- Bitcoin’s price was expected to be somewhere between $50,000 and $73,000.

- The market fell prey to fake news surrounding the approval of ETFs.

The crypto market was buzzing with excitement over the likely approval of about half a dozen Bitcoin [BTC] Pursuing ETF applications, hoping it would spur the next wave of investment in the space and free it from the grip of the long-term bear market.

How much are 1,10,100 BTCs worth today?

A new dawn of hope

Remarkable, Ark Invest and 21Shares were the early movers when it came to filing a spot Bitcoin ETF. The pair previously submitted the application in April, followed in June by a flood of applications from other TradFi giants such as BlackRock, the world’s largest digital asset manager.

If approved by the US Securities and Exchange Commission (SEC), these financial instruments would provide an easier way to gain exposure to crypto assets.

A Bitcoin ETF allows investors to gain exposure to Bitcoin’s price movements without actually owning the asset directly. Unlike a futures ETF, which already exists, a spot ETF involves holding Bitcoin as the underlying asset. So when investors buy shares of a spot ETF, they are essentially buying a representation of actual Bitcoin.

Clearly, asset managers would have to buy a lot of Bitcoins in the market to tie the ETF to the real-time value of the crypto. This factor has contributed to the feverish interest in spot ETFs.

With that said, can we evaluate the quantitative impact of these financial instruments on Bitcoin’s market value?

Bitcoin price rises…

Popular on-chain analytics company CryptoQuant predicted a capital inflow of $155 billion into the Bitcoin market following approval of the ETFs.

The firm arrived at this figure by assuming an allocation of 1% of asset managers’ total assets under management (AUM) – approximately $15.6 trillion – into spot ETFs.

When new capital enters the market and investors snap up Bitcoins at a higher price, the realized limit typically sees an increase. Realized limit values an asset based on the price of each of his coins when they last moved, instead of market value.

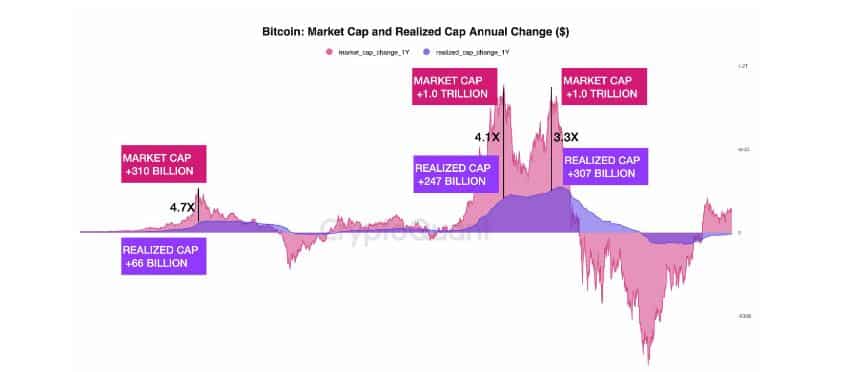

On the other hand, more conventional market capitalization could potentially rise faster than realized capitalization. This was because the market capitalization would revalue all coins in circulation.

This was evident from the graph below. During the bull markets of 2017 and 2021, market capitalization grew three to five times higher than realized capitalization.

Source: CryptoQuant

This relationship, also called the MarketCap-RealizedCap Elasticity, remained in the range of 3-6 during bull markets. Based on this, it was predicted that Bitcoin’s market capitalization would increase between $450 and $900 billion if $150 billion were invested in the market through spot ETFs.

Furthermore, if the market cap rises in the manner indicated above, this could send Bitcoin’s price to anywhere between $50,000 and $73,000. At the time of writing, BTC was valued at $28,350, per CoinMarketCap. This would mean a growth of 80% to 160%.

It was interesting to compare this scenario with the largest Bitcoin fund in the world, Grayscale Bitcoin Trust (GBTC), during the last bull cycle. As BTC soared, GBTC saw its realized cap increase by just $5.5 billion, a fraction of the expected $155 billion capital injection via spot ETFs.

Source: CryptoQuant

Fake news reduces ETF approval chances?

In recent months, the crypto market has mainly responded to developments surrounding spot ETFs, while other catalysts took a back seat. However, when the market is stressed, it is exposed to the flood of unconfirmed information.

The drama unfolded on Monday when a popular crypto media platform posted fake news about the approval of BlackRock ETFs on X (formerly Twitter). The news went viral and sent BTC soaring to almost $30,000.

Is your portfolio green? Check out the BTC profit calculator

However, when the outlet backed out and relented on his behalf, the King’s coin quickly fell to $28,000.

Popular crypto market analyst Adam Kochran slammed the media platform, accusing it of jeopardizing ETFs’ chances of approval over the blunder.

I look forward to them providing documentation on where that report came from.

Because they greatly damaged the chances of real ETF approval and/or blatantly scammed people. https://t.co/Nyd2LJfzIo

— Adam Cochran (adamscochran.eth) (@adamscochran) October 16, 2023