- Data showed that Bitcoin could fall below $66,000 despite rising bullish sentiment.

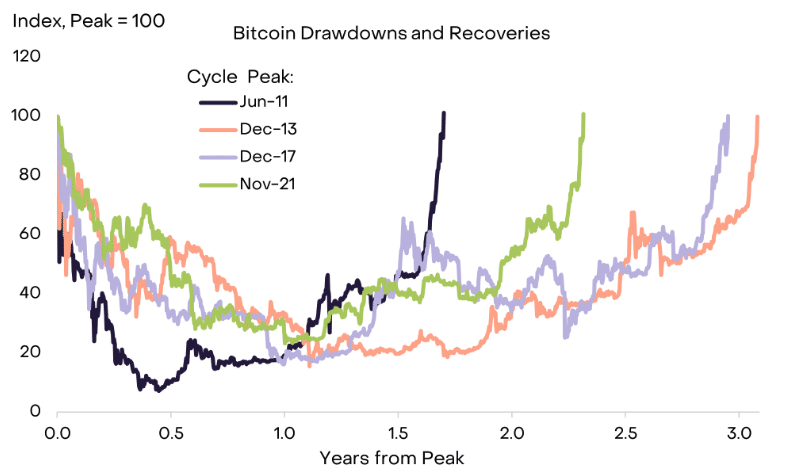

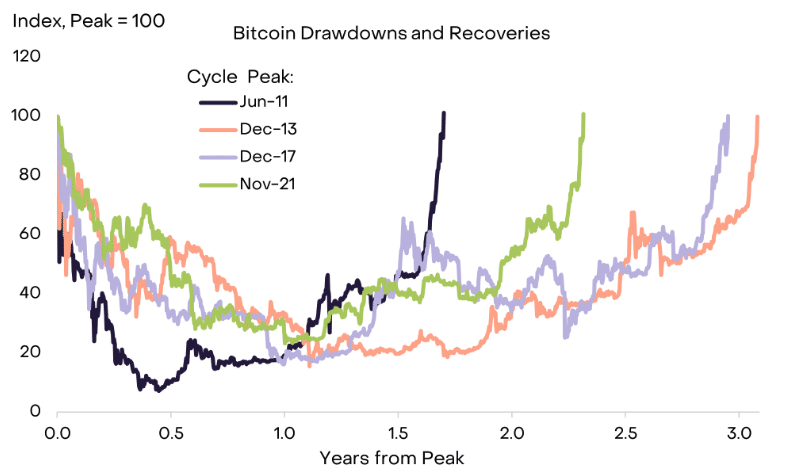

- A report explained how Bitcoin could reach new peaks faster than previous halvings.

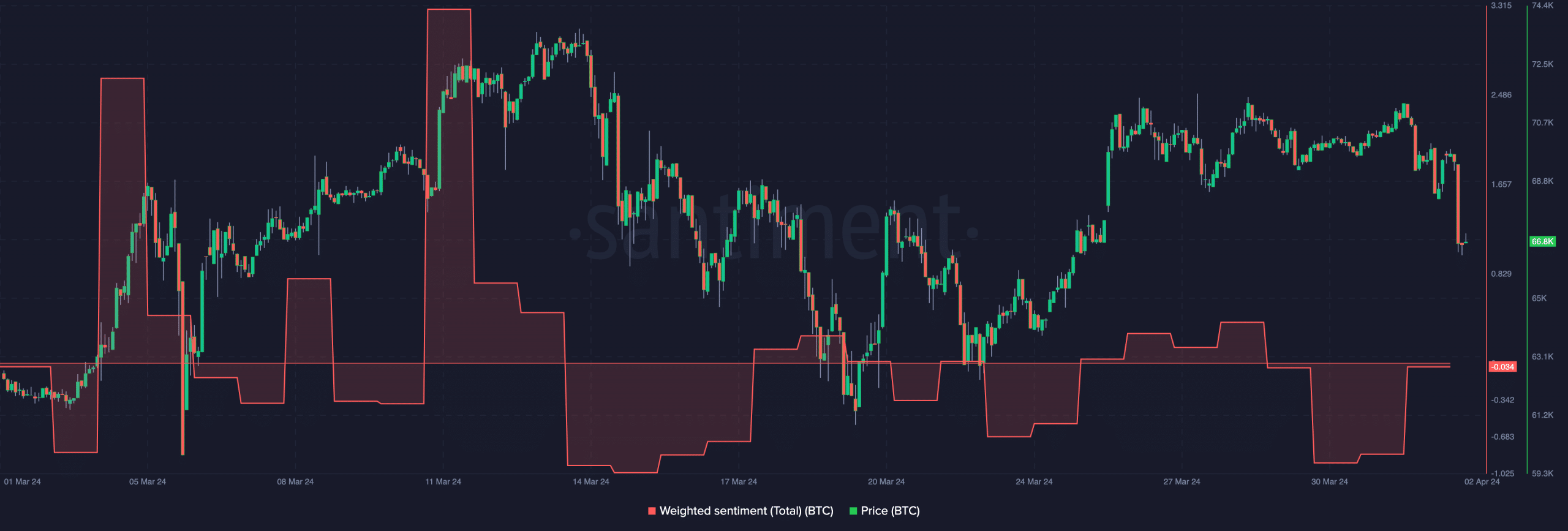

Instead of panicking after Bitcoin’s [BTC] the price has collapsed, market participants are confident that the currency will recover. AMBCrypto got this information after looking at social volume using Santiment.

