- Bitcoin’s dominance remained substantially high compared to ETH.

- An altcoin season in the coming months could turn the scenario in Ethereum’s favor.

Bitcoin [BTC] And Ethereum [ETH] have performed well in the recent past, with the former reaching record highs. While both top coins are under scrutiny, BTC and ETH have new targets in their sights: $100,000 and $4,000 respectively.

But which crypto is more promising?

Bitcoin has the upper hand!

As mentioned above, Bitcoin reached an ATH in November 2024. On the contrary, ETH’s ATH was recorded during the November 2021 crypto bull market.

While some expected the ETH 2.0 upgrade to turn things around, that was not the case. Nevertheless, ETH currently appears to be on track to target its ATH in the coming months.

Since BTC hit an ATH a few days ago, more BTC investors made profits. According to IntoTheBlock’s facts98% of Bitcoin addresses were ‘cashable’, while for ETH addresses it was 88%.

Another front where Bitcoin had a clear advantage was its dominance. AMBCrypto found that despite a decline, BTC’s dominance remained well above ETH’s dominance.

To be precise, while Bitcoin dominance stood at over 56%, ETH dominance declined marginally over the past 24 hours, reaching 12.8%.

Source: BTCtools.io

What statistics suggest…

Going forward, both cryptos had a problem. For example, Bitcoin’s NVT ratio increased. A similar increase was also seen on ETH’s chart. This indicated that both cryptos were overvalued, indicating possible near-term pullbacks.

Source: Glassnode

However, the metric that turned in BTC’s favor was the exchange rate balance. Bitcoin’s balance on the exchanges fell as ETH’s balance increased.

This meant that investors were still considering buying BTC, while ETH investors were selling. Generally, an increase in selling pressure results in price corrections.

Source: Glassnode

As selling pressure on Ethereum increased, it won’t be surprising to see the king of altcoins fall towards $3.38 in the event of a major correction.

On the other hand, BTC’s increasing buying pressure has once again pushed the coin above its resistance at $96,000. This suggested that the king coin could soon begin a rally towards $100,000, which would in turn mark a new ATH.

Nevertheless, ETH investors should not lose hope as there were chances of ETH outperforming BTC in 2025. As the market gained bullish momentum, several people speculated about a new altcoin season in the coming weeks or months.

If that happens, ETH could make investors more profits than BTC.

