- Bitcoin price drops more than 6% after Trump’s rates, with global markets that are braced for further fall -out.

- Bitcoin and Altcoins hit rates, with market sentiment that shifts to a cautious, bearish look.

After the latest trade rate bomb of the US President Donald Trump, the market is faltering.

Bitcoin [BTC]The flagship digital assets, felt the victim of the impact, diving by more than 6% in the aftermath of the announcement on 2 April.

While Trump’s rates are focusing on 185 countries, the fall -out has been fast – liquidations are hit hard and the asset prices are in free fall.

With the global economy that scraps for wrinkle effects, can Bitcoin drive the storm, or is this the start of a deeper dive?

Trump’s tariff storm

On Wednesday, US President Donald Trump announced an aggressive series of rates that rocked the global financial markets.

A rate of at least 10% would be imposed on all exports to the US, with extra tasks aimed at 60 countries with the largest trade balance with super power.

China was hit hardest and confronted with a steep rate of 34%, followed by India (26%), Japan (24%) and the European Union (20%).

In a television address from the rose garden of the White House, Trump justified The move by claiming that the US “charged about half of what they are and have charged us.”

Source: X

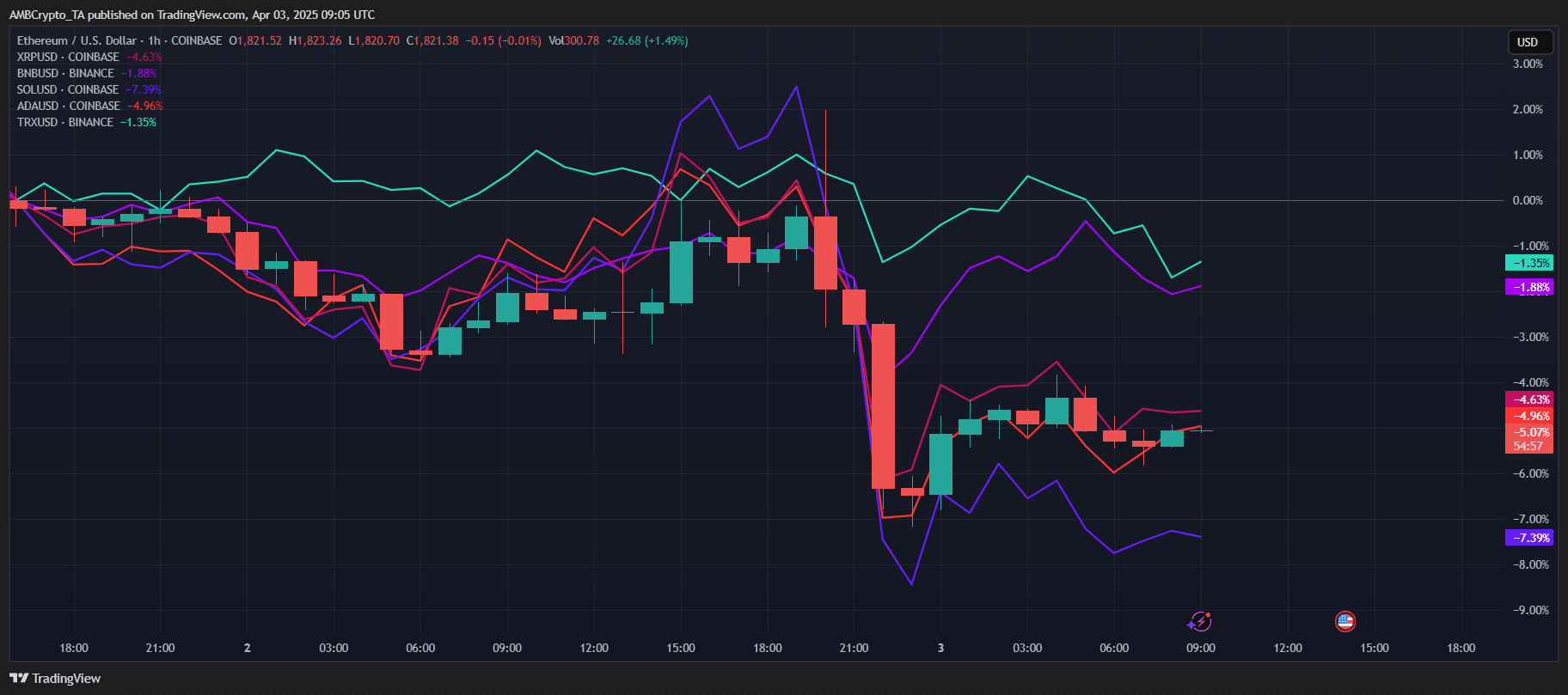

While the first reactions in the cryptomarkt were positive, with a short increase after the announcement of the 10% Universal rate, the market soon became south.

As the full scope of the rates became clearer, the sentiment and prices started to fall across the board. Bitcoin, who had traded in the vicinity of $ 87K, saw a dramatic dip up to $ 82k before a mild recovery was samened.

Rates cause damage to Bitcoin -price

After the sharp drop activated by Trump’s rate announcement, Bitcoin tried to stabilize in the vicinity of the $ 83,000.

The last hourly table shows a mild recovery after the first dive, but the momentum remains weak.

Source: TradingView

The OBV indicates that decreasing purchase interest rate, while the RSI is floating around 45, which suggests that neutral to somewhat bearish sentiment. With volume descending, the ability of Bitcoin to reclaim higher levels remains uncertain.

While the market consumes broader economic implications, careful trade will probably continue to exist.