- Dormant Bitcoin worth $681 million was moved, boosting on-chain volume by $37.4 billion – the highest in seven months.

- Bitcoin inflows to exchanges are increasing, indicating potential selling pressure as BTC stabilizes around $61,000.

A major Bitcoin [BTC] A transaction involving a dormant wallet sent 10,158 BTC, worth approximately $681 million, into circulation.

This large transfer resulted in total volume of $37.4 billion across the chain, the highest in seven months.

This activity was identified from Santiment, a blockchain analytics platform, and is attracting attention in the market. Historically, the reactivation of stagnant Bitcoin causes upward price movements.

This event underlines a change in behavior among long-term holders as a significant amount of previously inactive BTC has returned to the market.

The transaction was also linked to data from Lookonchain, suggestive that this could have a ripple effect on the market.

Increase in activity in the chain

Transaction volume of $37.4 billion in on-chain transactions occurred in a single day, which is the largest daily volume since March 12, 2024.

This spike was largely driven by dormant Bitcoin being put into circulation, indicating that large holders are becoming more active.

Santiment noted that the “Age Consumed” indicator tracks the movement of older BTC that had remained dormant for a long time.

The Age Consumed metric saw a sharp increase, indicating that a significant portion of transaction volume came from older, inactive Bitcoin.

This move is often interpreted as a sign of renewed activity among whale accounts, with potential future implications for Bitcoin’s price direction.

Source:

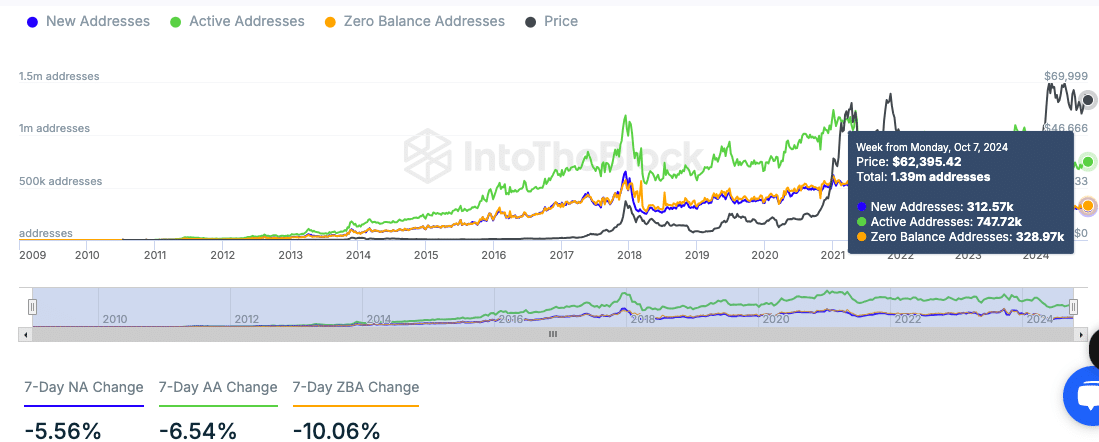

Bitcoin network statistics show mixed signals

While on-chain volume has increased, some key metrics for Bitcoin addresses have fallen.

Data from InTheBlok revealed a drop in the number of new, active and zero-balance addresses over the past week.

The number of new addresses fell by 5.56%, active addresses by 6.54% and zero-balance addresses by 10.06%, with the total number of active addresses standing at 747.72k as of October 7.

Source: IntoTheBlock

This decline in address activity could indicate a short-term slowdown in network participation. However, Bitcoin’s price remains relatively strong, with recent market activity showing resilience.

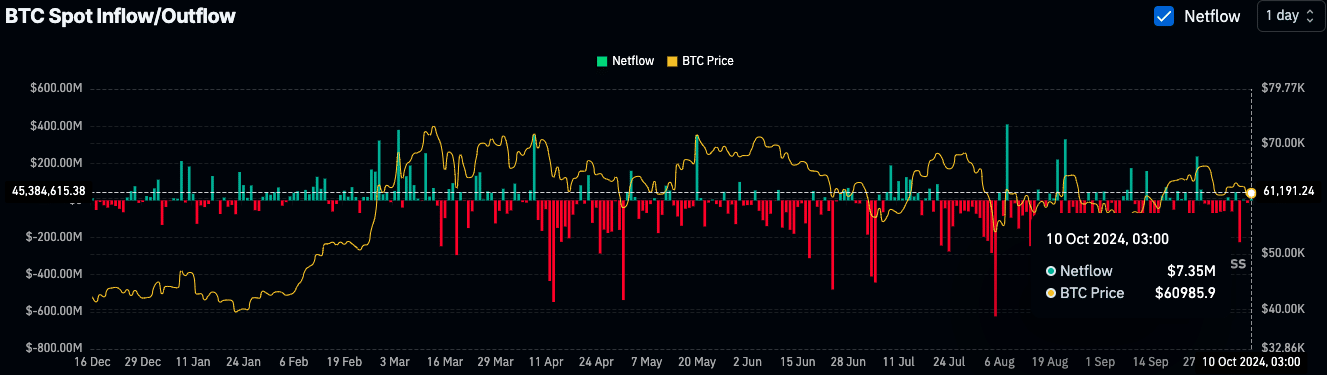

Possible selling pressure

AMBCrypto’s analysis of Bitcoin’s spot inflows and outflows showed the movement of more BTC onto exchanges. On October 10, there was a net inflow of $7.35 million.

Positive inflows typically indicate potential selling pressure as traders transfer Bitcoin to exchanges for possible liquidation.

This small inflow indicates that some traders may be positioning to sell, but it is not large enough to signal a significant market shift.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024–2025

The price of Bitcoin rose $60,947 at the time of writing, with a slight decrease from the previous week.

Despite the influx, the price has remained relatively stable. So the selling pressure may not be strong enough to cause a major downside move at this point.