- Whales have withdrawn 110,000 BTC in 30 days, which indicates aggressive accumulation and possibly upward momentum.

- Traders are highly positioned on key levels, with $ 496 million in longs near $ 102.8k and $ 319 million in shorts for $ 104.8k.

Bitcoin [BTC]The world’s largest cryptocurrency, has moved the general cryptocurrency market in recent days with its impressive recovery.

The rise seemed largely powered by whale activity, which was performed on both spot and derivative markets.

Whales withdrew 110,000 BTC, time to buy?

Since the day Bitcoin started bleeding, whales and industrial giants have taken the opportunity to buy the dip.

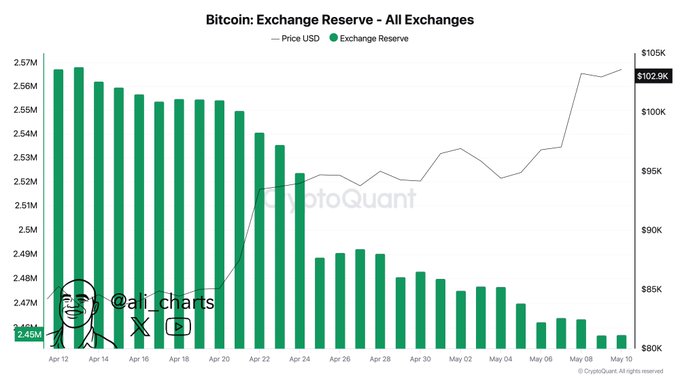

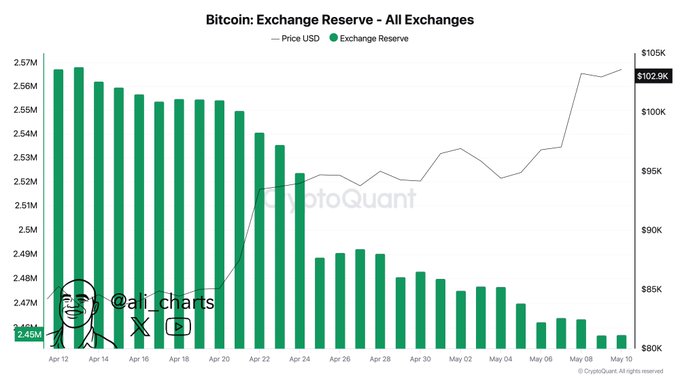

Recently a prominent Crypto -expert Shared data about Bitcoin Exchange reserves in the past 30 days, which shows that whales have withdrawn more than 110,000 BTC during this period.

This substantial withdrawal of BTC indicates potential accumulation and can cause purchasing pressure, which leads to a further upward rally, which explains the recent increase in Bitcoin.

In the meantime, whales have not yet stopped, they have continuously collected BTC.

In just 48 hours, whales added another 20,000 BTC to their wallets.

This continuous accumulation of BTC reflects the importance and confidence of whales in the active for the long term.

Source: X

Retailers the least participation

On the other hand, retail investors were largely absent during this period and were given the discharge of their participations because of panic.

According to on-chain analystsRetail usually returns in the vicinity of market tops, not during recovery or corrections.

Despite BTC trade with only 5% below the previous peak, the participation of the retail trade remained damped, possibly limiting foaming speculation – for now.

$ 500 million in bullish bets

In addition to all this, traders seem to be aligned with the current market sentiment, as revealed by the Coinglass of on-chain analysis.

Data shows that traders are currently died at the level of $ 102,819 at the bottom (support) and $ 104,871 at the top (resistance).

At these levels, traders for $ 496.55 million in long positions and $ 319.26 million in short positions.

This metric indicates that bulls are currently dominating the market, in the hope that the BTC price will not fall quickly below the support level of $ 102,819.

At the time of the press, BTC traded around $ 104,300 – a maximum of 0.75% in 24 hours. However, the trade volume fell by 7%and indicates a lower involvement.

Bitcoin -Price promotion and technical analysis

According to the technical analysis of Ambcrypto, BTC Bullish seems and it is ready for a new high. The daily graph reveals that it is actively on its way to the most important resistance level of $ 106,800.

Source: TradingView

If this upward momentum continues and the price breaks through this resistance, there is a strong possibility that BTC could experience a remarkable increase and possibly achieve a new of all time high.

BTC’s Relative Strength Index (RSI) was 74, indicating that it is active in Overbought area.

There is a strong possibility that it can experience a price correction until the RSI left the Overboughtzone.