Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

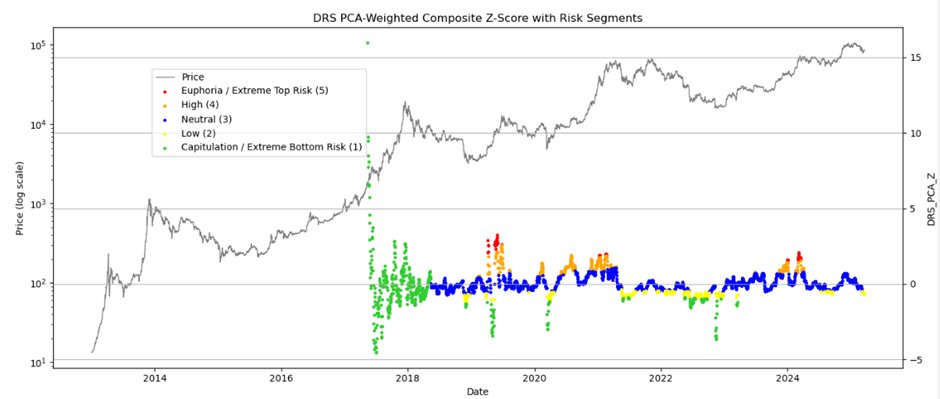

Real Vision Chief Crypto analyst Jamie Coutts has sounded a grim warning for Bitcoin in the coming months. With reference to his new Bitcoin derivatives risk (DRS) model, Coutts claims that the leading cryptocurrency price is confronted with one of the two competitive results: a serious decline or an increase in all time (ATH).

Bitcoin’s Q2 Outlook

In commentary Coutts is shared today via X and emphasizes its “first pass” on the DRS model and notes that the most recent copy of the “Cat 5 Euphory” market in Q1 2024 was followed by a withdrawal of only about 30%. He contrasts this with a similar delivery in 2019, in which a decrease of 50% was fallen – spreading 70% when the COVID shock is justified.

Related lecture

“Looking back on the Cat 5 eup1 2024 -I then marked (in February 2024) -I am still surprised that the pullback was only -30%. The only comparable movement outside of a cycle top in 2019, with a decrease of 50% (70% if you have a factor in the shock of Covid),” he explains.

Coutts emphasizes that 2019 is a better barometer for current market conditions than 2021. He notes the reasons, is that the 2019 rally precedes an important global liquidity expansion. By 2021, Bitcoin had already appreciated 12x of his low, while global liquidity grew by 30%, which reflected a hugely different macroom environment.

Related lecture

Coutts assess the current risk level of the market and points out that the Bitcoin DRS-Metriek has slipped in the “quantile with low risk”, a zone that, according to him, offers minimal predictive power for future prices. “So, where are we now? Bitcoin’s Drs is in the quantile with a low risk-alien-to-predictive power. If Bitcoin has reached a peak, we must expect a brutal bleeding lower,” he warns that the possibility of a rebound remains high.

Global liquidity in the increase

Coutts then underlines the potential of global liquidity to activate another Bitcoin rally. He believes that an upcoming bending point in global liquidity – driven by the need to stimulate heavy debts – will probably feed the market for derivatives, which he calculates to be four times larger than the spot market.

“However, that is not my prospects. Worldwide liquidity is ready to blow that the Derivatives Market (4x spot) will reconnect, which makes Bitcoin possibly be thrown to new ATHS by May (or end of Q2 for extra filling).”

Another important insight from Coutts focuses on the Global Liquuidity Index, which he says is an unprecedented piece in contraction. “This is the longest contraction of the global liquidity index in the history of Bitcoin-three years and counting (measured from the peak). Previous tightening delivery (2014-2016 and 2018-2019) lasted <2yrs. How much longer will this go?"

He claims that a renewed injection of liquidity is inevitable, pointing out that Government, especially with debt-to-BDP ratios of more than 100%, should be suppressed to refinancing if the nominal GDP remains in the event of rising interest costs. “The Fiat, fractional reserve, debt -based system will implode without liquidity injections. The herb must flow.”

At the time of the press, BTC traded at $ 87,703.

Featured image made with dall.e, graph of tradingview.com