- The short-term holders of Bitcoin (STHS) currently hold an average non-realized loss of 6%.

- A movement above their cost base can shift the sentiment. What are the opportunities?

Bitcoin [BTC] has risen in the past two weeks after four important resistance levels and previously pushed underwater holders back into profit.

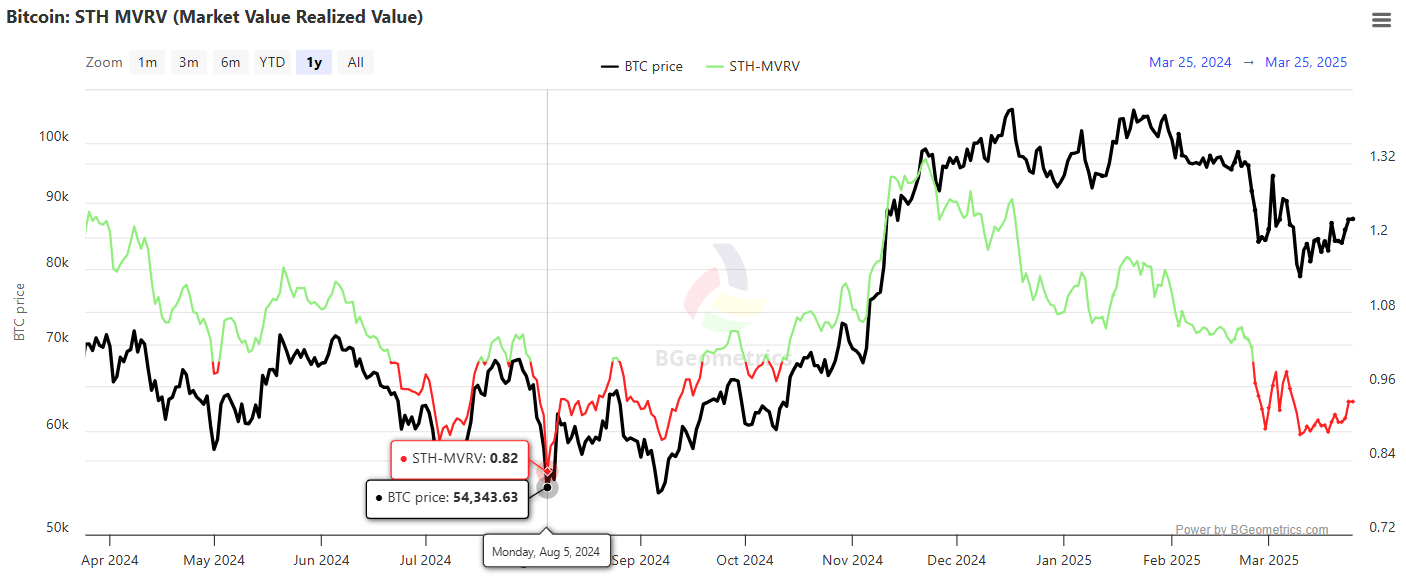

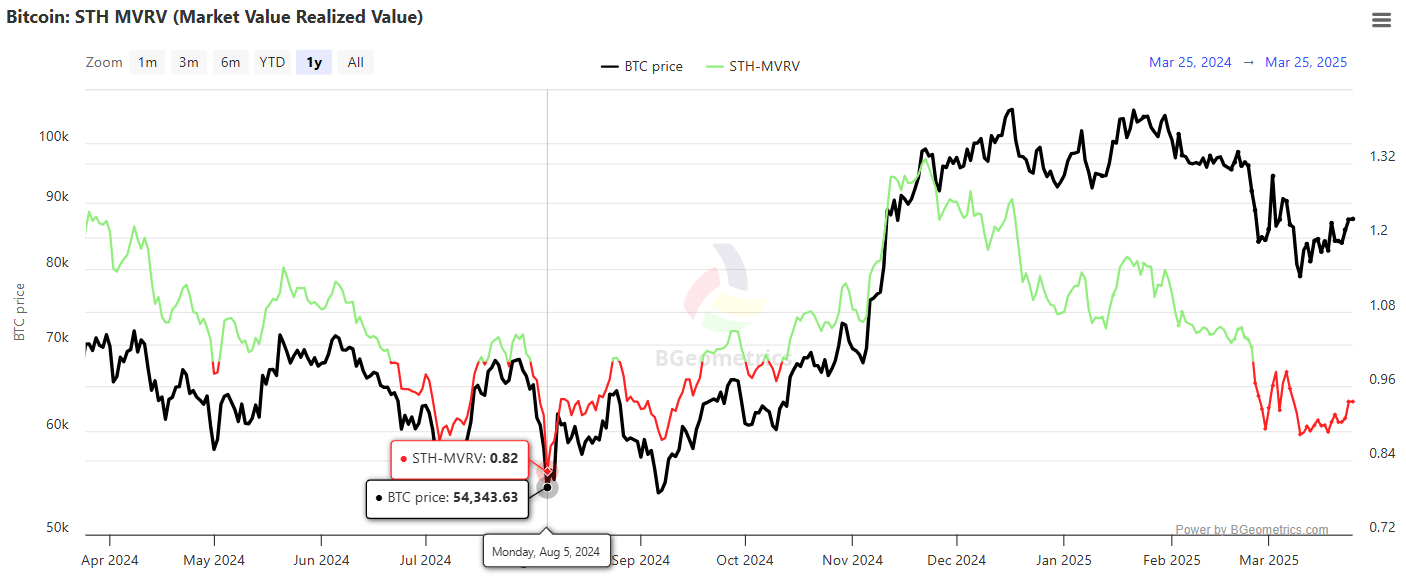

However, the market value in the short term and the ratio of the realized value (STH MVRV) remained in a negative area, indicating that holders still have an aggregated non-realized loss in the short term.

A persistent movement above their cost base is required to stimulate FOMO and to unlock further upward potential. Unclean facts Van Glassnode fixed $ 93.5k as the critical break life, which marks an important resistance cluster.

For Bitcoin To maintain its current market value of $ 88,041 and to extend the rally, bulls must prevent forced liquidations between holders in the short term that can cause distribution -driven sales pressure.

A failure to do this risks a repetition of the capitulation event at the beginning of August 2024, with a negative STH MVRV lecture preceding the sharp drawing of BTC from $ 68,525 to $ 54,343 in less than two weeks.

Source: Bgeometrics

The direct goal for bulls is therefore to put the resistance of $ 93.5K into support, a movement that would drive the STH MVRV ratio in a positive area.

