- BTC is down about 1% at the time of writing.

- Shortholders continue to make profits despite the decline in the past 24 hours.

Bitcoin [BTC] recently lifted the mood in the crypto market, breaking the $60,000 price barrier and moving closer to another key resistance level. This rise has allowed some whales to make significant profits and liquidate numerous short positions.

Bitcoin Whales Take Profits

An analysis of Bitcoin’s daily chart shows that it broke through its short-term resistance on September 17. This resistance, formed by the short-term moving average (yellow line), was overcome as BTC gained more than 3% to reach around $60,300.

Bitcoin experienced consecutive uptrends after this breakout, closing the last trading session at around $63,362.

Source: TradngView

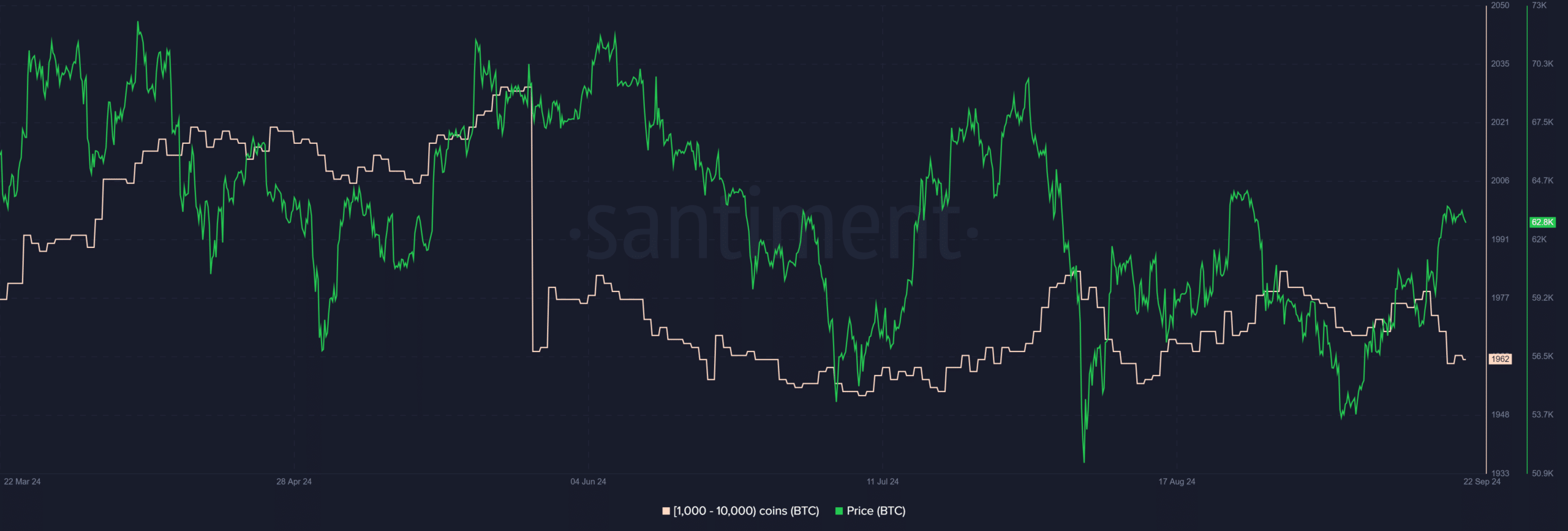

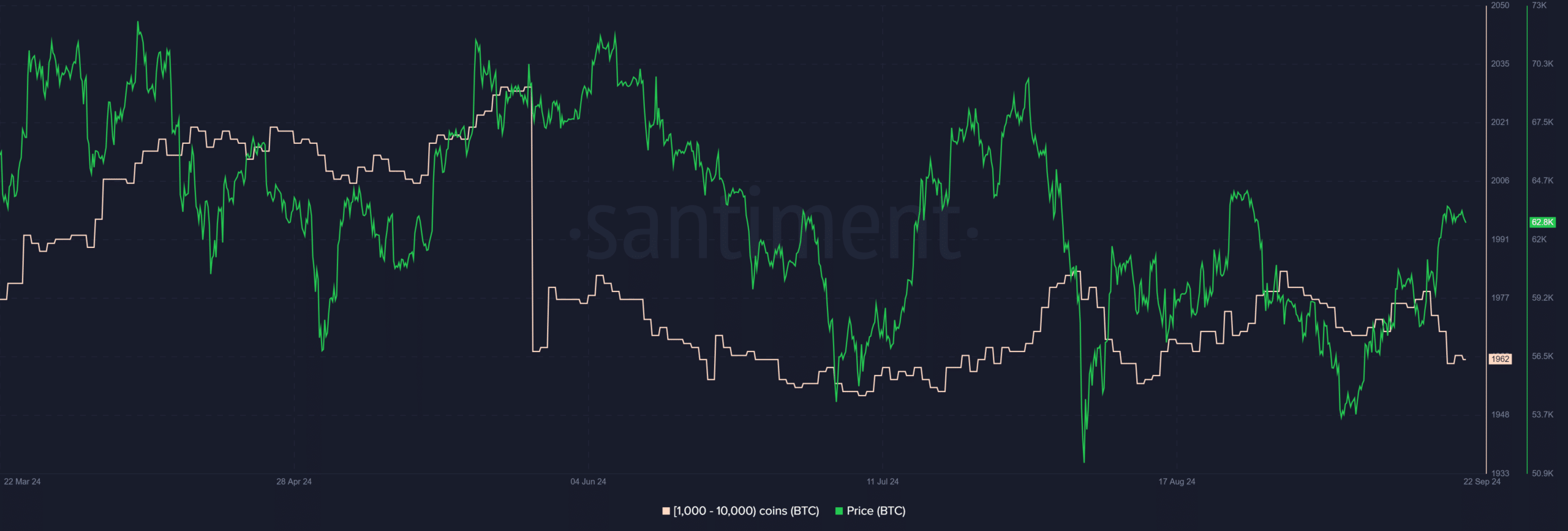

Data from Santiment shows that this price increase has pushed some BTC whales to make profits. In the last 96 hours, these large holders have sold more than 30,000 BTC, worth approximately $1.86 billion.

Despite this significant sell-off, Bitcoin remains bullish, as evidenced by the Relative Strength Index (RSI), which has remained above 60.

