- Making a profit on Bitcoin has continued to shrink, while sellers were declining in the market

- Liquidity flows from the market revealed that Bitcoin investors could regain confidence again

As the cryptocurrency market wins, Bitcoin [BTC] has followed that pattern, with a rally of 3.22% during this period. This seemed to indicate that market confidence is growing. However, that is not all like sEverale simultaneous developments seemed to show that a rally can brew. Especially when signs of seller fatigue come to the surface.

Of course, when comparing the prevailing market performance with previous episodes of turbulence, the setup feels creepy.

The seller’s exhaustion comes after

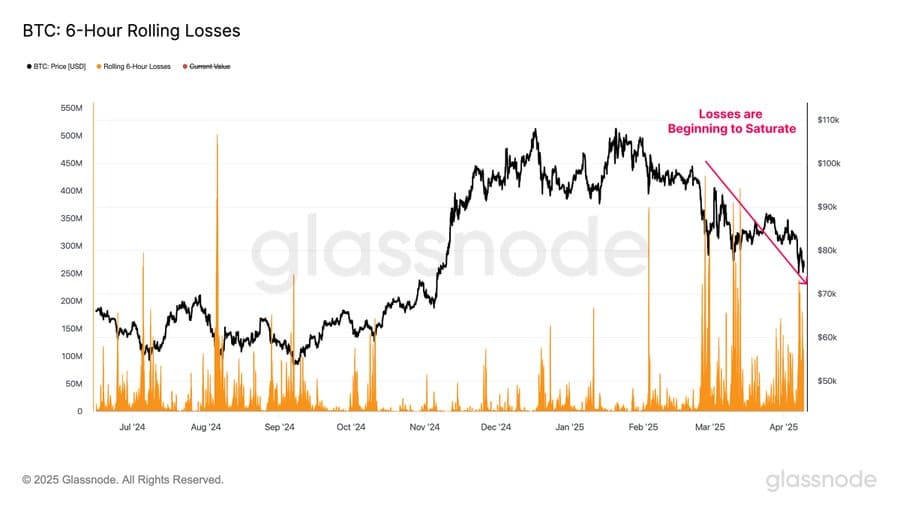

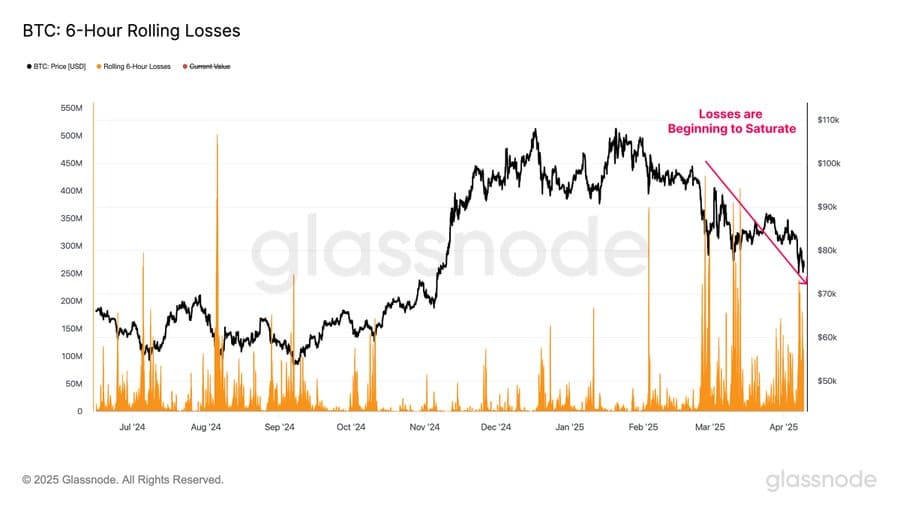

During the latest market collection – one of the largest in the history of Crypto market – investors registered large losses of up to $ 240 million. Such episodes Usually invite aggressive sales pressure. In this specific case, the realized profits continue to shrink.

This contraction could be a sign that sellers are apparently low on ammunition.

In fact, it pointed to exhaustion setting among market participants – a condition that often precedes a rebound.

