- The six- to twelve-month holding cohort has contributed to Bitcoin’s recent price stagnation below $100,000.

- Declining whale transactions and reduced Open Interest indicated a possible sideways move in the short term.

Bitcoins [BTC] Price developments in recent weeks have remained muted, with limited upward movement, despite market expectations for a year-end rally.

Since mid-December, Bitcoin has failed to maintain levels above $100,000, mostly fluctuating between $94,000 and $95,000.

This price range reflects a decline of 5.8% over the past week. At the time of writing, Bitcoin is trading at $95,657, marking a further decline of 2.5% in the past 24 hours.

Who benefited during the $100,000 range?

Amid this market stagnation, analysts have turned their attention to investor behavior to better understand the factors behind Bitcoin’s price movement.

A CryptoQuant analyst, Yonsei Dent, has highlighted insights from the Spent Output Age Bands (SOAB) indicator.

This metric tracks Bitcoin selling activity based on investors’ holding periods, providing a clearer picture of the selling pressure among different market participants.

The facts reveals that six- to twelve-month holders have been the most active sellers during the recent Bitcoin rally, mainly benefiting from the gains made during the market’s upward move earlier this year.

Source: CryptoQuant

Interestingly, these investors, who likely bought Bitcoin around the time of the spot ETF launch in early 2024, have been a major source of selling pressure, contributing to the current price stagnation.

However, long-term holders – those who have held Bitcoin for more than a year – appear to have sold relatively little during this period.

Additionally, the Binary CDD (Coin Days Destroyed) indicator shows a decline in sales of older Bitcoins in December compared to November.

So many long-term investors remain optimistic about future price increases and hold on to their positions.

