- BTC is down 5% in the last 24 hours.

- The king coin could reach a new ATH by the end of 2024.

Bitcoin [BTC] has witnessed multiple price corrections, dropping the coin’s price below $65,000. However, investors should not lose hope as BTC appeared to be following a historic price trend leading up to the halving.

So if history repeats itself, BTC could witness a further price drop before gaining momentum and reaching $100,000.

Bitcoin goes below $65k

After reaching an all-time high, BTC’s price fell rapidly. According to CoinMarketCapBTC has fallen by more than 10% in the past seven days.

In the last 24 hours alone, the price of the king of cryptos fell by more than 5%. At the time of writing, BTC was trading at $64,509.53 with a market cap of over $1.27 trillion.

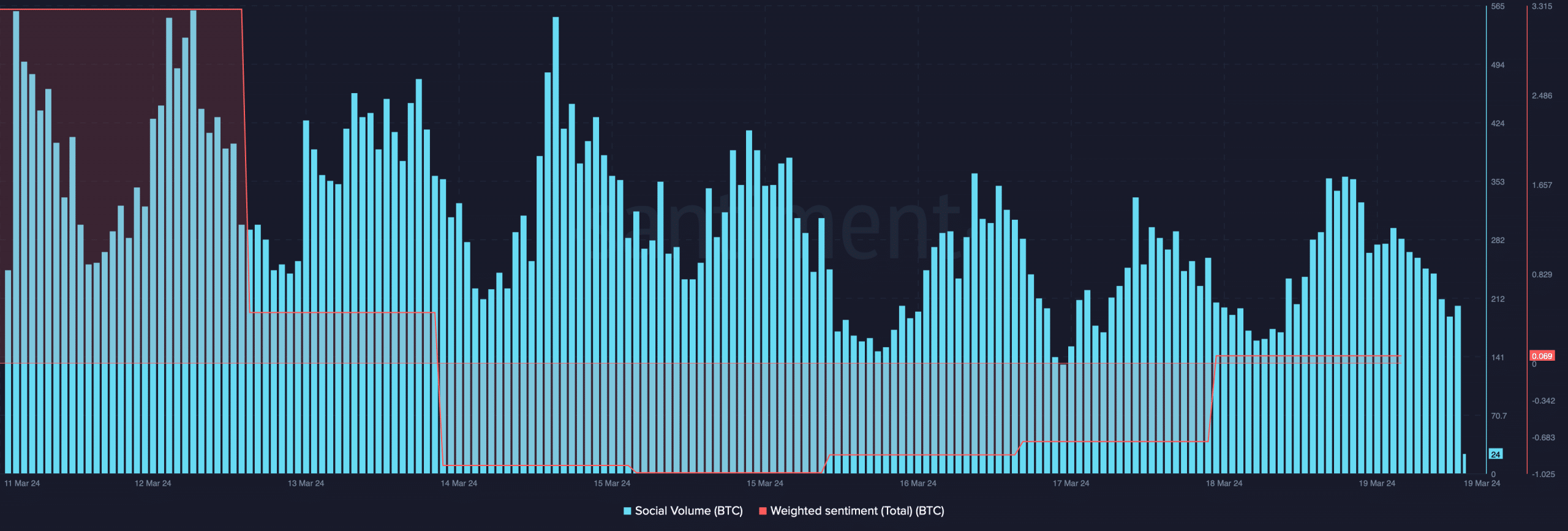

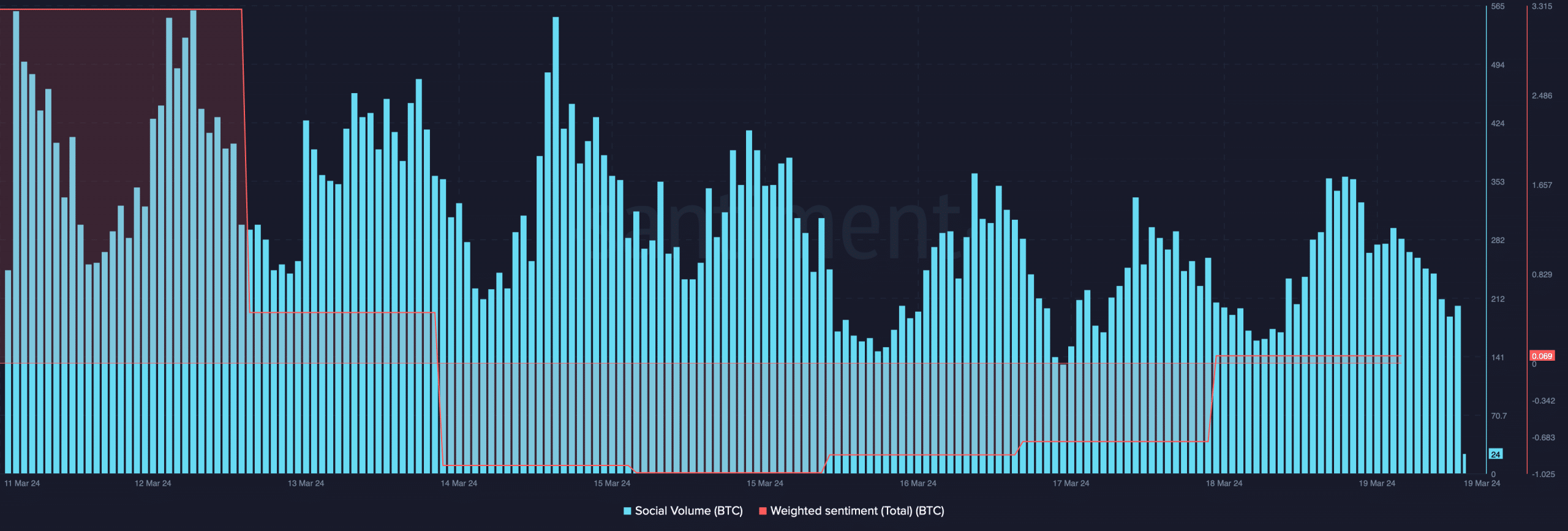

As a result of the price drop, Bitcoin’s social volume dropped, indicating that its popularity waned somewhat. Weighted sentiment also fell, meaning bearish sentiment around the coin was dominant.