Consequently, the short-term holders (> 155 days) would bring in non-realized profits, which relieves the pressure on the sales side.

This outbreak is particularly crucial as Q2 approaches, with macro -economic shifts that are ready to introduce liquidity fluctuations. So, to prevent forced liquidations, Bitcoin must confirm this as a demand zone.

A critical week ahead

Bitcoin’s Retracement to its layer for the $ 78k elections on March 10 activated “Extreme fear”, historically a strong accumulation zone.

Since then, BTC has risen 12.82%, so that a substantial part of the stakeholders is restored in the net non -realized profit.

This shift has pressed the market sentiment in the “faith” phase, as indicated by the net non -realized profit/loss (NUPL) metric.

Source: Cryptuquant

Simply put, this signals a preference for hodels above distribution at key resistance levels.

In addition, Open Interest (OI) has returned to his peak of November of $ 57 billion, with $ 12 billion in New lifting tree positions In the past two weeks, the strong speculative demand underlines.

Bitcoin’s recovery of $ 93.5K, an important Brak Holder (STH) break life level, remains uncertain. A persistent rejection here can cause sales pressure, which increases the risk of liquidations.

A deeper decline in STH MVRV would then attach the capitulation between weak hands, which makes it possible to accelerate a wider distribution phase.

Of Macro -economic uncertainty Vooruit could introduce Q2 new volatility – a factor to look at before he deals purely about bullish statistics.