Bitcoin ETFs vs. Ethereum ETFs

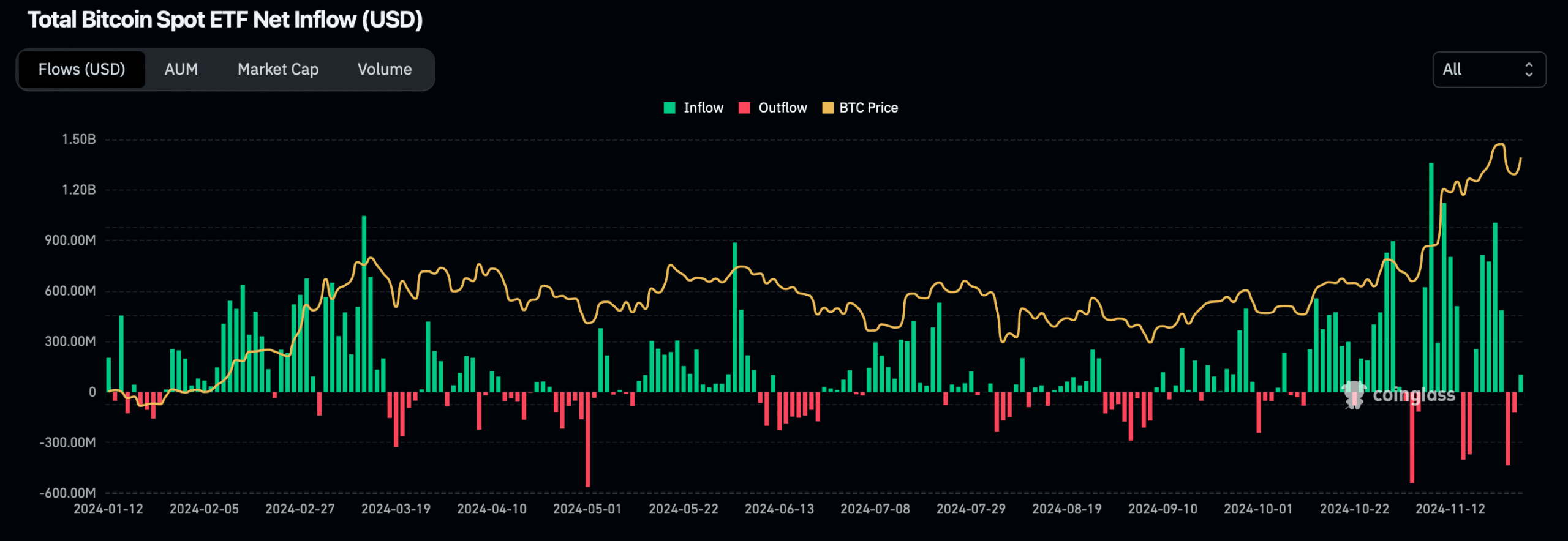

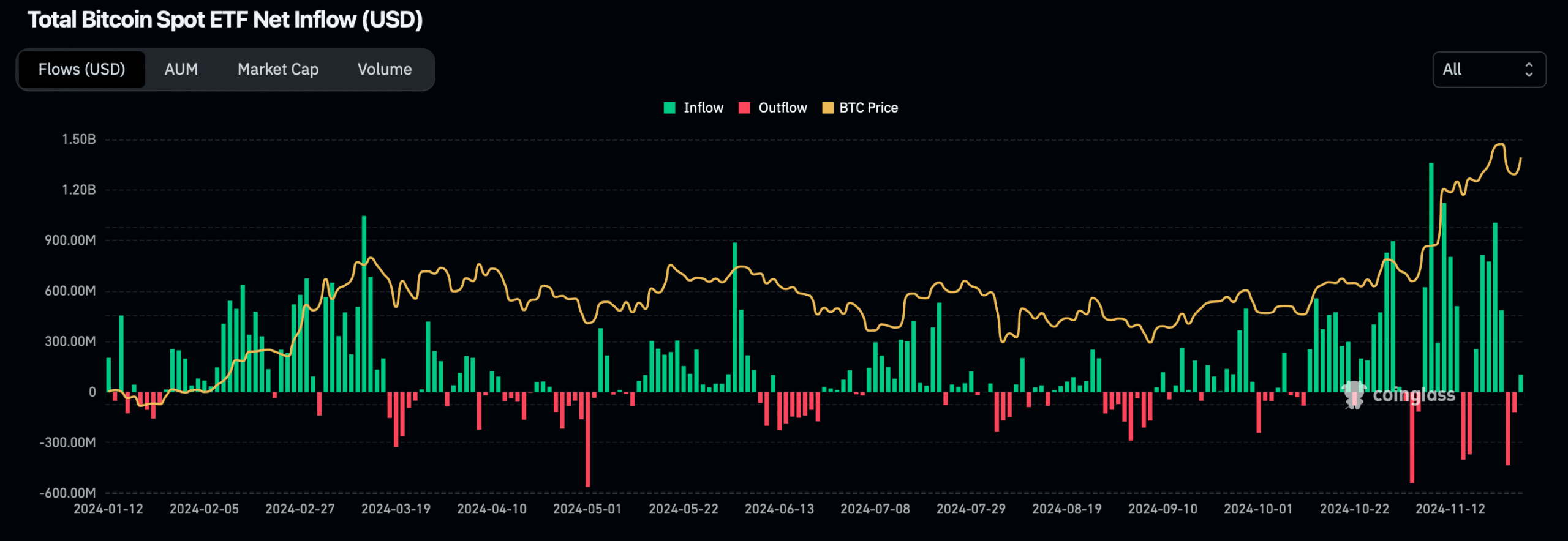

When comparing both cryptos, it becomes crucial to talk about their respective ETFs as they were one of the most talked about topics in 2024.

Interestingly, both cryptos showed impeccable performance on this front. During the massive price increases of BTC and ETH, their ETF inflows reached record highs. To be precise, Bitcoin ETF inflows exceeded $1.3 billion on November 7.

Source: Coinglass

Read Bitcoins [BTC] Price prediction 2024–2025

In the same way, Ethereum ETF inflows also rose to a record high of $295 million on November 11.

While these top 2 cryptos have different purposes, they both boast robust market caps. Which crypto beats the other, in terms of market value or profitability, is a question that only time will answer.