Source: Santiment

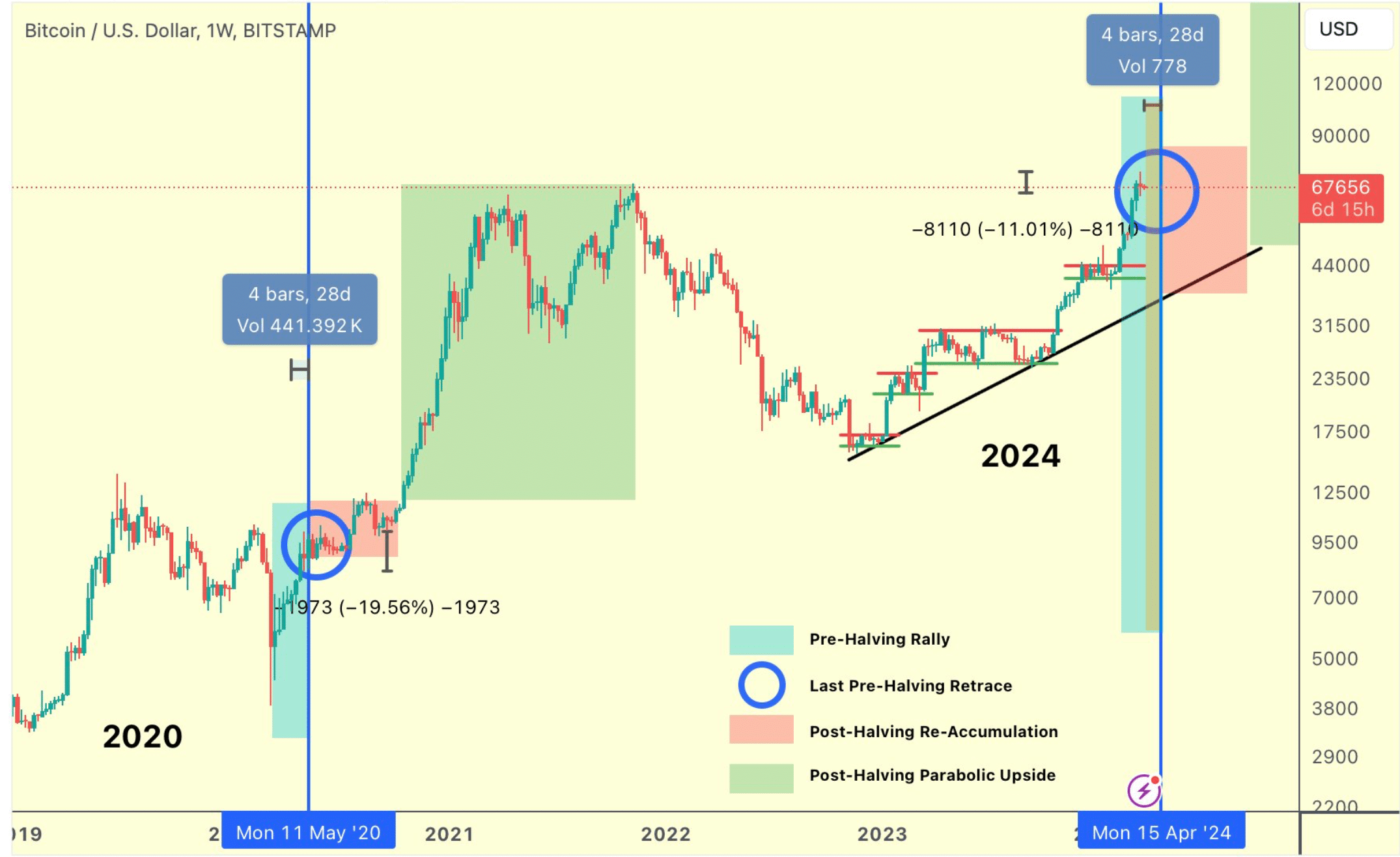

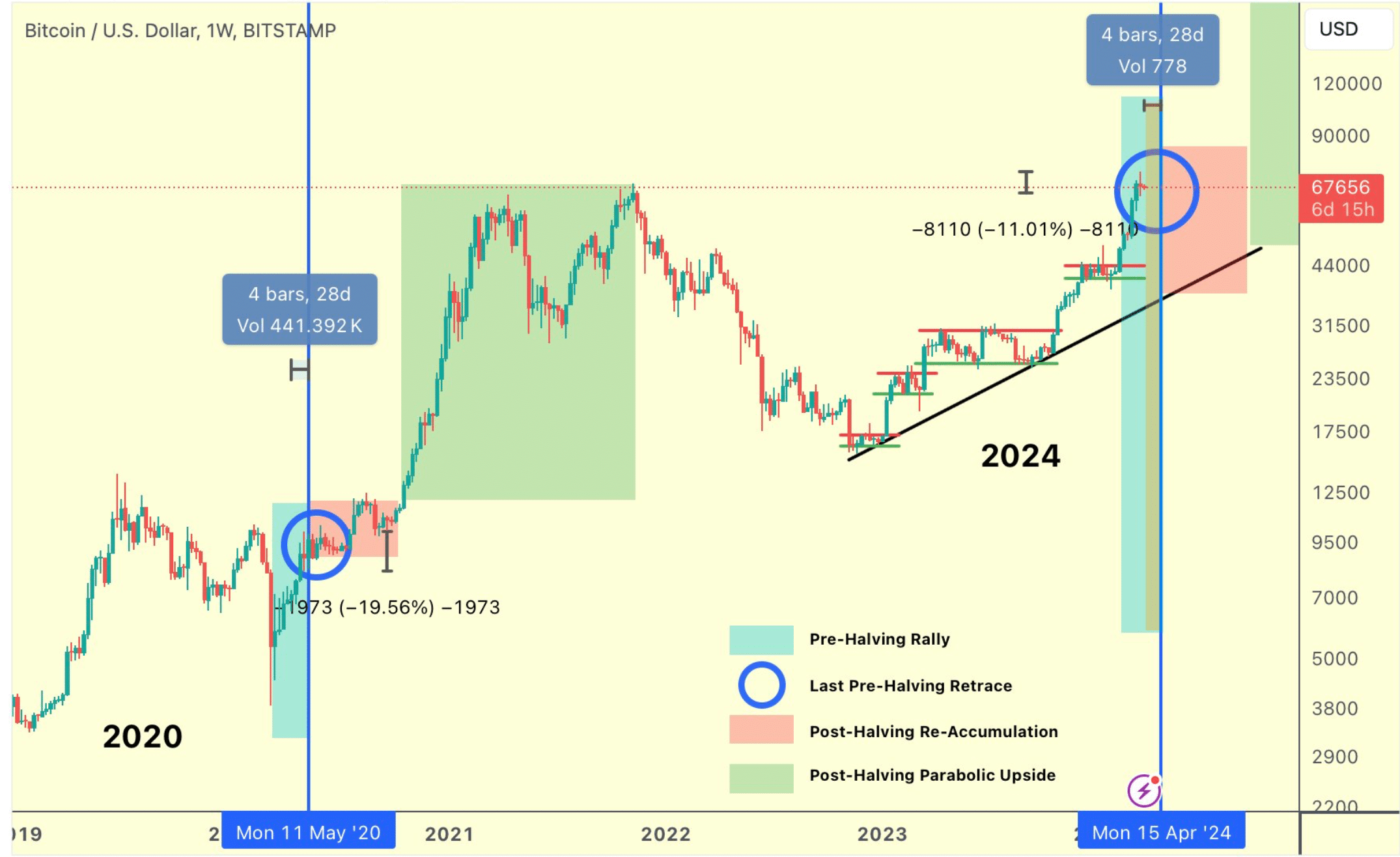

However, this downward trend was not unforeseen, as shown in a report by Rekt Capital analysis regarding BTC following a historical trend leading up to the upcoming halving.

According to the analysis, Bitcoin entered the pre-halving rally phase for the first time. During that phase, BTC managed to reach an all-time high a few days ago.

The breakaway from the Pre-Halving Rally was a few days ahead of schedule. However, Bitcoin slowly made the transition from the ‘Pre-Halving Rally’ phase to the ‘Pre-Halving Retrace’ phase.

Source:

Will the value of Bitcoin continue to decline?

Since Bitcoin entered the pre-halving retracing phase, there seemed a good chance that the coin would register a further price decline. Rekt Capital’s tweet mentioned that the pre-halving retrace usually occurs 28 to 14 days before the halving. The phase resulted in price drops of 20% and 38% in 2020 and 206 respectively.

This time, BTC might as well reach $60,000.

To see if that is possible, AMBCrypto took a look at CryptoQuant facts. Our analysis showed that the net deposits of BTC on the exchanges were high compared to the average of the last seven days, indicating high selling pressure.

