This article is available in Spanish.

Bitcoin (BTC), the largest cryptocurrency by market capitalization, started the third week of October with a daily increase of 6%. BTC’s performance has fueled bullish sentiment among crypto investors and market watchers, who suggest the company may be poised to go to $70,000.

Related reading

Bitcoin regains key support levels

Bitcoin started the week by regaining key resistance levels after rising 6% from Sunday’s price. This performance saw BTC leave the $62,000 support zone to retest the $66,000 support area on Monday morning.

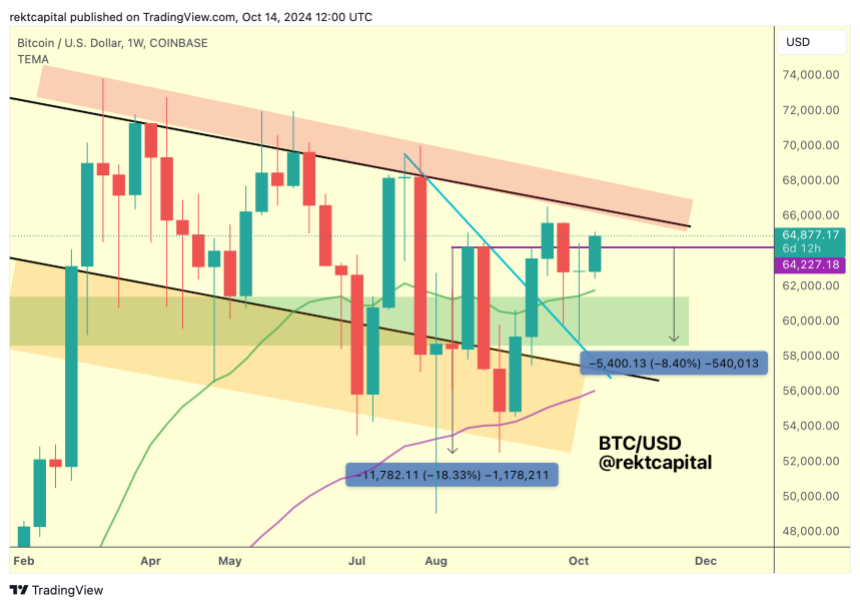

Following recent performance, Bitcoin returns have turned green in October so far, with a monthly return of 3.17%. Mint glass facts. Crypto analyst Rekt Capital highlighted Bitcoin’s recent moves, noting that BTC has been able to reclaim a two-month downtrend as support.

According to the analyst, the flagship has cryptocurrency tested again a downward trend line going back to the end of July since the beginning of October. BTC has successfully retested and risen from the trendline for two consecutive weeks, turning the range into support.

Additionally, the analyst pointed out that Bitcoin has had several successful retests, including a “volatile retest” of the 21-week Bull Market Exponential Moving Average (EMA).

“Notice how the bottom of the green box merges with the retest of the July downtrend and the retest of the 21-week EMA merges with the top of the green box,” the analyst added.

So does Ali Martínez marked that BTC is currently making another attempt to reclaim the 200-day moving average, after four consecutive rejections in the past two months.

BTC Challenges August Highs

Rekt Capital noted that BTC has consolidated the $58,000-$61,000 range as a support area throughout the year: “It has done so at a higher low compared to last month’s down lows and August’s down lows.”

Furthermore, the analyst stated that Bitcoin challenged the August highs around $64,200 following the recent retests of key levels. He suggested that BTC’s recent moves are a “clear sign” that the August level is “weakening as resistance.”

Rekt Capital pointed out that BTC is retesting the multi-month weekly downtrend channel top, which is also weakening as resistance. The flagship cryptocurrency successfully tested the channel lows as support this month.

The range lows were confluent 7-month support with the previous all-time high (ATH) area. Nevertheless, the analyst noted that BTC must have a weekly close above the top of the downtrend channel to break this pattern.

A weekly close above the August highs, followed by a successful retest of this level, would “put significant buying pressure on the falling channel top,” which could be accelerated if BTC’s daily close breaks above $64,200.

Related reading

Furthermore, a daily close above $65,000 and a successful reclamation of the support zone range could send BTC’s price towards the $70,000 resistance zone. The analyst noted that whenever Bitcoin closed the day above this level, the cryptocurrency moved within the $65,000-$71,350 range in subsequent days.

At the time of writing, BTC is trading at $65,812, up 4% and 10.3% in the weekly and monthly installments.

Featured image from Unsplash.com, chart from TradingView.com