- Bitcoin’s volatility and price dropped significantly.

- However, traders remained bullish.

The expectation surrounding the approval of the place Bitcoin [BTC] ETFs brought with them large amounts of volatility. However, according to certain analysts, the event, which took place almost a week ago, led to decreasing volatility of the king coin.

Silence before the storm?

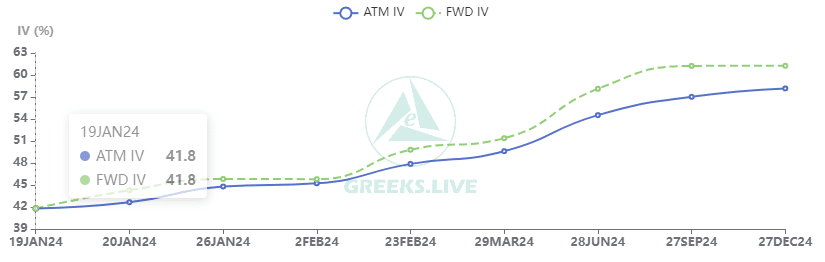

Market researchers Greeks.live analyzed the current options market, showing that the immediate effects of the ETF’s approval have largely dissipated.

Notably, Bitcoin’s volatility has reached a new low, marked by a decline in both realized volatility (RV) and implied volatility (IV), with the IV falling below 45% in the short term.

Realized Volatility (RV) reflects the actual price movements of an asset, while Implied Volatility (IV) measures market expectations for future price movements.

The decline in both RV and IV indicates a period of reduced price volatility and reduced uncertainty about Bitcoin’s short-term movements.

Possible impact on Bitcoin

Bitcoin could soon see the direct effects of decreasing volatility. More risk-averse institutional investors could find their way to the king coin in search of a more stable environment for their investments.

The aforementioned decline could also indicate increased market confidence and potentially pave the way for broader adoption of Bitcoin.

However, traders and investors who thrive on price fluctuations to make profits may not benefit enough from it. For them, a less volatile environment can limit trading opportunities and potential profits.

Furthermore, a prolonged period of low volatility could lead to reduced interest from speculators, potentially impacting Bitcoin’s overall trading activity and liquidity.

Source: Greeks.live

Regardless, BTC’s Put-to-Call ratio has been steadily declining from 0.52 to 0.46 over the past few days. This indicated that many traders were still bullish on BTC at the time of writing.

Some positive and negative points

As for the price of the king coin, at the time of writing it was trading at $42,507.73, having fallen 0.65% in the past 24 hours. BTC’s MVRV ratio also dropped significantly during this period.

The number of profitable addresses with BTC had therefore decreased. This factor could bode well for the King Coin, as these addresses may not want to sell their holdings just yet.

Read Bitcoins [BTC] Price prediction 2024-25

The addresses that are not yet sold could help support BTC’s current price level. However, Bitcoin’s declining Long/Short ratio could hurt BTC’s future prospects.

For context, a declining long/short indicator indicates that the number of long-term bonds has decreased. These long-term holders are generally less likely to sell their holdings.

Source: Santiment