Source: Glassnode

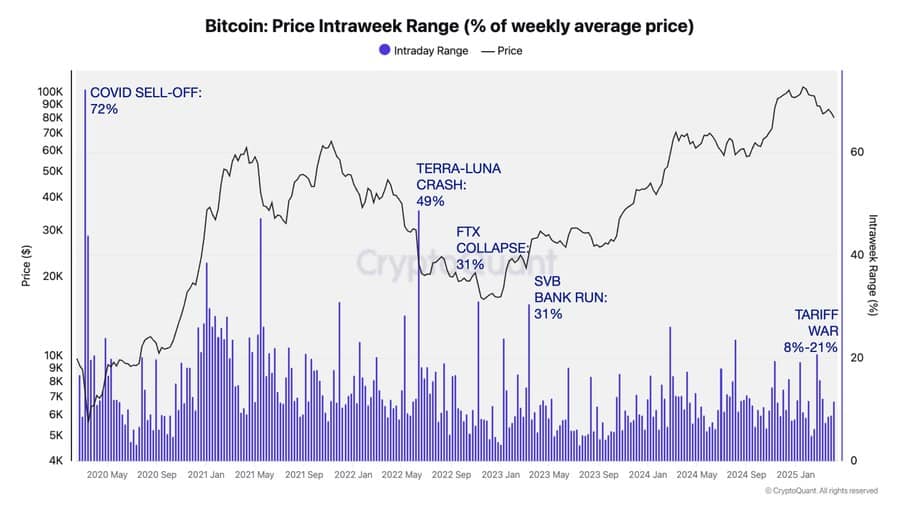

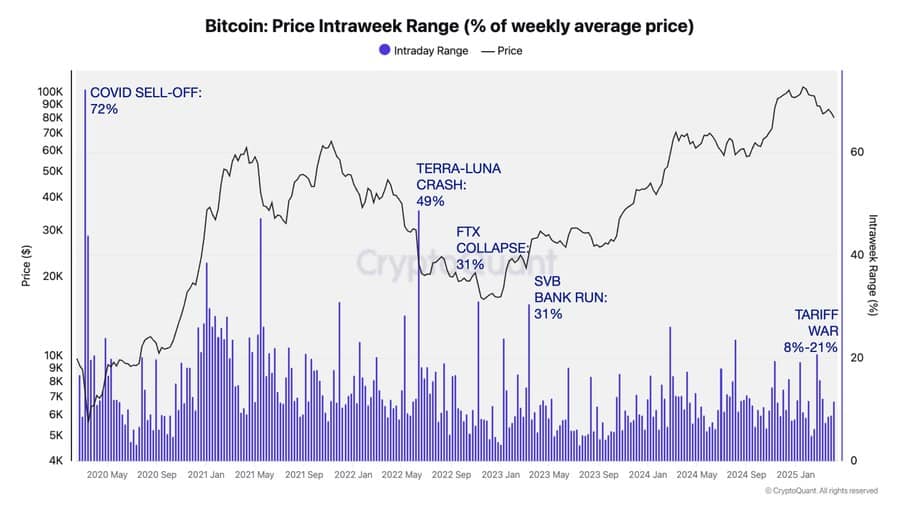

When we place the current setup next to each other with earlier capitulation phases, such as the DIA, the COVID-19-Crash, the Terra-Luna and FTX-Meltdowns, or even the SVB-Bankschriefing, the similarity is striking.

They were all followed by periods of renewed merchants.

Source: Cryptuquant

To give clearer guidelines on possible market movements, Ambcrypto has investigated additional statistics to understand the actions of large investors. We have discovered that an important rebound can approach soon.

