- Arthur Hayes believes BTC could fall below $50,000 this weekend

- However, Bitget’s Gracy Chen maintains a bullish long-term outlook

Bitcoins [BTC] The weakness intensified in September as the world’s largest digital assets struggled on the charts below $60,000. According to Arthur Hayes, co-founder of BitMEX and CIO at venture capital fund Maelstrom, BTC could even do that. drop further down and reach below $50,000 over the weekend.

“$BTC is tough, I’m aiming for less than $50,000 this weekend. I made a cheeky short.”

More BTC Losses in the Short Term?

Earlier this week, Hayes made a bearish call for BTC in the short term, arguing that the Fed’s expected rate cuts would not move crypto markets higher. This was before interest rate traders rose bets on a Fed rate cut of 0.25% and 0.50% ahead of Friday’s US jobs report.

According to the execution argument. US liquidity is under pressure as financial institutions have opted for the Fed’s RRP (reverse repurchase agreement) for higher returns, rather than betting on risky assets like Bitcoin. This would mean net negative liquidity, which could lower BTC prices despite likely Fed rate cuts, he added.

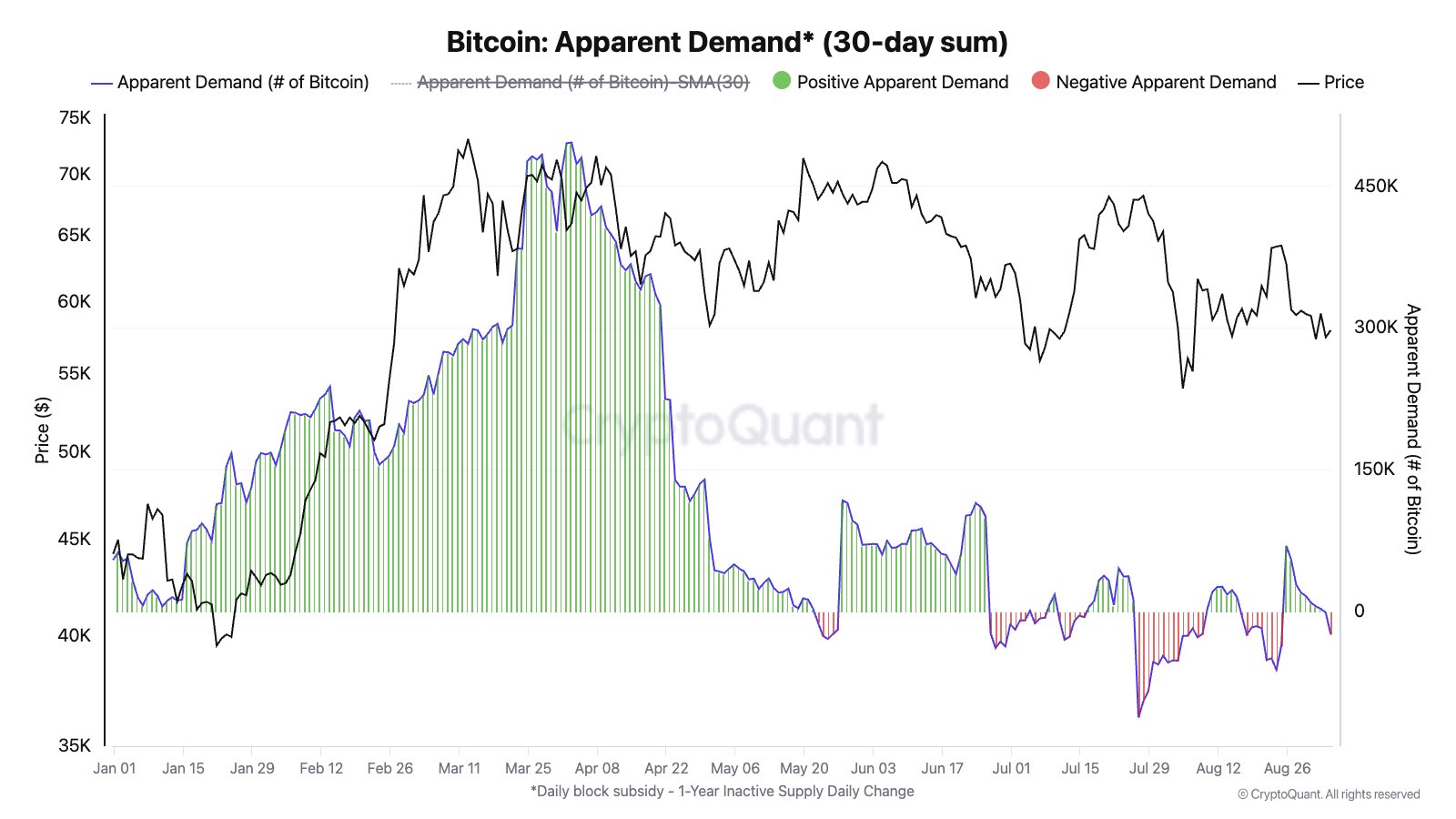

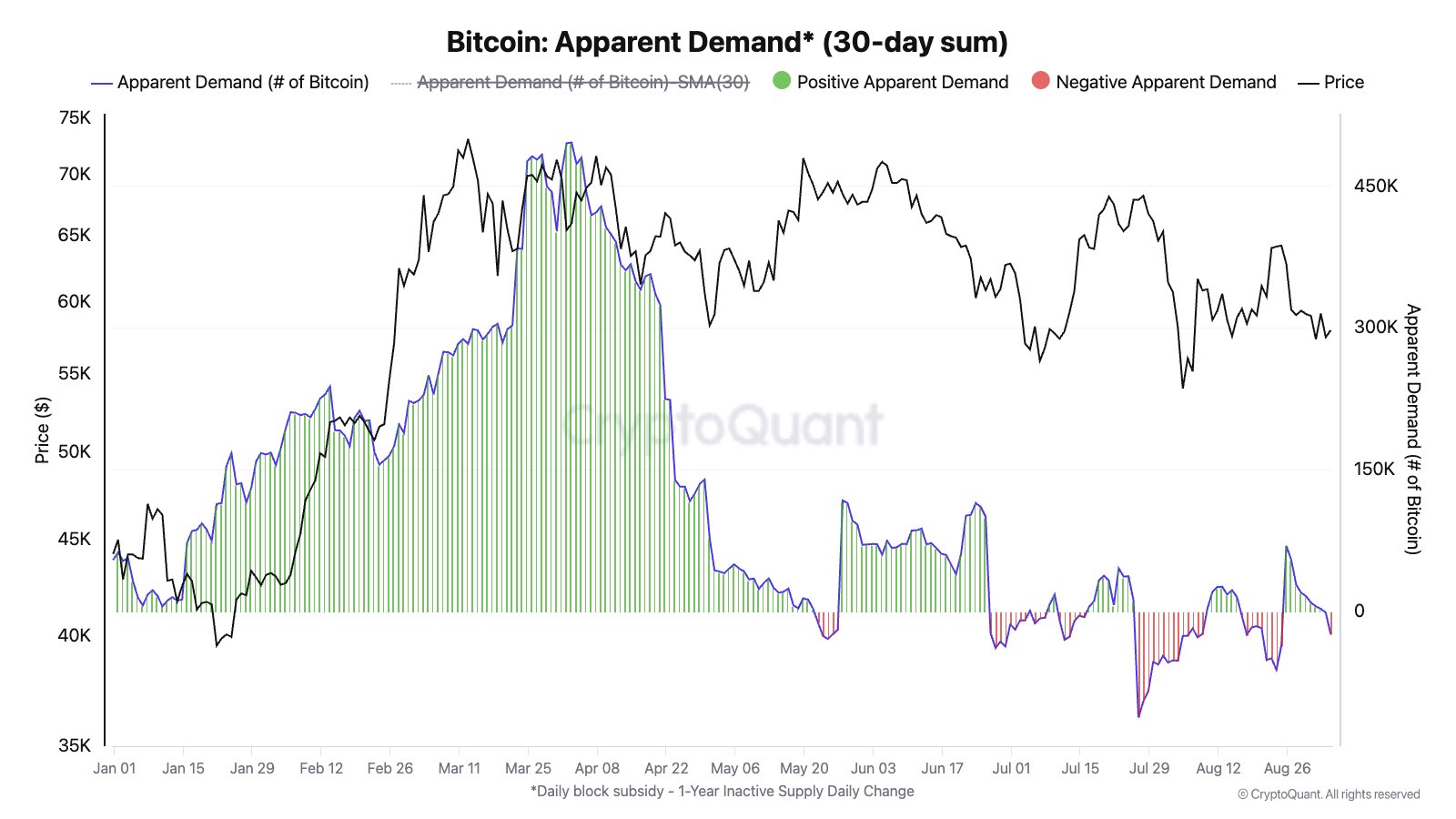

Here it is worth pointing out that demand for crypto has also decreased significantly since the first quarter. According to CryptoQuant factsInvestor demand hit record lows at the time of writing, which could put further downward pressure on the crypto’s price.

Source: CryptoQuant

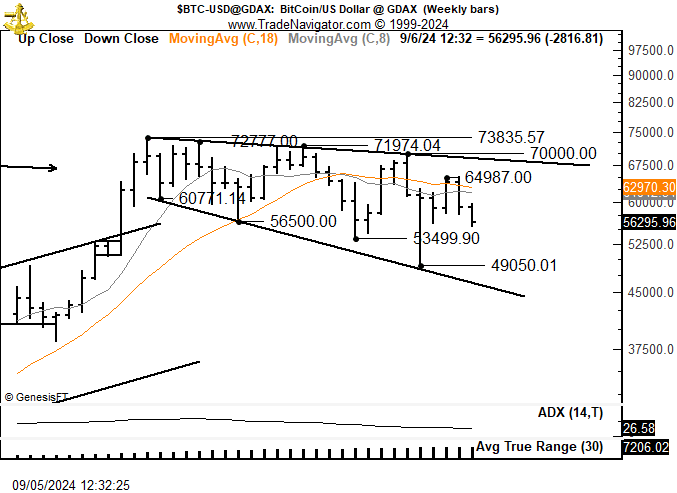

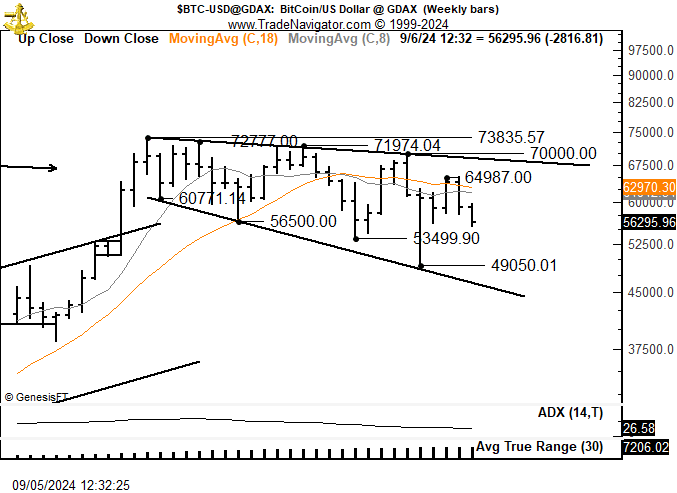

For his part, Peter Brandt suggested that BTC would sell more than buy given the current megaphone price chart pattern. In the worst-case scenario, Brandt predicted that BTC could fall to $46,000.

Source: X/Peter Brandt

On the contrary, some market insiders remain optimistic in the long term. Gracy Chen, CEO of crypto exchange Bitget, told AMBCrypto that the September losses would be the “last drop” before a possible BTC rally in the fourth quarter and 2025.

“The recent market decline in early September is often referred to as the ‘last drop’, with prices expected to reach new highs by the end of the year. Many analysts remain quite optimistic about Bitcoin’s price prospects for the fourth quarter of 2024.”

Given the bullish long-term outlook, Chen predicted that BTC could rise above $100,000 by November.

“In a scenario without black swan events, Bitcoin could potentially break the $100,000 threshold in November, undergo a correction and then begin its climb to $200,000.”

BTC was valued at $56.4k at the time of writing as traders and investors waited for the US Jobs report.