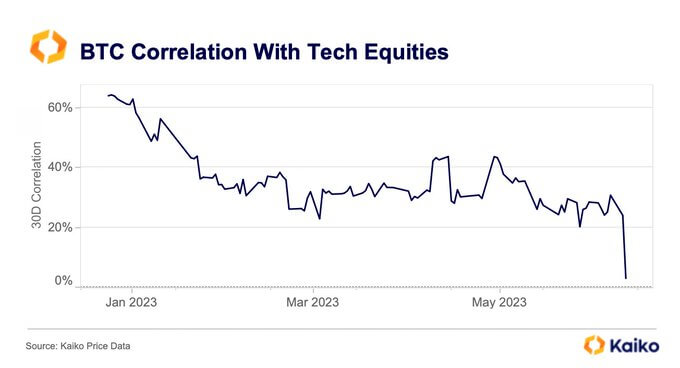

Bitcoin’s (BTC) correlation to the Nasdaq dropped to 3% in June, according to data from Kaiko – indicates divergent sentiment between cryptocurrencies and tech stocks.

The price-performance ratio for the leading cryptocurrency in June was between $24,800 and $31,360, opening the month at $27,200.

BlackRock’s spot Bitcoin ETF filing on June 15 was a bullish catalyst, reversing the previous downtrend some eight days later to a new year-to-date high of $31,440.

Since then, Bitcoin has been trading in a narrow band between $29,860 and $31,030 – down 3% since its YTD high on June 23.

Meanwhile, the tech-heavy Nasdaq 100 has been on a continuous uptrend since the start of the year, reaching a YTD high of $15,230 on June 16. Since Bitcoin’s all-time high on June 23, the Nasdaq is up 0.7%.

On a 30-day basis, the Bitcoin-Nasdaq correlation started the year at 60% and dropped to 22% in March, indicating a decrease in the similarity of price movements between the two. This period of change consolidated somewhat, with the correlation struggling to rise above 45%.

The correlation between Bitcoin and Nasdaq has continued to decline throughout the year, dropping sharply to 3% this week from more than 20% in May.

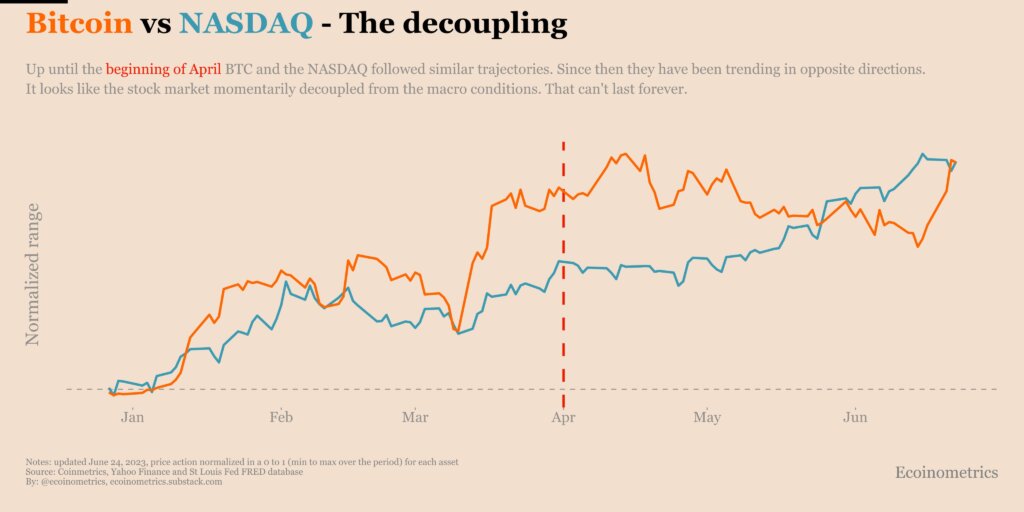

Data research agency Ecoinometrics published a chart of Bitcoin-Nasdaq range movements from the start of the year to June 24. It showed a similar trend between the two until April, after which a “nice disconnection” occurred.

Ecoinometrics further noted that the performance of the Nasdaq is decoupled from the broader macroeconomic landscape, implying an upside trend reversal is underway.

“But this bear market rally for equities cannot escape the gloomy macro picture forever.“

The post Bitcoin correlation with Nasdaq fell to 3% low in June first appeared on CryptoSlate.