According to our analysis, there has been an increase in the use of words like ‘bullish’ and ‘buy’. Similarly, statements like “sell” and “bearish” also increased.

Afraid of earning more?

However, we noticed that the bullish side was almost double that in fear. Normally, you would expect this sentiment to cause a quick rebound for Bitcoin. But history says otherwise.

Yes, buying opportunities arise when prices crash, as they have in the past 24 hours. However, a further crash could occur if beliefs are as high as at the time of writing.

Source: Santiment

Historically, this could be the best time to buy the dip when fear outweighs optimism and the retail cohort panic sells. At the time of writing this has not yet happened.

Therefore, BTC is likely to fall below $66,400 in the near term. Hours before the piece, AMBCrypto reported how Bitcoin could experience high volatility as the halving approaches.

“This cycle can be faster”

Interestingly, crypto asset management company Grayscale also published its thesis on the event and its possible impact on the price.

The report, dated April 1, focused on Bitcoin’s performance in March and its possible recovery after the halving. Grayscale also mentioned certain factors that could impact BTC later this year.

According to the report, Bitcoin outperformed many other assets last month as many central banks worldwide showed signs of a rate cut.

Therefore, demand for alternative stores of value such as Bitcoin increased. Regarding the upcoming halving, the company noted that it expected prices to drop.

Source: Grayscale Investment

However, the recovery could be faster than during previous halvings. The rack read,

“For comparison: the recovery from the previous two credit crises took about three years, while the recovery from the first major credit crisis took about a year and a half. According to Grayscale Research, we are now in the “middle innings” of a new Bitcoin bull market.”

Bitcoin has others to look up to

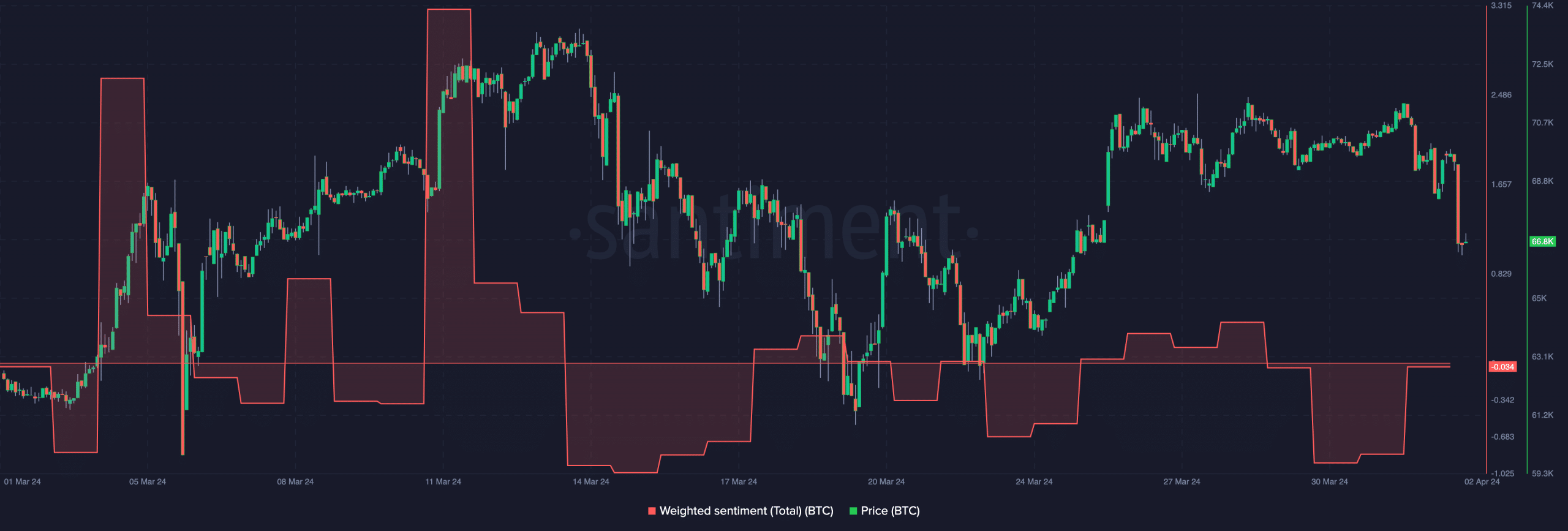

Meanwhile, AMBCrypto controlled the general perception of the coin in the market. On April 1, weighted sentiment dropped to -0.937, indicating that most participants were bearish.

But at the time of writing, the benchmark seemed to be going back into positive territory. If the measurement becomes positive, this would strengthen the participants’ initially mentioned confidence.

Source: Santiment

Speaking further, Grayscale said Bitcoin ETFs are likely to remain a price driver. Therefore, if inflows increase, BTC may rise.

However, an increase in outflows, as we have discussed recently, could cause Bitcoin to stall or fall further.

Additionally, the company noted that the Federal Reserve’s decision to cut rates could help BTC appreciate.

For the long term, it was also noted that the November 2024 US elections could affect the currency’s rate.

Read Bitcoin’s [BTC] Price forecast 2024-2025

During the last election in 2020, Bitcoin went from less than $13,000 to $20,000 in a month.

Will the scenario be similar this time? Time will tell. But for now, the currency’s decline could last a little longer.