- CryptoQuant CEO Ki Young Ju also noted that whales are accumulating Bitcoin and that we are in the middle of the bull cycle.

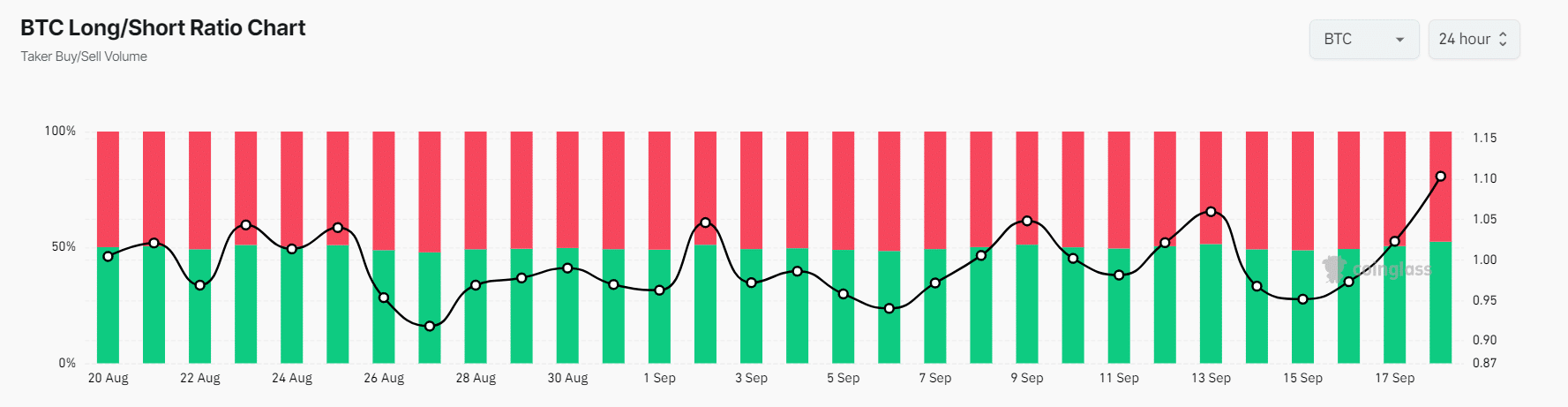

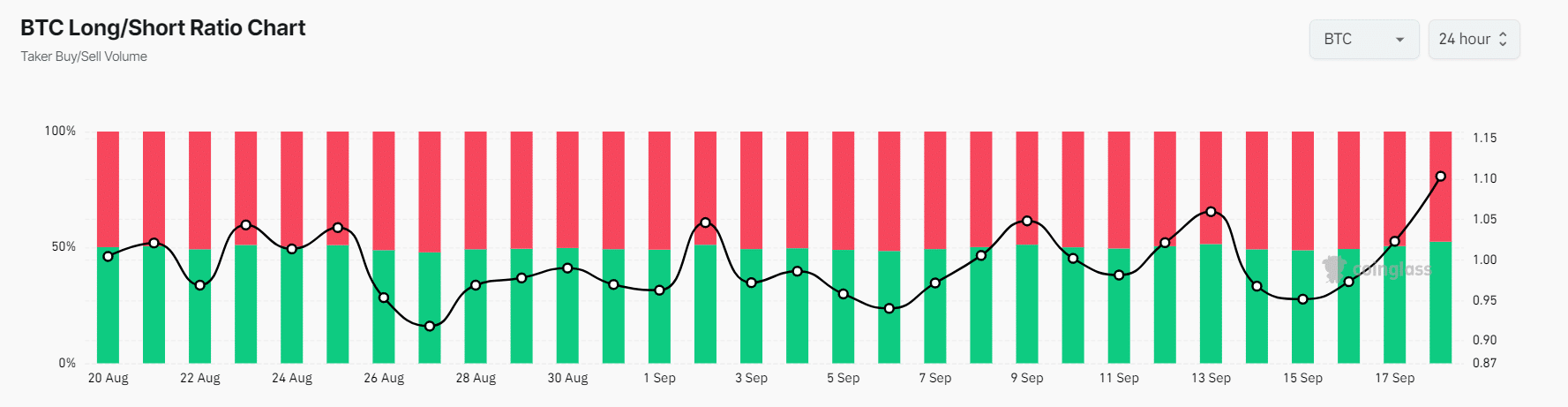

- BTC’s Long/Short ratio currently stands at 1.1048 (a value of the ratio above 1 indicates bullish market sentiment among traders).

