- Bitcoin’s shares-to-flow ratio decreased by 16.66%, which reflects a reduced scarcity reflected by increased miner or holder distribution.

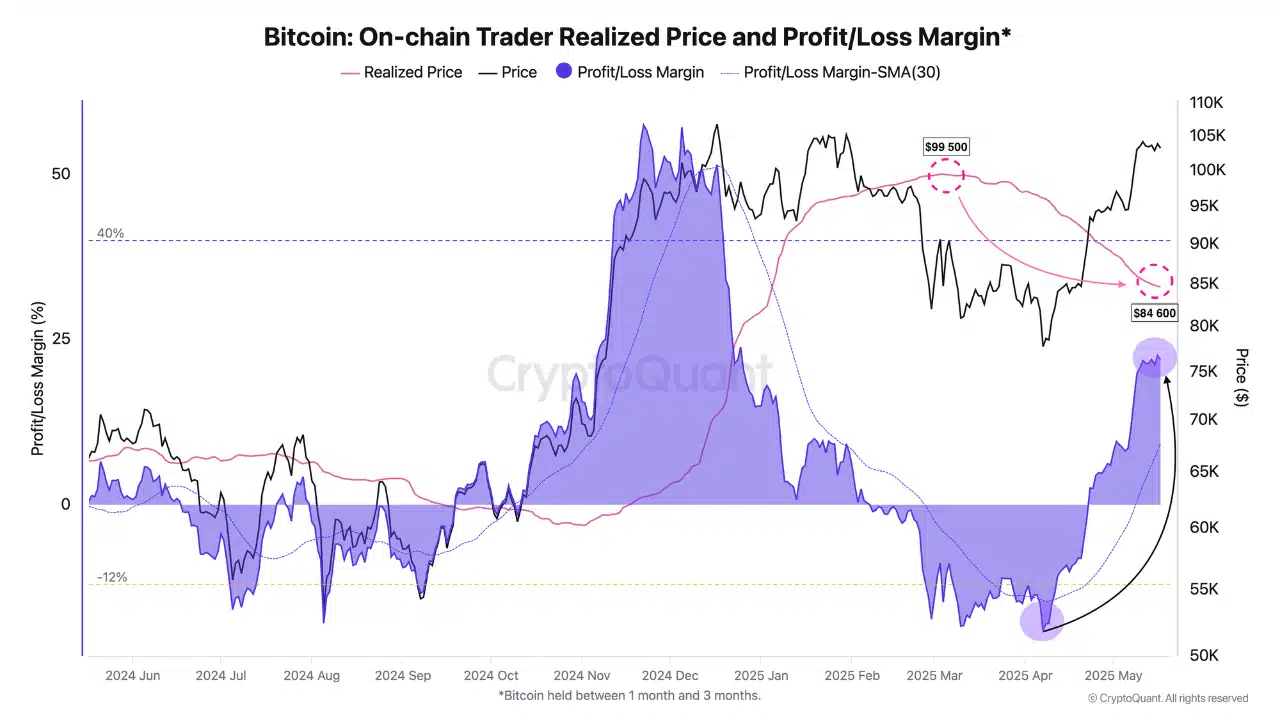

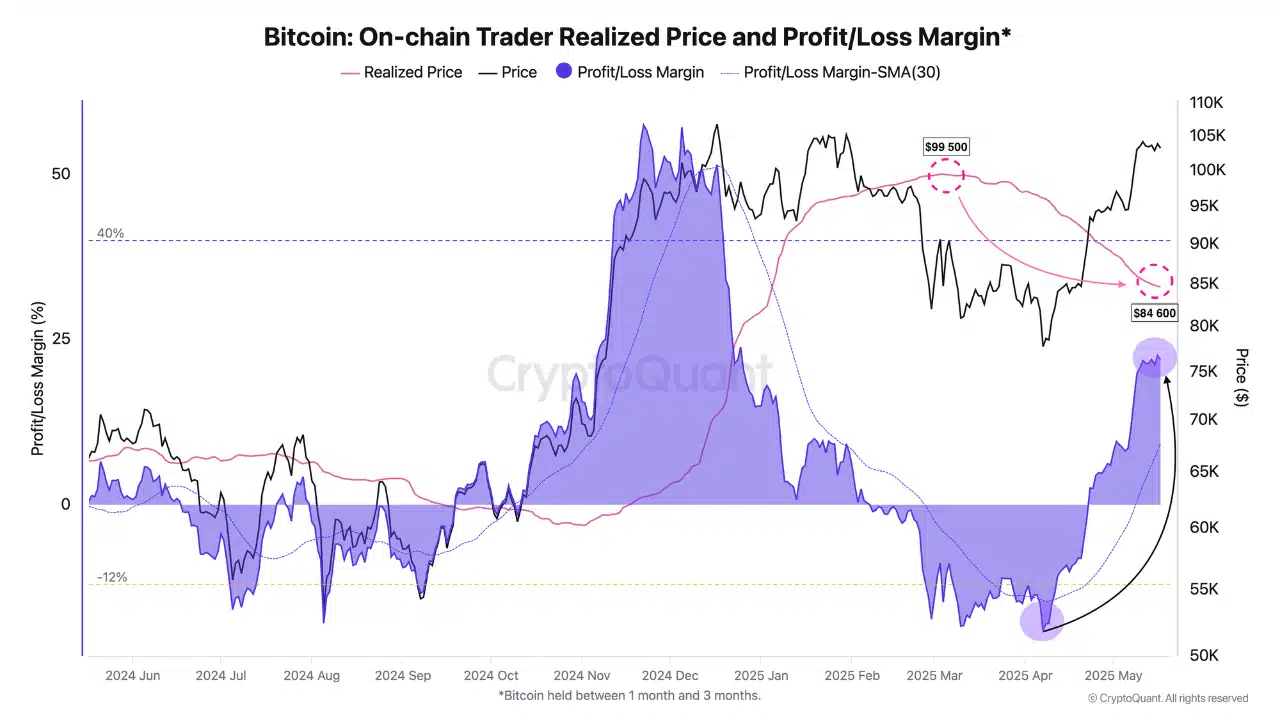

- The short -term margin of BTC turned from -19% to +21% in May in April.

Bitcoin [BTC] Holders in the short term have returned strongly, with their profit/loss margin jumping from -19% in April to +21% in May. These passage signals renewed the optimism of the trader after weeks of correction.

The realized price for the 1-3 months cohort is stabilized at $ 84,600, which supports a further supporting accumulation sentiment. At the time of the press, BTC floated to $ 103,447, an increase of 0.03% in the last 24 hours.

In addition, the 30-day advancing average of the profit/loss margin is now at +9%-under the overheated +40% threshold.

This indicates the headroom for more profit without making aggressive profit.

Source: Cryptuquant

Did BTC’s appreciation. Are foundations?

That said, not all indicators are tailored to the price recovery.

The ratio of the network value and transaction (NVT) climbed by almost 70% to hit 52.81. This sharp increase implies that the market capitalization of Bitcoin is growing faster than the actual transferred volume on-chain.

Although this can reflect the expansion of the bullish valuation, it is often preceded by local tops when it is not supported by active network use.

That is why the current peak increases early caution, especially if the growth has been detached from transaction entry.

Source: Cryptuquant

In fact, network use could not keep track of.

Bitcoin’s stock-to-flow Proportion drop with 16.66% to 1,0595 million. This decline reflects reduced scarcity of pressure, possibly due to changing my work behavior or a delay in the accumulation of long -term holders.

When trends for stock-to-flow are lower, new mined BTC is usually entered the circulation faster, so that may be created medium-term pressure if the demand does not allow.

