- The 1-3 month UTXO cohort will be in a favorable position if they continue to do this.

- The Open Interest increased as long positions also followed.

The recent retrace of Bitcoin [BTC] According to the pseudonymous on-chain analyst onchained, this has not exactly been a bad omen for the king coin.

How many Worth 1,10,100 BTC today?

The analyst, who wrote about Bitcoin market sentiment and the impact on CryptoQuant holders, noted that the decline has put the 1-3 month UTXOs in a favorable position.

Existing opportunities, regardless of decline

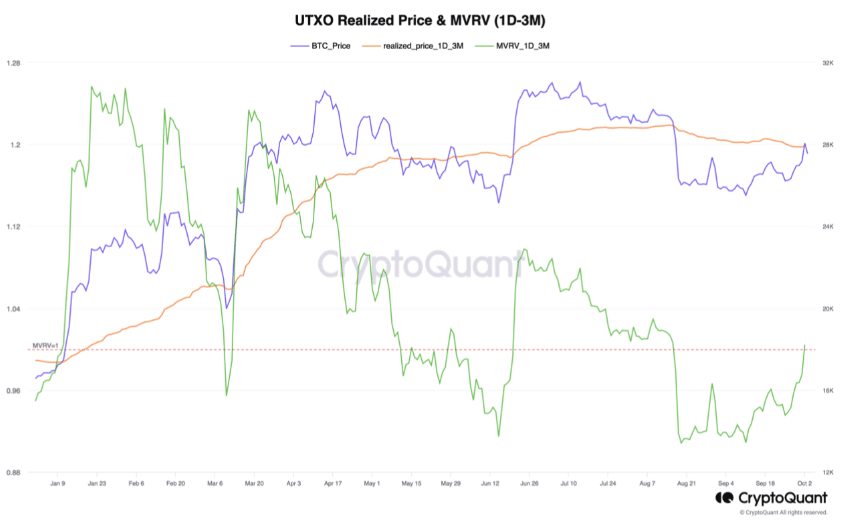

Onchained came to this conclusion because the UTXO shares with a term of 1 to 3 months are only slightly below the average purchase price. Usually this is a sign of minimal unrealized losses. So a possible move towards break-even levels could lead to more to trust on the market.

To get to this conclusiondid the analyst use the Market Value to Realized Value (MVRV). This is done by taking the UTXO’s supply on the 1-3 month frame and dividing it by the MVRV.

The MVRV is a function of the division between the total market capitalization and the realized market capitalization. The result of this measure gives an idea of whether Bitcoin is a fair value, undervalued or overvalued.

Source: CryptoQuant

According to onchained, Bitcoin’s MVRV was above 1 at the time of the analysis, meaning the coin has more of a tendency to rise in an upward direction than to fall.

He further noted that,

“In our current scenario, the MVRV for the swing trader cohort recently crossed the 1 level to the upside, which can be interpreted as a bullish sign, possibly indicating an opportunity to gradually enter a long position or strengthen an existing position.”

BTC to $32,000, who says no?

Around the same time onchaned published its analysis, research analyst Alex Adler Jr. posted. on X (formerly Twitter). According to Adler, there is an increase in the number of Bitcoins long positions.

Adler also took into account the status of the Taker Orders in his position. The Taker Orders measure both the bid and ask positions taken by traders in the derivatives market.

According to the analyst, Taker Orders’ 8-hour cumulative delta was positive. This data reinforced the idea that market sentiment was bullish.

The market is seeing an increase in the opening of long positions, and the cumulative 8-hour delta of Taker Orders is also in the positive zone.

Macro alert pic.twitter.com/X4moAWhgIK

— Axel

Adler Jr (@AxelAdlerJr) October 4, 2023

Realistic or not, here it is The market cap of ETH in BTC terms

Also Mint Glass revealed that open interest in BTC Futures has increased in the last 24 hours. As an indicator to determine price strength, Open Interest is the total number of contracts held by market participants.

When Open Interest increases, it implies an increase in liquidity. When it decreases, it means an increase in the closing of initially held contracts. While the former was the case, it was also interesting to see traders aiming as high as $32,000.

Source: Coinglass