Despite significant volatility in the cryptocurrency market, Bitcoin remains [BTC] whales and institutions seem to be taking advantage of the current sentiment by collecting coins.

In recent days, overall market sentiment for cryptocurrency has been challenging, with major cryptocurrencies such as Ethereum, Solana and XRP struggling to gain momentum.

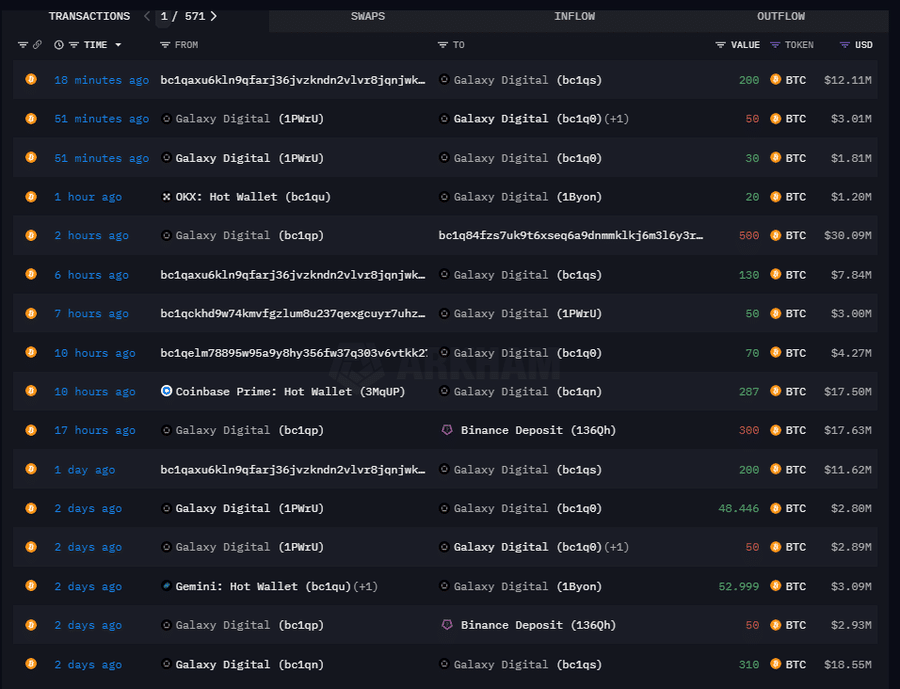

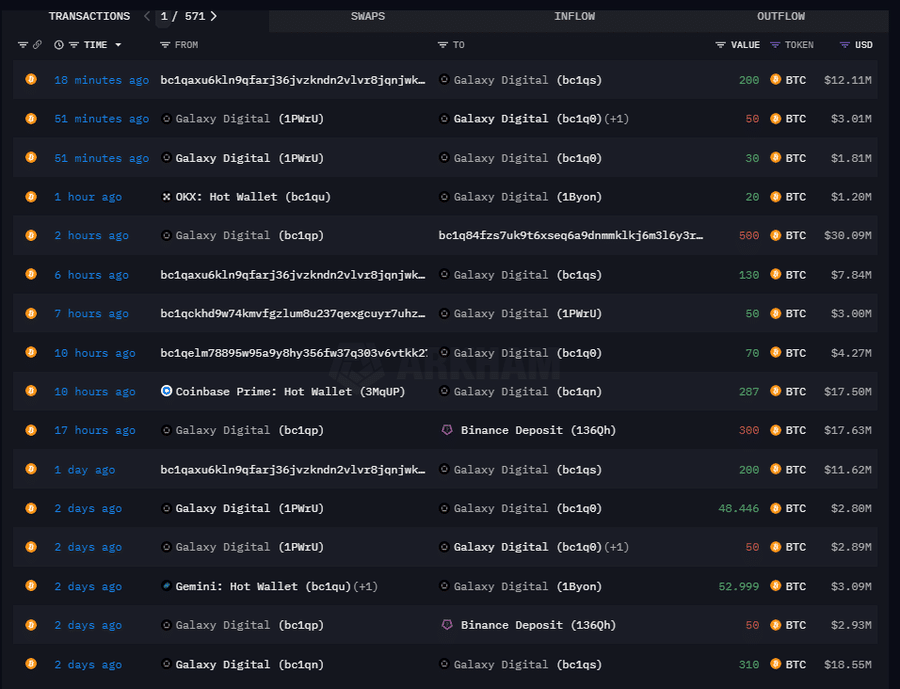

Whales and institutional accumulation

On a chain analysis company posted on Gemini.

With this recent accumulation, the company now owns a massive 8,790 BTC, worth $532.38 million.

In addition to this post on X, CEO of CryptoQuant Ki Young Ju also shared data supporting the same perspective on Bitcoin whales. In a post on X, Ki Young noted that whales are collecting Bitcoin.

He added: “Six days of accumulation warnings in a row, mainly due to the inflow of custody portfolios. Nothing has changed for Bitcoin; we are in the middle of the bull cycle.”

Ideal buying moment?

Bitcoin’s accumulation in these challenging conditions is a positive sign and may indicate an ideal buying opportunity.

Despite the significant accumulation and bullish outlook from whales, Bitcoin remains stable and consolidates between $58,000 and $60,000.

At the time of writing, BTC is trading around the $60,550 level and has experienced a price increase of over 3.35% in the last 24 hours. During the same period, trading volume increased by 40%, indicating greater participation among traders.

BTC’s bullish on-chain metrics

Currently, Bitcoin’s on-chain metrics are sending bullish signals. According to on-chain analytics firm Coinglass, BTC’s Long/Short ratio currently stands at 1.1048 (a value above 1 indicates bullish market sentiment among traders), the highest since August 2024.