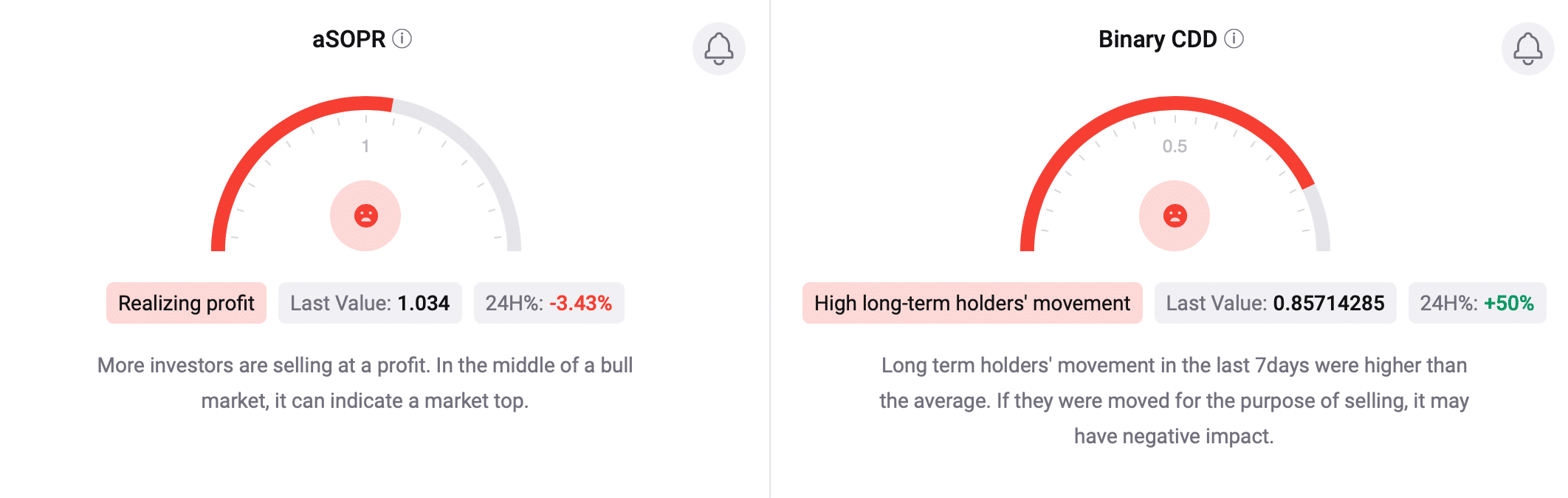

Two other bearish indicators were the SOPR and the Binary CDD as both were red, indicating high selling pressure.

