- New Bitcoin investors are showing more resilience compared to the bearish trend of the past.

- New Bitcoin investors are facing minimal losses as BTC holds levels above $60,000.

Bitcoin [BTC] has made a solid recovery since the US Federal Reserve announced a 0.5% interest rate cut.

Recently, BTC hit a five-week high above $64,000, and while it has since retreated to trade at $63,685 at the time of writing, bullish signals continue to emerge.

Per Glass junctiontraders who bought Bitcoin in the last 155 days or less are showing a higher “degree of resilience” compared to previous market cycles.

New Bitcoin Investor Behavior

Short-term Bitcoin holders often cause short-term price volatility because they are more reactive to price movements.

Over the past five months, BTC prices have fluctuated between $71,000 and $49,000, indicating that a significant number of new investors who bought at the high prices are underwater.

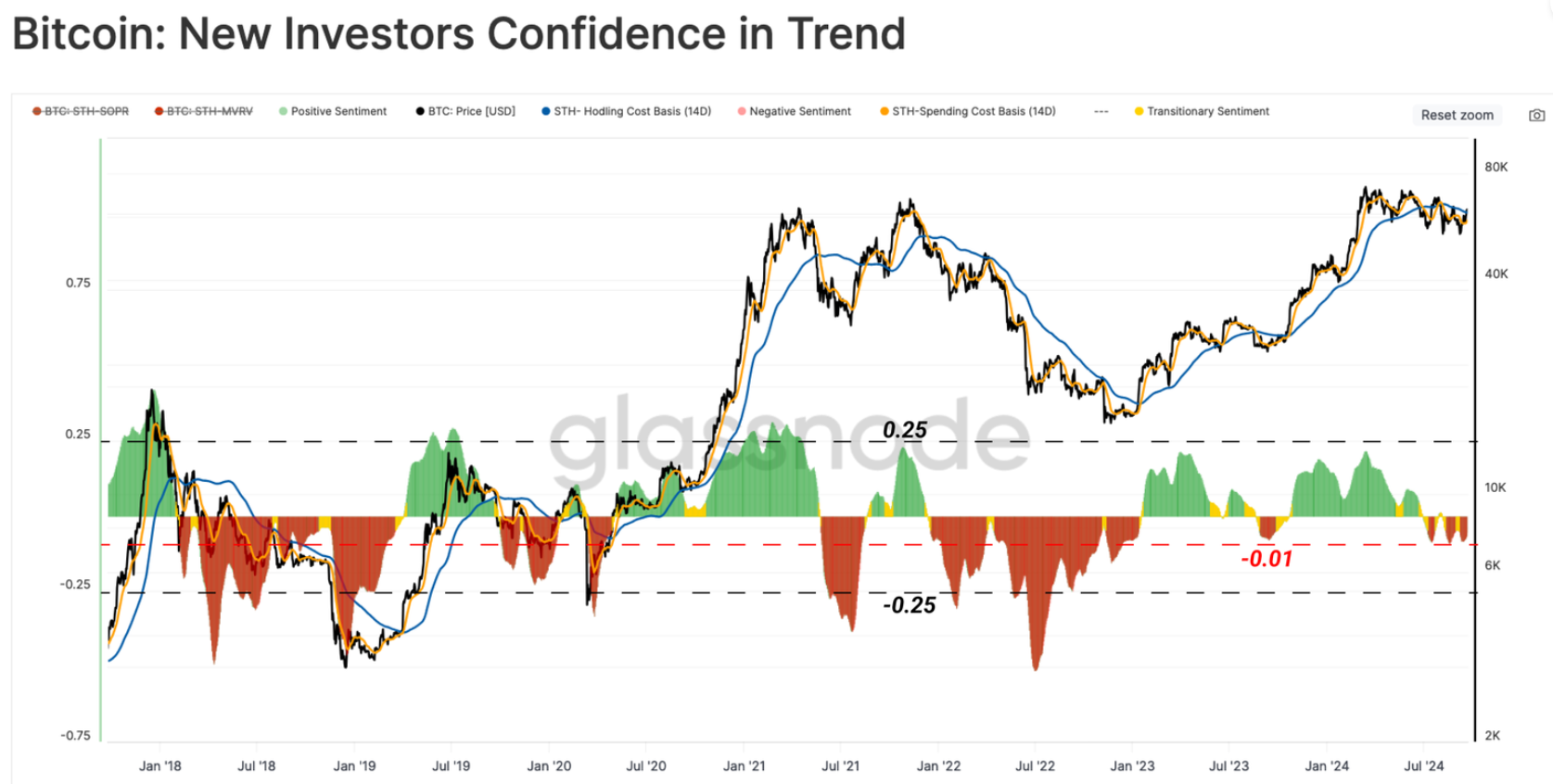

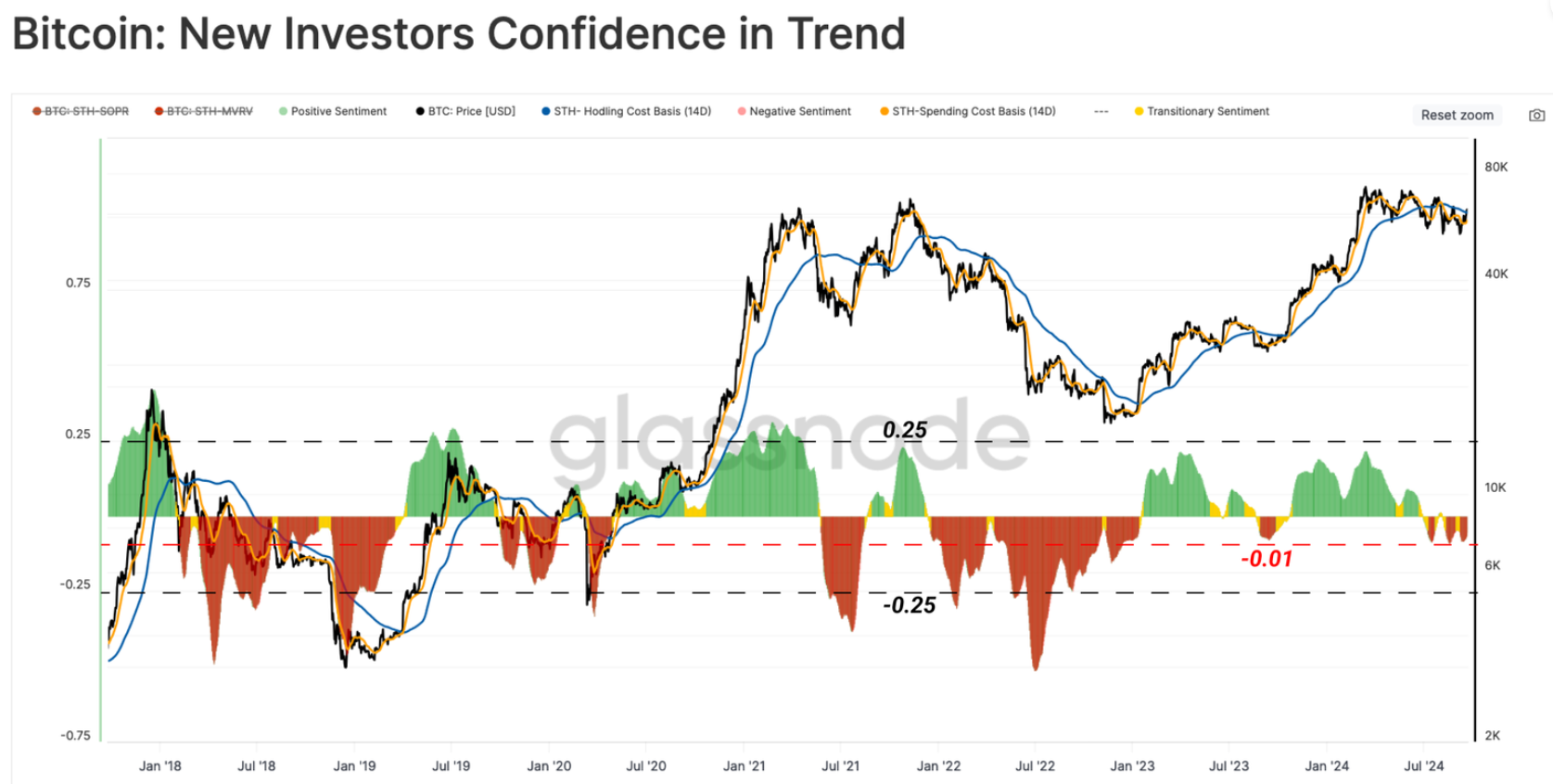

According to Glassnode’s New Investors Confidence in Trend metric, short-term holders are showing confidence and deviating from previous patterns of tending to panic during bearish trends.

