Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Bitcoin prices have risen to $ 85,020 in the last 24 hours, which marks an increase of 1.2% that reverses part of the recent Neerwaartse Momentum. The cryptocurrency now tests an important resistance level that dates from the January peak of $ 110,000, according to market analysts.

Related lecture

Signs of a rebound rise

While Bitcoin Still shows a decrease of 3.4% in the past week and a decrease of 9.5% In the past month, signs of recovery are on the rise. Technical analysts have seen a strong one -day price candles that have completely deleted the losses of the previous three days.

The Relative Strength Index (RSI), a popular momentum indicator, is bouncing from its support line. This technical signal often suggests building Momentum for an upward price movement.

According to reports of TradingView -analystsBitcoin stands for the most important challenge with the falling trend line that started on January 20. This resistance coincides with the 50-day advancing average and Bitcoin has tested this level four times before.

$ 100,000 goal within reach when resistance breaks

Market Watchers look at a target just under $ 100,000 if Bitcoin can break his current wall. This goal is at the top of the Barrièrezone of February and corresponds to the 2.0 Fibonacci extension level, an important sign used by traders.

A breakthrough could point a movement in the direction of a long -term bullish trend for the cryptocurrency, which has had to deal with major obstacles in recent weeks.

The fifth test of this resistance level can be decisive for the price direction of Bitcoin in the short term. Traders are closely monitoring to see if this attempt will be successful where the previous one has failed.

Great holders show a growing faith in Bitcoin

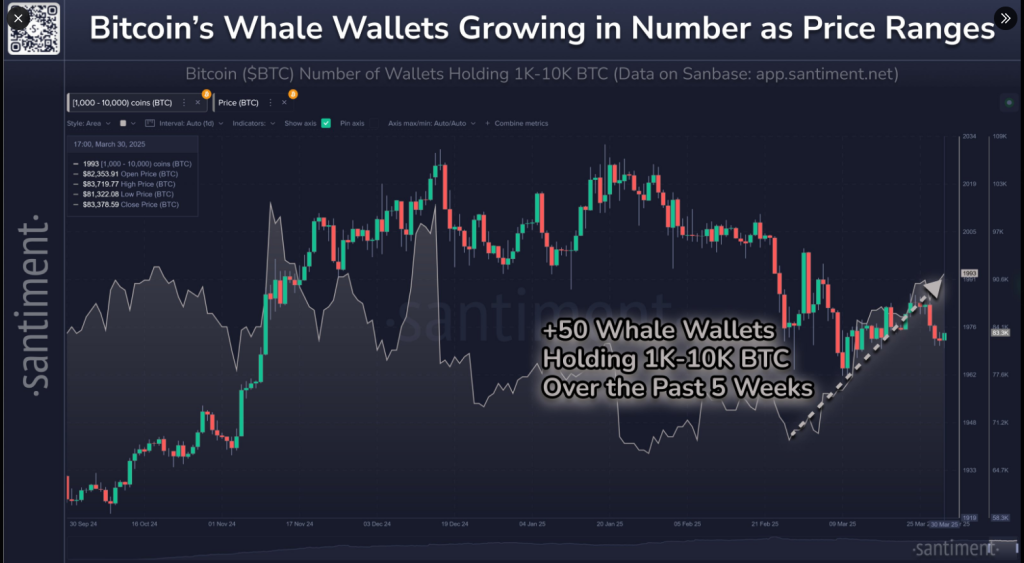

According to figures supplied by SantimentThe portfolios that held between 1,000 and 10,000 Bitcoins increased to 1,993 by 31 March. It is the largest since December 2024 and an increase of 2.5% within a five -week period when 50 large wallets came to the market.

Bitcoin’s market value fluctuates between $ 81k to $ 84k Monday. And while the prices continue to vary as March further, Walgsportfeuilles (in particular 1k-10k $ BTC Holders) continue to grow in number.

There are now 1,993 #Bitcoin Wallets of this size, which is the highest … pic.twitter.com/ivyj9xdxaj

– Santiment (@santimentfeed) March 31, 2025

This accumulation pattern by large holders tends to reduce the supply of Bitcoin in circulation. If the demand remains constant or increases while the supply is decreasing, prices tend to rise.

Related lecture

Exchange outflows signal in the short term bullish-outlook

The activity of this “whale” Wallets is a primary measure for market sentiment because these large holders are usually aware of advanced research and market analysis that guide their investment choices.

In the meantime, the movement of Bitcoin to and from fairs shows a decrease of 38% in the net flows in the last 24 hours. According to Intotheblock Analytics, this suggests that traders move their bitcoin of exchanges instead of preparing for selling.

Featured image of Gemini Imagen, Graph of TradingView