A big rebound can be closer

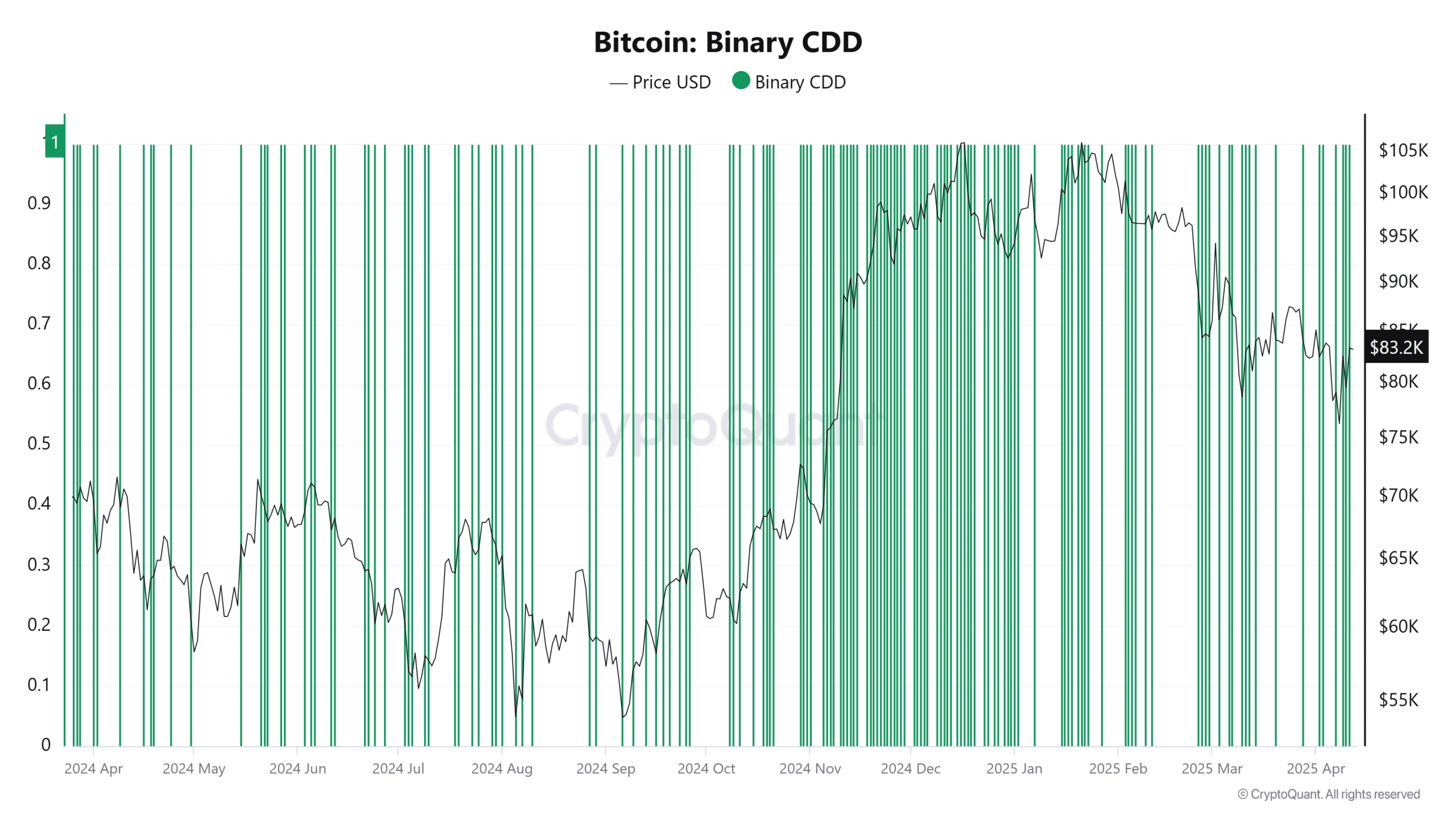

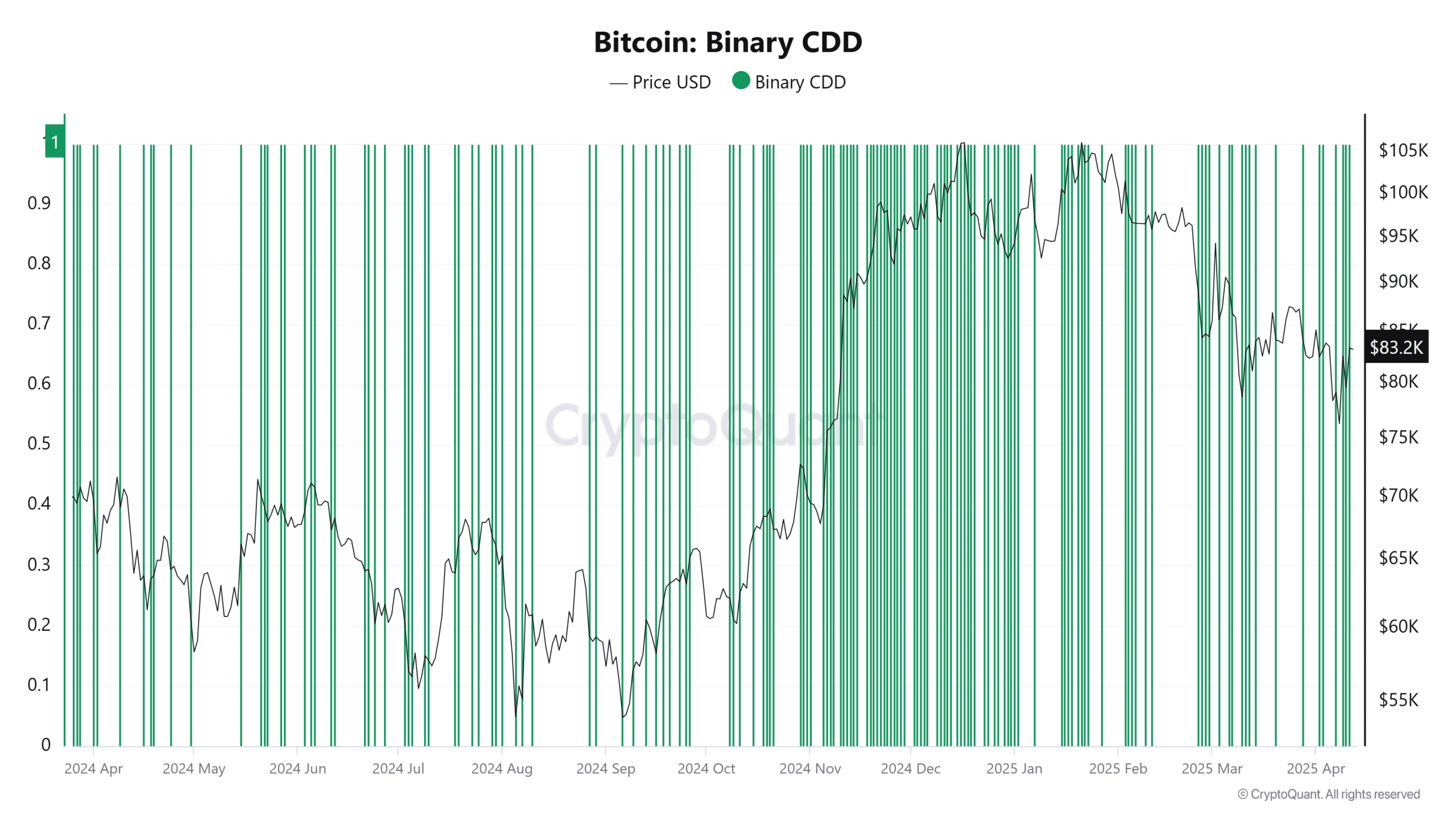

Moreover, the binary coin days destroyed (CDD) metric tells us its own story.

At the time of writing, it flashed a lecture of 1-indicative for the fact that long-term holders, often the Stoic believers in Bitcoin, joined the selling cohort.

That is a powerful signal. When holders load post-drop in the long term, this is to lock up profits or lower losses. These are both signs of capitulation.

Now, although the market sentiment can be crooked to sell, the pace is delayed.

This mix of statistics – Shrinking achieved win, a binary CDD lecture from 1 and historic parallels – all converge into a well -known story. It is – fatigue of the seller is here and a auxiliary prally can be the next chapter very well.

Source: Cryptuquant

In fact, in the field of signs of the seller’s exhaustion, long -term holders can now approach their last sales phase.

