- Peter Schiff opined that the price of Bitcoin might not rise due to the event.

- Despite its high value, a key metric revealed that buying BTC could remain profitable.

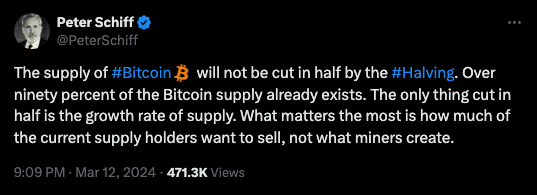

Pronounced Bitcoin [BTC] Skeptic Peter Schiff has made another prediction, saying that the supply of the coin will not be halved by the halving.

Schiff posted this on X (formerly Twitter) on March 12, emphasizing his reasons.

According to him, 90% of the total Bitcoin supply already exists. Therefore, the only thing left to cut is supply growth, not Bitcoin.

Source:

Schiff’s hypothesis does not hold

If we were to follow the economist’s view, it could be difficult for BTC’s value to experience exponential growth after the halving.

This was not the first time Schiff criticized the coin. But despite his stated skepticism, Bitcoin has continued to defy his prediction.

This year, the price of the coin has risen by as much as 64.90%, while reaching new all-time highs.

As for the halving that will most likely take place in April, miners will receive 3,125 BTC as a reward. Historically, Bitcoin’s price has risen to astounding heights after the halving.

But this time it was different as the coin hit a new high before the event.

However, that does not take away the possibility of further growth. For example, in the first halving in 2021, BTC rose from 12 to $126. The halving in 2016 and 2020 also created astronomical values for the coin.

For AMBCrypto, opinion and history alone do not move the markets. That’s why we felt it necessary to evaluate the state of Bitcoin on-chain.