Source: Coinglass

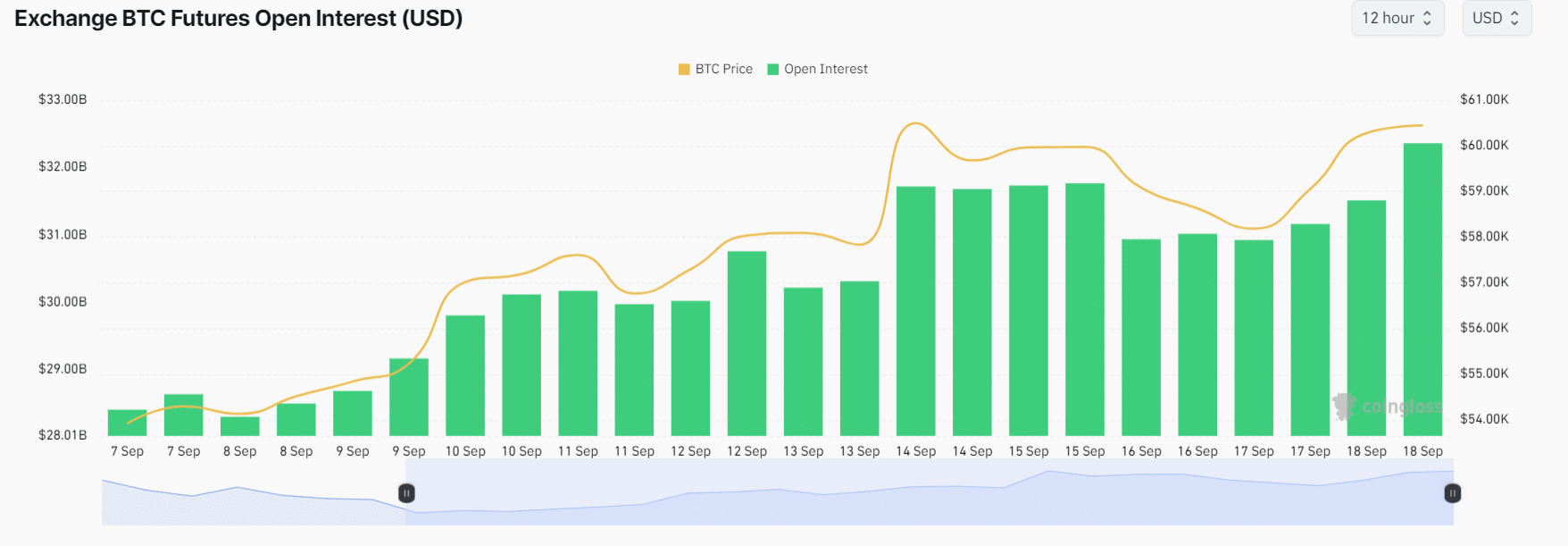

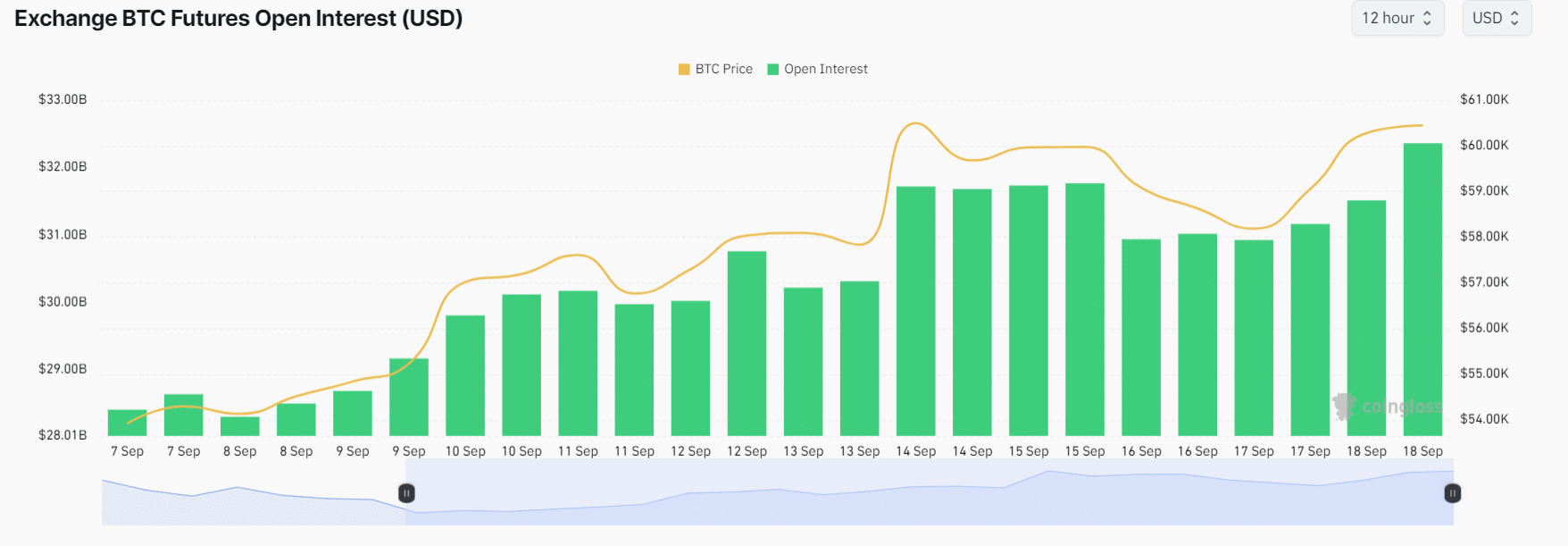

Furthermore, BTC future open interest has risen 6% over the past 24 hours and continues to grow, indicating increasing interest from traders and investors.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024-25

Currently, 52.5% of the top Bitcoin traders have long positions, while 47.5% have short positions, indicating that the bulls are back and dominating the asset.

Meanwhile, BTC’s OI-weighted funding rate stands at +0.0053% and is in the green, reflecting bullish sentiment among traders and investors.