- According to CryptoQuant data, BTC could expect to hit $84K next.

- There was more room for BTC growth amid renewed whale betting.

On October 29, Bitcoin [BTC] touched $73,000 and extended its market dominance to a new high of 60%. The additional rally brought the stock closer to a new all-time high (ATH), as analysts predicted more growth potential.

Is $84,000 the next goal?

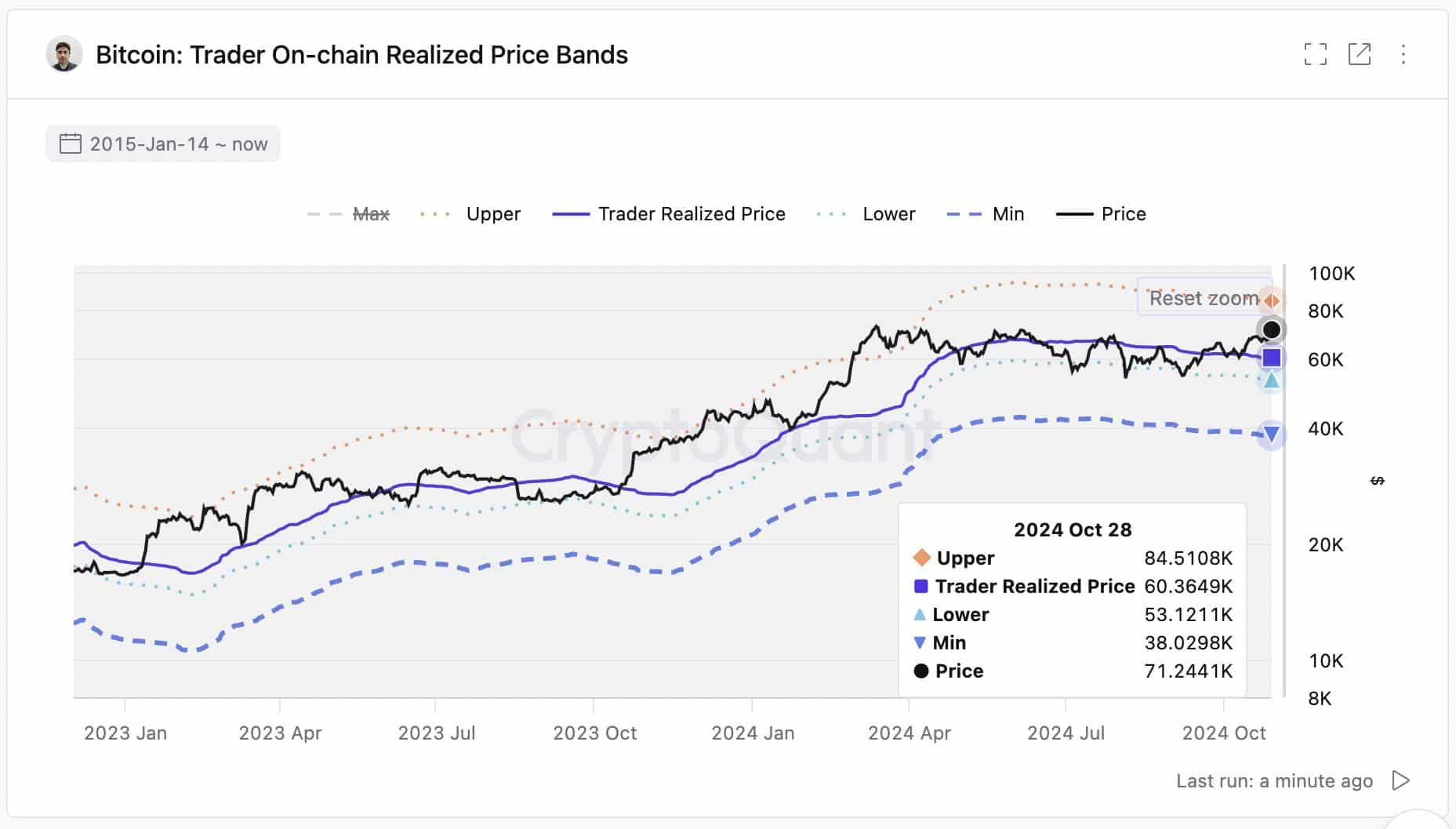

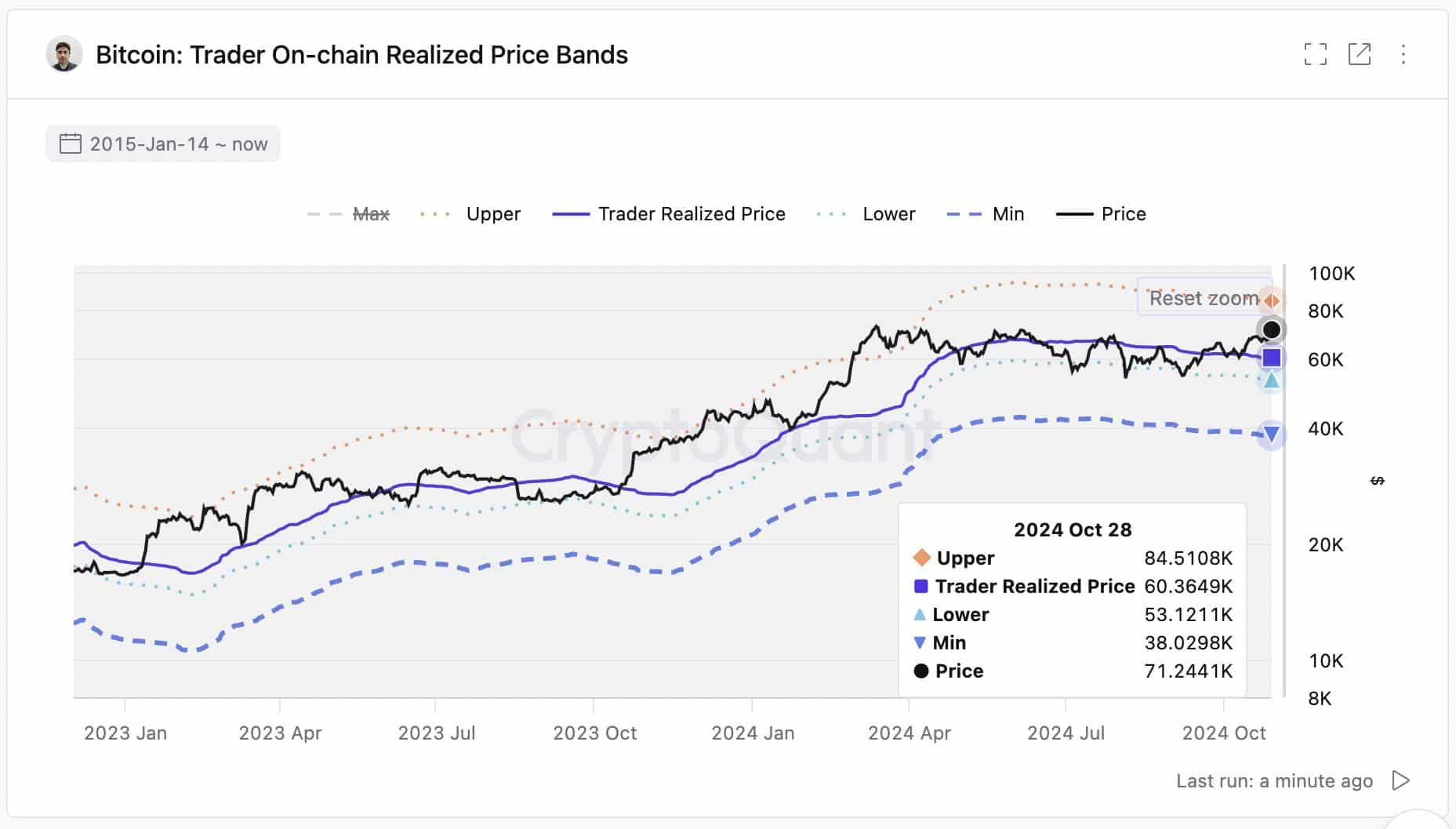

According to CryptoQuant’s head of research, Julio Moreno, the next target would be $84K if the March ATH of $73.7K was approved. He said,

“Bitcoin is near a new ATH. From a valuation perspective, $84,000 would be the next target (the “upper” band.”

Source: CryptoQuant

For the unfamiliar, the price band achieved by the on-chain trader is a valuation metric based on historical BTC price data.

It uses the realized price (the average cost basis for short-term BTC traders) as a reference point, with upper and lower bands as resistance and support levels.