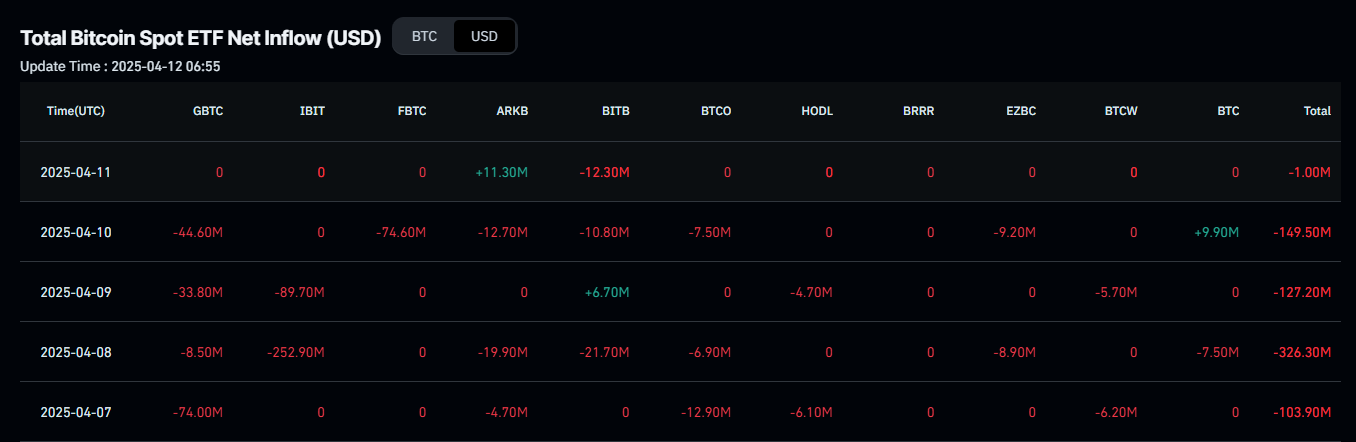

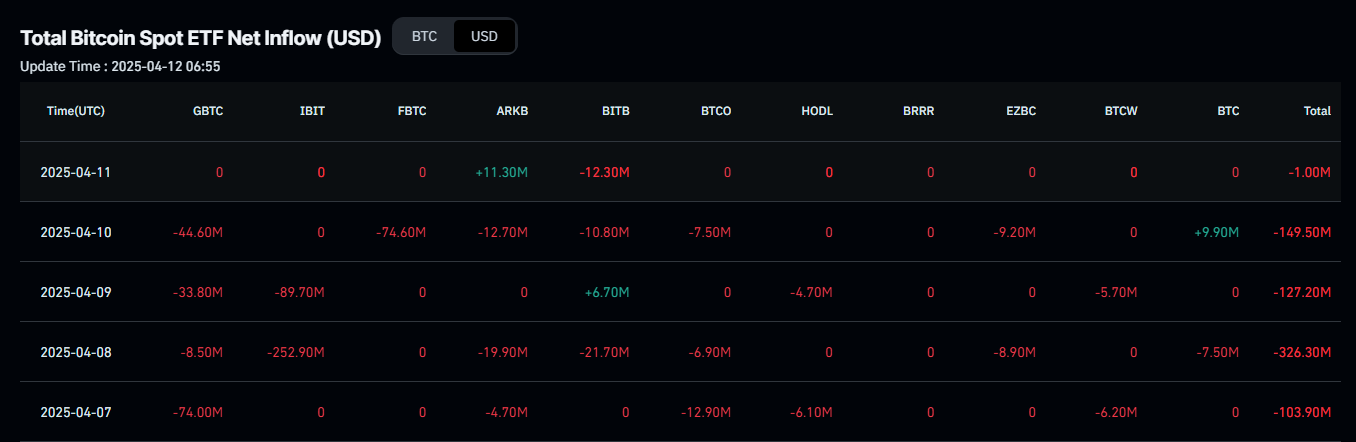

They could hold the rest quickly. This is especially true for institutions, which also change gears.

For example – Institutional Netflows have dried up. Only $ 1 million was recently sold to Bitcoin, at a $ 176.72 million four -day average.

Source: Coinglass

That is a huge drop. Of course this means that trust crawls back into the hands of players with big money. These settings do not act lightly. Their actions often form the next major movement of Bitcoin.

On the Spotmarkt, the data from Cryptoquant emphasized a new trend. Netflows turned negatively – always a bullish signal. That suggested that accumulation has been switched on and that Bitcoin is being moved to private wallet and away from fairs.

In this phase, 1,959 BTC were scooped up – worth around $ 162 million. Average purchase price? $ 83,000. If this pace applies, Bitcoin could continue to suck the remaining sales pressure. An outbreak can be closer than expected.