- The price of BTC has moved marginally over the past 24 hours.

- Market indicators looked bearish on the coin.

Bitcoins [BTC] The price has been in a consolidation phase in recent days as it stuck around $70,000. There were even chances that BTC would fall near the $60k zone in the short term. If that happens, it will be the right opportunity for investors to stock up.

Is Bitcoin Under Threat?

AMBCrypto reported previously that the price of BTC was in a consolidation phase, moving between $60,000 and its ATH. Our analysis of IntoTheBlock’s facts revealed that more than 97% of BTC holders made profits. At first glance this may seem optimistic, but in reality it can cause problems.

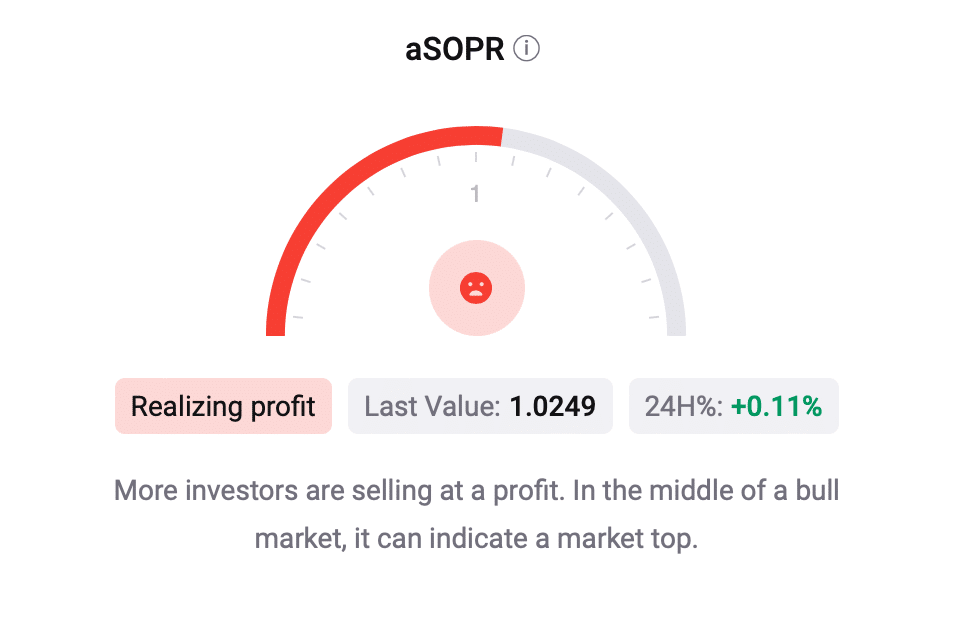

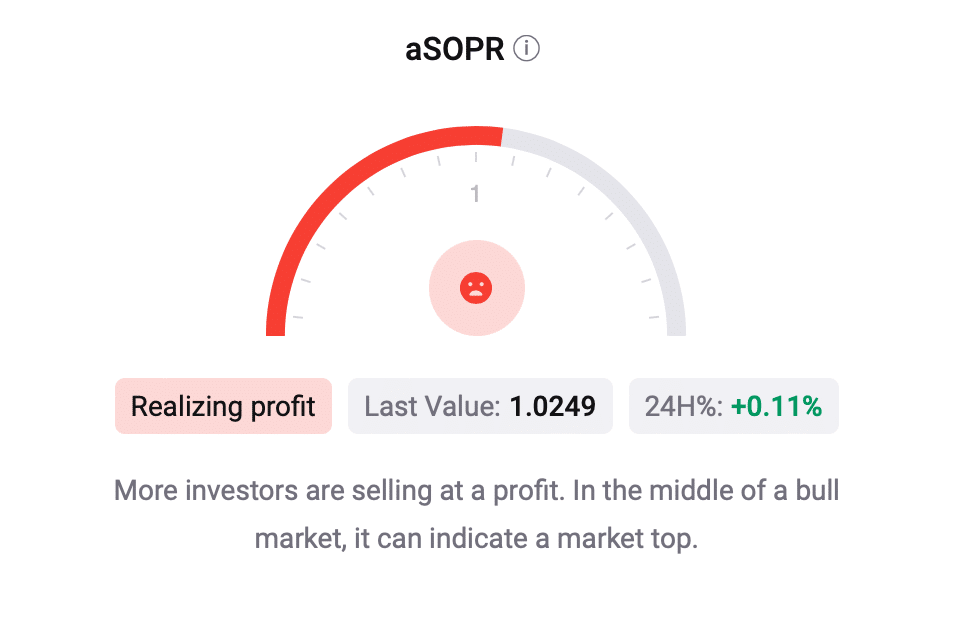

When such a large number of investors make a profit, they often sell their assets to make an exit with the money, increasing the selling pressure. When we checked CryptoQuant’s factsit turned out that BTC’s aSORP was red.

Source: CryptoQuant

This meant more investors sold at a profit. In the middle of a bull market, this could indicate a market top, which signals a price drop.

According to CoinMarketCapBTC’s price has moved marginally over the past 24 hours, trading at $70,446.45 at the time of writing.

Investors are still buying BTC

It was interesting to note that despite these aforementioned warning signs, BTC investors showed tremendous confidence in the coin as they continued to accumulate.

Ali, a popular crypto analyst, recently posted one tweet It highlights that BTC showed a strong accumulation score while consolidating around record highs.

An analysis of BTC’s statistics also suggested that buying pressure remained high. For example, BTC’s foreign exchange reserve was green. According to CryptoQuat data, BTC’s Coinbase Premium was also green, meaning buying sentiment was dominant among US investors.