Source: CryptoQuant

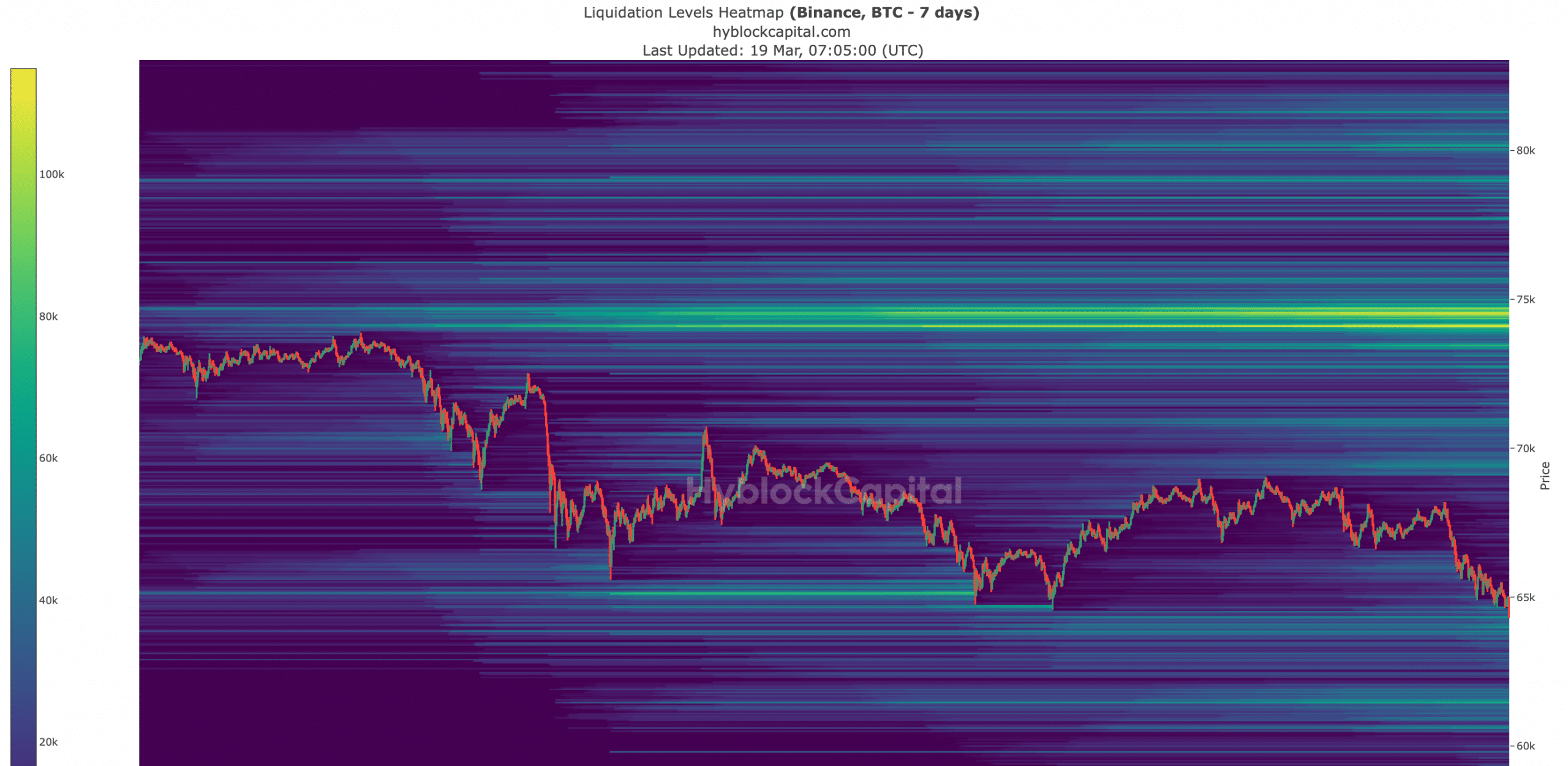

To check how much the coin could fall, AMBCrypto then looked at the liquidation heatmap. According to our analysis, BTC has strong support around $64,000.

Therefore, the price of BTC could recover after reaching this level. However, if it fails to test the support and falls below it, there is a good chance that BTC will reach $60,000.

