Bitcoin’s price hasn’t had the clearest performance in 2024, despite a strong start to the year. The flagship cryptocurrency has spent most of the past two quarters in consolidation, hovering between $50,000 and $70,000.

This uninspiring performance has sparked conversations about the current cycle, with several analysts and experts predicting whether the bull run is still ongoing. One of the latest comments is from the CEO of CryptoQuant, who offered an interesting insight into the cycle in the chain.

Why are whales making less profit this cycle?

In a post on the X platform, Ki Young Ju, CEO of CryptoQuant, said revealed that the Bitcoin whales have held onto their assets this cycle. As a result, the big investors have set the record for the least profit taking compared to other cycles as the current bull run ends now.

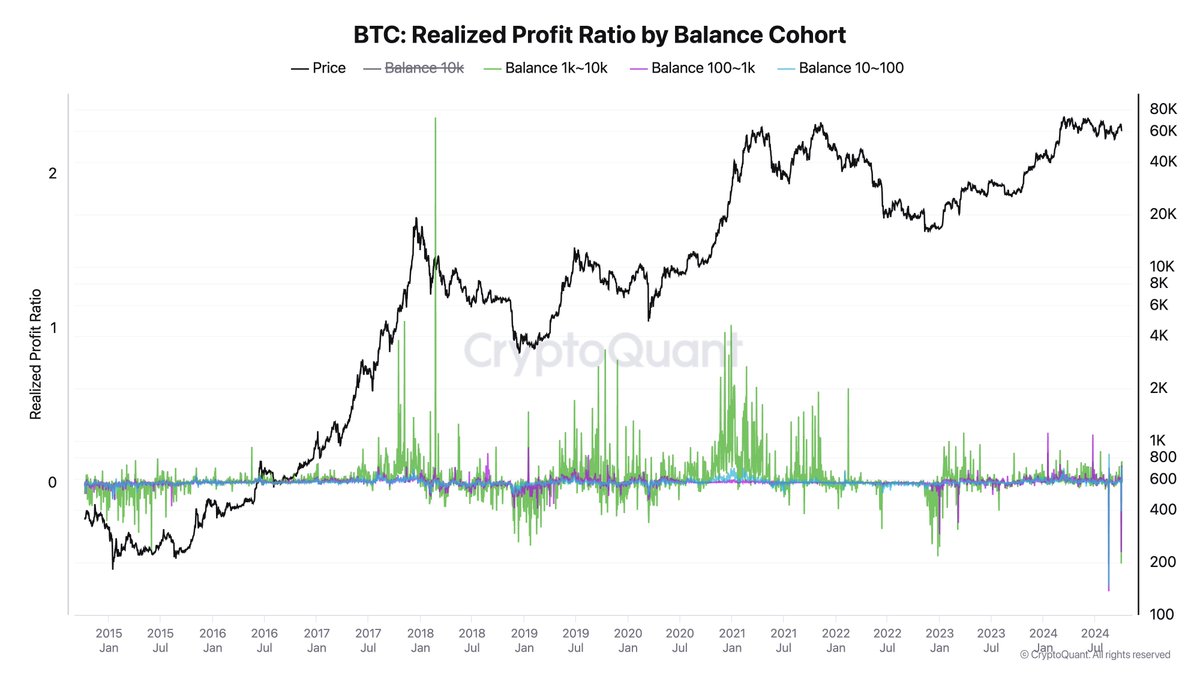

This on-chain disclosure is based on the Realized Profit Ratio by Balance Cohort metric, which measures the ratio of the number of coins sold at a profit by an investor class to the total number of coins sold at any given time. It basically evaluates the profitability of different cohorts of Bitcoin holders.

When whales’ realized profit ratio is high, it generally implies that a sell-off is likely underway, with major investors believing that prices have peaked. On the other hand, a low realized profit ratio often indicates a low level of profit-taking, meaning investors are not cutting their losses or expecting further price gains.

Current on-chain data points to a trend where the large holders have made the least profits across all bull cycles. This could mean that the Bitcoin whales still have confidence in Bitcoin’s long-term potential. Ultimately, this suggests that the current bull run is far from over and that there is a possibility that the Bitcoin price upward trend may resume.

Bitcoin ‘Dolphin’ addresses on the rise again: Santiment

In a post on X, Santiment revealed that Bitcoin’s “Dolphin” cohort, which owns between 0.1 and 10 BTC, has been growing steadily in recent months. The analyzes showed that this level of investors mainly sold at a profit in the first half of the year.

However, the number of addresses holding between 0.1 and 10 BTC has been on the rise since early July. Specifically, the 0.1 – 1 BTC wallets increased by an additional 25,671 addresses, while the 1 – 10 BTC wallets increased by approximately 4,000 addresses.

This indicates that small-scale investors may be returning to the market, which could be positive for the Bitcoin price in the coming months. As of this writing, the major cryptocurrency is valued at $61.94, reflecting a 1.7% increase in the past day.