- Bitcoin could rise to the $62,000 level, based on historical price momentum.

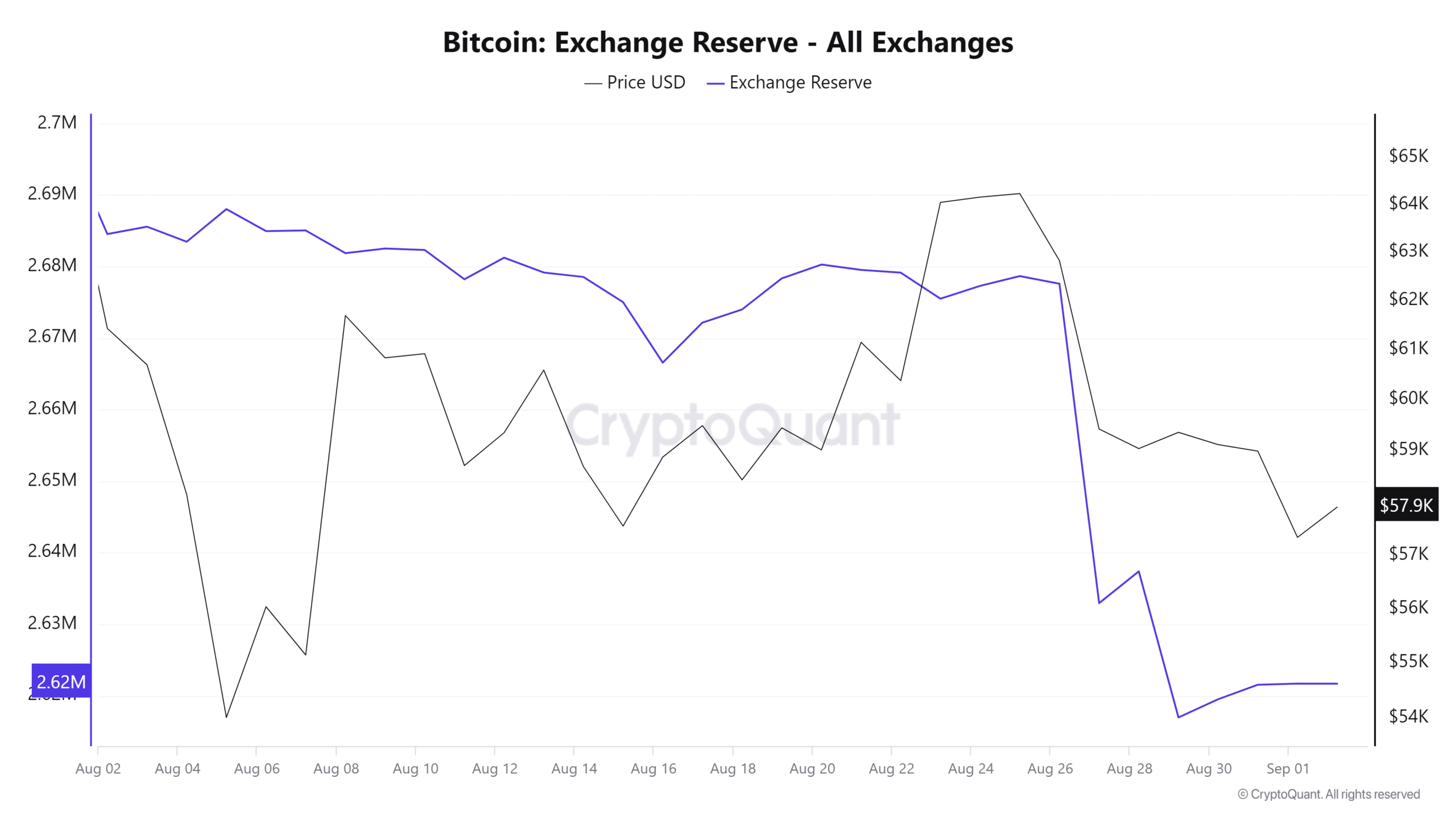

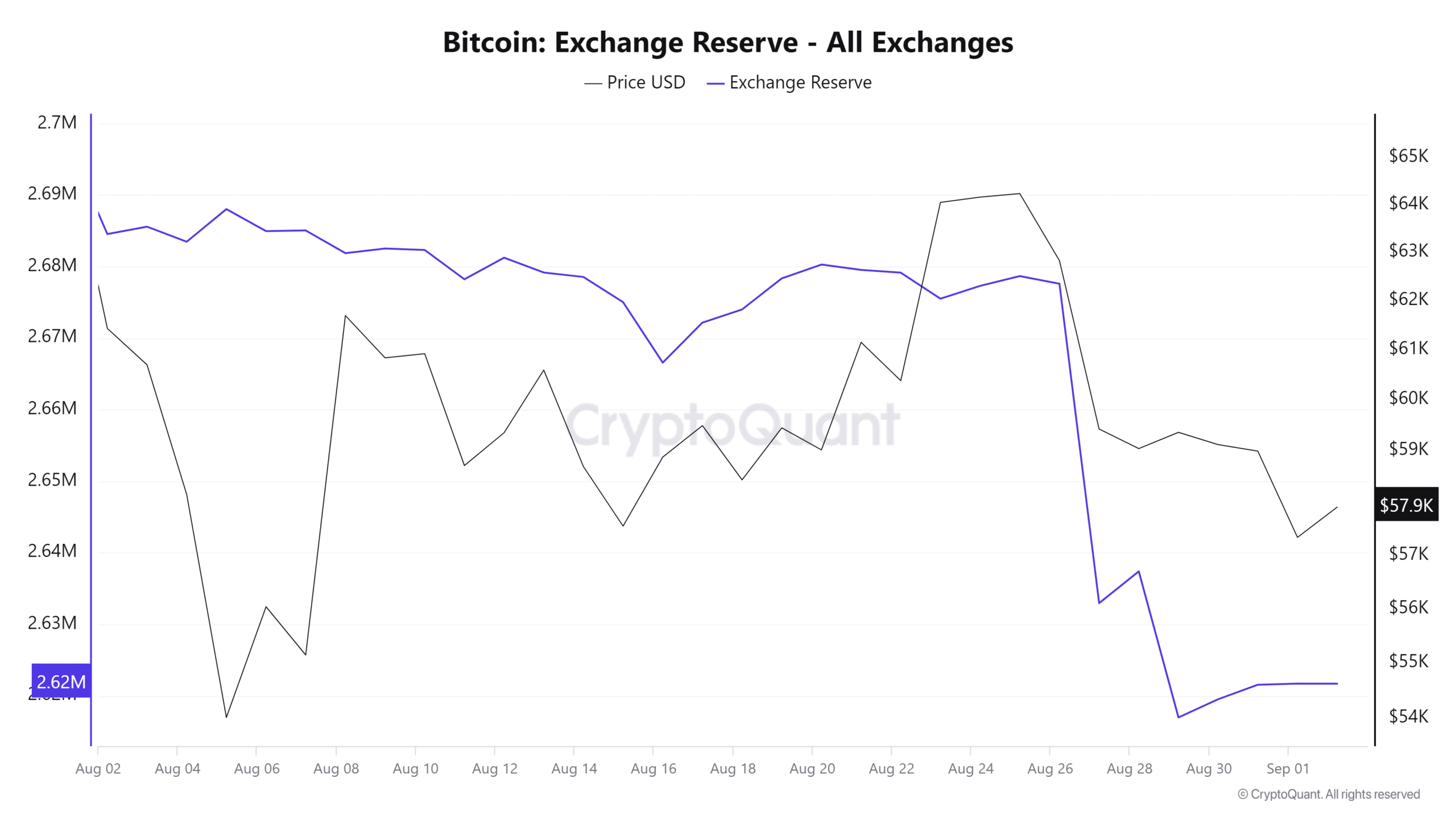

- Data on BTC exchange reserves showed potential buying pressure from investors as it has fallen significantly in recent days.