The reason behind this shift in sentiment is that the magnitude of losses suffered by this group is relatively low.

Source: Glassnode

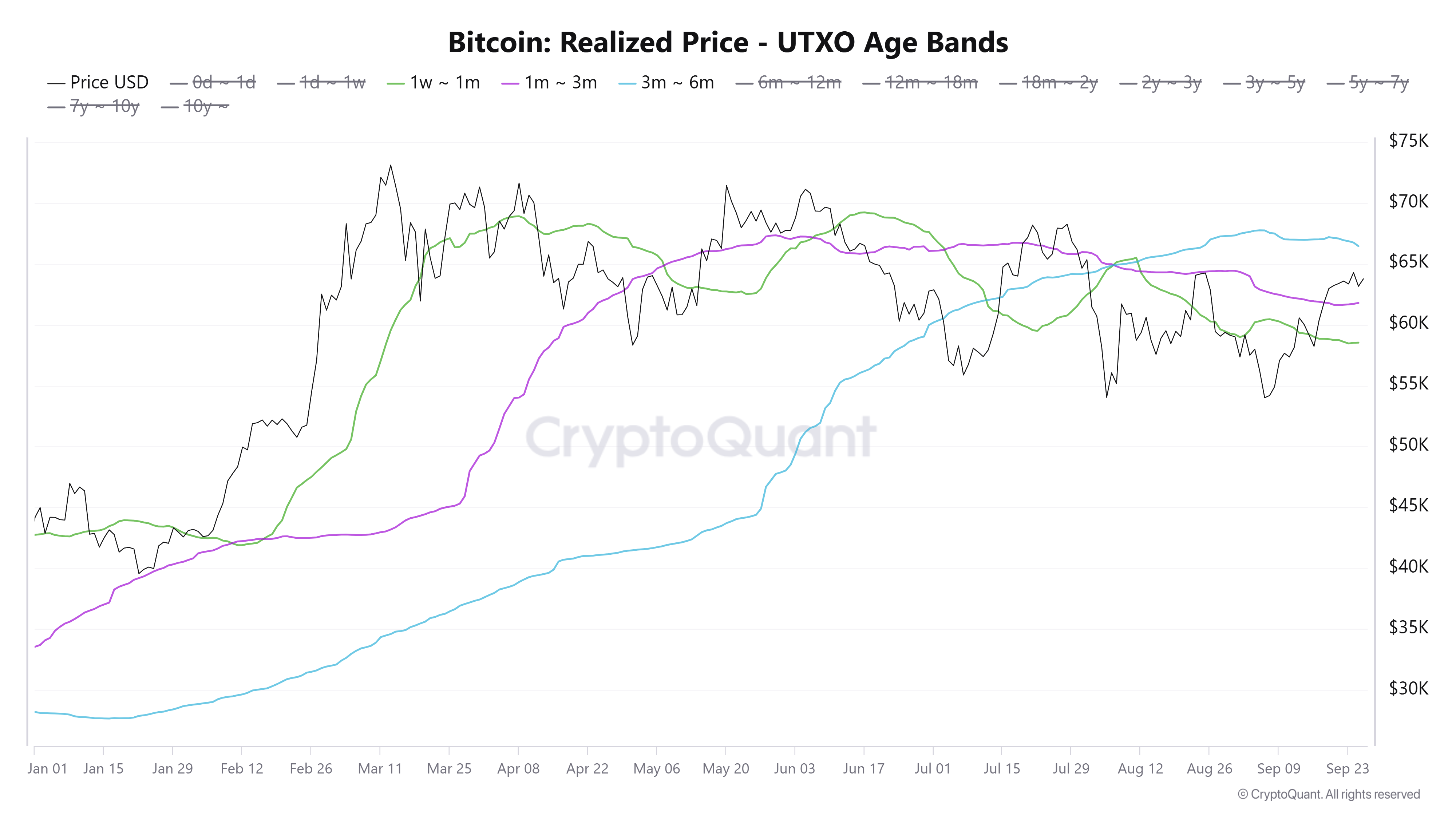

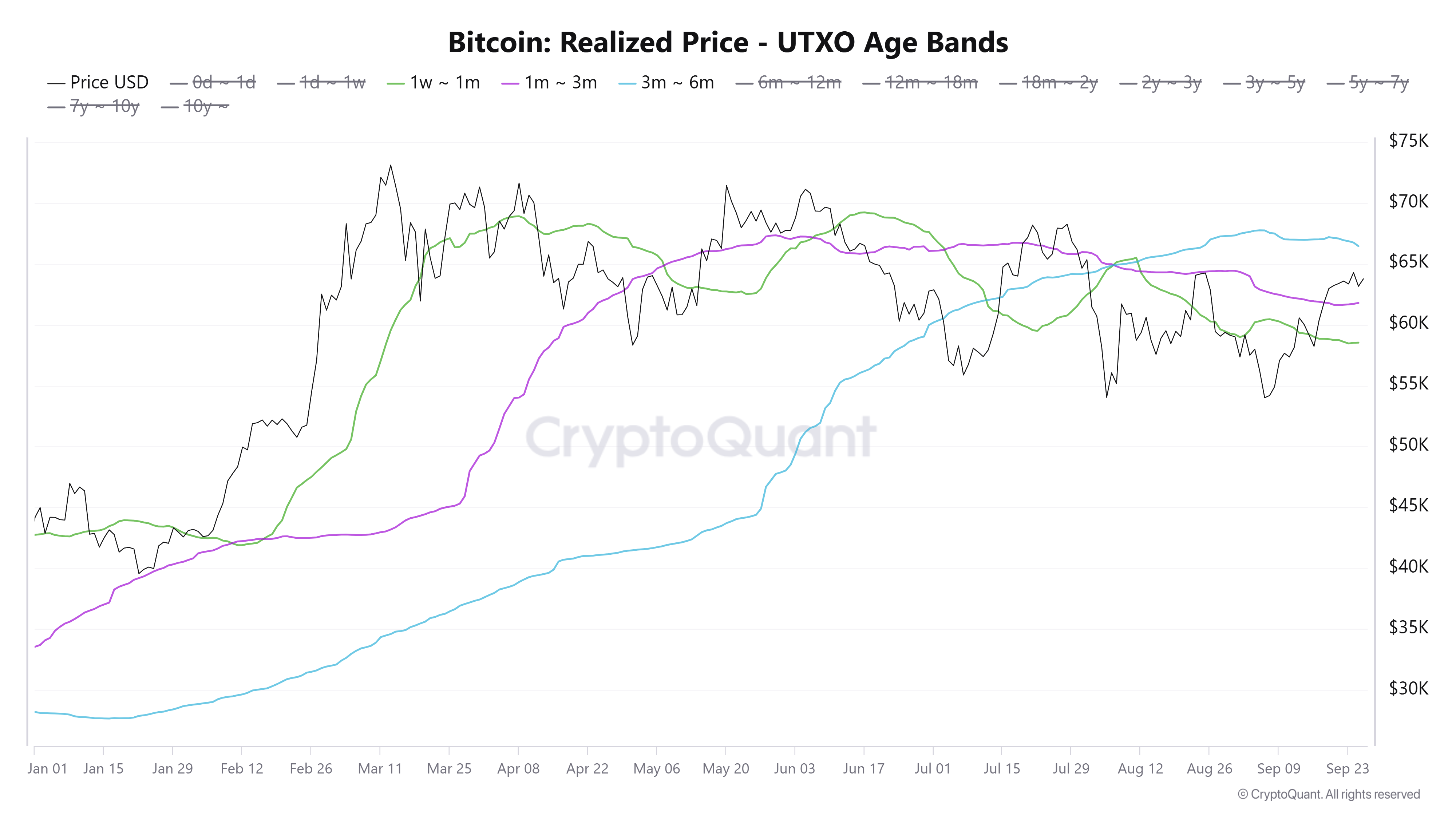

A look at the Bitcoin Realized Price by Age Bands on CryptoQuant also shows that traders who have not held BTC for more than three months have exceeded their purchase price since prices rose above $61,000.

Furthermore, those who hold Bitcoin for 3 to 6 months will break even once the price crosses $66,500. This data also shows that short-term losses are minimal.

Source: CryptoQuant

Per one previous analysis According to AMBCrypto, short-term holder profitability could be the key to pushing BTC above $70,000.

