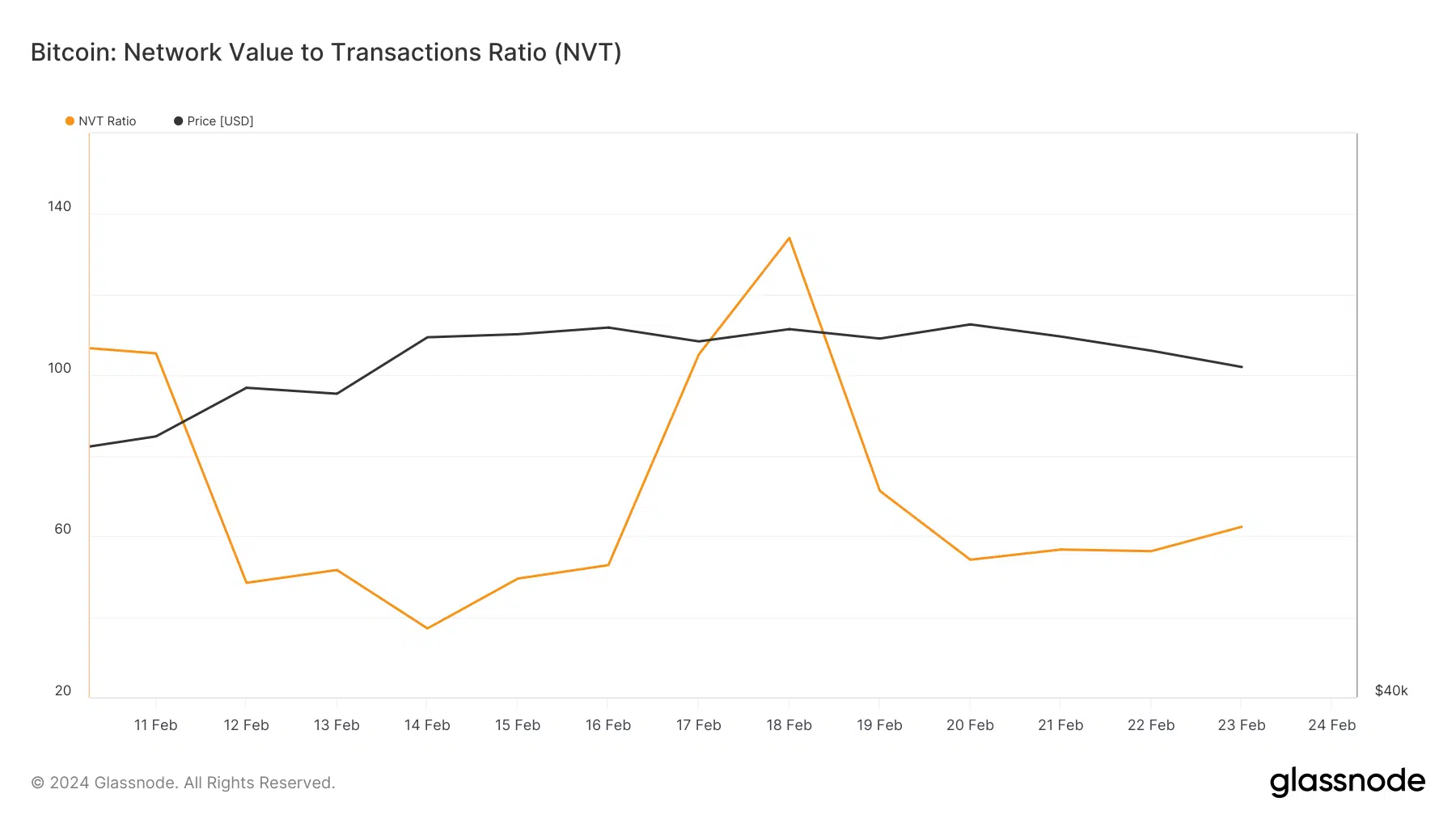

- BTC’s NVT ratio fell, meaning it was undervalued.

- A few metrics and market indicators looked bearish on Bitcoin.

After crossing the $50,000 limit, Bitcoins [BTC] Momentum slowed again as the value moved sideways. In fact, the price of the king of cryptos was floating between a price range, indicating a few more slow-moving days to come.

Bitcoin is slowing down

After growing nearly 30% in the past 30 days, BTC’s price action became sluggish once again. This was evident from the fact that its value moved only marginally in recent days.

At the time of writing, BTC was trade at $50,948.23 with a market cap of over $1 trillion.

Coinglass’ recently tweet also pointed out that the price of BTC moved between $52k and $50.5k. These levels also acted as resistance and support levels of BTC respectively.

If the price of BTC manages to break out of the resistance zone, there is a good chance that BTC will reach $55,000.

However, if the opposite happens and BTC falls below its support zone, investors could witness a further downtrend. Therefore, to gain more clarity, AMBCrypto checked BTC’s on-chain data.

We found that BTC’s Network Value to Transactions (NVT) ratio registered a decline in recent days. Whenever the measure falls, it indicates that an asset is undervalued, indicating that there are opportunities for a price increase.

A few other metrics also looked bullish. For example, according to our analysis of CryptoQuant’s factsBitcoin’s foreign exchange reserve fell. This meant that the buying pressure on the currency was high.