Mixed sentiment on the market

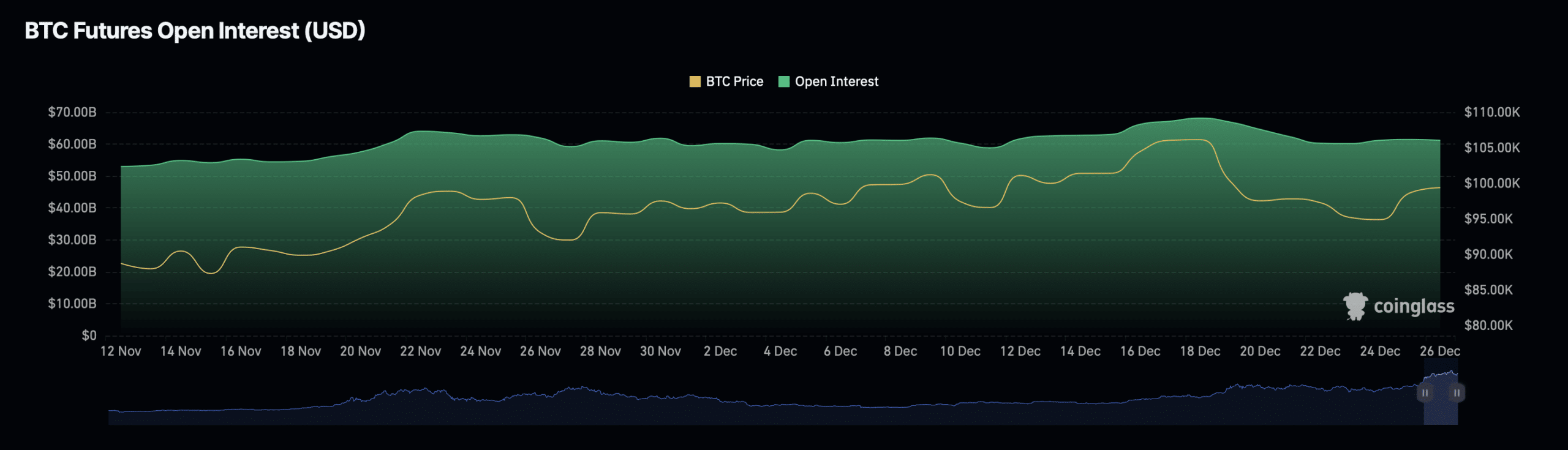

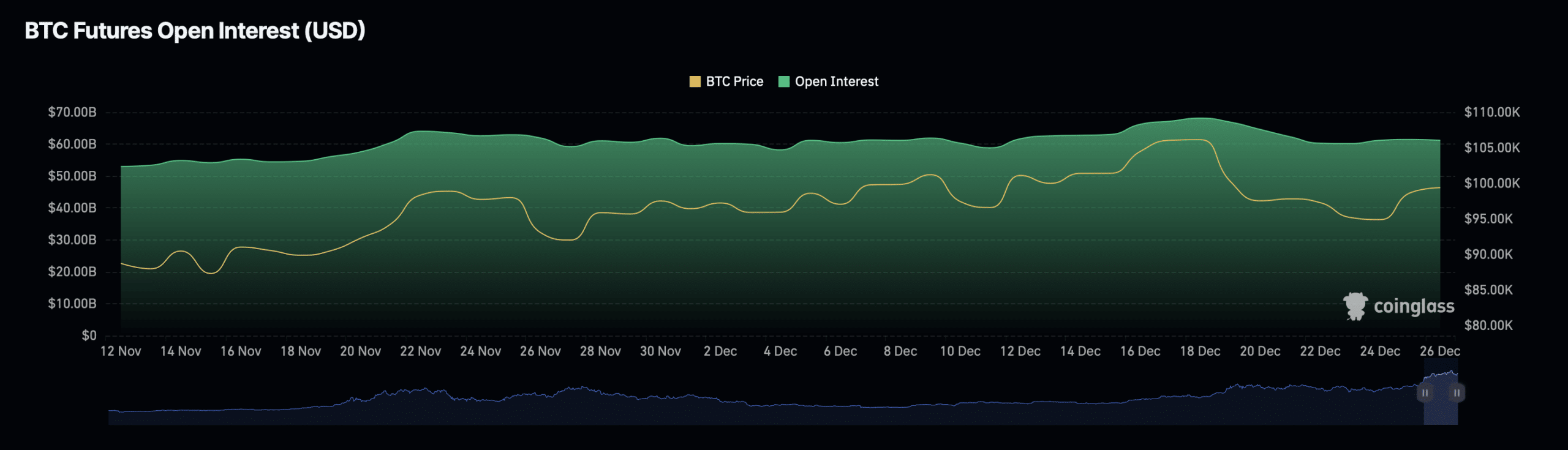

Furthermore, Bitcoin’s Open Interest provided additional insight into the direction of the market.

Open Interest represents the total value of outstanding Futures contracts and serves as a barometer of market sentiment and liquidity.

According to facts from Coinglass, Bitcoin open interest fell 0.69% to a valuation of $60.68 billion.

Source: Coinglass

Bitcoin Open Interest volume also fell 1.45% to $94.14 billion.

These declines indicate a decline in speculative trading activity, suggesting traders are being cautious amid Bitcoin’s stagnant price movements.

Lower open interest often indicates reduced market participation, which can limit significant short-term price movements.

