- Bitcoin posted losses of 14% in the past six days.

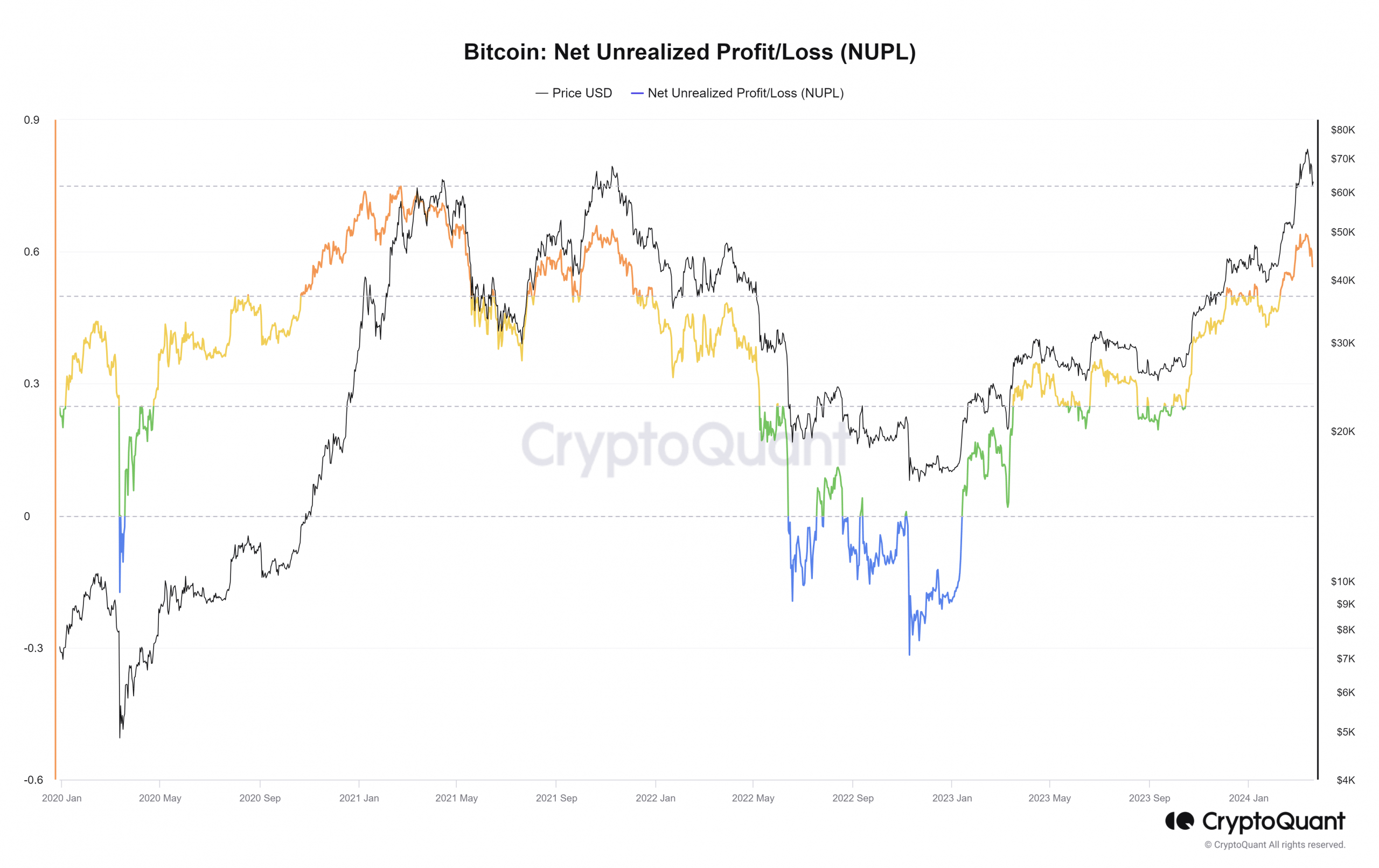

- The NUPL generally does not remain above +0.6 for long periods of time.

Bitcoin [BTC] recorded losses of 7.2% in ten hours before press time. BTC’s withdrawal was live, as AMBCrypto previously reported. However, the support region at $64.8k failed to stop the bearish advance.

An analyst posted CryptoQuant’s insights page on how the current Bitcoin uptrend could be nearing its end. They examined the NUPL metric and what it could mean for BTC investors.

Bull run conditions even before the halving

The net unrealized gain/loss (NUPL) is a useful tool for identifying when investors are making a profit. The calculation includes Bitcoin’s realized limit to better understand investor profitability.