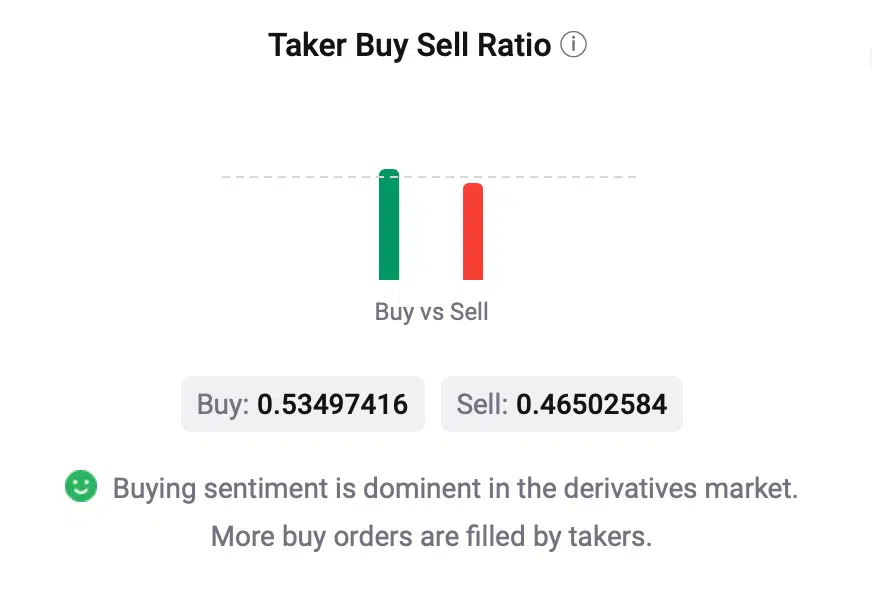

Moreover, buying sentiment was also dominant in the derivatives market, which was clearly reflected in the buy/sell ratio of green buyers.

Problems still remain for Bitcoin

While the aforementioned metrics looked bullish, a few others suggested otherwise and hinted that BTC’s price might as well reach its support level in the coming days.

AMBCrypto reported rather that BTC could witness a short-term price correction as there was a movement of coins from long-term holders (LTHs) to short-term holders (STHs).

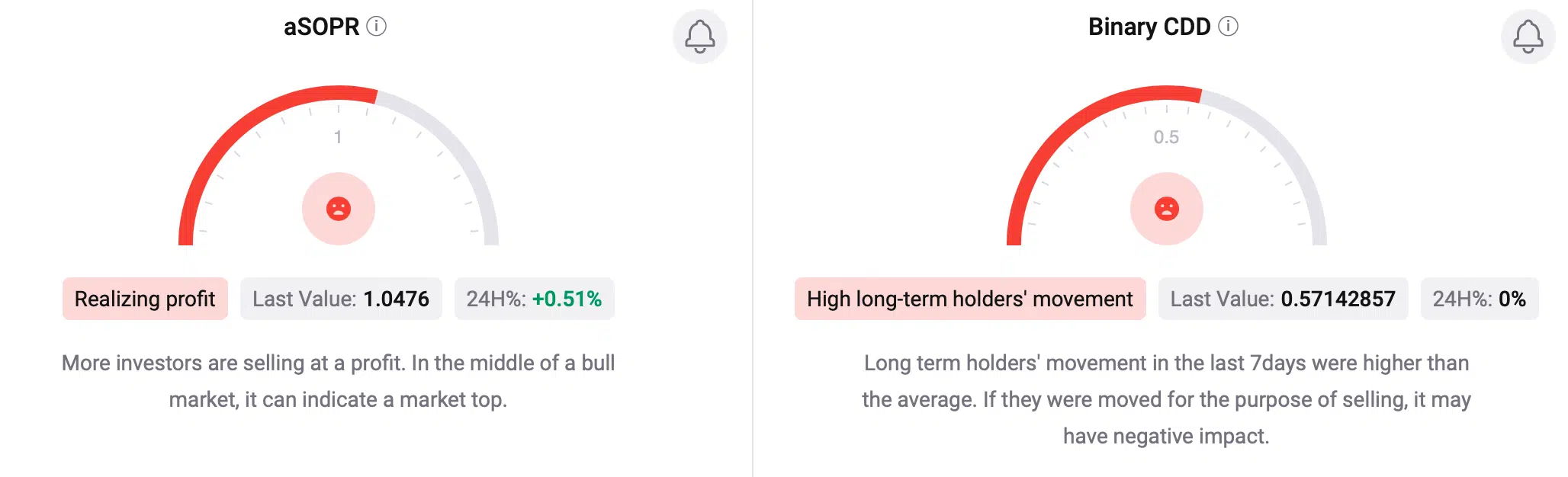

The token’s binary CDD remained red, meaning that long-term holders’ moves over the past seven days were higher than average.

The aSORP was also red. This suggested that more investors were selling at a profit. In the middle of a bull market, this could indicate a market top.

A look at BTC’s daily chart revealed other bearish indicators. The MACD showed a bearish crossover.

Read Bitcoins [BTC] Price prediction 2024-25

Both the currency’s Relative Strength Index (RSI) and Money Flow Index (MFI) registered a decline. These statistics suggested that the probability of a decline in the price of BTC was high.

Nevertheless, the price of BTC remained above the 20-day simple moving average, as depicted by the Bollinger Bands. This can serve as support and help BTC’s recovery.