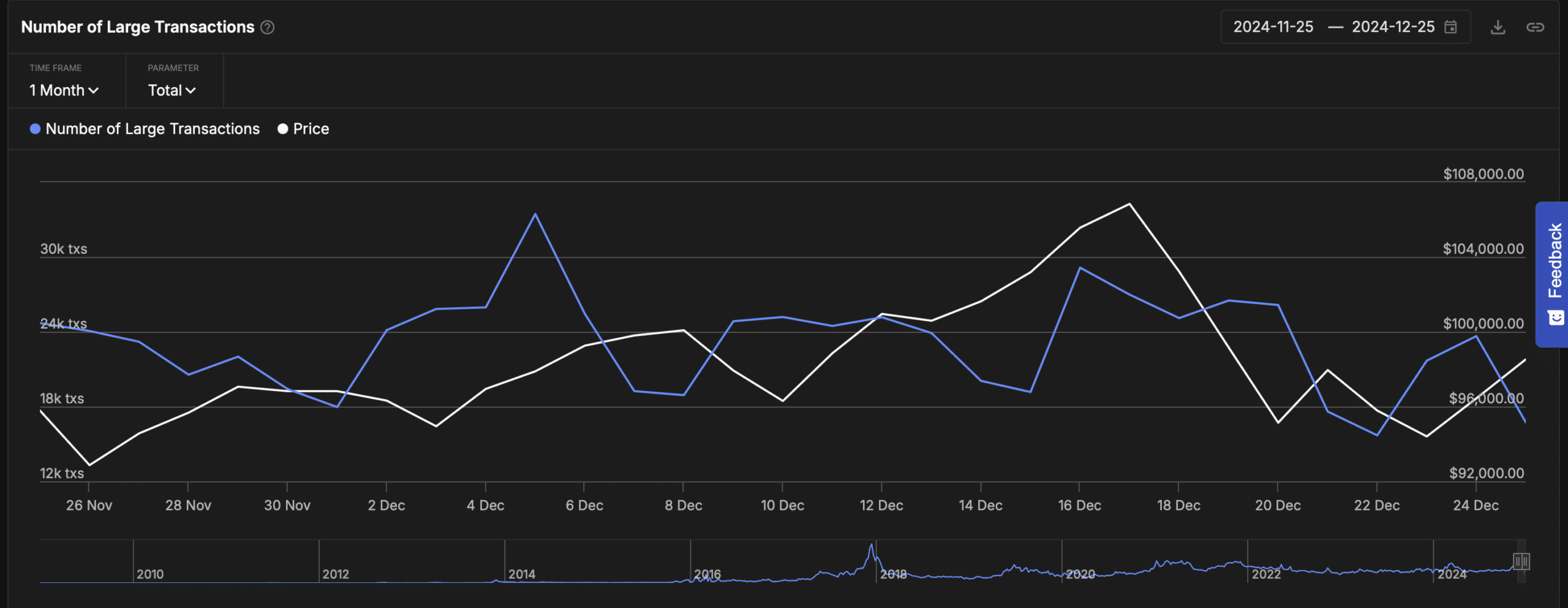

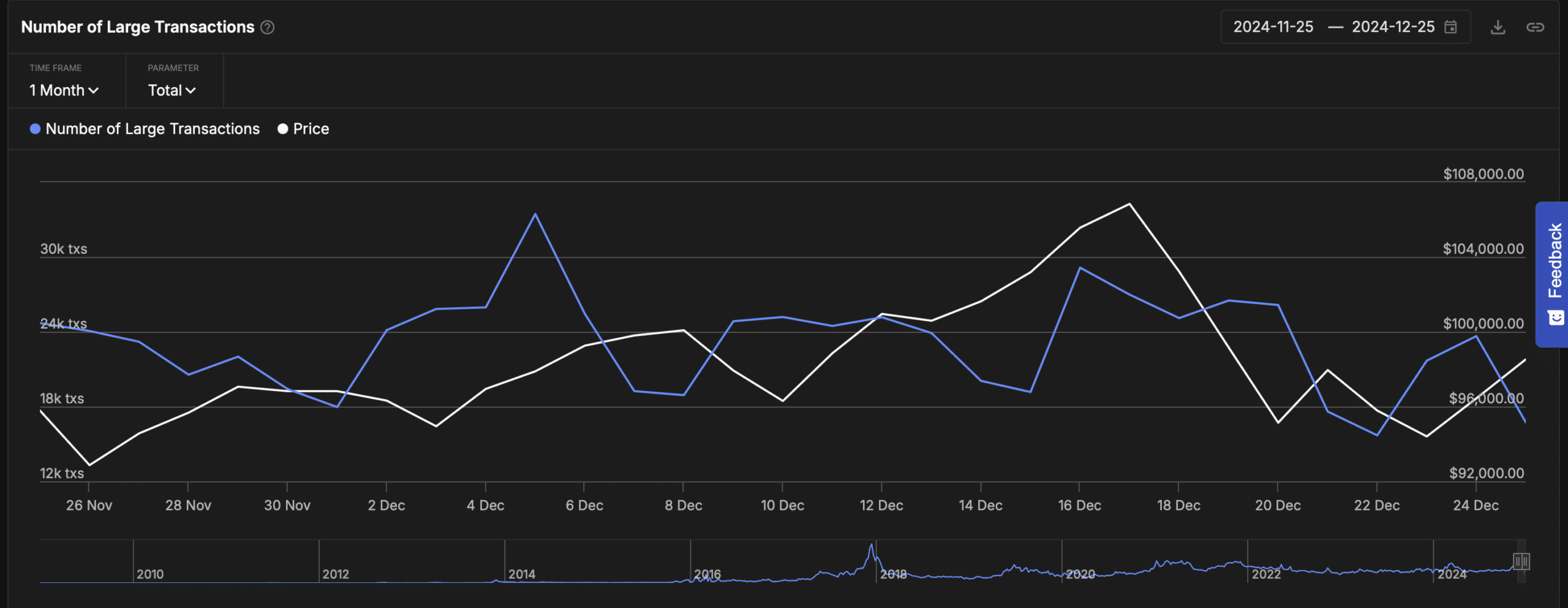

Meanwhile, Bitcoin’s whale transaction activity has fallen sharply over the past month.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Data from InTheBlok revealed that transactions above $100,000 have decreased significantly, from almost 40,000 transactions in early December to just 16,700 on December 25.

Source: IntoTheBlock

Whale trades are often seen as a strong indicator of institutional or high-net-worth investor activity, and a decline in these trades signals reduced market confidence or a temporary pause in large-scale accumulation.