The analyst noted that the NUPL metric rarely stays above 0.6 for long. A +0.6 value for this measure is usually followed by a sharp price correction, although this trend is broken during bull runs.

From December 2020 to April 2021, the NUPL was consistently above +0.6 as Bitcoin rose from $19,000 to $60,000.

On February 28, the NUPL climbed above +0.6 again. Bitcoin sailed past $73,000 but couldn’t hold on. Since March 16, NUPL has fallen below +0.6, and the price was $63k at the time of writing.

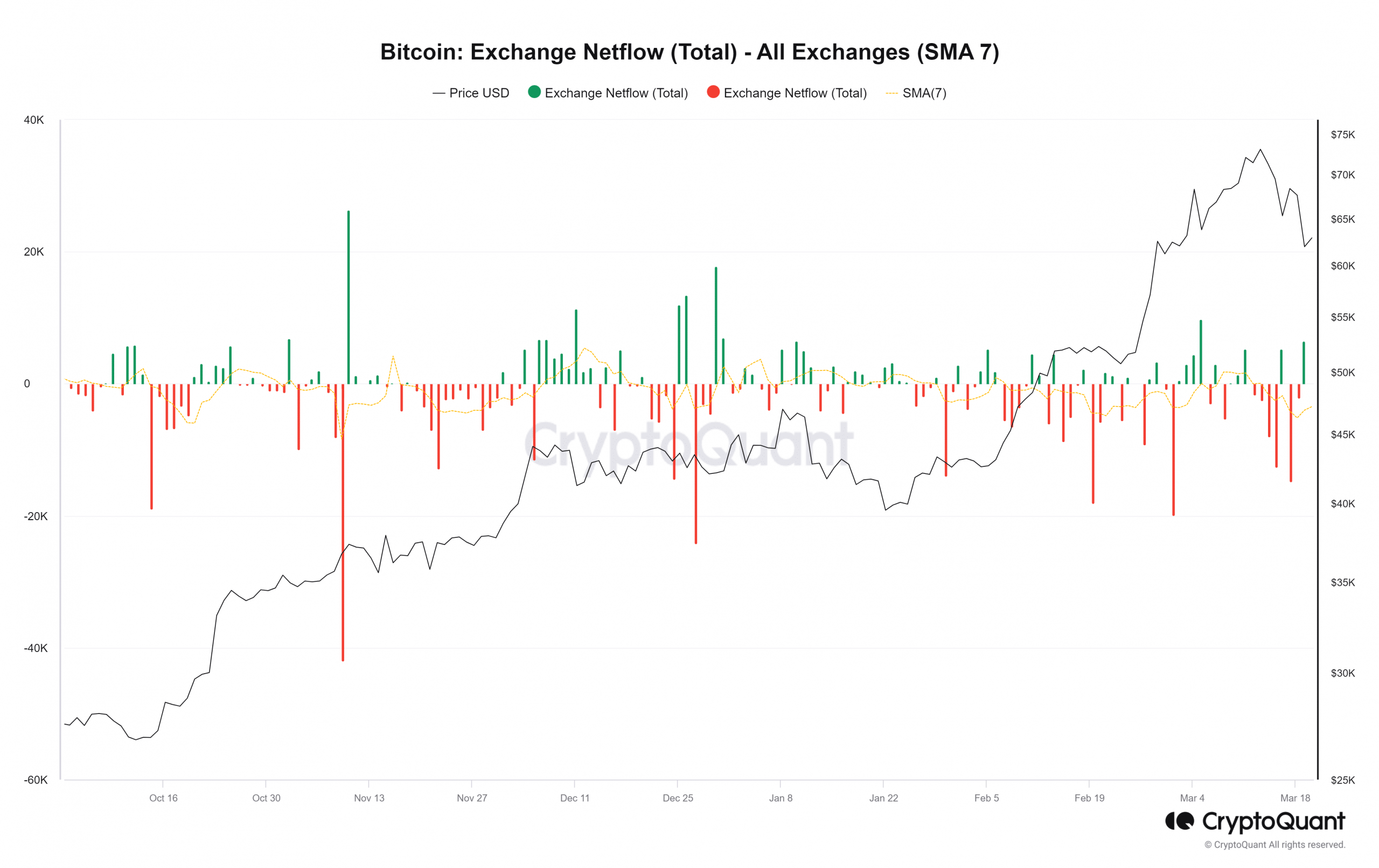

The short-term outlook favored a deeper correction towards $58,000. On the other hand, Bitcoin continued to leave exchanges over the past week. This was a sign of accumulation.

The BTC net flow chart showed more BTC leaving centralized exchanges than entering, even as prices started to retreat from the $73,000 mark.