Since the current price action was above the realized price, the next and immediate target was the upper band (resistance) at $84K, provided BTC prices remained above $60K.

Well, the $84,000 goal isn’t far-fetched considering that BTC Options Traders were looking at $80,000 at the end of November, regardless of the outcome of next week’s US elections.

That said, the current market structure also showed more room for growth, as noted by Mathew Siggel, VanEck’s head of digital asset research.

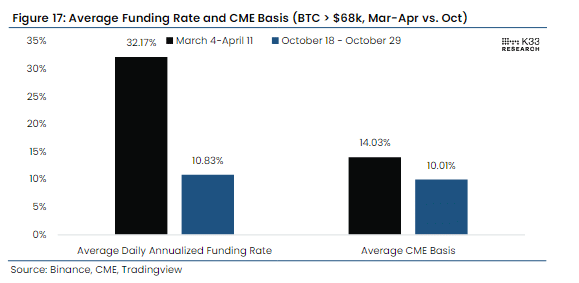

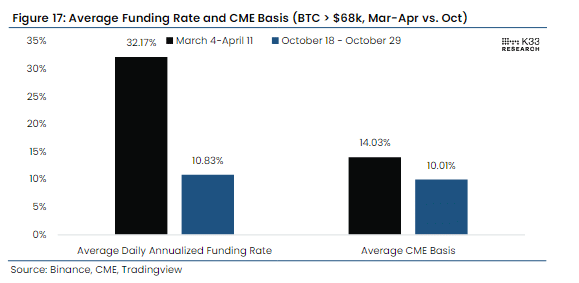

Siggel said that despite BTC approaching new ATH, the market was not as overheated as in March/April.

“Previous BTC spikes coincided with rising bounties for perpetrators, and that is hardly the case today. Additionally, current spot volumes are at half of March/April, indicating substantially less panic buying by retail participants – a welcome observation for continued strength.”

Source: K33 Research

In short, the market was more stable and healthy, unlike the massive euphoria we saw in March when BTC hit a new ATH.

