- Bitcoin whales continued to accumulate despite the price increase, which is a sign of long-term confidence in its potential.

- Bitcoin ETFs saw massive inflows, boosting market confidence and raising questions about future trends.

The post-election impact on the crypto market has been undeniable, with Bitcoin [BTC] experienced a remarkable increase. BTC was trading at $93,515.07 at the time of writing, up almost thirtyfold in a month. CoinMarketCap.

As the cryptocurrency approaches the psychologically significant $100,000 mark, many are speculating that this milestone could be reached at any time.

Bitcoin Whale Movement Signals…

However, despite Bitcoin’s impressive rally, its largest holders, often referred to as “whales,” have failed to cash in on the gains.

Instead, they continue to accumulate Bitcoin at these high price levels. This indicated a potentially bullish outlook for the digital assets going forward.

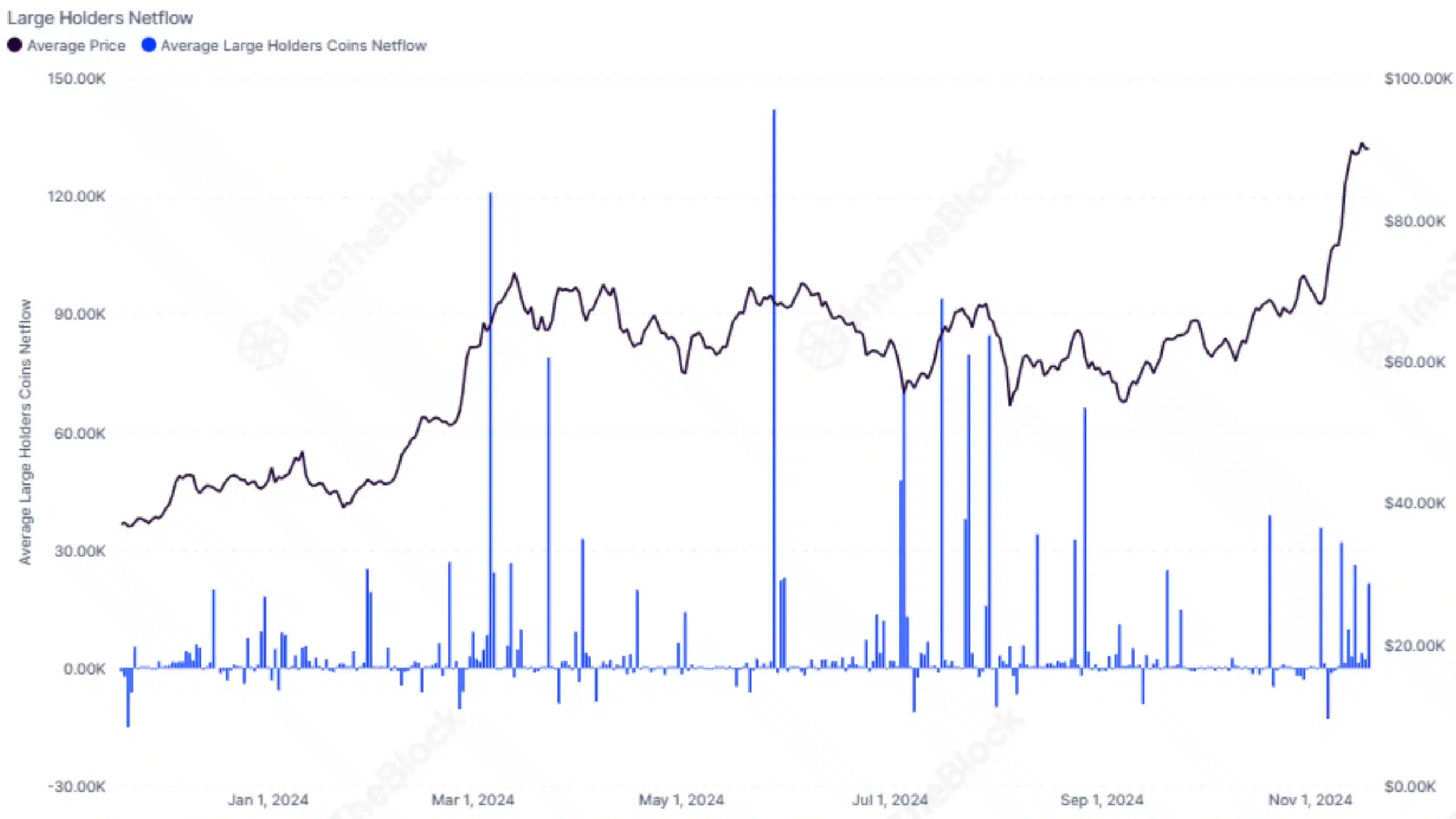

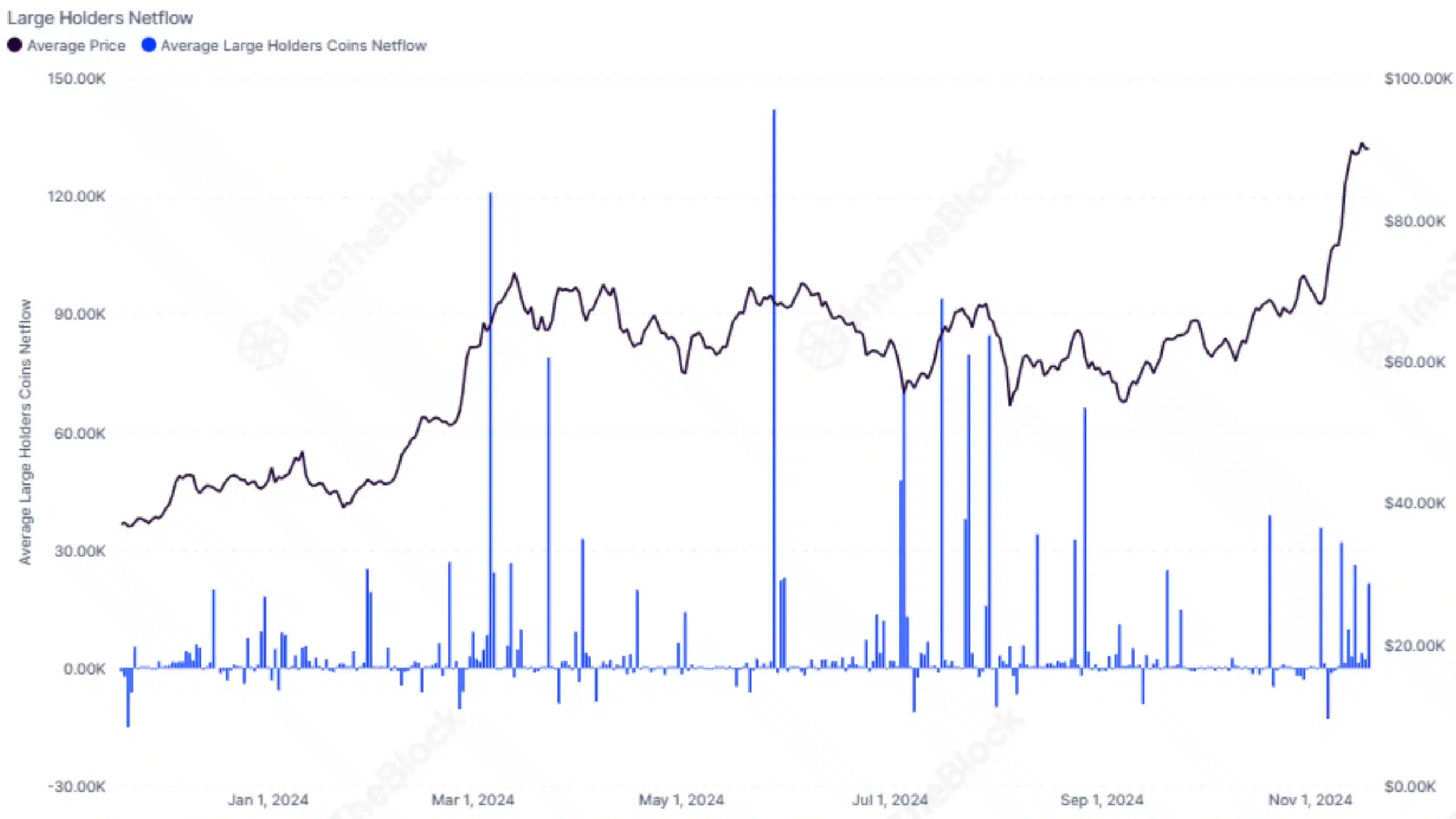

Data from an analysis company in the chain InHetBlok revealed that net outflows from the largest Bitcoin portfolios have remained remarkably low throughout the year.