Source: Santiment

Bitcoin MVRV shows a 5% gain

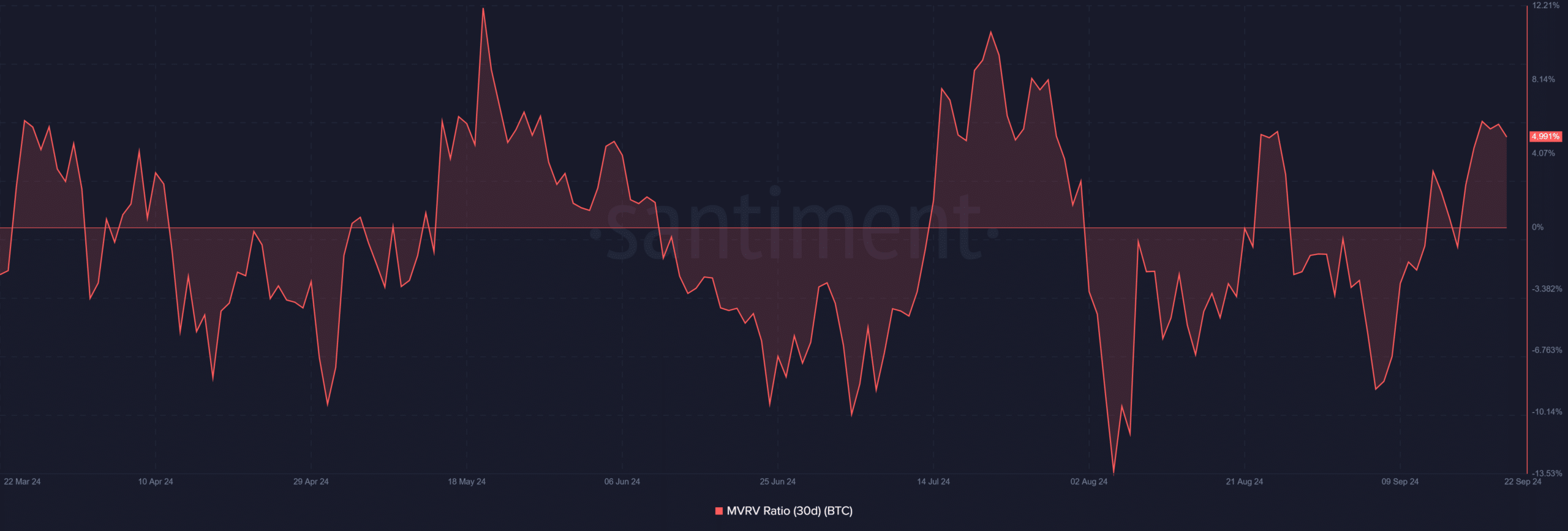

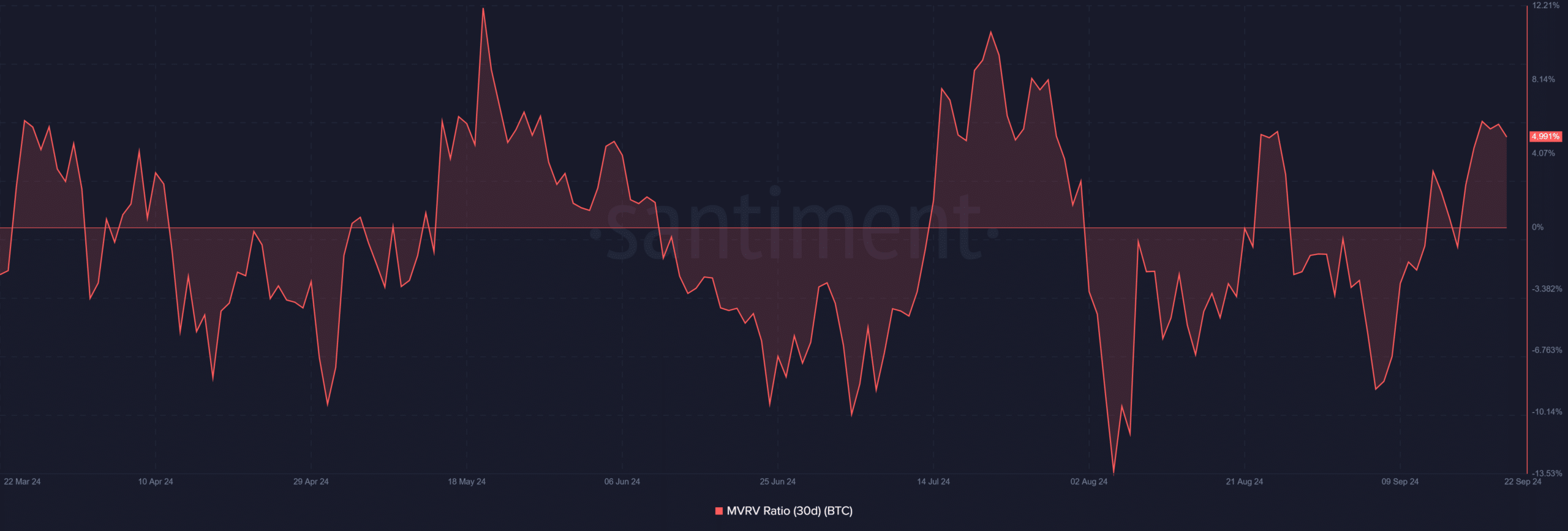

Short-term Bitcoin holders have started making profits as a result of the recent price surge. Analysis of Santiment’s 30-day market value to realized value (MVRV) ratio showed that it rose above zero on September 17 and is currently close to 5%.

This means that holders will average gains of almost 5% within this time frame, matching the gains the whales have made in recent days.