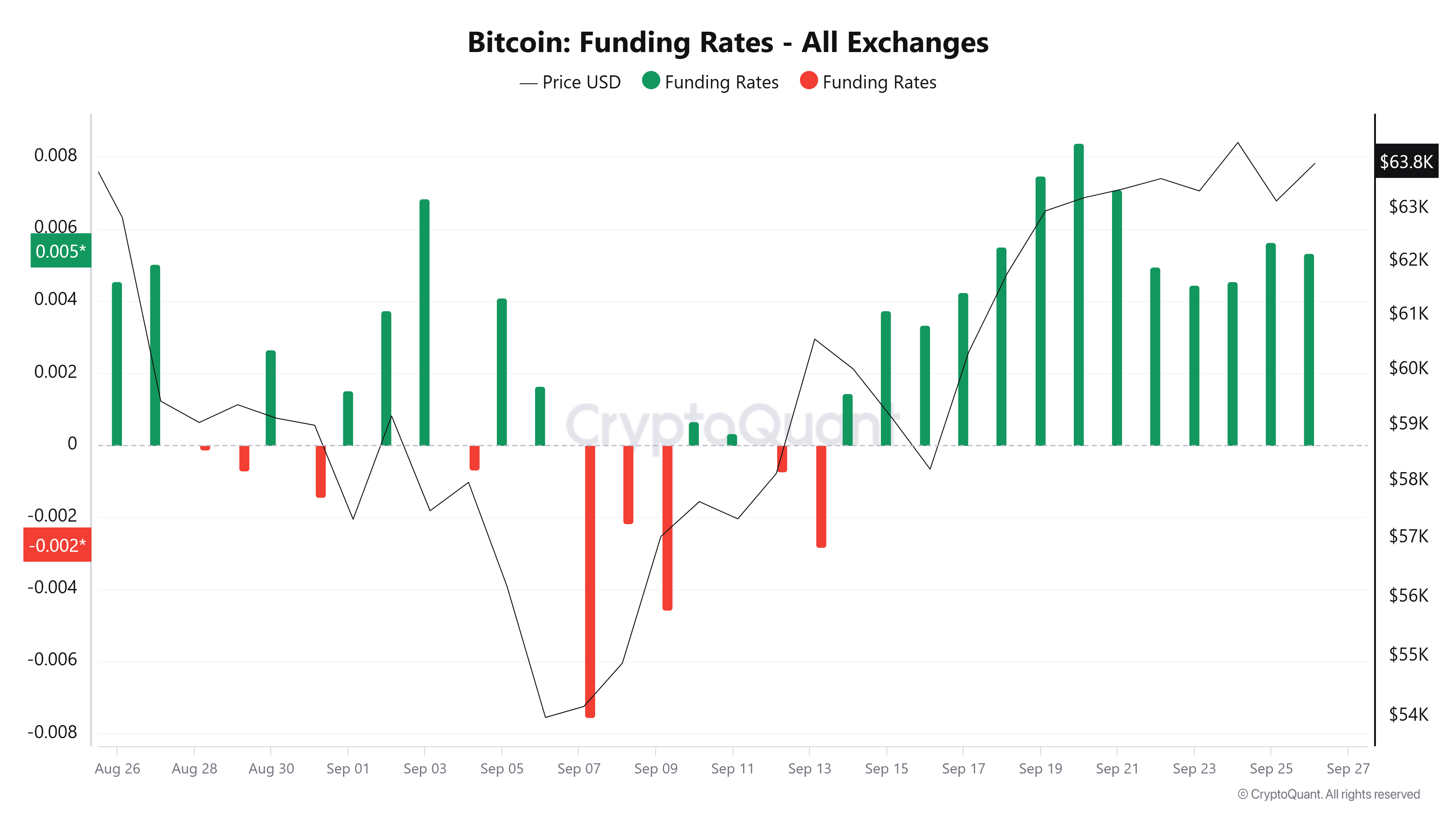

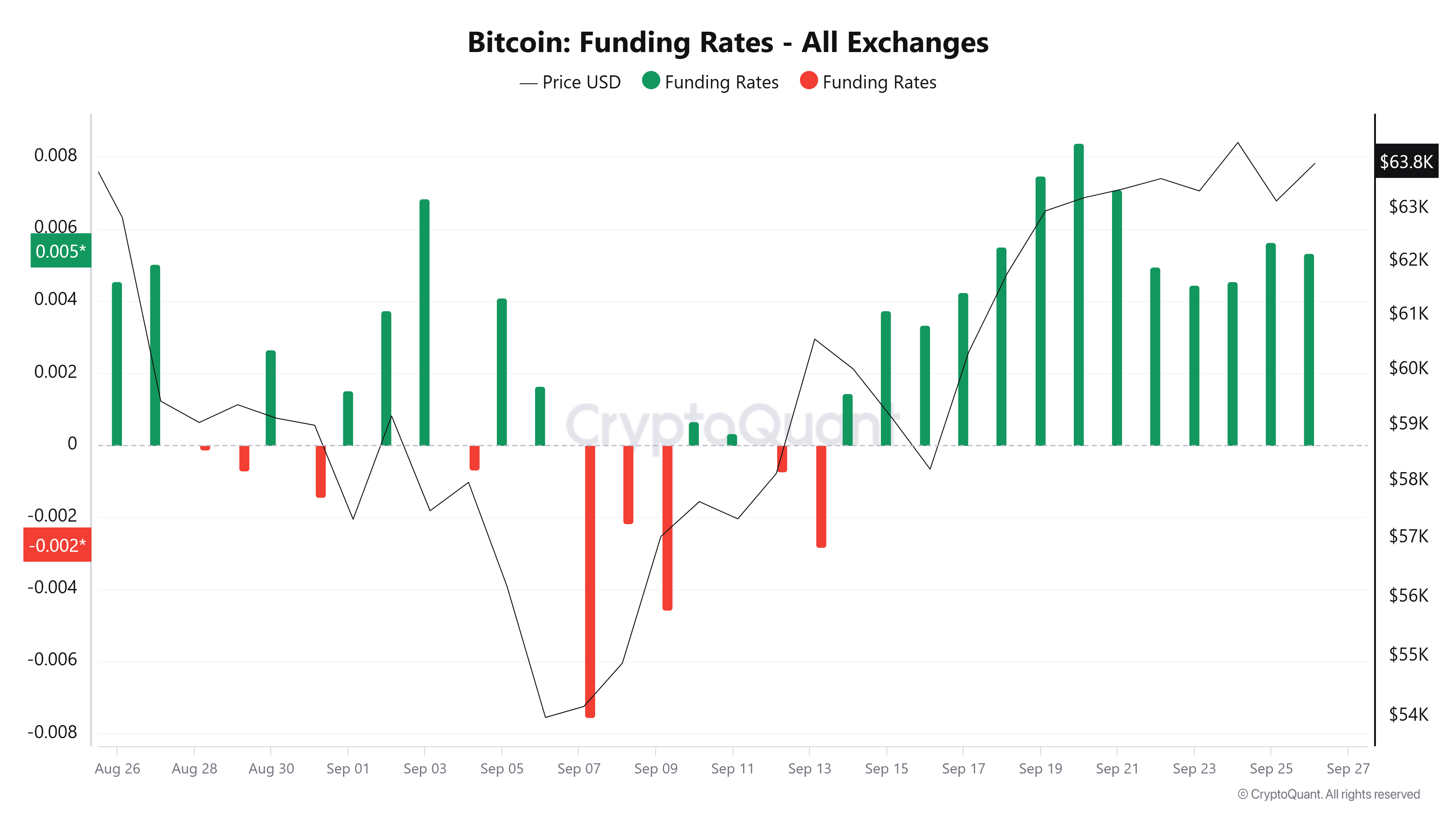

Shift in the futures market

The Bitcoin Futures markets showed an increase in activity. Since BTC rose above $60,000 on September 17, funding rates have increased and been mostly positive.

This means that there are more long traders betting on further price increases than the short sellers. These traders are willing to pay a premium to hold their long positions, demonstrating bullish sentiment.

Source: CryptoQuant

Data from Mint glass further demonstrates a bullish bias as long traders dominate.

Read Bitcoin’s [BTC] Price forecast 2024–2025

At the time of writing, 52% of traders had long positions, while 47% had short positions, indicating that fewer traders are predicting prices to fall.

The positive sentiment is also reflected in the Bitcoin fear and greed index which has recovered from a state of fear to neutral, shedding further light on market confidence.