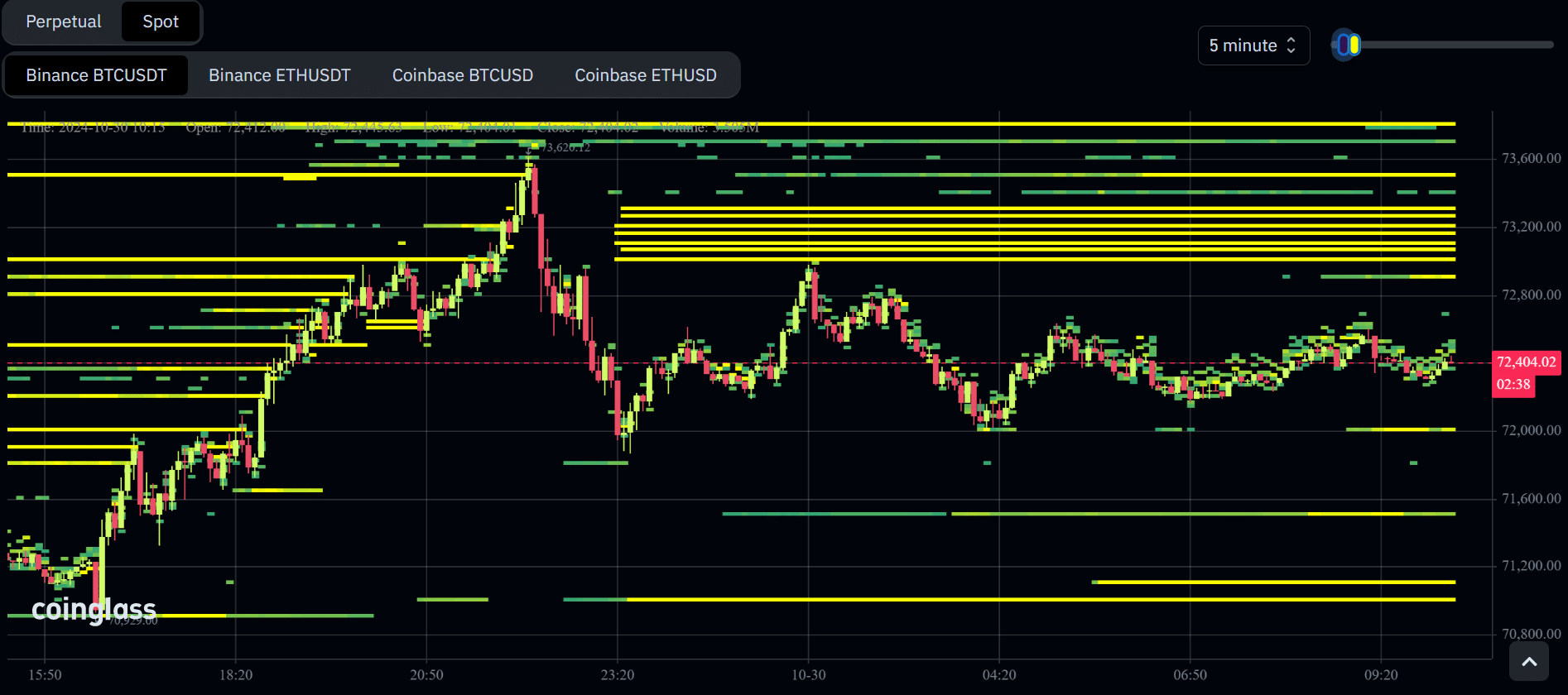

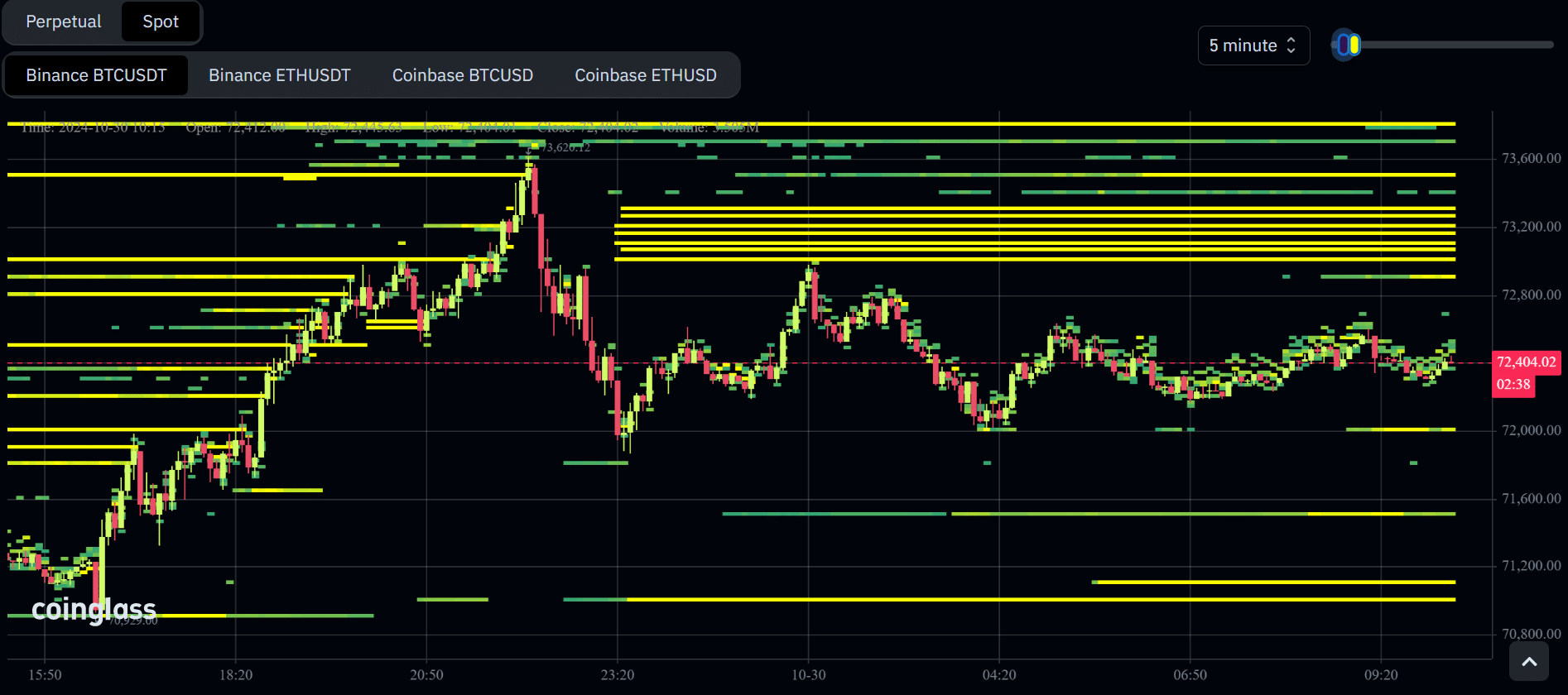

But there was a small short-term caveat. There were significant ones sell walls (yellow lines at $73.2K and $73.8K) on the Binance spot, right at the March ATH, which could become a roadblock for a few hours or days.