In this bearish market sentiment, crypto whales aggressively bought the dip as major cryptocurrencies, including Bitcoin [BTC] and ether [ETH]experienced significant price drops.

On September 2, on-chain analytics company Spot On Chain posted a message on X (formerly Twitter) that a Bitcoin whale had purchased almost 1,000 BTC worth $57.4 million from Binance [BNB].

Bitcoin whales buy the dip

Furthermore, the same whale had purchased nearly 2,000 BTC worth $117 million from Binance over the past four days at an average price of $58,525.

With the recent purchase, the Whales’ Bitcoin holdings have increased to 8,559 BTC worth $494 million.

Previously, the whale had dumped a whopping 7,790 BTC worth $467 million worth of BTC in July 2024 before market sentiment turned bearish.

Upcoming levels

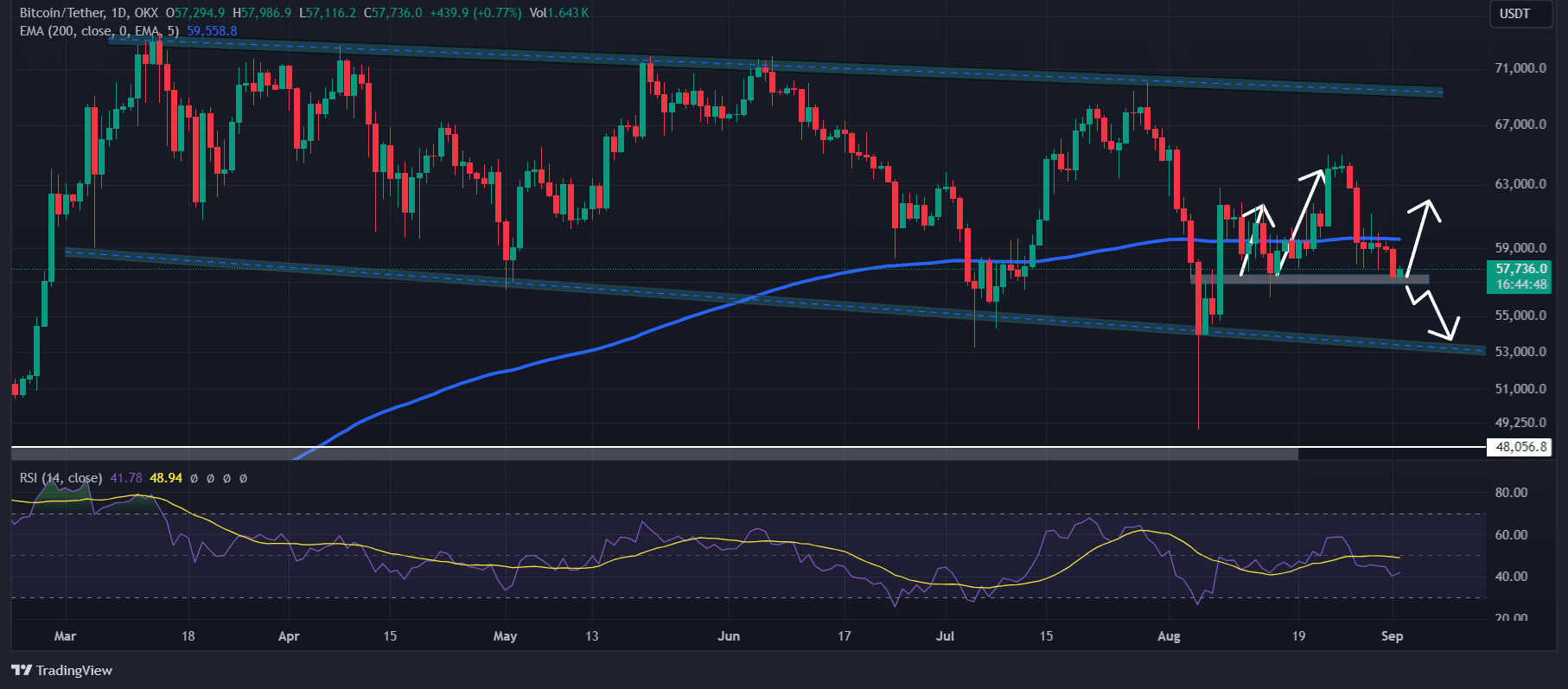

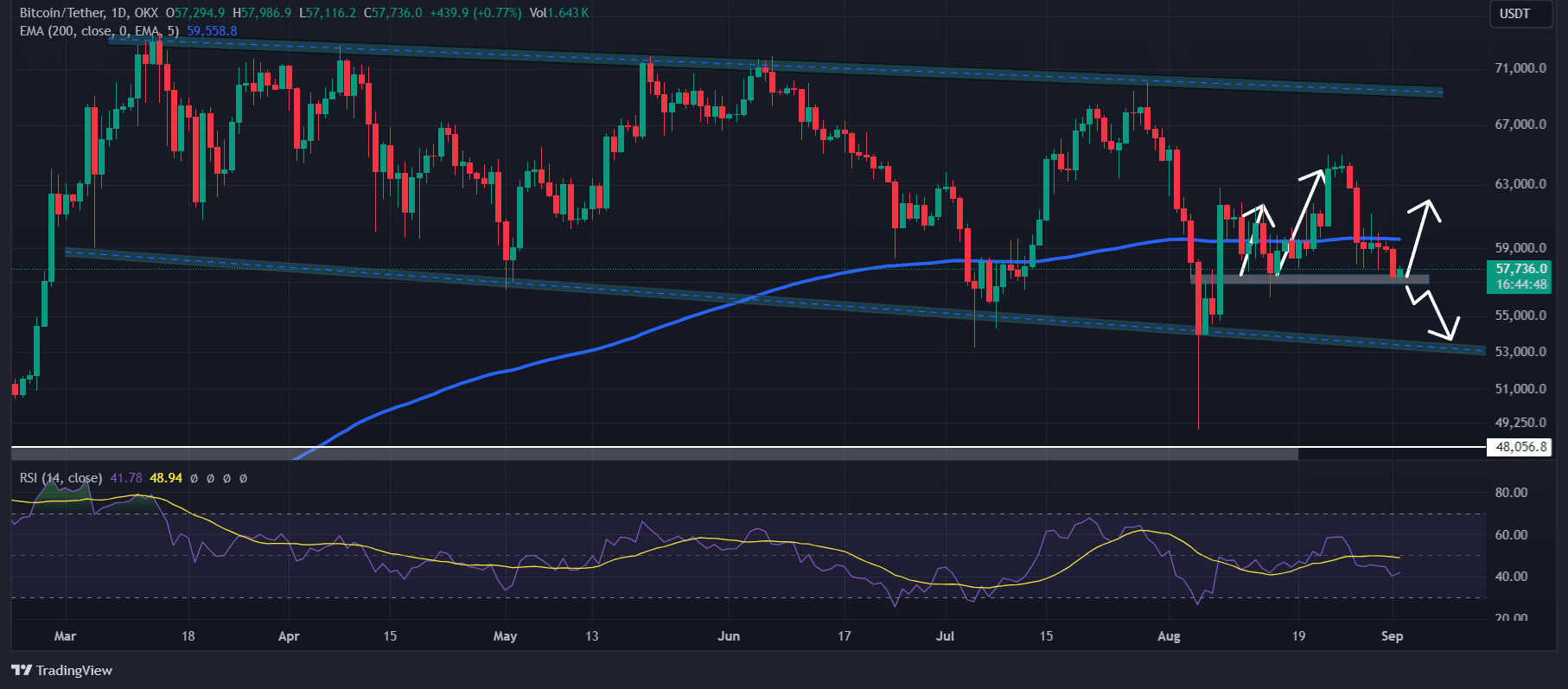

AMBCrypto’s look at TradingView data showed that the king coin was at a crucial support level of $57,300 at the time of writing. On a daily time frame, it traded below the 200 Exponential Moving Average (EMA).