Long-term investors remained firmly convinced

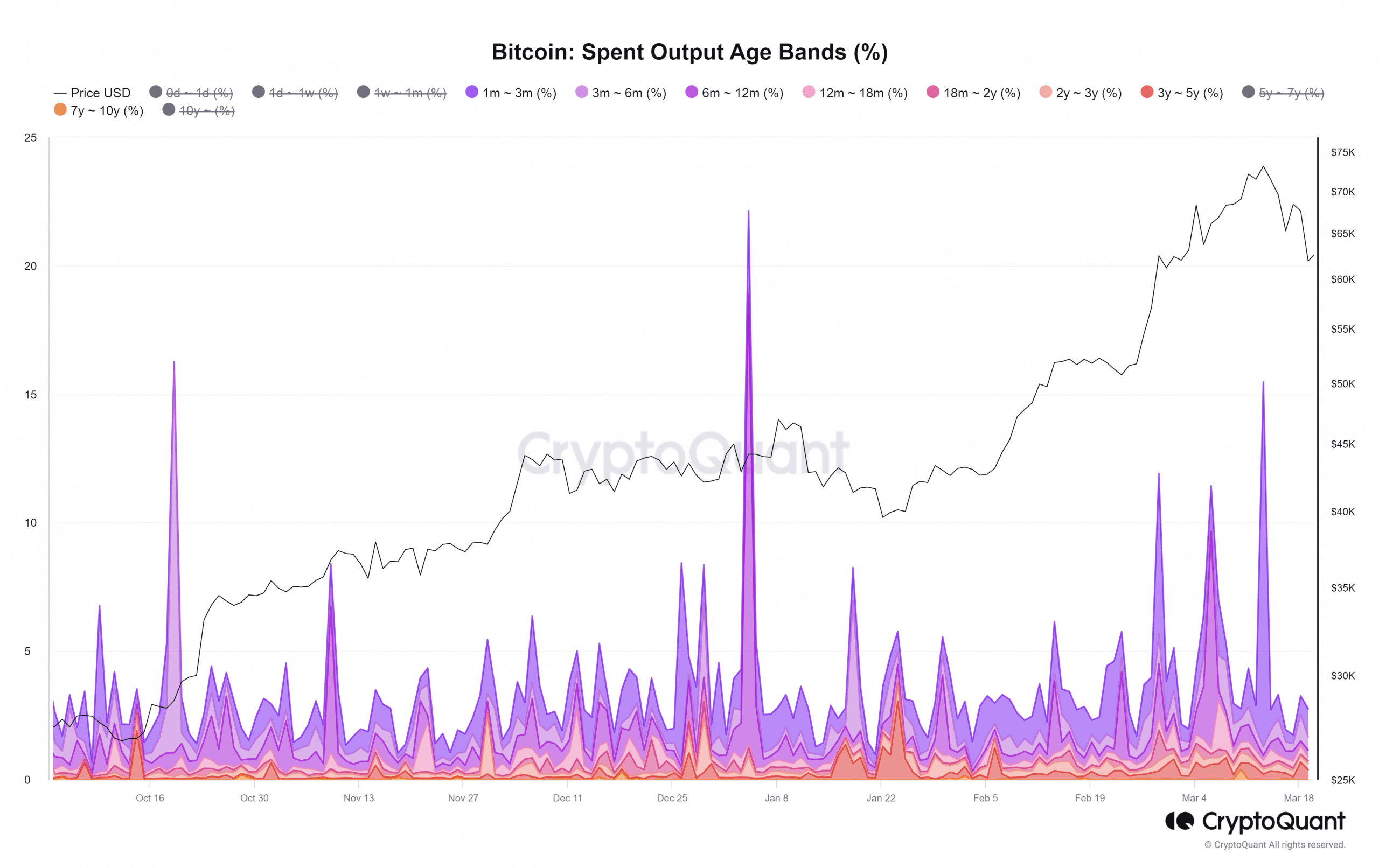

The spent output age ranges saw a large spike in spent output from holders whose BTC was only 1-3 months old as of March 13. This meant that short-term holders made profits. Similar spikes in late February and early March also saw holders selling as prices rose higher.

However, only a few of the longer-term holders, whose coins were a year or more old, did not give up their assets as prices recently fell below the $70,000 level. This showed confidence in Bitcoin.

Is your portfolio green? Check the BTC profit calculator

But we must remember that their behavior is not a perfect guide to Bitcoin’s trends. Sometimes long-term holders panic and sell en masse even when BTC hits a long-term low.

A recent AMBCrypto report explored how the current retracement could play out over the next four to six weeks. Bitcoin’s halving cycle appeared to be repeating itself, but long-term investors don’t have to worry about short-term price volatility.