Source: Hyblock Capital

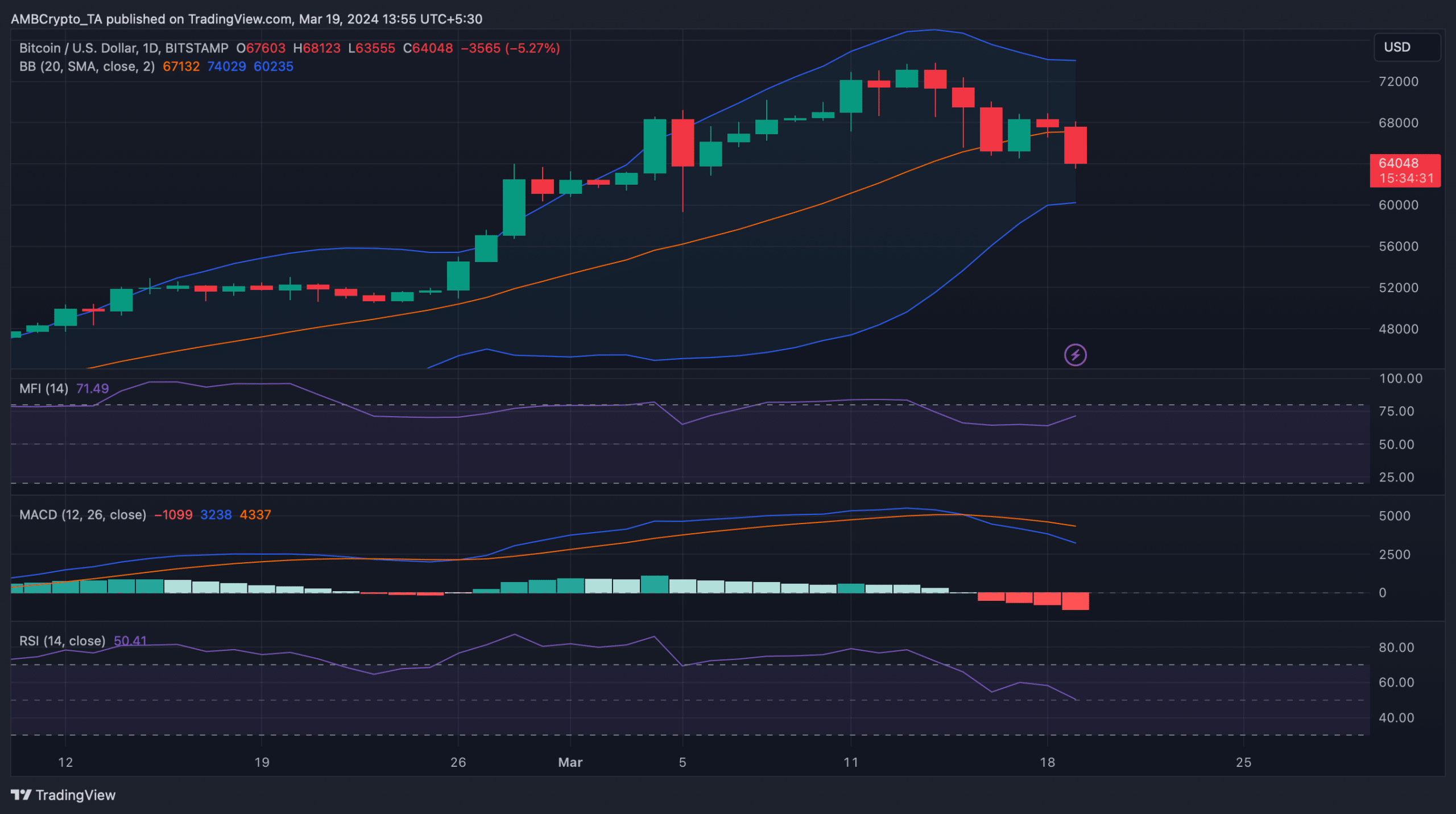

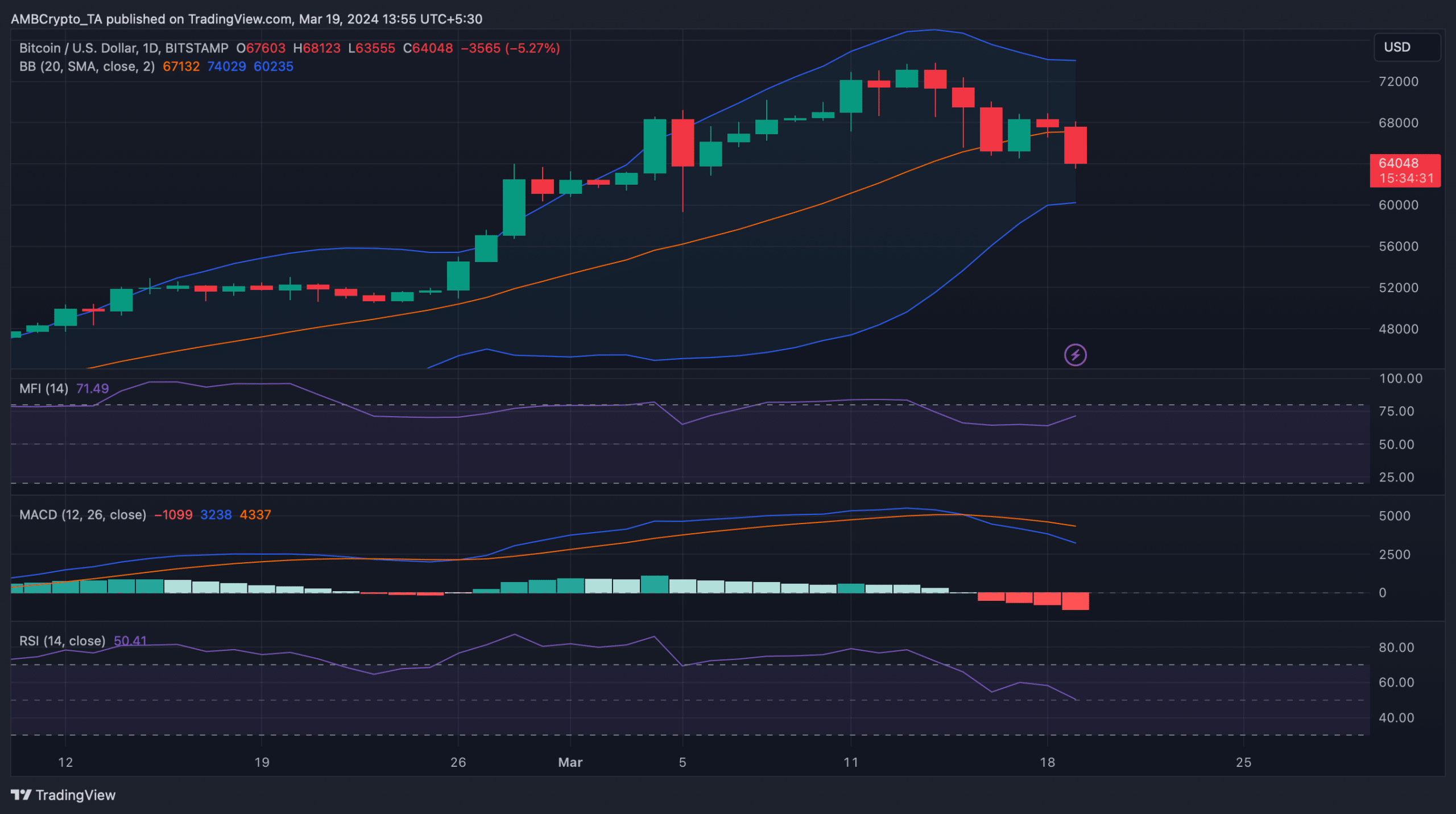

To better understand the chances of a continued price decline, AMBCrypto checked Bitcoin’s daily chart. The Relative Strength Index (RSI) of the king of cryptos registered a sharp decline.

The MACD also showed a bearish edge, suggesting that the coin’s price could fall further in the coming days.

Nevertheless, the Money Flow Index (MFI) recorded an upturn. According to the Bollinger Bands, the price of BTC was in a less volatile zone, which could prevent the value of the coin from falling further.

Source: TradingView

Bitcoin could reach $100,000 after the halving

Although the price of BTC might witness another price correction, things looked bullish in the long term. Notably, after the retrace phase before the halving, BTC will enter the reaccumulation and parabolic uptrend phase.

The accumulation phase might as well last almost five months. Interestingly, this cycle would be the very first time that this reaccumulation range could develop around the New All-Time High region.

The said analysis,

“As a result, this reaccumulation range may simply take the form of a regular sideways range and it may not be long before a further uptrend continues.”

After that, BTC would enter the parabolic uptrend zone, which would allow BTC to create a new ATH. Historically, this phase has lasted just over a year.

Read Bitcoins [BTC] Price prediction 2024-25

However, with a potentially accelerated cycle currently underway, this figure could be halved in this market cycle.

Therefore, at that stage, investors could see BTC reaching $100,000, which could happen by the end of this year.