This article is available in Spanish.

Bitcoin volume has experienced a serious crash initial price momentumfell by about 27% and caused a subsequent decline in the value of the pioneer cryptocurrency. This significant drop in volume has caught the attention of market participants, as a crypto analyst discusses the mechanisms and meaning of a Bitcoin drop and whether it signals a Distribution or accumulation phase.

Bitcoin price drops as volume drops 27%

Facts from CoinMarketCap has revealed that the daily Bitcoin trading volume has crashed 26.46%, pushing the value to $85.89 billion. This significant drop in Bitcoin volume coincides with a broader correction in the cryptocurrency’s price.

Related reading

Over the past 24 hours, BTC has experienced a price drop to $87,848 at the time of writing. The cryptocurrency was before trading above $90,000but has recently fallen by 2.87%. This plummeting volume often indicates one reduced market interest or lack of enthusiasm. However, this may not be the case for Bitcoin as the cryptocurrency is experiencing high market activity due to the just-concluded US presidential election that resulted in a Donald Trump wins.

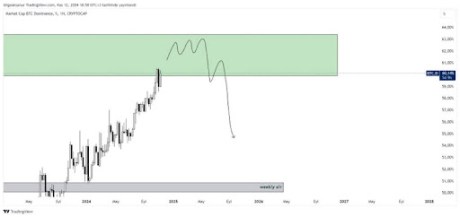

The most likely reason for the reduced volume could be: market consolidationwhere Bitcoin’s price could stabilize before a possible breakout. In support of this, a crypto analyst, ‘Personal Trader’, declared that the market has entered a phase of decline, where Bitcoin could be entering its last correction period before we head towards the $100,000 milestone.

BTC price drop may indicate a distribution or accumulation phase

Considering the recent drop in Bitcoin price and volume, a crypto analyst identified as ‘IonicXBT’ has gone to X to identify and discuss the significance of this decline based on two major trends visible in a Bitcoin market cycle: the accumulation and distribution phases.

Related reading

The Accumulation phase is when smart money, including investors or institutions, starts to do that Buy Bitcoin. During this phase, prices are usually low or have stabilized after a decline. Additional, Bitcoin trading volume is increasing during the same period when buyers intervene to push prices up. Furthermore, any upward price movement tends to show strong volume, indicating increased buying pressure.

In the distribution phase, on the other hand, there is smart money sell or distribute their Bitcoin. During this phase, prices may have peaked or are considered overvalued. The volume of BTC increases while the price decreases, which is a signal intense selling pressure. Furthermore, price spikes, which are accompanied by low trading volume, indicate weak buying interest, a red flag indicating that smart money is leaving the market.

Based on these Bitcoin phases, IonicXBT has revealed that it is the Bitcoin market top and bottom soon. The analyst has shown that Bitcoin is not currently in the distribution phase, meaning it is still a ‘buyer’s market’, indicating the potential for future price increases.

Featured image created with Dall.E, chart from Tradingview.com