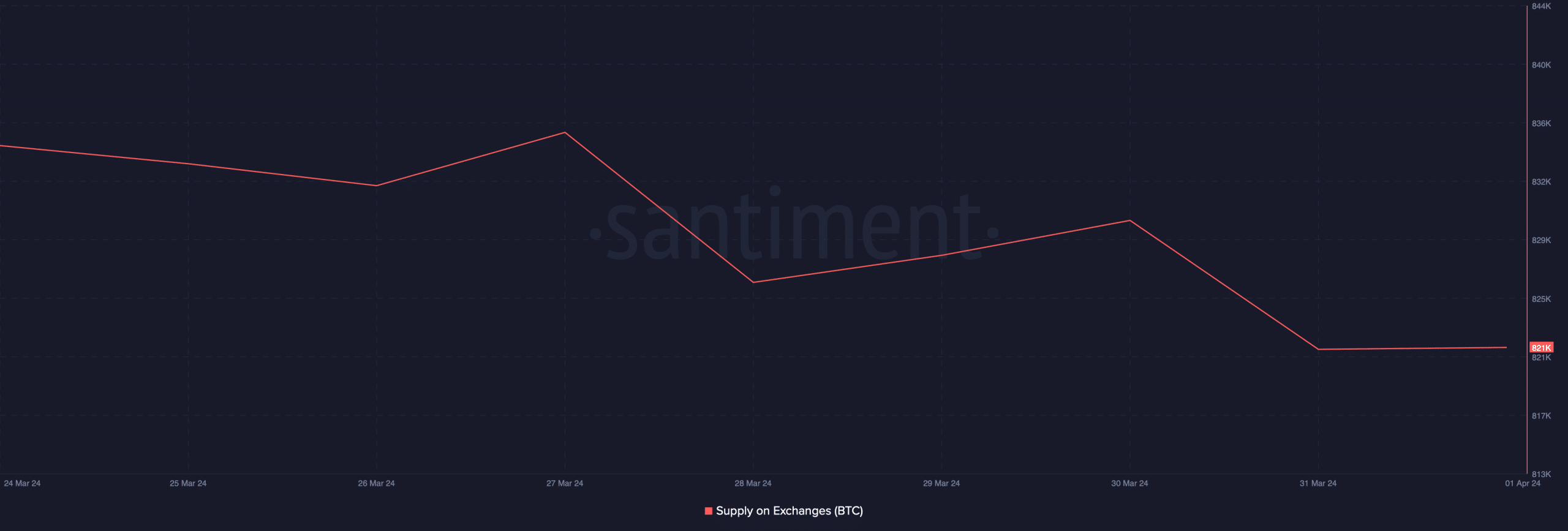

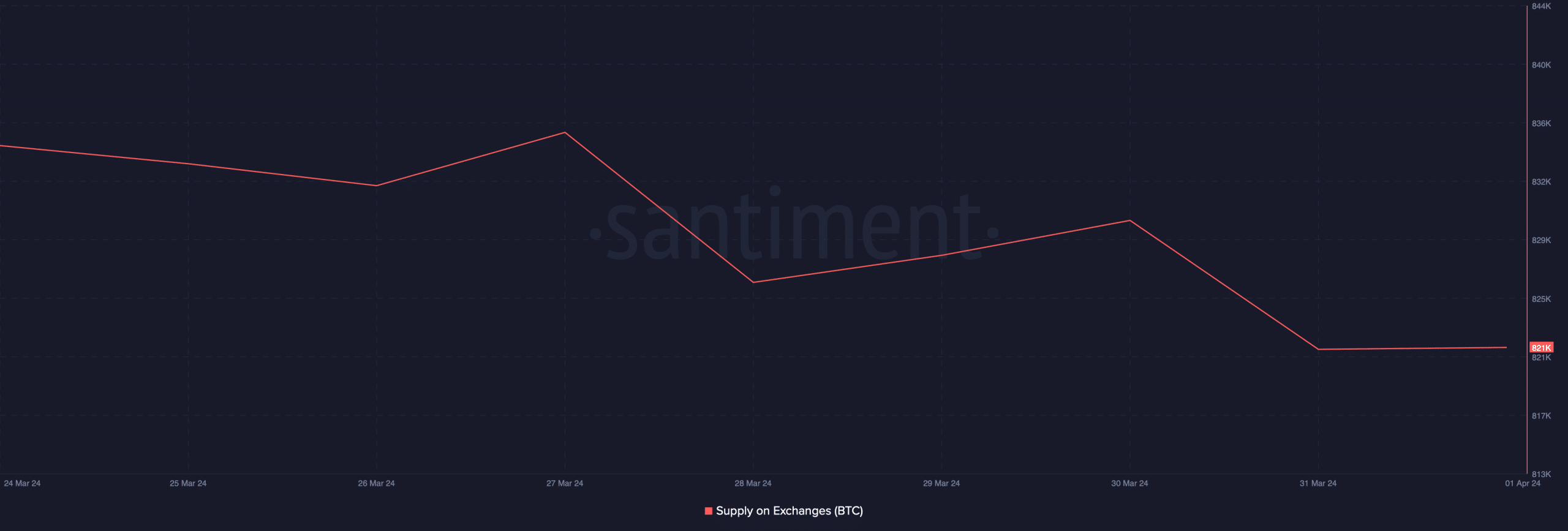

Furthermore, the supply of BTC on the exchanges decreased over the past week, further demonstrating that investors bought BTC while the coin was in a consolidation phase.

Source: Santiment

High buying pressure may not be enough to stop the bears as damp market indicators suggested a price correction, raising the chances of BTC reaching $60,000.