The price below the 200 EMA indicated that it was currently in a downtrend.

Source: TradingView

In this market downturn, whenever BTC reaches this level, it experiences buying pressure and an upward rally. This time there is plenty of speculation about an upward rally to the $62,000 level.

Furthermore, the technical indicator Relative Strength Index (RSI) was in oversold territory, indicating a potential price reversal, which is a positive sign for investors and traders.

Bullish prospects emerge

Other on-chain data also supported this bullish outlook. CryptoQuant’s BTC exchange reserve data showed potential buying pressure from investors as the exchange reserve has dropped significantly in recent days.

Source: CryptoQuant

Meanwhile, CoinGlass’ BTC Long/Short Ratio chart at the time of writing was at 1.0043, the highest level since August 26, indicating bullish market sentiment.

BTC is currently trading near the $57,730 level, following a modest 0.8% price decline over the past 24 hours. Meanwhile, Open Interest fell 1% over the same period.

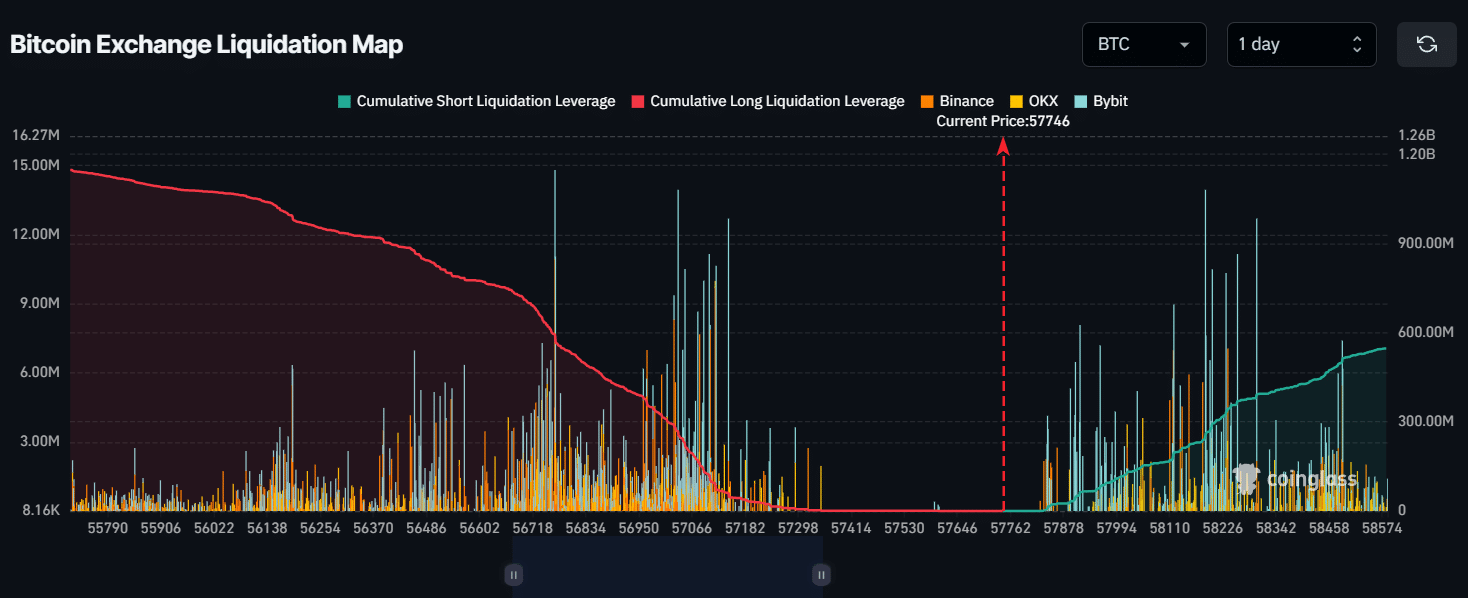

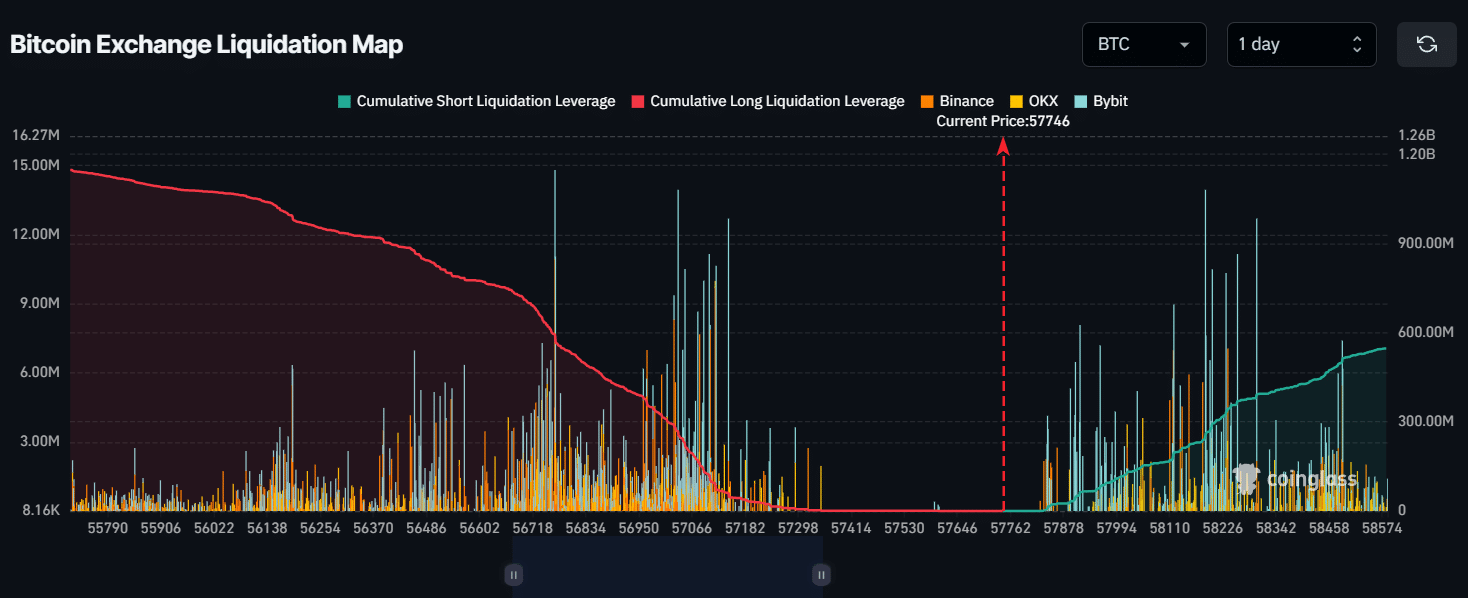

Main liquidation levels

AMBCrypto’s look at CoinGlass’ Bitcoin liquidation chart indicated that bulls were dominating and possibly liquidating short positions at the time of writing.

The key liquidation levels were around the $56,760 level on the downside and the $58,300 level on the upside, as traders are over-indebted at these levels.

Source: CoinGlass

Read Bitcoin’s [BTC] Price forecast 2024–2025

If sentiment remains bearish and the BTC price falls to the $56,760 level, nearly $600 million worth of long positions will be liquidated.

Conversely, if sentiment changes and the price rises to the $58,300 level, approximately $390 million worth of short positions will be liquidated.