- Using the coinblocks models, Cointime Economics can determine BTC’s movement.

- The on-chain metric can also identify the liveliness or inactivity of the network.

After 18 months of intense research, a new on-chain metric has been added to the Bitcoin [BTC] clan. And the initiators are none other than on-chain analytic platform Glassnode and global asset management firm ARK Invest.

How much are 1,10,100 BTCs worth today?

As you are probably aware, on-chain metrics play a crucial role in understanding the dynamics of the Bitcoin network and market sentiment. For ARK Invest’s research associate David Puell and Glassnode’s lead analyst James Check, calling this new metric “Cointime Economics” was the best tag to give the metric.

Also, if you are familiar with the on-chain landscape, you’d realize that Puell, the famous creator of the Puell Multiple, is not new to introducing metrics. Check, on the other hand, has also been recognized for his work in contributing to metric development on the Glassnode platform. So, what exactly is the Cointime Economics?

Coinblocks to the rescue?

According to the collaborative research paper, Cointime Economics would act as a fungible measurement of Bitcoin’s supply and demand. In evaluating the metric, Check and Puell noted that some existing metrics need to be considered.

These metrics include the Market Value to Realized Value (MVRV) ratio, the Bitcoin inflation rate, and volume-weighted cost.

Based on the information from the report, a combination of the metrics would help identify Bitcoin’s valuation, activity, and economic state. This, then, leads to the introduction of the coinblocks. The paper explained the term as:

“Coinblocks are the product of the number of Bitcoin and the number of blocks produced during the period in which those Bitcoin remained unmoved.”

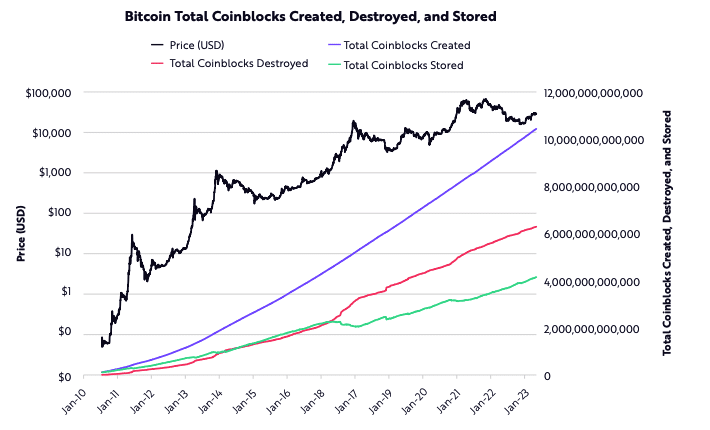

But it does not end there. To assess Bitcoin’s economy, value, or network activity, the Coinblocks Created (CBD), Coinblock Destroyed (CBD), and Coinblocks Stored (CBS) would play different roles.

The CBD measures the time-weighted turnover of Bitcoin’s volume, or the number of Bitcoins moved in a given period, holding period, or the time held before moving.

Destruction equals capitulation

So, when there is heavy coinblock destruction, it suggests that long-term holders are selling. It also implies that Bitcoin’s “smart money” trades from lower cost bases while generating higher profits.

Thus, major spikes in coinblocks destroyed have had a high correlation with a peak in Bitcoin’s price.

On the other hand, Coinblocks Stored (CBS) represents the total number of coinblocks or the difference between total coinblocks created and total coinblocks destroyed.

When CBS is negative over a period of seven days, it means that the number of coinblocks destroyed has surpassed the number created. This suggests the movement of a substantial number of old coins in a short period of time.

When the CBS is positive, it implies that coinblocks created have surpassed the number of coinblock destroyed. In this case, it would mean that fewer old coins have moved within a short period.

Lastly, the Coinblocks Created (CBC) represents the total cointime created in the Bitcoin network, irrespective of the coin movement. By combining all the parameters, Glassnode and ARK Invest considered what happened in 2017 when CBD surpassed CBS.

Source: ARK Invest and Glassnode

From the chart above, the research paper concluded that Cointime Economics was building blocks over time. It mentioned that at this point:

“More coins were active in the market as opposed to lost or strongly dormant.”

How lively is the economy?

Another model derived from the report to understand Bitcoin’s economic state was by using liveliness and vaultedness. For context, Bitcoin liveliness is a value from 0 to 1 which shows the rate of liquidation from long-term holders.

If liveliness increases, then long-term holders are liquidating positions. However, a decrease in the metric suggests that holders have decided to continue HODLing. Furthermore, Vaultedness measures the inactivity of the network.

In a case where liveliness increases to 1, then there will be no Bitcoin holders. And when vaultedness reaches 1, it means miners have never sold any of their BTC.

Source: ARK Invest and Glassnode

To check for Bitcoin’s economic position, the Cointime Economics also considers the nominal and adjusted inflation rate. By definition, the inflation rate is the percentage of new coins divided by the current supply.

Lower inflation rate for BTC

So, in order to explain this, Puell and Check examined what happened with the metrics between 2013, and 2017, and at the time of writing. The conclusion was

“Conversely, from 2013 to 2017, cointime inflation reached parity with nominal inflation, then has surpassed it as of the day of this publication.”

Realistic or not, here’s BTC’s market cap in ETH terms

At press time, the nominal and cointime adjusted inflation rate suggested that inflation was being underestimated. This was because of the slow BTC appreciation, which was much lower than in earlier years.

Source: Ark Invest and Glassnode

While the Bitcoin Cointime Economic is still in its early days, there’s no denying that the metric may offer more insight into market sentiment. Smart money traders may also need to assess other factors alongside the metric to get a full picture of what it offers.