This suggests that the whales did not sell their positions despite Bitcoin’s impressive price increase.

Rather, they continue to accumulate, which signals strong confidence in the cryptocurrency’s long-term potential and further indicates that these big players can position themselves for even bigger gains in the future.

Source: IntoTheBlock/X

Bitcoin’s long-term viability

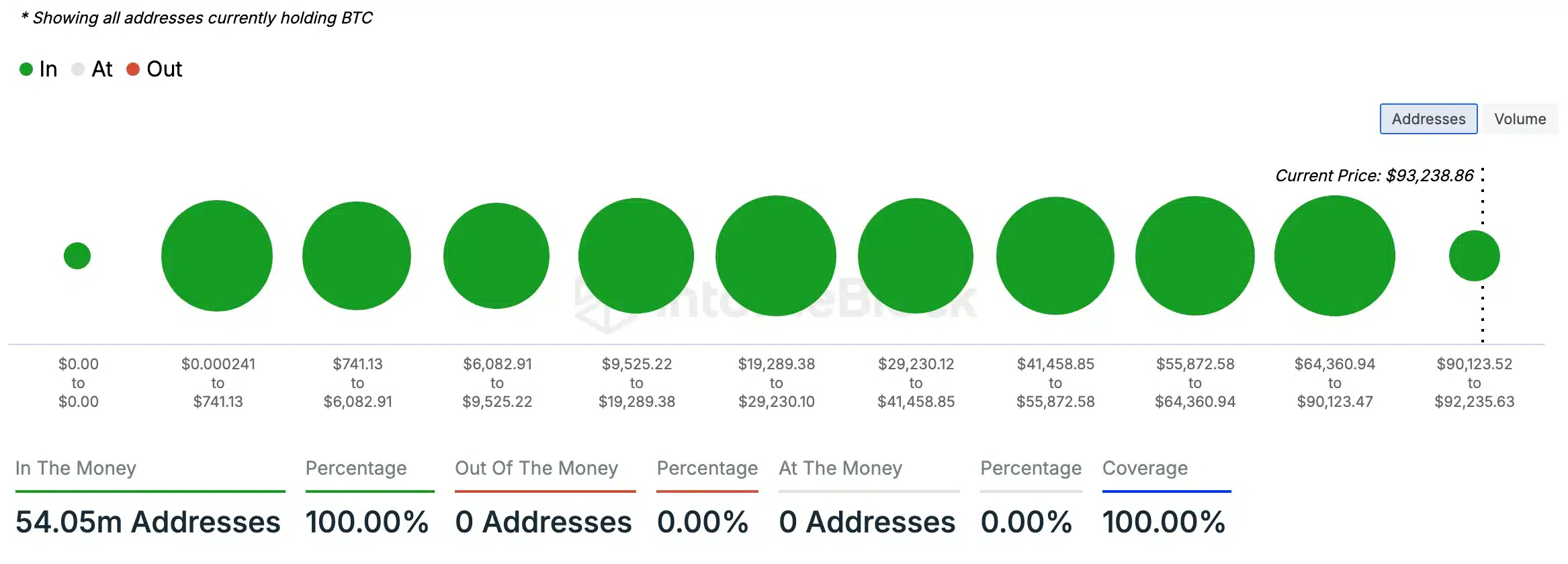

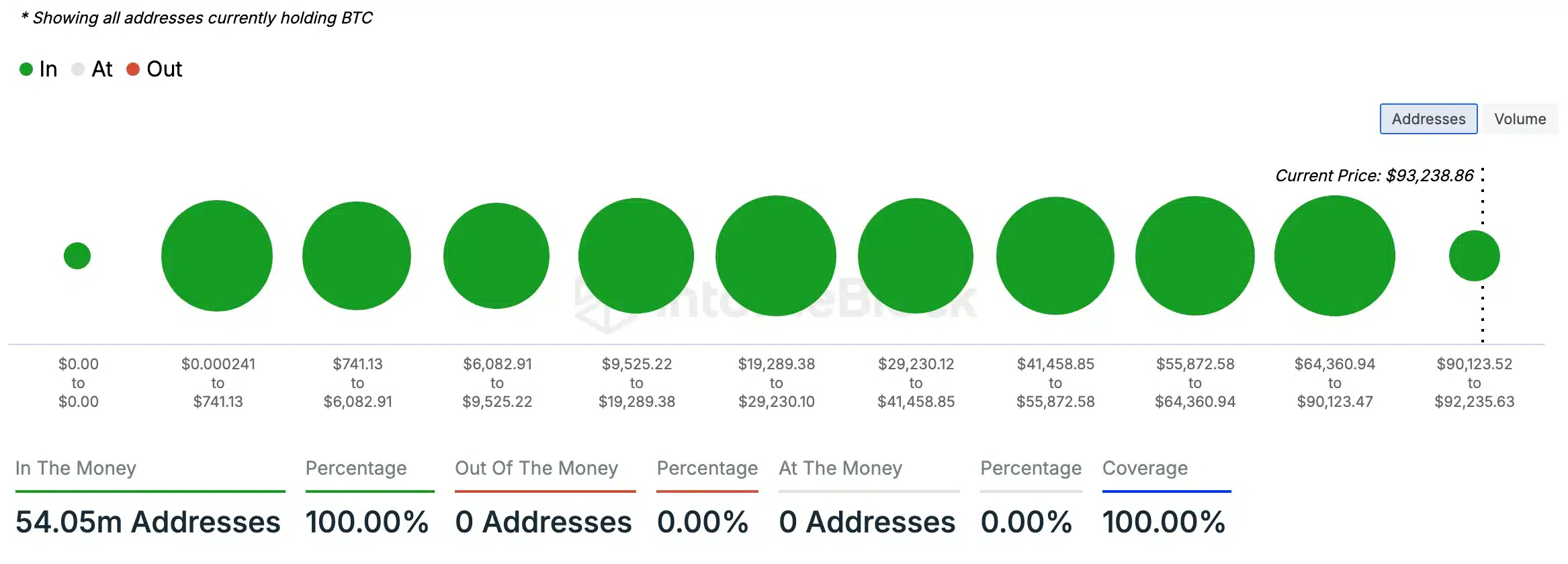

AMBCrypto’s analysis of IntoTheBlock data further supports this bullish outlook, showing that 100% of Bitcoin holders currently own tokens worth more than their original purchase price.

This means that all BTC holders are in the money, a clear indication of widespread profitability.

Conversely, there were no holders in the ‘out of the money’ category, reinforcing the prevailing bullish sentiment around Bitcoin. This indicates a potential for further price increases in the short term.

Source: IntoTheBlock

However, in light of this exponential rise, some traders are urging caution and warning of potential risks ahead.

Source: Ash Crypto/X

Cryptocurrency inflows are increasing

This follows a week in which cryptocurrency investment products saw a notable inflow of $33.5 billion. More than $2.2 billion flowed in last week alone.

The growing momentum in cryptocurrency investment products, with assets under management reaching a record $138 billion, underlines the increasing confidence in the market.

Bitcoin ETF also makes news

Bitcoin ETFs are seeing significant inflows, with $816.4 million coming into BTC ETFs on November 19, according to Farside Investors.

A recent one 13F application from a leading Wall Street firm unveiled $710 million in spot Bitcoin ETFs, including a substantial stake in BlackRock’s iShares Bitcoin Trust.

As Bitcoin’s dominance increases, it will be fascinating to see how these developments shape the cryptocurrency landscape. These changes will impact the strategies of both institutional and retail investors.