Source: Coinglass

Read Bitcoin [BTC] Price prediction 2024-2025

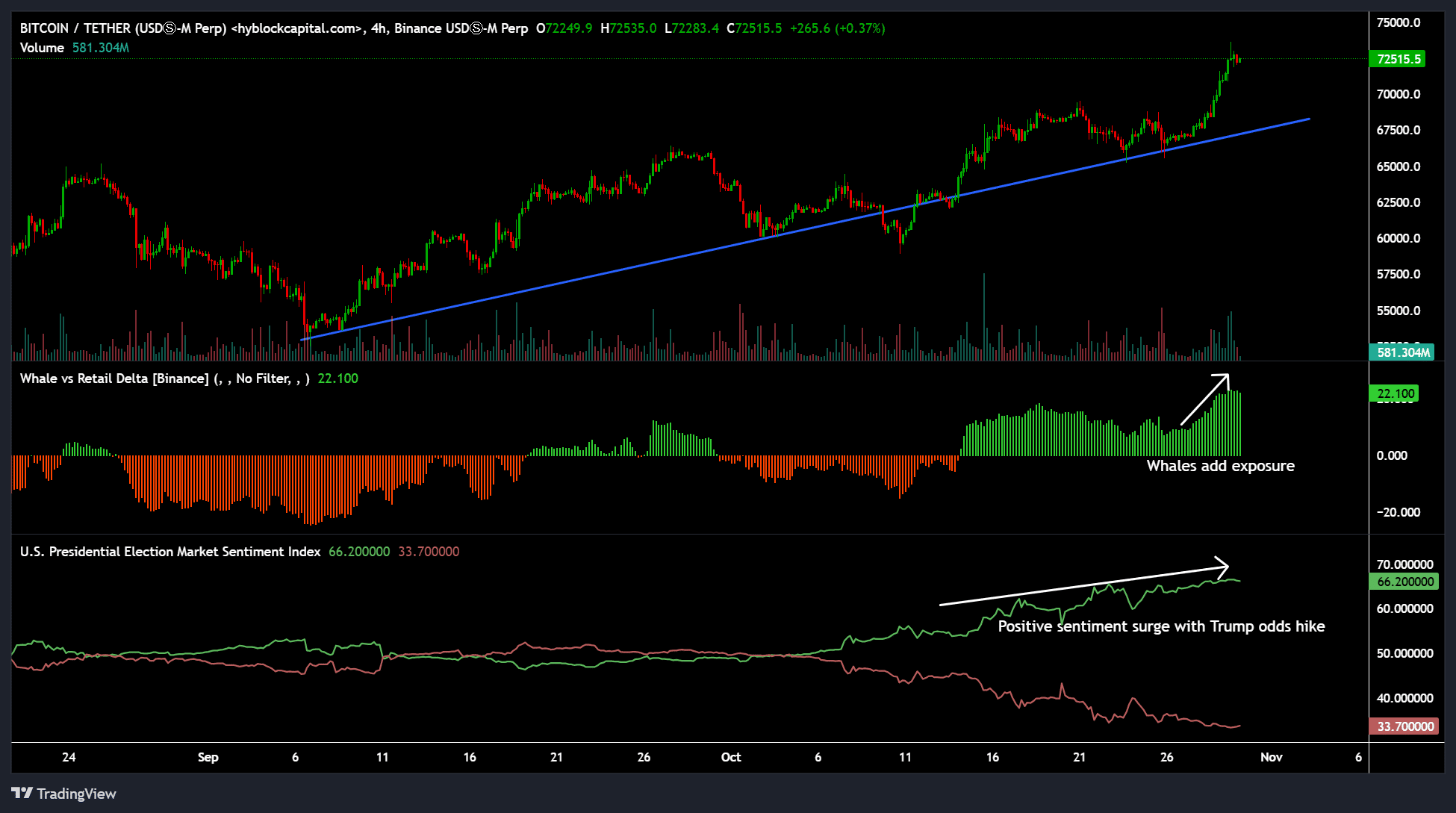

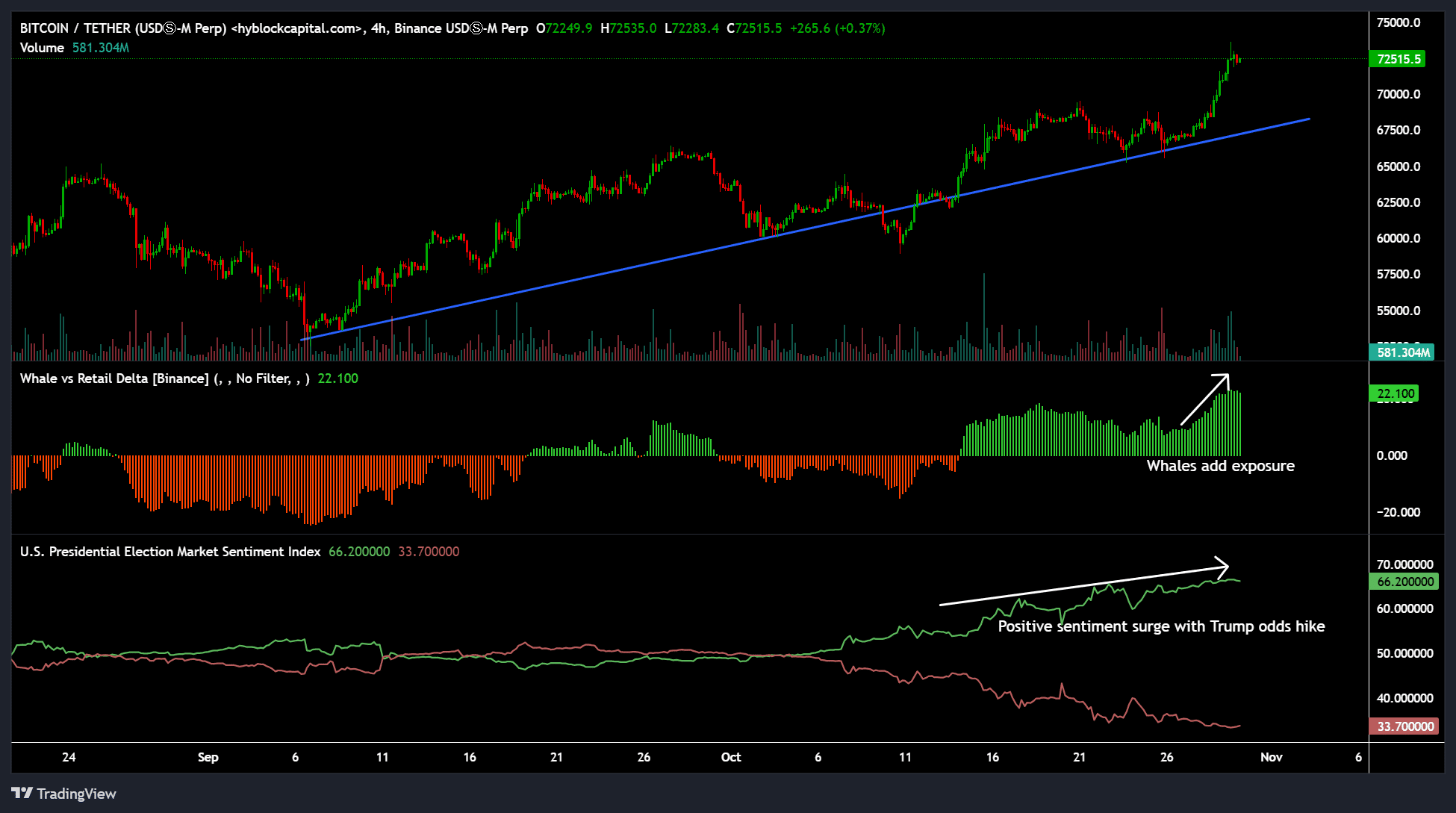

Nevertheless, the whales remained adamant and showed high positive beliefs. In fact the run-up to $73K seemed to be largely driven by big players as they added more exposure over the past five days.

This was illustrated by the rising Whale to Retail Delta indicator, which suggests that major players were more optimistic about BTC than retail at current levels.

Source: Hyblock