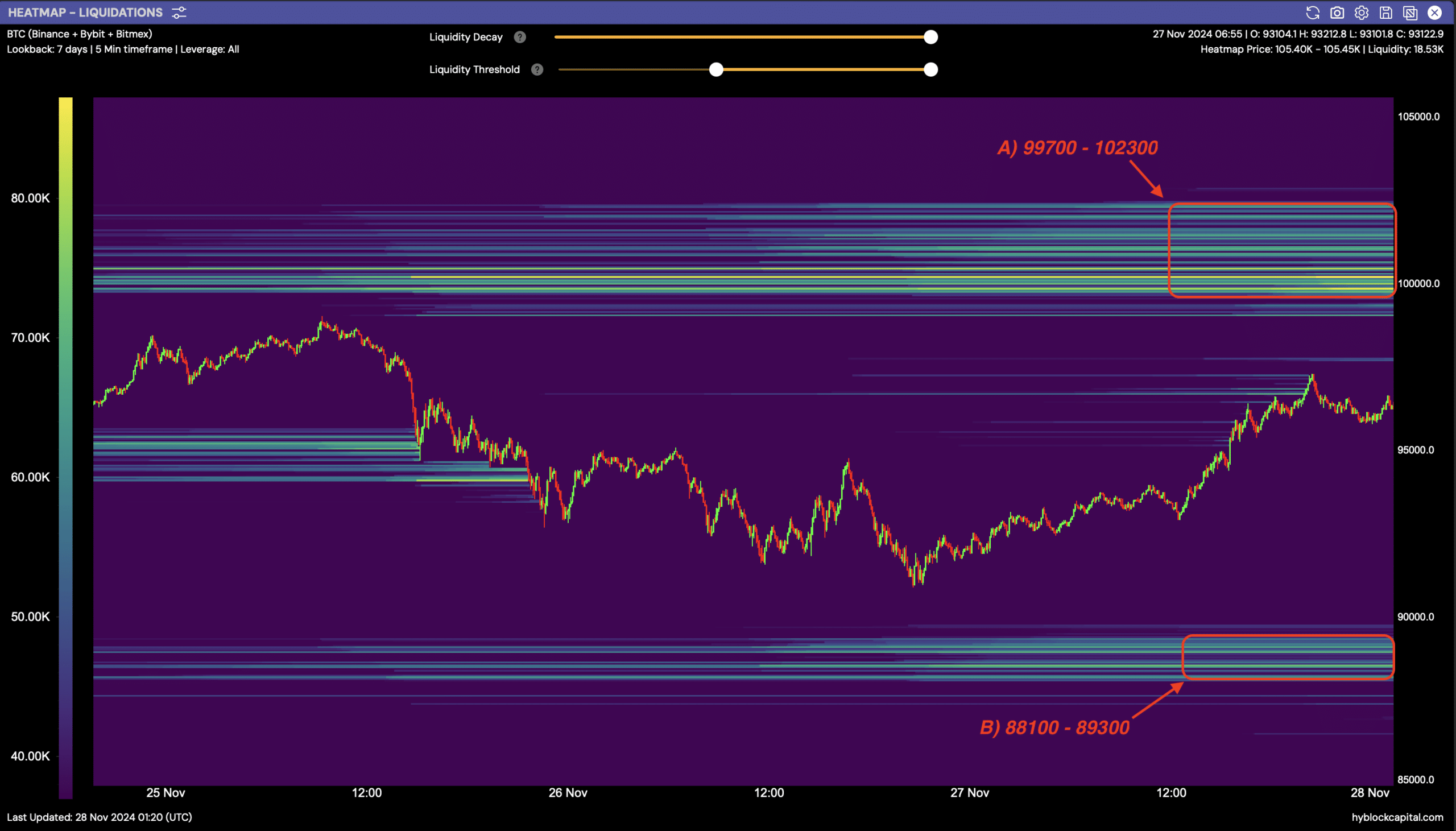

BTC faces two-way pressure amid liquidity clusters

According to Hyblock Capital, Bitcoin is currently under pressure considerable pressurewith liquidity clusters both above and below the current price, creating a scenario where the asset can move in either direction.

Above this, the liquidity cluster ranges between $99,700 and $102,300, while below it ranges from $88,100 to $89,300.

Liquidity clusters often act as price magnets, pulling the market to these levels to clear orders before the trend continues.