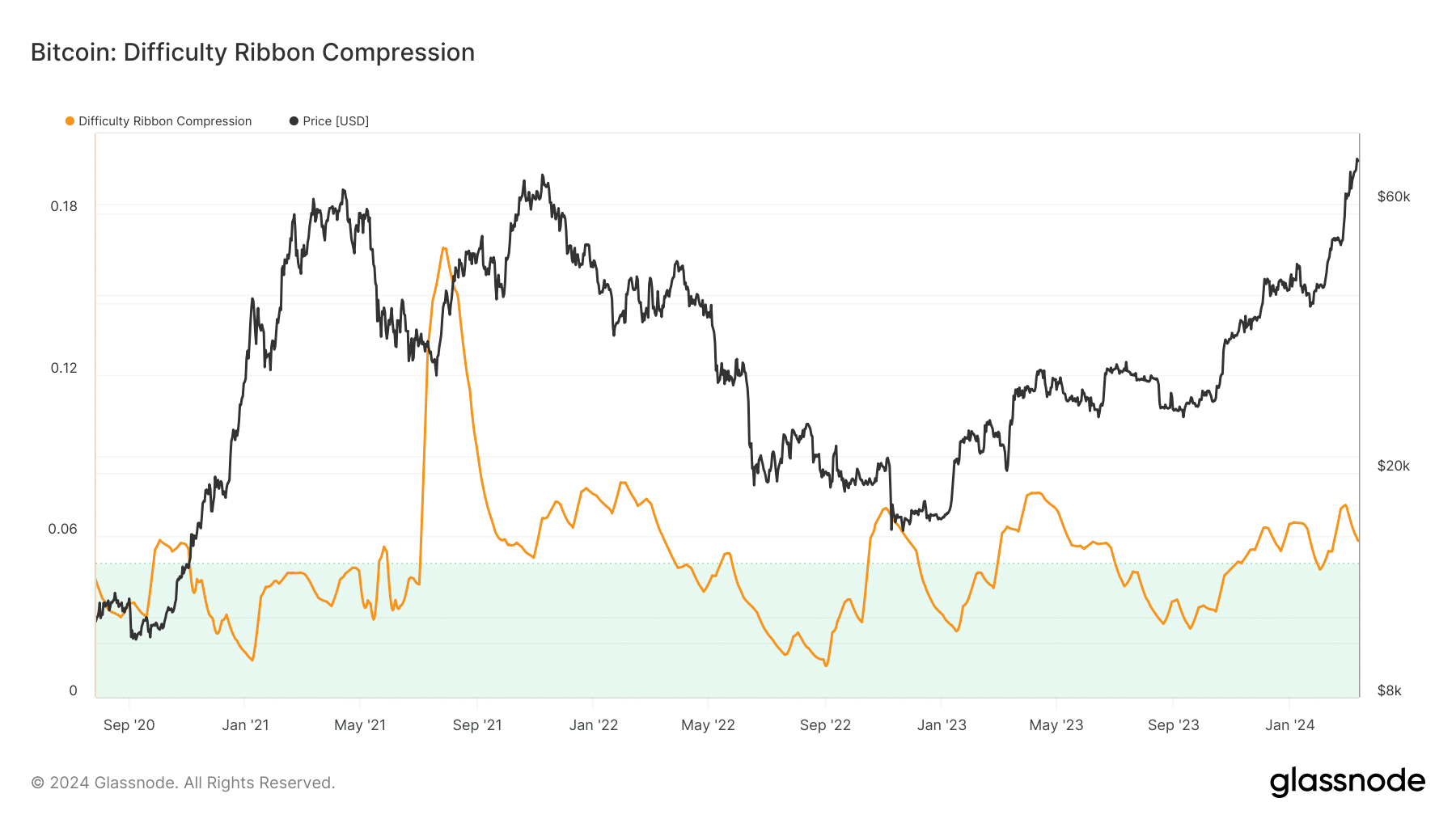

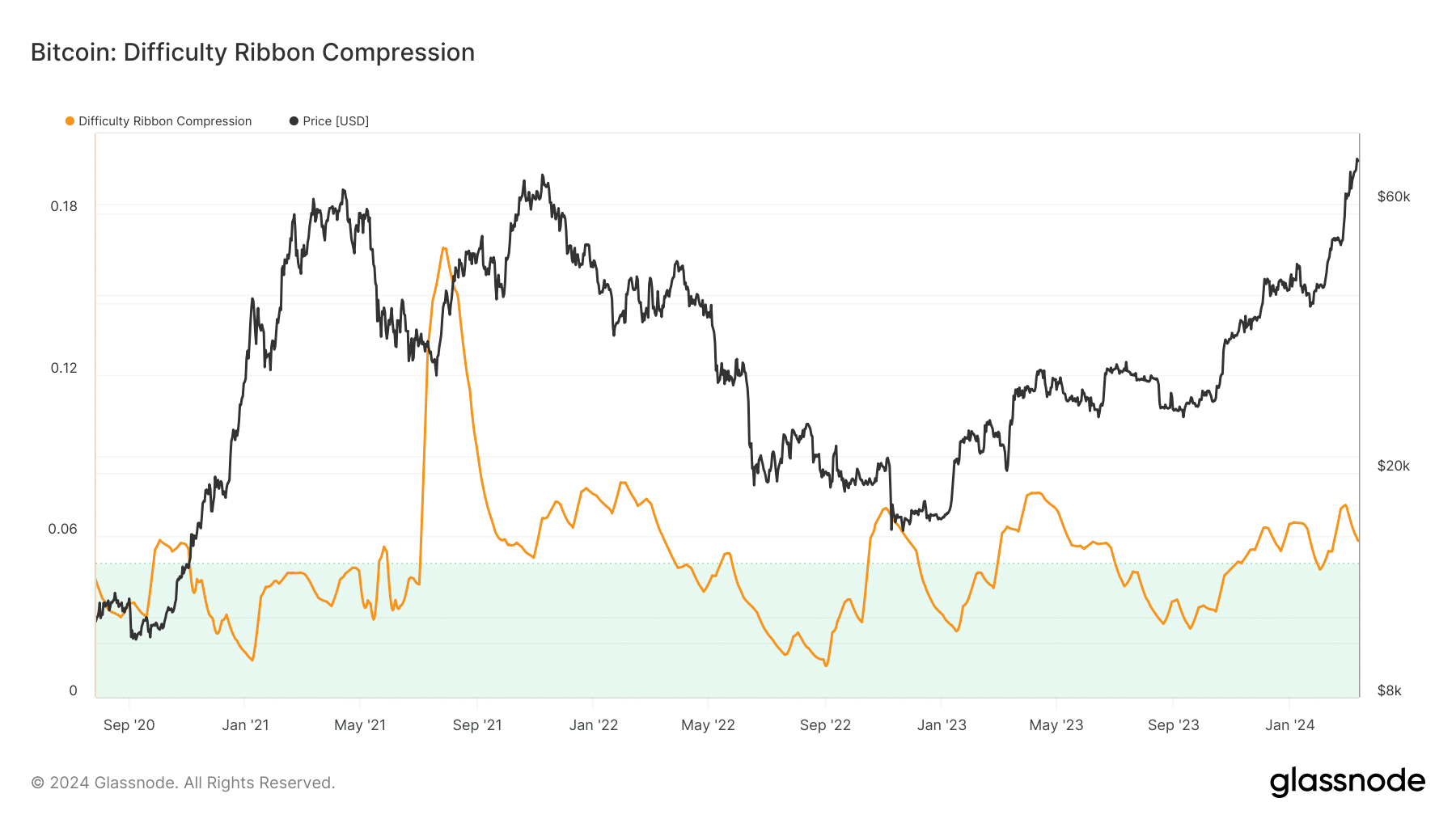

One metric we looked at was the difficulty of ribbon compression.

For the uninitiated, the Difficulty Ribbon Compression quantifies high and low compression zones that can help with spotting buying and selling opportunities.

Source: Glassnode

With a compression threshold of 0.05, the benchmark suggested that Bitcoin remains a good buying opportunity at $72,864.

If this metric were to send a sell signal, the value would have been between $0.10 and $0.16, as it was in the fourth quarter of 2021.

Inflation is decreasing, the hype is returning

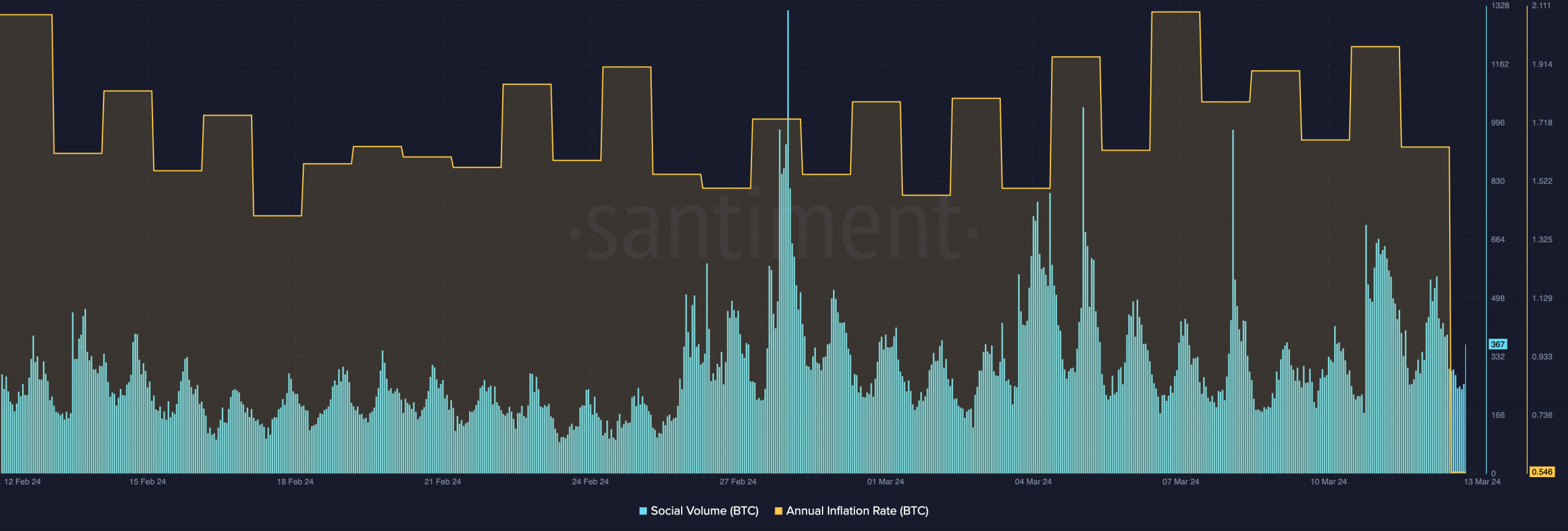

Another metric we examined was annual inflation. According to data from Santiment, AMBCrypto noticed that Bitcoin’s annual inflation rate had fallen to 0.54.

If inflation continues to decline as the halving approaches, Bitcoin’s gains could accelerate within months. In addition, attention to the coin has increased, as evidenced by its social volume.

At a reading of 367, the increase in social volume implies that mentions of the coin have increased on various social channels.

If this metric continues to rise, BTC demand could follow suit.

Source: Santiment

How much are 1,10,100 BTCs worth today?

If this were the case, Schiff’s opinion would not hold water and the price of Bitcoin could soar towards six figures.

However, traders should be vigilant about their optimism as a correction could occur in the process.