Is BTC’s network activity too weak to support the rally?

Despite the fact that Bitcoin ralls up to more than $ 103k, the daily active address (DAA) divergence remains deep negative at -241.32%.

This indicated an important decoupling between price action and user activity, because fewer unique addresses have interaction with the network compared to the increasing valuation.

Historically, such steep negative divergence signals the Fundamentals on the chain behind price movements.

Source: Santiment

In addition, transaction and network growth fell sharply to 67.2K and 52.9K respectively.

The cool-off in use signs hesitation of both new and existing participants and unusual backgrounds for a persistent rally.

A healthy rally usually corresponds to the increased acceptance of users and transaction supply. However, this recent decline is in contradiction with the price momentum and suggests that the rally may have strong fundamental support.

Source: Santiment

Long/short ratio signals rising indecision on the derivatives market

Looking at derivatives, the long/short relationship fell to 0.9964.

Longs made up 49.91%, while Shorts tapped up to 50.09% – even.

This almost equivalent distribution reveals increasing uncertainty in the expectations of the trader. The sharp shift of a rather long -heavy Bias emphasizes the growing caution after the recent price destination of Bitcoin.

Source: Coinglass

The current market previews present a conflicting story.

On the one hand, Bitcoin’s recovery suggests in the trader’s profit margins and the persistent price -strength bullish momentum.

On the other hand, a strong increase in valuation is not matched by growth in transaction activity, user involvement or network expansion.

This decoupling calls concern about the sustainability of the rally. To continue the upward trend in a healthy way, fundamental statistics in the chain must improve.