Source:

AMBCrypto’s analysis suggests that BTC is more likely to break upward and clear the cluster above it than it is to fall. This view is supported by the coverage ratio and the long-to-short ratio.

The Funding Rate, which tracks the balance between long (buyers) and short (sellers) positions, has increased, indicating that buyers are gaining control. At 0.0206%, this indicates continued upward momentum.

Moreover, the long-to-short ratio shows more long positions than short positions, with a value of 1.0090, reinforcing the bullish sentiment.

A bullish confluence is emerging for BTC

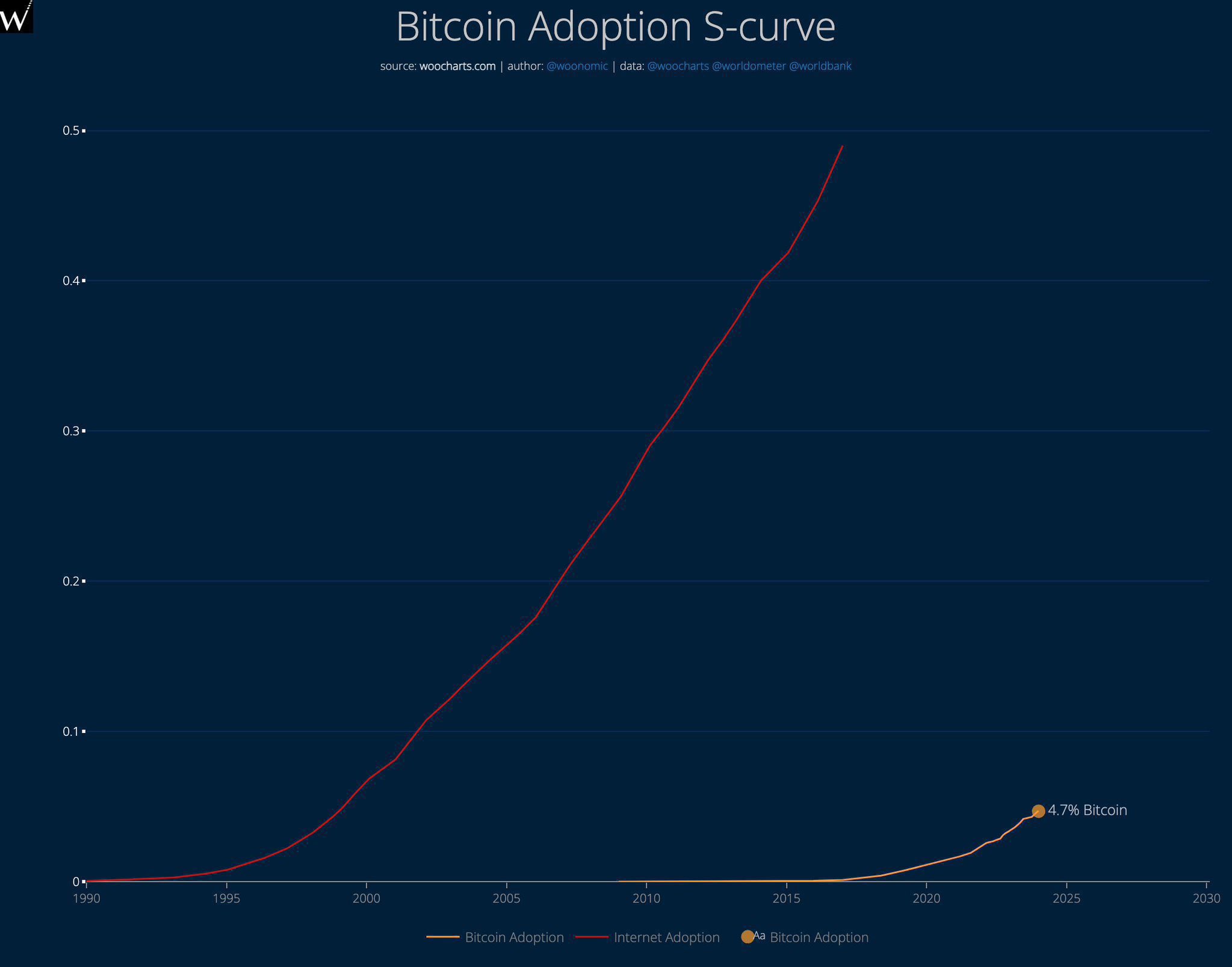

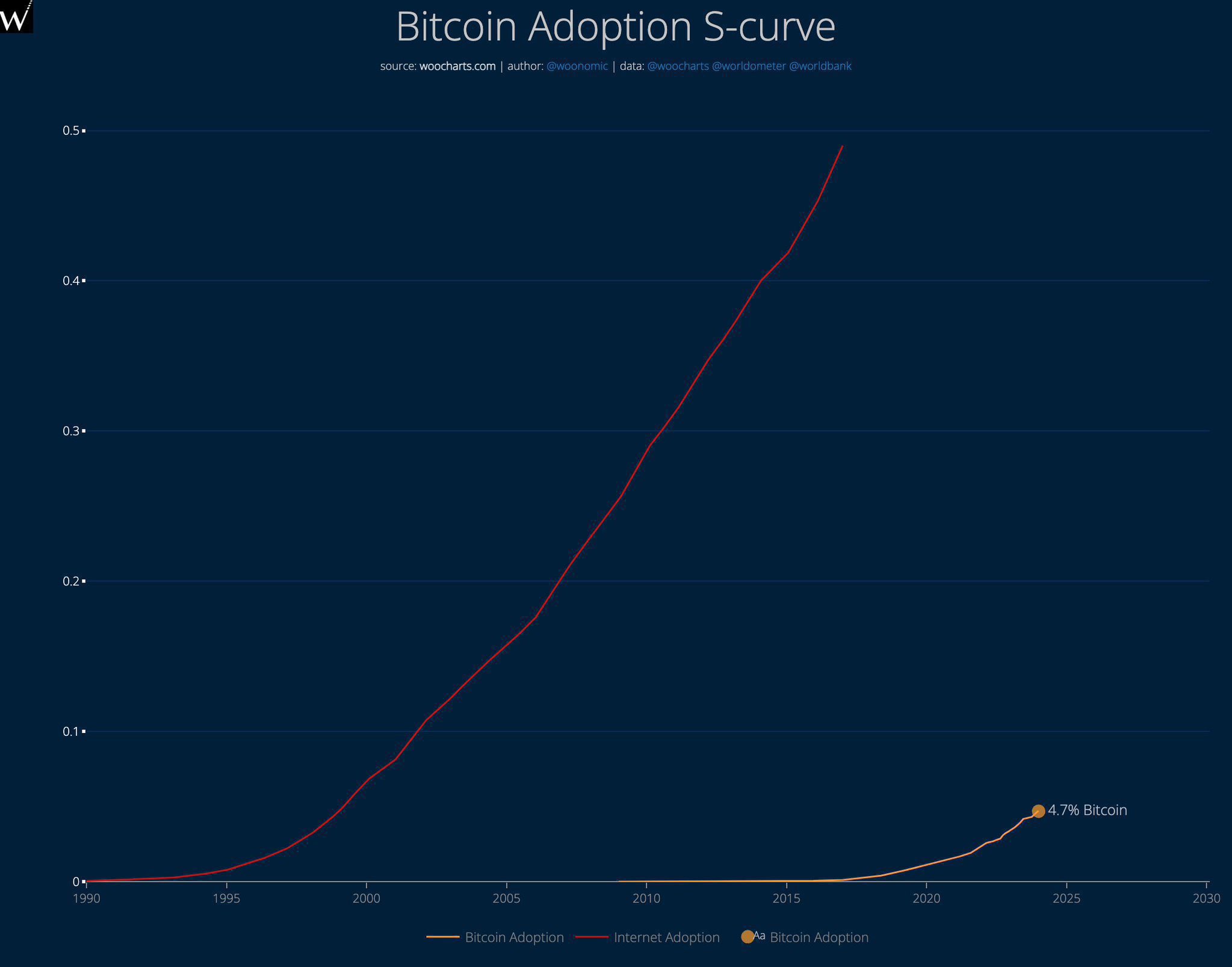

According to the Bitcoin Adoption S Curve, Bitcoin is in a similar adoption phase as the Internet was in 1999.

Read Bitcoin’s [BTC] Price forecast 2024–2025

This indicates that the market has not yet fully embraced Bitcoin, and as adoption continues to grow, the likelihood of further price appreciation increases, along with greater liquidity flowing into the asset.

Source:

Together, these indicators suggest that BTC is more likely to trend upward rather than experience a sharp decline.