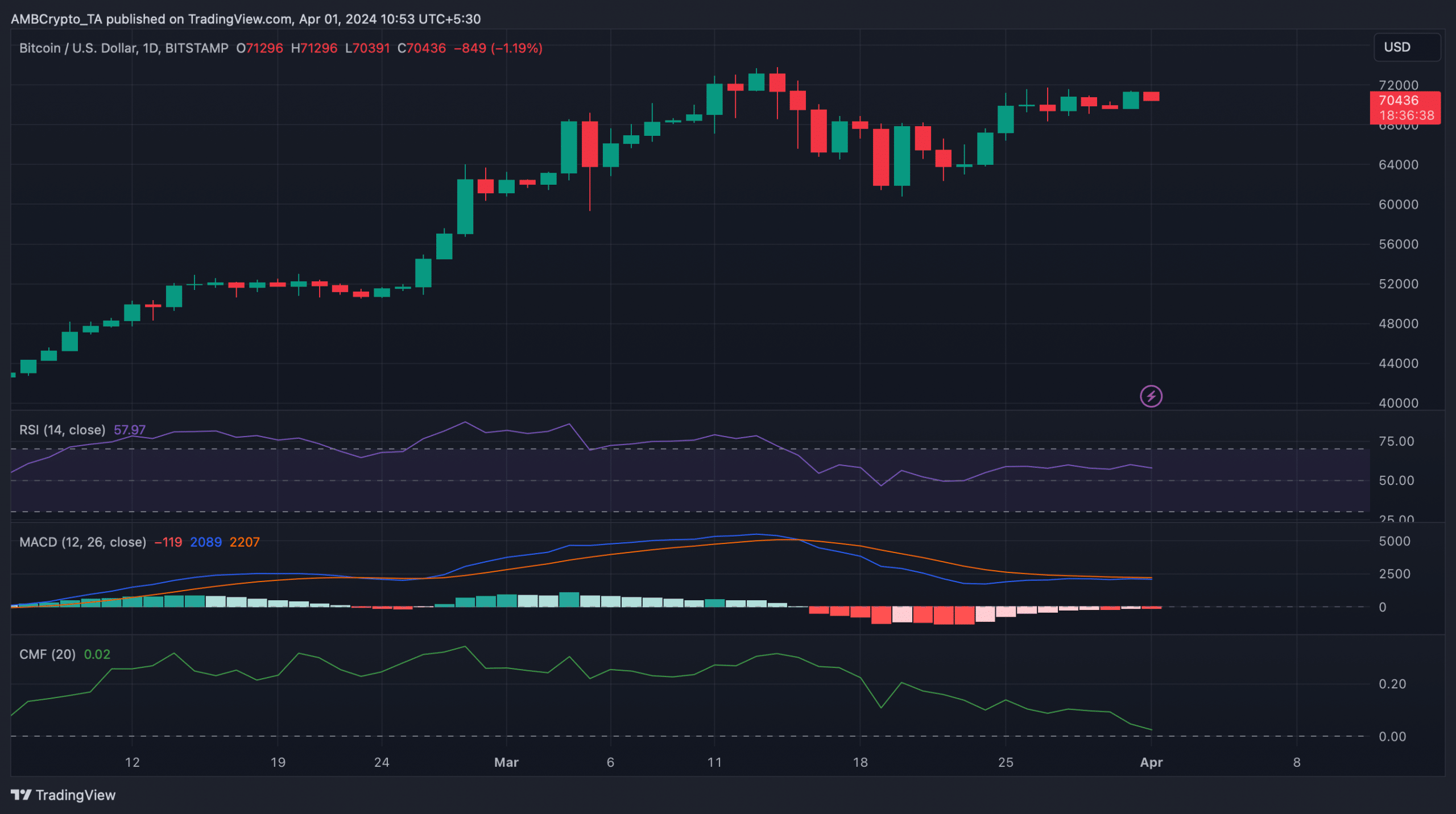

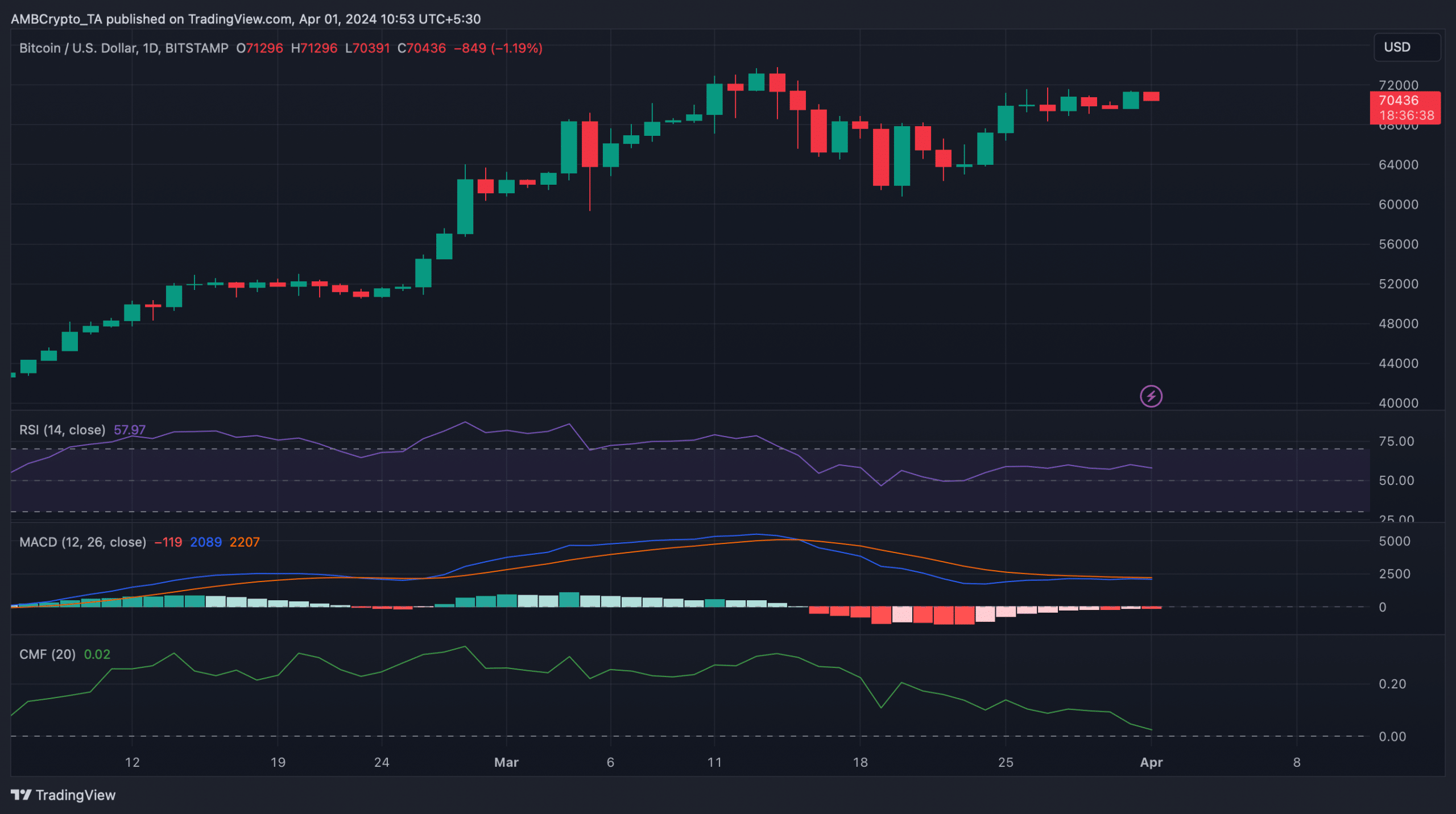

For example, the MACD showed a bearish crossover. The Relative Strength Index (RSI) registered a downward trend after days of sideways movement.

Read Bitcoins [BTC] Price prediction 2024-25

Furthermore, Bitcoin’s Chaikin Money Flow (CMF) fell sharply and was heading towards the neural frontier. These indicators pointed out that BTC could soon witness a price correction.

Therefore, investors might consider waiting longer before increasing their accumulation.

Source: TradingView