Source: Santiment

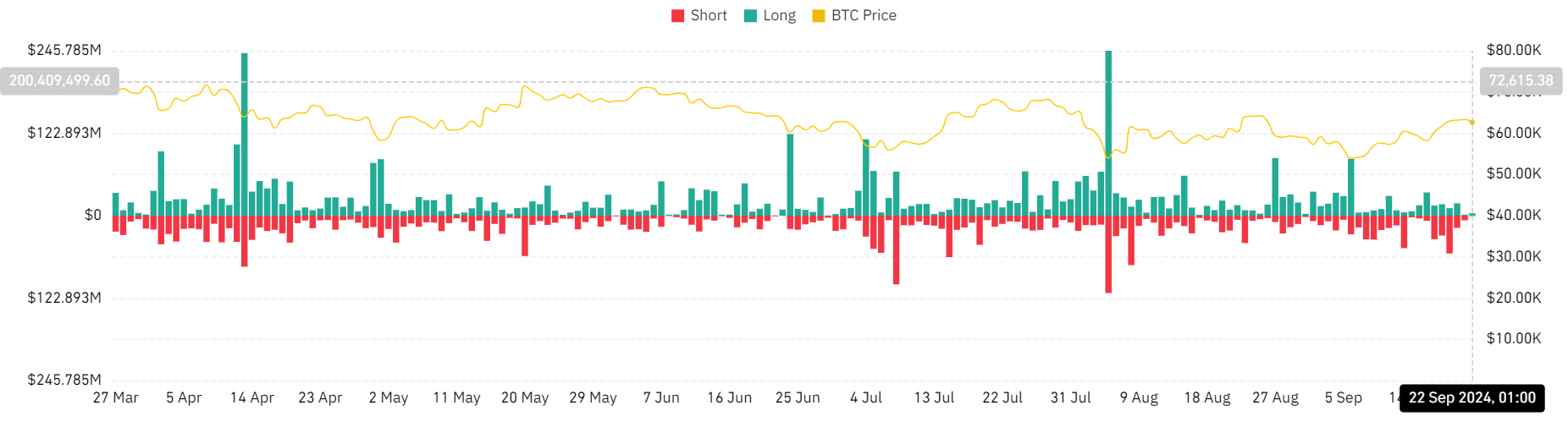

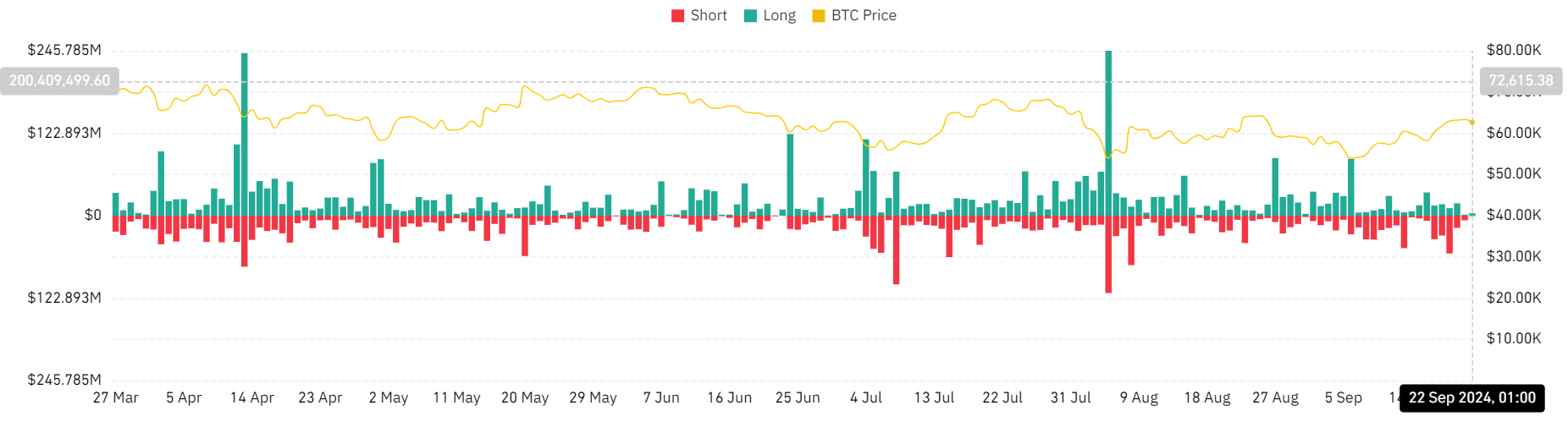

Short positions are facing increasing liquidations

Since Bitcoin’s uptrend began, there has been a significant increase in the liquidation of short positions. Analysis of Mint glass reveals that more than $146 million worth of short positions were liquidated between September 17 and 21.

In contrast, long positions saw liquidations of approximately $63 million over the same period.

Source: Coinglass

Read Bitcoin (BTC) price prediction 2024-25

Furthermore, BTC’s funding rate has remained positive in recent weeks, indicating that more buyers are entering the market than sellers – a positive sign for Bitcoin.

This trend could help Bitcoin absorb selling pressure from profit-taking whales.